Deutsche Bank fails US Stress test - Can we see a 2008 crisis again?

It's time Investors need to pay attention to the financial sector as a clue to what might occur in the Broader Markets.

In 2008, as we were very close to one of the biggest crisis in the history of the World Economy, the banking sector was weak all year. They were signaling trouble that might be coming soon. And boy, it was earlier than expected!

While a handful of investors had foreseen the storm on the horizon, most folks had their ears shut. However, just months before the epic collapse, the industry tycoons were praising the economy on television as if they were in a fairy land. Government officials were promoting the idea of growth and renewal in the economy.

Well, we all know how that turned out.

Are we seeing it coming back again? Is there Déjà vu with the banks?

Because, The US Federal Reserve yesterday said Deutsche Bank US operations had failed the central bank's annual stress test due to "widespread and critical deficiencies" in its risk management.

The Fed's yearly stress tests are meant to determine if big banks are strong enough to sustain a major economic downturn. The qualitative test done looked at capital planning, including share buybacks and dividend payments.

The authorities also mentioned, "Concerns include material weaknesses in the firm's data capabilities and controls supporting its capital planning process, as well as weaknesses in its approaches and assumptions used to forecast revenues and losses under stress"

Here are some facts about Deutsche Bank in 2018:

• S&P Downgraded the rating from A- to BBB+

• The audited annual financial statement show a loss of €735m (£648.21m), significantly higher than the €497m (£438.31m) figure provisionally posted at the beginning of last quarter.

• Despite this being the third year in a row with losses, employees of the largest German bank received around €2.3 billion (£2bn) in bonuses while shareholders will receive dividends of 11 cents (9.7p) per share.

• Job cuts : 7,000 job cuts were made in May and 10,000 more would be done by the end of March 2019 as per reports.

• Since 2008 Crisis, shares are down from EUR 88.50 to EUR 9.20 as of 1st July 2018.

• Times Square - New York office is shut down recently.

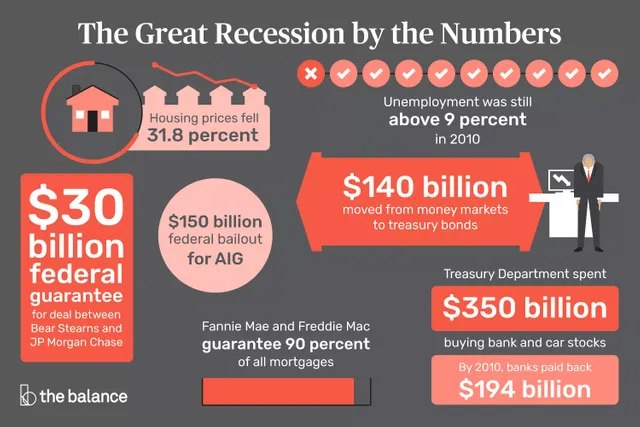

Well in 2008, many legislators have blamed Fannie Mae and Freddie Mac for the entire crisis. To them, the solution was to close or privatize the two agencies. But if they were shut down, the housing market would collapse. Because, they had guaranteed 90 percent of all mortgages. Furthermore, securitization, or the bundling and reselling of loans, has spread to more than just in the housing sector.

The government must step in to regulate. Congress passed the Dodd-Frank Wall Street Reform Act to prevent banks from taking on too much risk. It allows the Fed to reduce bank size for those that become too big to fail. However, what about Goldmans & the Morgans or JP's ?

There will still be capitalism until may be, we all move to MARS with Bitcoins, Bitcoins and only Bitcoins! :D

What do you think ?

Remember mortgage backed security derivatives, and highly questionable CDS trading of Goldman Sachs, that nearly crashed the financial system in 2008? Well what makes anyone think D'B's $64 trillion exposure to the derivatives market is any more secure today? Obviously not the ECB.

The point is, nothing happened after the 2008 regulatory debacle. In fact, with the Basel accords, the B.I.S actually reduced liquidity requirements to practically nothing.

Why? Because Fiat currency (without which their couldn't possibly be a $550 Trillion - £1.2 Quadrillion derivatives market) is a total farce. Of course there will be a massive global financial collapse. It's all part of the predetermined and absolutely essential boom bust cycle that enables global corporations' to operate their huge scale asset grabs, buying stocks for pennies on the dollar, whenever they decide to trigger one. Deutsche Bank's obvious insolvency is just the means to an end.

As for Bitcoin I really hope the principle of the decentralised blockchain will be protected but may I make a tentative prediction?

There will soon be a FedCoin or similar global 'central bank backed' cryptocurrency. China have already started preparing theirs and central bank states will all soon follow suit. These will not be blockchain based (though they will claim that they are,) will be centrally controlled, will have market exchanges and will not have restricted 'anti inflationary' issue limits. When the BIS controlled global banking cabal rolls out its FedCoin/CryptoYuan all other crypto currencies will be declared illegal. The only difference will be the end of voluntary exchange and the cabals total control of everything every human being on earth is able to buy.

@oyddodat : Yes! Absolutely, I agree with your prediction there. Things like FedCoin could be released soon.. When something like bailout would be a possibility, the account where we hold the so called FED backed Crypto would be freezed as they would be mining it centrally.

And, yeah.. look at the manipulation now, JP Morgan CEO says Bitcoin is a ponzi scheme & next day JPM buys Bitcoin. Are you serious? Why do they even think capitalism is good? It's all a game. Financial Industry is corrupt by these Whales!

Transparent if you can see it. I would be interested to know what pressure they think they can put on the blockchain itself, as a an entirely separate issue to Bitcoin. Seems to me the cat is out of the bag on that one. 'Faith backed currency' is their problem. It's inherent to their system so what's to stop you and I saying we don't have any faith in your crypto and we have decided to use a blockchain backed alternative instead. Legislation and heavy handed enforcement is their only recourse I suspect.

@oyddodat : Well, Retail investors don't know what they actually want. So even if you & I agree to consider Bitcoin as our currency, the media & marketing team of the government (like Cambridge Analytica) will pull other confused retail investors to their side :-/

upvote for me please? https://steemit.com/news/@bible.com/6h36cq

We will move to mars for sure.

Haha :D see you there!

Sure.

Wow greate article!

Thanks for using the @postdoctor service!

Thank you @postdoctor :)

This post has received a 5.26 % upvote from @boomerang.

You got a 43.31% upvote from @joeparys! Thank you for your support of our services. To continue your support, please follow and delegate Steem power to @joeparys for daily steem and steem dollar payouts!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

I drink a lot of beer

Sneaky Ninja Attack! You have just been defended with a 3.13% upvote!

I was summoned by @tapan676. I have done their bidding and now I will vanish...

woosh

A portion of the proceeds from your bid was used in support of youarehope and tarc.

Abuse Policy

Rules

How to use Sneaky Ninja

How it works

Victim of grumpycat?

Great post!

Thanks for tasting the eden!