How much PEL stock needs to be bought for 5000 Rs dividend each year?

To determine the amount of PEL stock needed to receive a dividend of Rs. 5,000 per year, we need to find the dividend yield and then calculate the required investment amount.

Given information:

- The most recent dividend paid by PEL was Rs. 31 per share on June 16, 2023.

Step 1: Calculate the dividend yield.

Dividend yield = Annual dividend per share / Current share price

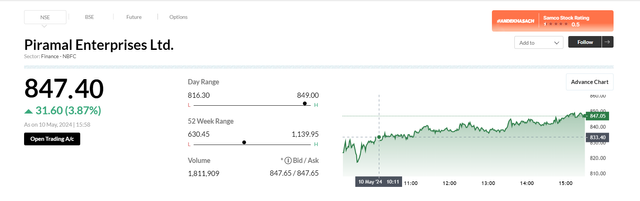

Let's assume the current share price of PEL is Rs. 1,000 (since the actual share price is not provided).

Dividend yield = Rs. 31 / Rs. 1,000 = 0.031 or 3.1%

Step 2: Calculate the required investment amount to receive Rs. 5,000 in dividends.

Required investment amount = Desired annual dividend / Dividend yield

Required investment amount = Rs. 5,000 / 0.031 = Rs. 161,290

Therefore, to receive a dividend of Rs. 5,000 per year from PEL stock, you would need to invest approximately Rs. 161,290 and purchase around 161 shares (Rs. 161,290 / Rs. 1,000 per share) of PEL stock.

Please note that this calculation is based on the assumption that the dividend and share price remain constant. In reality, dividends and share prices fluctuate, so the required investment amount may vary accordingly.