Why Do Altcoins Get Such a Bad Rap?

Since the 21st of October 2010, we’ve seen altcoins rise and fall. Believe it or not, Testnet1 was the first alt-coin in existence, designed to allow developers to test new protocol breaking features on the Bitcoin network, now we’re on version 4, still known as Testnet Bitcoin. Eventually, more use cases that require drastic differences in use come along that lead to a more dramatic fork- such as using Namecoin, a DNS registry altcoin or Ripple becoming a centralized multi-currency pronged payment channel - these coins are were never expected to be pull-requested upstream into Bitcoin’s core software. To begin this article series, I’d like to get into a few reasons for why we shun Altcoins time after time as junk investments and the reasoning behind those assertions.

- Altcoins are designed with little regard to value and are issued to pump then dump

The phrase Pump and Dump came from the era of Penny stock trading. The saying goes: “Pump the stock to investors and market participants. Make them feel that the asset is a hidden Gold Mine; they can’t lose!” Then as your victim Investor proceeds to buy in, you dump that junk asset at a higher premium. Altcoins are often created in repetition without end by Amateur software developers looking to fleece bitcoin with false hopes and promises of even greater gains through their Junk - alt. Usually, these “new” crypto coins have a different block-time (usually faster) or a larger amount of coin issued (Bitcoin has a distribution cap of 21 Million Coins, LiteCoin, by contrast, has a cap of 50 Million coins to be created.)

- Altcoins have the tendency to be Pre-mined in bulk near or immediately preceding an announcement

Known as an [ANN] thread on Bitcointalk, we’ve seen that a coin-dev will often make an initial unveiling thread perhaps days or even hours before sharing seed-nodes with the public and will use this small gap between announcement to begin mining their new coin for their benefit. In 2012 Novacain was released by Balthazar in the Russian Subforum of Bitcointalk as a fork of the then-broken Peercoin. Not months later was it discovered and announced that there was a premine of about 200,000 NVC before being released to the public. We can see the deceitful activity from the deposits made onto btc-e.com. What's more suspicious is that NVC was added first, before PPC; the coin it forked from…leading to my next point

- Altcoins are forked so often that they usually have no differentiation to merit their use

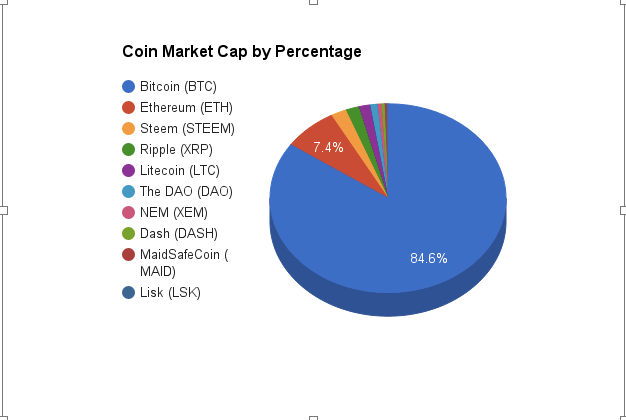

As of writing, there are more than 667 different cryptocurrencies. How many of those distinctive coins create value? The number may range in the dozen. Once you have private keys and a way to sign messages or transactions, what more is needed? How much more can alt coins be differentiated? Even differentiators have their limits; 600+ alt coins aren’t around for the use of exploring the possibilities. The sheer number of different coins makes the next coin seem less attractive from the last. Furthermore, many such coins provide no technical improvements but are in fact created to exist as a marketing cause. Some of those coins include mazacoin, auroracoin, hobonickels, weedcoin, and sexcoin.

- Altcoins can be used as a vector to spread malware

Around July 2014, a hacker drained a few wallets on Cryptsy.com to the tune of just over 9 million dollars based on a malware injected version of an altcoin named Lucky7coin…this coin had a rogue developer who offered to take over the maintenance of the project, yet that project had a rootkit embedded. A rootkit is a software tool designed to give the wrong person root also known as administrative access to a computer, essentially providing full control to what should be secured private data. With that control, the rogue developer drained Bitcoin, Litecoin, and Dogecoin wallets from Cyptsy’s servers. Altcoins can be easily forked as explained above. It's trivial for a hacker to insert a small innocuous looking change that would turn a forked alt-coin into malware as had happened with Lucky7Coin.

- Altcoin user base is usually too small

The bitcoin user base itself is also far too meager in its ability to support a small or medium generalized business. For example, it would be a terrible business decision to support Bitcoin solely in your local grocery store. You may take on a customer or two, perhaps a few dozen if you live in a tech-rich city. However, trying exclusively to support your small or medium sized business with a cryptocurrency is not a viable option to remain in business. Now, expand that train of thought towards altcoins, even newer coins or concepts such as Ethereum, DaoTokens, or Monero. Ether is the only coin of those three to be possible to accept with an off the shelf WordPress installation and Coinpayments.net to process cryptocurrency payments. Both DaoTokens and Monero have no built in systems to calculate and wait for payments.

To manually sell merchandise, one must collect orders by email and send back a payment address - In this day and age, as a business owner, having a fully functional cart and payment system is essential for a smooth user experience and higher sales conversions. As with my example above, two of those three emerging coins have no such option to do so. There are specific exceptions to the rule where the natural use case is viable; however, those circumstances only merit value towards the existing holders of that altcoin - a user base infinitesimally smaller than the sheer number required by a business owner to break even. Even a blogger who specifically discusses all news and events related to XYZ coin is limited to the sheer number of ad impressions and sparked interest in that XYZ altcoin. Due to that small user base, the long-term end-game to write about that currency to provide income is limited by the number of interested users, especially in an ideal world where all users are both aware of the blog and interested in viewing said published content.

To Conclude, altcoins get a bad rap for various reasons. Though seeded in greed sometimes, other times it simply has to do with lack of demand or interest in coins that cause altcoins to fail to reach critical mass concerning usage and ubiquity, ultimately limiting the feasibility of using them long term. Next time, we’ll discuss the benefits garnered from creating and using altcoins. Do you agree or disagree with the sentiments above? Are there other caveats to share that I haven’t quite covered here? Let’s talk about them below!

image credit: Cryptocommics

very interesting post, thanks for posting it !