Blockport (BPT) ICO Review: A New Era Cryptocurrency Exchange

What is Blockport?

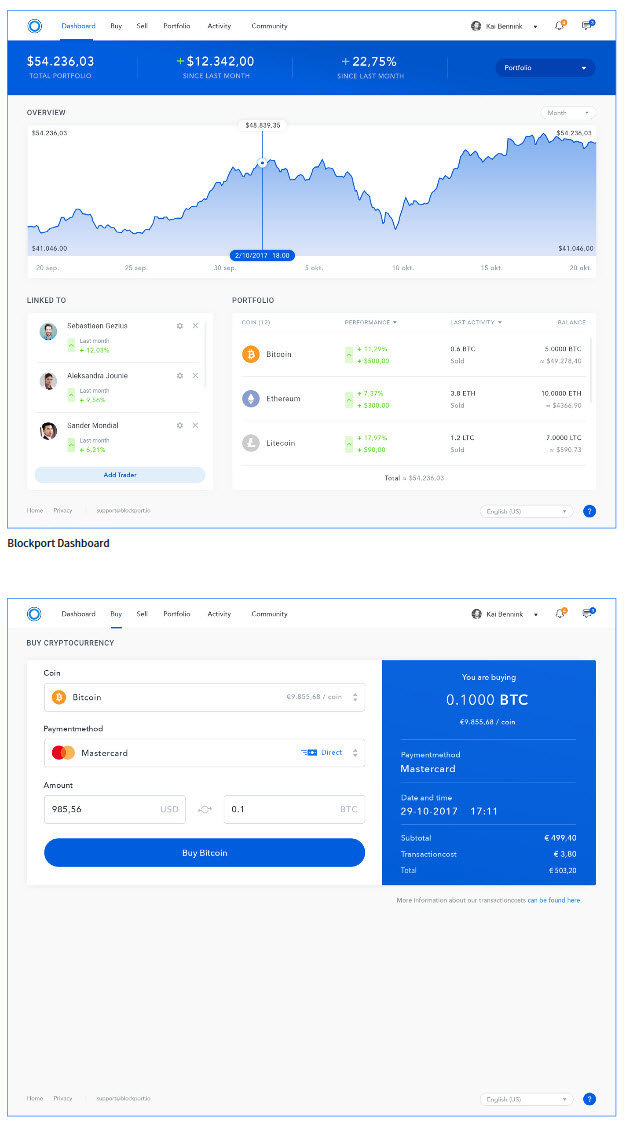

Blockport describes itself as "a hybrid-decentralized exchange with a strong focus on user-friendliness, social trading features and building a knowledge sharing community." <3> This new era cryptocurrency trading platform will leverage the best parts of both centralized and decentralized exchanges and deliver a user friendly experience that will appeal to new and veteran traders alike.

Blockport designs <4>

Blockport Highlights <1>

Started: Q3 2017

Market cap: $20,282,522 <2>

Price per coin: $0.41 <2>

Reddit subscribers: 30

Twitter followers: 2,321

Facebook likes: 472

Telegram members: 1,600

Circulating supply: 49,600,000

Total supply: 69,440,000

Consensus method: ERC20

https://blockport.io

Whitepaper

What sets Blockport apart from existing exchanges?

Most large exchanges in existence today, such as Bittrex or Kraken, are centralized entities which come with a host of issues including: <5>

- Lack of security - when users leave funds on exchanges they are trusting that organization to secure their funds. Although most exchanges do their best to protect users, history has shown that they are vulnerable to hacking and internal fraud.

- Lack of transparency - organization information, as well as commissions and fees associated with a trade are not always made clear to users.

- Lack of usability - most exchanges are either geared towards experienced traders or require some technical understanding.

- Lack of education - resources for new users are often limited and exchanges generally don't offer great support.

Decentralized exchanges, such as EtherDelta, overcome security issues by offering private on-chain wallets, however they still suffer from lack of usability, lack of education, and most importantly liquidity. Blockport's hybrid system will attempt to balance this trade-off and address the issues raised as by: <6>

- Accessing the internal Blockport exchange, as well as a combination of linked public exchanges to provide greater liquidity than an individual exchanges. Additionally, fiat to crypto, crypto to crypto and crypto to fiat will all be available through the platform, creating further liquidity.

- Improving transparency by analyzing prices across exchanges, therefore giving users a more realistic view of current prices.

- Making use of a decentralized internal exchange and on-chain wallets to securely handle user funds on the blockchain.

- Designing Blockport with usability and user-friendliness are at the forefront, improving the user experience for all and generating appeal from outside audiences. Users will be given a choice between simple and advanced interfaces (similiar to what Binance does) based on preference and familiarity.

- Developing a knowledge base for new users and a members forum in order to encourage knowledge sharing. Users will also have access to 24/7 customer support via chat or email and can access additional insight within the trade portal.

All of this sounds like a great balance and it will be interesting to see if the team are able to pull it all together. Initially, Blockport will be more on the centralized side of the spectrum until they are able to introduce on-chain wallets in a later release. The platform will also have a limited cryptocurrencies available in the early days and will only be linked to one external exchange, so liquidity will likely be low to begin with. However, trading with fiat pairs should attract many users as straight fiat to crypto options are very limited at this stage, and as future releases increase the number of linked exchanges adoption will likely follow suit.

One other unique feature of Blockport that could increase early adoption will be social trading which will allow veteran traders to publicly share their portfolio to other users who can then not only follow it, but can actually copy the portfolio distribution and automatically partake in trades made by that user.

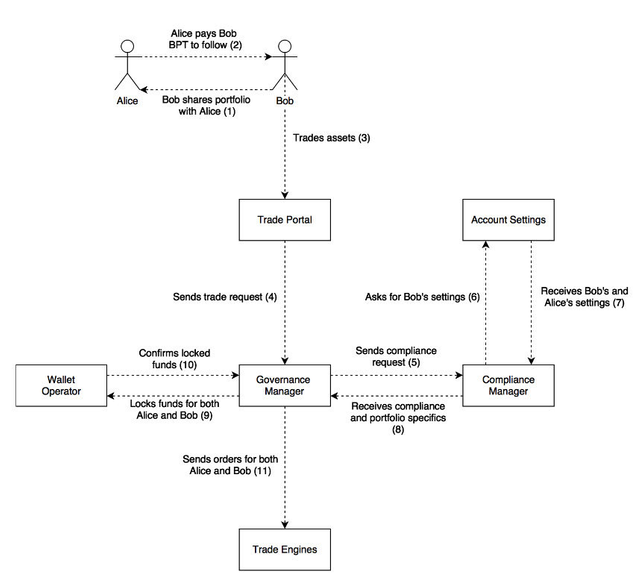

Social trading example <7>

In the above example <8> Bob, a veteran trader, has made his 100% BTC portfolio publicly available and Alice, a new trader, has decided to allocate 50% of her portfolio (also 100% BTC) to copy Bob's portfolio and his trades; when Alice chooses to follow Bob he receives Blockport tokens (BPT) from her. Bob then decides to trade 40% of his BTC for ETH and the request is sent to the governance manager which prepares the trade and sends a compliance request to the compliance manager to verify that Bob and his followers are eligible for the trade and have the necessary funds. The trade funds are then locked by the wallet operator and the orders are submitted to the trade engine. At the conclusion of the trade, Bob's portfolio is 60% BTC and 40% ETH while 50% of Alice's portfolio that wasn't assigned to Bob remains unchanged and the 50% that was following him is now 30% BTC, 20% ETH.

Users benefit from being able to partake in experienced cryptocurrency trader's moves and are also able to chat with members they follow about trading strategies, thus increasing knowledge sharing and engagement on the platform. Veteran crypto traders benefit by receiving compensation in the form of BPT from their followers. In order to prevent manipulation, traders will have a maximum number of followers.

How the Blockport platform works

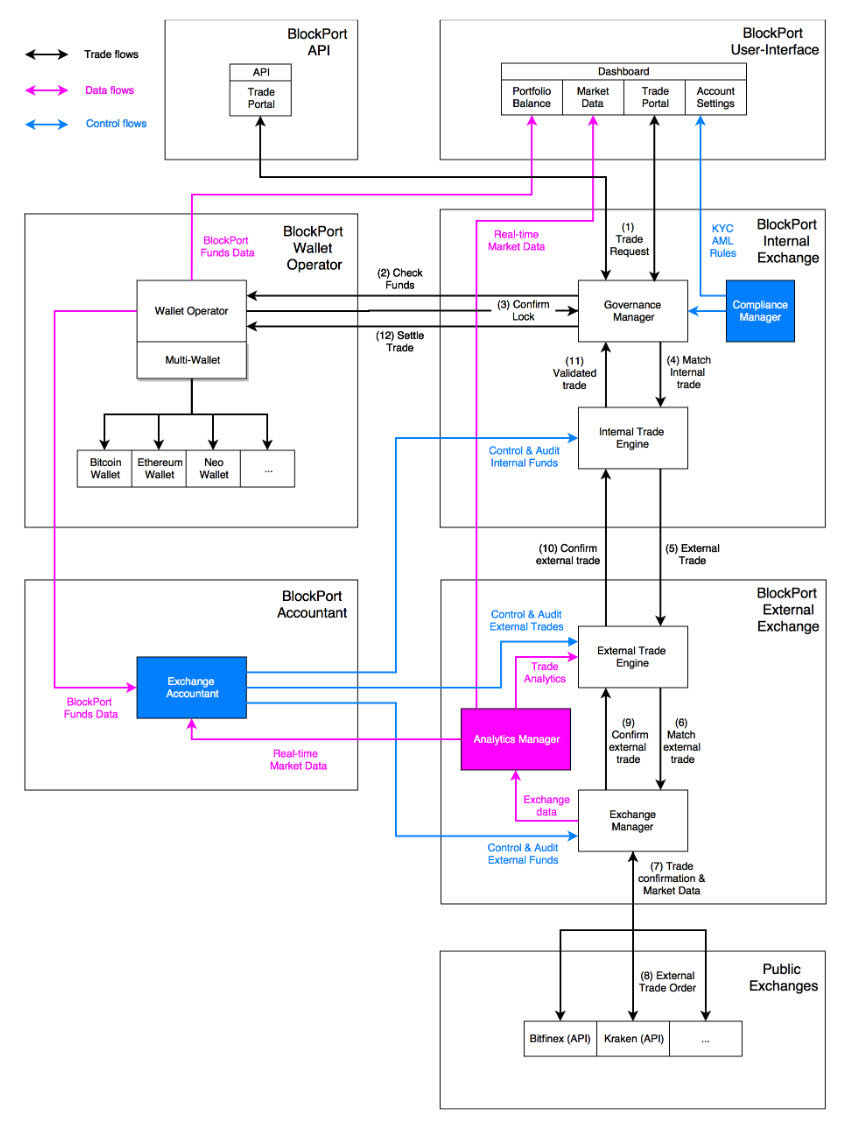

How Blockport works <9>

In order to facilitate all of the various Blockport functionality including the internal decentralized exchange, public centralized exchange connections and social trading there is a lot going on behind the scenes. The above image provides an overview of the model, but let's a closer look at some of the key functionality involved in making a trade on the platform: <10>

When a trade request is made, it is sent through the governance manager, as seen in the above example with Alice and Bob. Once the trade is validated, the governance manager will order the members' funds to be locked by the wallet operator, thus allowing the internal trade engine to match any available internal trades. These orders are submitted to a private order book and only become public when completed.

If the trade cannot be entirely filled internally, the internal trade engine will partially fill the order if possible and then pass the balance on to the external trade engine to be matched with connected exchanges. The external trade engine bases decisions on available supply, transaction costs and volatility, which are provided by the analytics manager from exchange order books. This data is sent to both the external trade engine and the exchange manager, who converts the action into an API order. Once filled externally, trade data will be combined with the internal trade engine to confirm the order was complete.

Throughout this process, the Blockport accountant tracks member's funds in order to maintain member order privacy, reduce transaction costs, and settle all interactions in one trade. Once complete, the funds are settled and stored in the on-chain multi-wallet, which is managed by the wallet operator who runs a node for each supported blockchain, and the trade is publicly broadcasted on the blockchain.

In theory this all makes sense though I do have concerns around how well they are able to handle KYC/AML once private on-chain wallets are integrated, the effectiveness and reliability of the analytics manager, and most importantly, the effect of network lags. Given the number of touch points involved in a trade, including external exchanges and the various "managers" within the platform I definitely question how quickly trades can be executed. The crypto world moves fast and with constantly fluctuating prices, network lag could be a major hindrance to trading and platform usability.

The Blockport token

The BlockPort token (BPT) is an ERC20 token which serves a key role within the Blockport platform, including discounted fees and social trading.

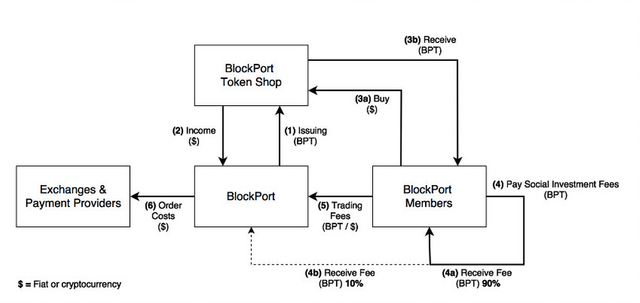

Blockport token use within the platform <11>

As seen above, the BPT token is used in several functions across the platform: <12>

- BPT is released from the reserve and sold to users via the token shop.

- Blockport generates income from the sale of BPT.

- Members can purchase BPT with fiat or cryptocurrencies.

- Members can pay other members with BPT to copy their portfolio and/or cryptocurrency trades. In this arrangement, 90% of the BPT goes to the member sharing their portfolio and 10% is received by Blockport as a fee. The social trading aspect of the platform will increase demand for BPT and the fees taken will reduce the overall supply.

- Members can use BPT to reduce trading fees, creating clear value for the token and increasing demand.

- Order costs from other exchanges are covered via income from trading fees.

I really like the model the Blockport team have used for BPT as it offers a clear value proposition and use case. Exchange tokens which provide discounted trading fees have already shown to be extremely valuable; Binance Coin (BNB) is currently trading at $16.81 and has been as high as $22.77 and Kucoin Shares (KCS) have been valued similiarly. Obviously Blockport will need to achieve significant volume before the BPT token has that kind of valuation but the social trading aspect is also unique to the platform and has a strong value proposition as well; for a comparison in this space, Trading View, which doesn't reward traders for sharing advice has nearly 400,000 members, although it spans beyond crypto markets.

Most of the BPT tokens will be made available in the pre-sale (completed January 3rd) and the crowdsale (starting February 1st), with most of the proceeds going towards a trading reserve, development and marketing. 10% will be reserved for shop stock and an additional 14.3% will be set aside for the team and early seed investors. Team funds will be vested across 3 years (25% immediately, 25% after 1 year, 25% after 2 years, and 25% after 3 years). <13>

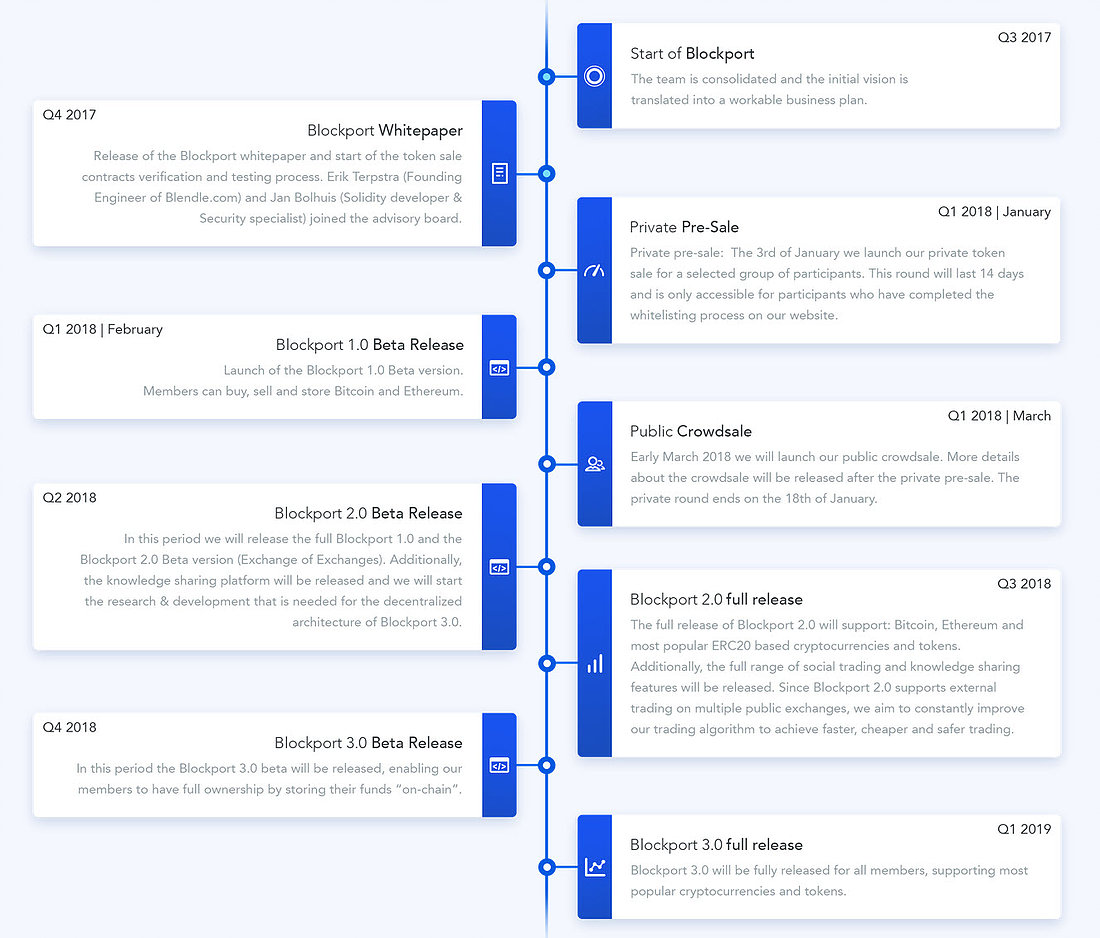

Roadmap

Blockport roadmap <14>

The public crowdsale will take place February 1st, 2018 (not March 2018) but otherwise the above roadmap gives a good indication of the release schedule for Blockport. The roadmap is fairly ambitious in that a new beta release is pushed out every quarter with major developments happening from one release to the next. Currently there is an alpha (alpha.blockport.io) though it's mainly just a preview of the design; functionality is very limited.

Blockport 1.0 will be the initial public exchange and will be launched in beta in February with a full release in Q2 2018. This release will connect with one external exchange and will support BTC, ETH and some ERC20 tokens.

Blockport 2.0 beta will launch in Q2 2018 and fully launch in Q3 2018. This will essentially be the full Blockport experience, without the decentralization. More exchanges will be added, social trading functionality and knowledge base experience will be incorporated and more cryptocurrencies will be supported.

Blockport 3.0, the final version, will be launched as a beta in Q4 2018 and will be fully released in Q1 2019. This version will introduce private on-chain wallets for decentralization of user funds and will fully integrate the internal and external exchanges. Prior to this release, user funds will be centrally held by Stichting Custodian Blockport (SCB) in an omnibus account. <15>

The team

The Blockport team, which consists of 9 team members and 6 advisors, are based in Amsterdam. Most of the team are fairly young and don't have extensive backgrounds, though many have taken part in other entrepreneurial ventures.

Sebastiaan Lichter, the founder and chief of product, was an innovation project manager at Independer, a large Dutch insurance platform and has a degree in entrepreneurship and innovation. The other founder, Kai Kain Bennik, did a stint with IBM around the use of AI in a number of large banks and has a MSc in management of technology. The CTO, Zowie Langdon, has 15 years experience in software development according to the whitepaper, though LinkedIn doesn't suggest anything prior to 2013; he has however co-founded two IT startups.

The lack of experience in the team is definitely a major concern for me, especially in the exchange space where regulations are so critical. However, that's one area where they've done well with advisors. Peter Kits is a partner with Deloitte, Johannes de Jong is head of regulatory at Osborne Clarke and Lars Rensing is the CFO of Ark.io. The strong expertise in legal and regulation from the advisors helps alleviate some concerns in that aspect but I still have concerns over the relative inexperience of the core team and the limited technical team given the complexities of the Blockport model.

What I like about Blockport

- User first approach;

- Unique platform features which distinguish it from other exchanges;

- Access to multiple exchanges in later releases which should provide liquidity and access to the best prices;

- Fiat pairings for most cryptos will attract many users and encourage crypto adoption in general;

- Social trading, if handled well, could create a large market;

- Clear use case and value of the BPT token;

- Partnerships with Deloitte and ARK.io;

- Leverages the good aspects of both centralized and decentralized exchanges;

- Strong regulatory and legal advisors; and

- Presale sold out in 3 minutes.

Concerns about Blockport

- Network lag could create havoc with the Blockport model;

- Complicated model with a number of systems needing to communicate to make a trade;

- Inexperienced team;

- KYC/AML is always a pain point with decentralization;

- Limited social following;

- Initial funding target was $11.9M but rise in ETH price has created questions about token valuation for the crowdsale; and

- As with any exchange, adoption will be key.

Competitors

There's dozens of competitors I can list - there's no shortage of exchanges, both centralized and decentralized. However, Blockport offers social trading and cross-exchange trading which is a package that isn't really offered by any other competitor.

Is Blockport a good investment?

Blockport set out with an initial funding goal of $11.9M which it has already technically surpassed given the supply of BPT and current ETH price. The team should be making an announcement on this shortly, but for now I'm looking at it as a $20M valuation until something official is released by the team.

For comparison, decentralized exchanges such as COSS and 0x are currently sitting at valuations of $94.5M and and $1.16B while a major centralized exchange like Bittrex is processing nearly $3B per day. In terms of the BPT token, the initial target price was $0.25 and current ETH prices have it sitting around $0.41 while BNB is currently sitting at $16.81 with a market cap of $1.66B and KCS is $20.06 with a market cap of $1.83B. There's definitely room for Blockport to grow.

Given the recurring issues of centralized exchanges, decentralized models have been picking up steam as of late so Blockport appears to be hitting the market at the right time. The team has already formed partnerships with major names like ARK and Deloitte and despite the limited social following and seemingly low hype, the presale sold out in three minutes so there's clearly strong interest. There's also a lot of unmet demand for both a user friendly platform and fiat pairings for a wide range of cryptocurrencies so I think there's a great opportunity for Blockport to step in and offer that service. Social trading should appeal to a large existing market (Trading View has nearly 400,000 members) that could become even larger due to veteran traders receiving incentives to share their portfolio and beginner traders being able to access automated portfolio trading that they wouldn't otherwise be confident doing. Lastly, having access to multiple exchanges (and therefore the best prices) within one platform should attract a large number of users as well.

Given some of the comparables (namely ZRX, BNB and KCS) the long-term market cap of Blockport could feasibly be more than $1B which would put the price of BPT north of $20 (50x current price and 80x initial target price), with potential for even higher figures due to greater token utility. However, let me make it very clear that this would require the platform to be fully functioning, reliable and achieve enough adoption to have huge volume; using Binance as a comparable is a lofty target as it's currently the world's number one exchange by volume.

Does Blockport have the potential to be valued over $1B in the future? Certainly - I really like the concept the team have developed and given the user-first approach, social trading, fiat pairings, multi-exchange access and the role of BPT I believe it could easily take on some of the comparables listed, and that's why I invested in the presale. However, even though I believe in the concept, there's a lot of question marks around the team, how they'll make all the various features work and the team's plans to promote the platform and gain adoption. Even if Blockport does achieve all of this, that kind of valuation is a long ways off and would require a lot to go right. Short term outlook should be decent as Blockport 1.0 will launch fairly soon but I'd look at it more as a long term investment.

Conclusion

Blockport is aiming to create a unique trading platform which will leverage the best aspects of centralized and decentralized exchanges with a number of features which will set it apart including social trading, access to external exchanges, fiat pairs and the BPT token.

I invested in the presale and really like BPT as a long term bet in the exchange space, though as with any ambitious crypto project there's no guarantees it will go anywhere, perhaps even moreso for this project than others. The team and complexity of the exchange model give me pause but I'm a big fan of the vision they've developed and early releases aren't far off, so it won't be too long until we get to see how well the platform works. If there was a stronger team behind the product I'd be less hesitant about it's future so it would be great to see them bring on additional advisors or technical team members.

Interested in getting involved in Blockport? Head over to blockport.io and sign up to be whitelisted for the crowdsale on February 1st, 2018. Make sure to use my referral code "BP102212" and we'll each receive a 2.5% bonus on your contribution.

If you have any comments, post below! If you enjoyed the article and found it informative, please consider leaving a small donation to help support the site:

ETH & ERC20: 0xEFC6eb094CA849DB9b8628B6cC9c1e601ECf21bc

Bitcoin: 1NMsXX96CiMnS5WPy9KQbFJCbzqXPM2qbv

Litecoin: LWBN5P3vj8F6zrCB2pbFS8ynU5194hbA7W

If you are unable to donate, consider supporting Crypto Advocate in other ways, such as sharing the site with your friends or using one of the referral links here. You can also follow me @crypto_advocate.

References and Notes

This post originally appeared at https://www.cryptoadvocate.net/single-post/blockport-a-new-era-cryptocurrency-exchange and was modified slightly for relevancy and for the steemit audience.

<1> Price, market cap, supply and logo are taken from blockport.io. All social stats taken directly from social media pages

<2> Based on ETH price at time of writing - target goal was initially $11.9M or 16,666 ETH

<3> Quoted from page 2 of the Blockport whitepaper

<4> Image taken from page 10 of the Blockport whitepaper

<5> Partly adapted from pages 4-6 of the Blockport whitepaper

<6> Adapted from pages 6-8 of the Blockport whitepaper

<7> Image taken from page 16 of the Blockport whitepaper

<8> Example adapted from pages 16-17 of the Blockport whitepaper

<9> Image taken from page 11 of the Blockport whitepaper

<10> Adapted from pages 12-15 of the Blockport whitepaper

<11> Image taken from page 21 of the Blockport whitepaper

<12> Use cases taken from pages 21-22 of the Blockport whitepaper

<13> Token information taken from pages 23-24 of the Blockport whitepaper

<14> Image taken from blockport.io

<15> Taken from page 27 of the Blockport whitepaper

All other information is either adapted from the whitepaper and other research or is personal opinion.

Crypto Advocate invested in the Blockport presale.

Wow, how are there so few votes on this? Nice article, thanks. Some good last-minute reading while I make a final decision (ICO begins in about 6.5 hours or so).

Thanks! Did you go through with it?

A good article thank you. I joined up to Blockport the other day, and I see you didn't mention that they currently have a bounty program where you can earn free BPT. http://queue.vip/zNgi8dp <--- This is my referral link. I'm not trying to steal your commissions I just didn't see it posted in your referral links. so if anyone does use this link, post your own referral link below and we can form a referral chain for everyones benefit.

Good in depth analysis.

Is Blockport exchange going to run on Ethereum blockchain? It is already clogged up. I don't know how or when it will be upscaled, but currently it is not suited for this task.

Blockport 1.0 will be the initial public exchange and will be launched in beta in February with a full release in Q2 2018. This release will connect with one external exchange and will support BTC, ETH and some ERC20 tokens.

Any idea which exchange that will be?

Would be great if it will be Coss

As far as I'm aware they haven't hinted at any possibilities yet.

Blockport has been promoted on kucoin exchange take a look to this article. https://blog.blockport.io/blockport-listed-on-kucoin-plus/