BTC: Latest Trends - Part 2

Yesterday I spoke of another BTC trend which I wanted to show you.

Yesterday I spoke about BTC price trends, today I'm still speaking about BTC trends, but not price.

BTC: Latest Trends - Part 2

Half a year ago I penned these posts:

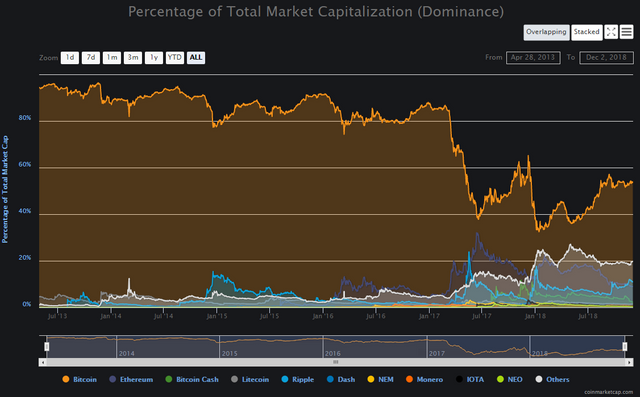

They dealt with something that I haven't seen anybody else deal with before or since: Bitcoin dominance patterns. In them I proposed that BTC dominance should have predictable patterns like BTC price does. This implies that Bitcoin dominance would also have trends. Which brings us to this post today.Because yesterday I found what may be a BTC dominance trend.

Take a look at this chart and see what you can see:

I should point out that the predictions I made in the previous BTC dominance posts I mentioned did not come true, they were far off. I don't mind, it was early days for BTC dominance TA. What I'm doing today is trying to refine and fix that prediction. I am probably still wrong, but I'm more right than before. I'll continue to watch BTC dominance from a TA perspective and will update you if I find interesting new developments.

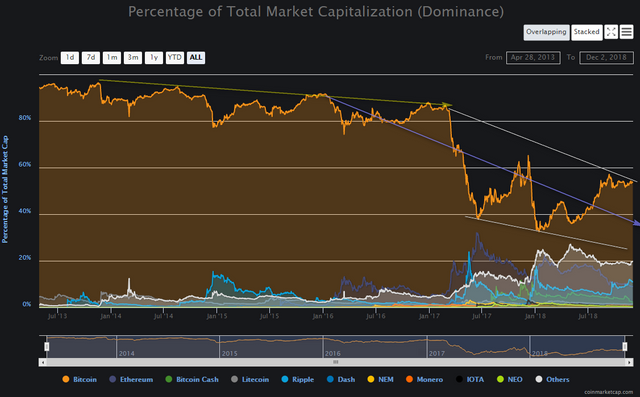

My latest BTC dominance trend idea (what I see when I look at this chart):

Explanation:

The arrow at the top indicates what I consider to be the previous BTC dominance trend - the trend before altcoins became popular. Sometime in 2016, probably early in the year, BTC dominance changed tack. After giving a last hurrah in early 2017, it started dropping rapidly and establishing a new normal - a falling trendline for BTC.

This new trendline is depicted by the blueish arrow. I am not certain of this trendline. I am not certain that it is at the right level, starts in the right place, is at the right angle or even that it exists. As usual, I am showing you my best guess. You must decide for yourself if I am right or not.

I believe BTC dominance to be in a negative channel. The white lines on the chart depict the borders of this channel. The fact that not all the lines are parallel suggests that I still have some work to do in refining this theory. I think that the trendline is probably too steeply negative and that future BTC dominance movements will correct my trendline. The real trendline is probably somewhere between the angles of my two white limiting lines of the channel in terms of gradient. My reasons for saying this are based mainly on the gradient of the lower channel limit and on fundamental beliefs about continued BTC dominance and rate of decline. To go into that in depth would take very long, so I won't. As always, I will answer any specific questions in the comments if you so wish.

Further thoughts

It could be that the trendline isn't supposed to be linear: as time goes by it may be revealed to be some sort of curve, perhaps a parabolic one, which I believe would make sense from a fundamental perspective: BTC decreasing rapidly in dominance as altcoins are born and balloon, but then losing ground more slowly as people cling to the grandfather of cryptocurrencies as a means to store their wealth.

The dominance index is an interesting one as it is somewhat related to price, but also independent of it. In a way it could be considered to be strongly representative of market sentiment, particularly with regards to risk. One might surmise that greater risk implies greater altcoin dominance, while a more risk averse market would be more inclined to be BTC heavy. In this way BTC dominance could be a better indicator of market sentiment than BTC price movement!

I will continue to watch dominance closely and try to associate it with the movements of the market. I believe that there is much to be learnt here, and Bit Brain loves to learn!

Yours in dominant crypto

BitBrain

BitBrain recommends:

Published by BitBrain

on

I also have been watching this closely as I think it is a risk indicator as well as a value indicator. First, as more people get out of altcoins they use BTC as the trading pair which would influence the dominance. However, this has been somewhat skewed with the over 150 stablecoins that have come to market. Also, I think it is a value play as it is estimated that over $15 billion have been put into ICOs and the fact that bitcoin continue to dominated over half of the market is a sign that those ICOs have yet to create the value of their funding. I find it difficult to believe that bitcoin will be able to hold on to this much dominance given the development happening elsewhere while bitcoin goes slowly. However, it could be the age old tale of the Hare and the Tortoise!

Posted using Partiko iOS

That's a beautiful assessment of the situation, and one which I agree with. Thank you for your valuable contribution!