The Innovation Of Ineptitude – Owning The Technological Battleground

“China-US” relations is a term that has been overly saturated to mean “Trade War” as it relates to the common knowledge narrative dictated to us by mainstream media.

However, the China-US relationship is the single most important variable in the immeasurably complex equation that is world affairs, and specifically, where things go from here and how it affects billions of daily lives; chief among them, our own daily life.

We’ve entered a stage where the narrative and sentiment is set to shift very dramatically and rapidly. As such, it is apparent that now is the time to position for this shift, whether this be from a defensive or offensive prerogative.

TL;DR – Review exposure to big tech, CCP backed organizations, and foreign bonds. Make no mistake, this is an extensive review as these very capital flows have come to be embedded in more investment vehicles than you can initially conceive of.

Let’s begin with a story about the man that helped shaped innovation and its role in the architecture of the American military complex: Vannevar Bush.

Bush received his education in mathematics and electrical engineering at the likes of Tufts, MIT, and Harvard around the time that the US was entering into World War I. As a result of the war, Bush spent the early part of his career working on antisubmarine research as a member of the American Radio and Research Corporation (AMRAD) and National Research Council (NRC).

Once the war had finished and the funding for both AMRAD and NRC had subsided, Bush became one of the five founders of Raytheon, in addition to becoming a professor of mathematics and electrical engineering at MIT. During his tenure at MIT, he helped to develop the differential analyzer, the first computer of its kind able to solve complex multi variable and differential equations. For this work, Bush received the Franklin Institute's Louis E. Levy Medal in 1928.

In 1938, Bush became central to a number of influential organizations driving scientific research and development across the highest channels in the US, including the Carnegie Institute for Science (CIS) and the National Advisory Committee for Aeronautics (NACA), a predecessor to NASA.

At the earliest stages of World War II, Bush realized just how advanced the German war machine was becoming (partially due to his integration into the international scientific community), and he warned President FDR that without cooperation between US scientific researchers and US military, the US would soon be outmatched and would lose the war.

In what is now a famous note, “OK — FDR” gave Bush the approval to create the National Defense Research Committee (NDRC), and later the Office of Scientific Research and Development (OSRD), to accelerate the creation of military technology to combat the Germans. The chief task of the NDRC and OSRD was to coordinate and facilitate information flow across the many military and scientific research channels, while prioritizing research and development resources for ideas that would play the most significant role in winning the war.

One of the first things these institutions developed were microwave-based radar systems. Compared to their much larger counterparts in long-wave radar systems developed by the US Navy during the 1930s, microwave-based radar systems were small enough to be equipped on US planes.

Up until this point in World War II, German U-boats had been dominating the Atlantic Ocean, virtually cutting of any, and all, supply lines between Western Europe and North America. The German U-boats were months away from starving the British war machine out of oil, food, and basic necessities required to continue the war.

With microwave-based radar equipped air planes, for the very first time the US Navy and Air Force were able to detect and sink roughly 1/3 of the German U-boat force over the course of 4 weeks. The Germans called all U-boats back in retreat, as a result.

This left the Atlantic Ocean open for Allied supply lines, and led to the eventual Allied invasion of Western Europe at Normandy.

Throughout the course of the war, these Bush-created institutions went on to discover how to mass produce Penicillin and how to create the world's first atomic bomb in the Manhattan Project. The significance of these discoveries cannot be overstated.

After the war's conclusion with an Allied victory, these very same institutions saw to it that all leading German scientists were brought to the US via Operation Paperclip where the saga of scientific and military cooperation continues.

It appears that we find ourselves in a time where the rhetoric around the importance of this saga is set to become centerfold.

I want to preface the remainder of this article with a terminology clarification.

Just as with any sovereign nation, it is healthy to distinguish between the government / ruling elite and the everyday person. You would not find it appropriate to compare a LA based construction day laborer with that of a US Senator in DC; likewise, it is not appropriate to lump 1.4 billion people together under the term “China” and “Chinese”.

Throughout this article, the terms “CCP”, “China”, and “Chinese” will be directly referring to the ruling elite who control China via the CCP.

It is painfully clear that the focal point for competition between China and the US is none other than technological innovation.

While China has made it absolutely clear that they will abide by nobody’s rules but their own internally-defined rules, they are openly stating that they will challenge the US and the existing global order across the board on technological innovation: AI, 5G, quantum computing, nuclear, space, bio-engineering, economics, social engineering, take your pick.

Seem a bit sensationalist? Just review what has been happening in the Northwest of China and in Hong Kong. Does this strike you as the actions of a group who give a damn about international opinion?

Of course not.

The thing that is quintessentially Chinese is one thing, and one thing only: WINNING.

Winning is so deeply embedded into Chinese culture that many Westerners underestimate the ends to which Easterners will go in order to achieve their winning means. Suffice it to say, the concept of participation trophies flies directly in the face of everything that is Chinese.

Of course, on a granular level one could very reasonably argue that East and West are identical. In fact, they are. Just as with any human, or living organism, it is sequenced into our DNA to compete, to win, to survive. In this sense of the individual, East is West and West is East when it comes to winning.

However, that is not what I am intending to discuss. Rather, we are focusing on the structural trends, the developments being done at scale of entire nation-states that supersede whatever any individual may have in mind.

The CCP and the Chinese elite have flipped the script on capitalism and are using the Western version of winning (making money) against itself. The Chinese use access to their massive consumer economy as a carrot to lure in foreign investment, foreign companies, foreign bankers, foreign politicians, and foreign influences. They draw capital into the Chinese sphere of influence, and where it goes from there is the question you ought to be asking yourself.

The Chinese then give the individuals in these groups “special access” to deals that always win. How do they always win? Well, the CCP just redirects capital towards these deals so its virtually impossible to “lose”. Unless, of course, you do not follow through with what the CCP wants you to do in return. In fairness, not all that different from what happens here in the US. But the scale and the speed at which it happens (think ROI) is mind boggling, and effective at luring in more capital.

Bribery, across the board, in its most flagrant form.

The NBA Twitter expose is only the most recent in a long string of public apologies, knee bending ceremonies, and mouth-shutting processes that has seen Chinese capital pocketed by Westerners in the name of the “winning = make money” game. The favored game of capitalism.

Of course, the Chinese game of “winning” is so much more than simply “making money”. It includes things like return to world superpower status, end the century of embarrassment, maintain central power, ethnic cleansing and unity, economic dominance , mass propaganda, and the (dis)like.

The China-US relations are at an inflection point. There is bipartisan support for a more aggressive, confrontational stance against China among the US ruling class. Yet, the narrative has not yet hit the mainstream because corporate America and Wall Street are still monetizing on China, and these factions own US media.

But, gross human rights violations against Uighurs is slowly seeping into the mainstream...

... and it will become increasingly difficult for the US media vanguards to ignore this narrative as it becomes common knowledge. One would be well within reason to question the incentive for the timing of an impeachment inquiry that is so lopsidedly dominant in US headlines.

Is it because the American president is targeting the cash-cow of so many and there are other storylines much more deserving of our time and attention? Par for the course, I suppose.

Wall Street monetizes each and every Chinese IPO in the US and Hong Kong market, the MSCI inclusion of Chinese A-Shares is increasing every banker and wealth management firm's assets under management (AUM), and it goes without saying that one of the primary funding avenues of both Silicon Valley and major media firms is a Chinese one.

Just as we have seen the sentiment shift with regards to the ethics associated with accepting Saudi Arabian money this past year, we will see a major narrative change and sentiment shift associated with accepting Chinese capital.

And just as with any other development, it will be a slow leak, until it becomes a major over-correction.

US Ruling Political Elite Sentiment

George Soros values open societies (see his philanthropic organization) and is one of the largest proponents in investing in democratic societies. For Soros to so plainly and openly state that China is now the largest threat to democracy across the world is a major narrative change worth noting.

Soros is a major donor within the Democratic party, in addition to being one of the voices among the US ruling elite that carries weight ($$$) to it.

Leading voices inside of the US Military and its arm of capital managers, including the former Head Admiral of the US Navy, are sounding the alarm on the fact that the hard-earned savings of US armed forces, when invested in any China-affiliated companies, are being redirected towards funding Chinese military applications.

Imagine that, the funding of Chinese companies is being siphoned towards funding Chinese military technological innovation – the very thing that will become the focal point of China-US relations moving forward. This is clearly an unsustainable trend.

Still not convinced we are at an inflection point?

How about listening to the words of Vice President Mike Pence? I recommend you listen to these two speeches, in their entirety, straight from the horse's mouth. Shots across the bow, to say the least.

Investment / Growth Management Sentiment

It's no secret that the only metric that anyone in the wealth management industry cares about is assets under management (AUM). This is where the bread is buttered, as a higher AUM translates to a higher commission based income.

Working hand-in-hand with AUM comes the marketing team which only cares about one storyline: growth!

While bullish investors, in pursuit of lining their own pockets via increased AUM, have been conditioned to restate the "MSCI’s inclusion of Chinese A-shares is a megatrend" storyline, this assessment is overly simplified and avoids all short-to-medium term nuance.

They will also point out that China's economy is growing at stupendous rates and so hopping off of the momentum train now is a fool's errand. However, what they are really doing is extrapolating recent growth trends linearly out into the future. Not the most prudent way to analyze and price risk.

Of course, this is all par for the course for any emerging market storyline. Wall Street will monetize any storyline they can until it is no longer feasible.

With all of the seeds planted among the US ruling political elite, it’s only a matter of time until the common knowledge variable shifts and mainstream opinion becomes one where China and the CCP are not as benign a force as they are currently regarded. This mainstream narrative will directly affect the feasibility for Wall Street to continue this monetization storyline.

The reality is that in a timeframe more immediate than the MSCI A-shares and domestic consumer growth story, capital inflows into China will taper from rates that we’ve been seeing over the last two decades, and these flows will be redirected to North American shores and the USD.

The US government is clearly on a track now that looks to re-assert the common knowledge of its dominance financially, militarily, and intellectually. This re-assertion will cut directly into the profits and marketing campaigns of all those in Wall Street and the investment / growth management industry ceaselessly promoting the Chinese growth story.

Donald Trump and Xi Jingping Sentiment

Donald needs to win a re-election, while Xi needs to secure his supply lines (food, resources, energy) and shore up his domestic credit markets and struggling bond markets.

It seems reasonable to expect that team Trump will do everything in its power to ride a "Trade Deal" and "strong US economy" story line into a re-election. Upon re-election is where reality will set in, and counter parties will understand who they are dealing with over the next 4 years.

And this is where I expect things to become truly volatile.

This is the time horizon one ought to be positioning now. Look no further than long energy, long security, and long shipping. Trump will have solidified himself as the US President (do not anticipate domestic backlash to this presidency to subside any) and the military advisers and economic strategists will have had more time to analyze the plethora of asymmetric moves the White House can take against the CCP.

On the flipside, Xi will likely have consolidated his own power base and will have re-directed resources into the areas that matter most: food supply, energy supply, reigning in a reckless credit supply, and shoring up a deteriorating bond market.

The Trump administration has the flexibility to acquiesce to CCP hardball, if this aligns with his PR campaign of closing deals and restoring jobs leading to a strong election campaign. Should the trade deals or campaign begin to move sideways on the Trump administration, they’ll have to exercise their ace in the hole.

The ace: putting it out there that the CCP is detaining millions of minorities and harvesting their organs. As Mike Pompeo calls its, “The Stain of the Century”.

President/Chairman/General Secretary Xi Jingping has some optionality on his end, as well. It plays to his benefit to see these trade deal negotiations extended in duration so that he can devote time and resources towards domestic focuses, all while strategizing a domestic and international marketing campaign that provides him and his regime with the cover fire needed for continuing operations, as is.

This marketing campaign has the largest distribution channels on the planet in WeChat, TikTok, etc. and its story will very predictably be one of "the West is the largest contributor to human rights violations while the CCP is human rights' greatest champion."

We are walking on thin ice here, so I will let you draw your own conclusions. It's complicated, to say the least. But the point carries through that Xi will refocus efforts towards domestic issues currently bottlenecking their economy all while rebranding the CCP's international image in preparation of countering the US' ace in the hole of common knowledge around the CCP's human rights violations in Xinjiang and abroad (see Africa).

Timing & Catalysts

Lever 1 - Human Rights / Magnitsky Act

Instead of being an if question, it appears to be a when question.

When will the White House and mainstream media outlets begin outlining and continuously covering the nature of the human rights violations taking place in Xianjing and Hong Kong?

Will this timeline be ramped up in order to further ongoing negotiations and bolster election cycle perceptions? Or will this issue continue to be swept under the rug in the name of international stability and saving face?

I suspect the latter, yet politics and domestic elections could throw a curve ball into this.

It is worth noting that all throughout history the only thing that supersedes an internal enemy (in this context, ceaseless political power struggles and "witch hunts") is an external enemy.

Lever 2 – Environmental Protection

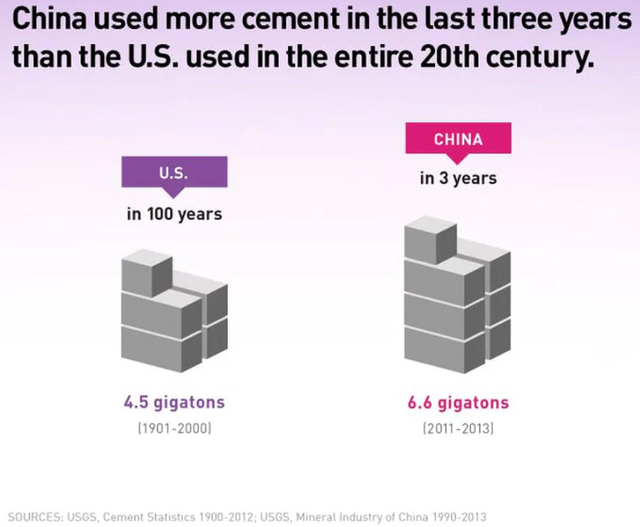

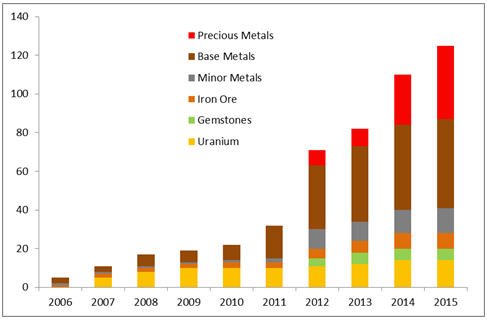

The other major lever that Western governments and lobbyists can pull with regards to bringing public perception around on this anti-CCP agenda is one of the environment. Nobody is more egregious in its environmental impact than China.

Without going too deeply into this, I’d rather just leave a bread trail for you to do your own research on this matter and draw your own conclusions:

China is not a leader in environmental protection, they are its biggest antagonist. How's that for an inconvenient truth? Expect this reality to be levered by the West.

Lever 3 - Economics

The whole bond market is distorted beyond repair. Hundreds of trillions of dollars across the globe, mispriced. Take down the bond market, and everything levered on top of it will collapse, as well. This is the nuclear option, but the US has exercised the nuclear option multiple times throughout its history as world hegemon.

For example, Greek bonds just began trading at a negative yield. In 2012, Greek bonds had a 35% yield, now they are at -0.2%. The way to think about it is the higher the yield on a bond, the higher the risk. So in 2012 after the entire nation went bankrupt, Greece had to offer investors a 35% yield (return) just to buy their bonds. Only 7 years later and still financially distraught Greece has bonds that are trading as if they are safer than US treasuries.

The current complacency in bond markets plays directly into the hands of the US, whereas China is more reliant on a stable bond market as they look to establish the yuan as apart of the IMF world currency basket and continue to lure in foreign investment. Shake up the bond market, shake up the over levered Chinese economy. Of course, all economies are over levered in today's environment, but on a relative basis, China leads the pack in being the most at risk.

Closing Remarks

All eyes are on China-US in the championship finale match, and it seems naïve to expect either side to continue holding punches for any extended period of time moving forward. The military industrial complex, economics, and digitally distributed information will all be leveraged in line with the longest storyline throughout modern man’s history:

From a practical sense, it's certainly time to review your exposure to big tech stocks and bonds. This includes a full review of where your pension, insurance, retirement accounts, trust funds, and personal funds are all currently being stored.

If you are passively invested in any 401k funds, ETF's, or mutual funds, I can virtually guarantee most of your holdings are big tech stocks and bonds. US Treasuries are one matter, but holding European or emerging market debt are out of the question.

Bonds and equities are correlated to one another, even though Wall Street will tell you otherwise. They operate in a linear world with a backend running on outdated models.

Review where your money is currently being stored and consider re-allocating and diversifying some of these holdings into overlooked industries that have upward mobility when it comes to mean reversion.

While everyone talks about trade wars, what is clear is that the anti-China narrative will only ramp up over the medium term. I imagine this narrative will reach new heights once the Democrats select their running candidate and Trump hits the campaign trail.

The major winners over the last 5-7 years stand to take a notable hit as Chinese capital retreats and "woke" US investors start to retreat from US businesses who bend the knee to Communist China in the name of maintaining profits and international growth metrics.

Whether this general outline becomes common knowledge within the next 12-18 months, or within the subsequent 4 year term, what is evident is that the broad big technology sector valuation is topping. As technological innovation begins to take on a more nation-state, military application flavor this structural trend will have no way of slowing.

The headwinds have been touted ever since 2009 and VC’s have deflected this perma-bear style prognostication for quite some time. However, capital is now retreating from big tech because of the probability that tech takes on a more nationalistic flavor moving forward. Nationalization is not appetizing from a risk/reward perspective.

And the risks to big tech associated now include sovereigns moving forward with examining monopoly structures, data rights, censorship, cybersecurity IP theft concerns, and as we've discussed, the two largest economies upon the verge of entering very dangerous rhetoric surrounding technology and an innovation arms race.

While the morals behind this will be debated all day, the economics make sense. And moving forward it appears that economics are beginning to matter again.

And within tech, specifically, this means profits; something that’s been overlooked throughout this cycle.

In the interim, crypto-assets remain an attractive risk/reward investment vehicle. While harvesting naked profits from big tech positions, it's healthy to frame crypto-assets as call options on the broader tech sector. Size accordingly.

For further reading, I recommend reading: (1) Energy, (2) Commodities and (3) Crypto-assets.

“Progress in the war against disease depends upon a flow of new scientific knowledge. New products, new industries, and more jobs require continuous additions to knowledge of the laws of nature, and the application of that knowledge to practical purposes. Similarly, our defense against aggression demands new knowledge so that we can develop new and improved weapons. This essential, new knowledge can be obtained only through basic scientific research.” – Vannevar Bush

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

Read More:

Pompeo on Silicon Valley and National Security

House Passes $738 Billion Military Bill

U.S. Army will fund rare earths plant for weapons development

Servicemen’s Savings Shouldn’t Fund Russia and China

Thiel, Wolfe & DoD On Innovation and US DefenseWatch the portion from 17:00 - 24:00

Former White House Chief Strategist Steve Bannon Talks Candidly About China