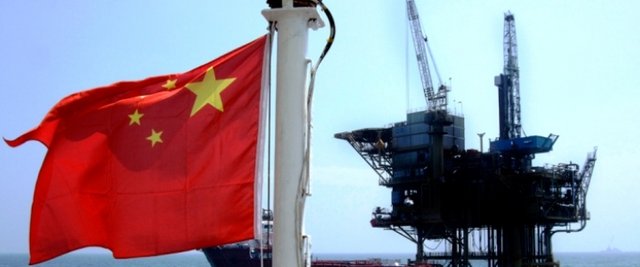

Will China’s “Debt Diplomacy” Backfire?

China is loaning money all over the world. They are accused of using "debt diplomacy" as a means to indebt countries to it.

Angola is one of the latest countries to fall prey to the lure of Chinese money.

The oil producing nation committed to breaking the dependence upon oil after the global crash in prices 4 years ago. In an effort to diversify the economy, Angola started to take on debt from other countries.

Other countries are finding that getting into bed with Beijing is not a great deal. Sri Lanka used Chinese money to fund a port. When it could not make the payments, the Chinese demanded another port be handed over to them.

Click on image to read full story.

They are heavily involved with Djibouti. They have built a railroad into Ethiopia, ports, etc. They have also established their first ever military base on foreign soil here.

You got a 100.00% upvote from @emperorofnaps courtesy of @steemium!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

Thank you so much for using our service! You were protected from massive loss up to 20%

You just received 76.92% upvote from @onlyprofitbot courtesy of @steemium!

More portion of profit will be given to delegators, as the SP pool grows!

Comment below or any post with "@opb !delegate [DelegationAmount]" to find out about current APR, estimated daily earnings in SBD/STEEM

You can now also make bids by commenting "@opb !vote post [BidAmount] [SBD|STEEM]" on any post without the hassle of pasting url to memo!

* Please note you do not have to key in [] for the command to work, APR can be affected by STEEM pricesIt's already backfiring. ASEAN countries (with the exception of the Philippines, whose president is Xi's most masochistic concubine) are renegging on previous high-interest loan plans from China, and the Pacific Islands Forum has all but openly declared itself a "bloc to resist China." The Sri Lanka Incident (Hambantota Port, specifically) was the wake-up call a lot of nations needed, and the eerie parallels between the handover of Hambantota and the handover of Hong Kong to the British Empire were not lost on many people.

Even Pakistan, China's "iron brother," is starting to chafe under the weight China imposes upon their neo-tributaries. The most important effect of China's loans, though, is going to be their inability to continue lending as much as they have pledged to loan. The loans are denominated in US Dollars, and the Renminbin is in a tail-spin (earlier today when I went to Minsheng Bank to exchange RMB for dollars the exchange rate had fallen to 6.94 RMB to 1 USD), and the Chinese population is starting to gripe about that money not being spent at home, since the CPC's entire claim to legitimacy for years has been "we make your lives more comfortable in exchange for the freedoms you give up."

The Western media doesn't show it (they need SOMEONE to be scared of, after all), but China is in the process of flying apart at the seams right now. Living in Beijing I am watching it happen.