Bailout #3: Chinese Bank With $200 Billion In Assets Is Nationalized

Step aside Baoshang Bank and Bank of Jinzhou, it's time for Chinese bank bailout #3.

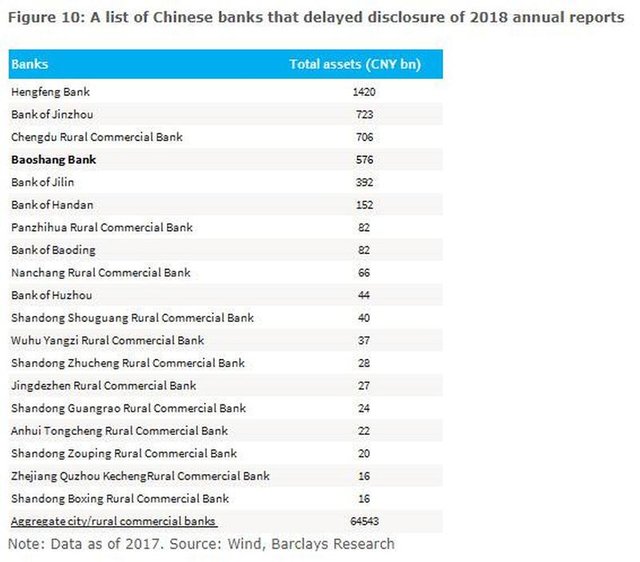

Last month, when reporting on the imminent failure of yet another Chinese bank in the inglorious aftermath of Baoshang Bank's late May state takeover, we dusted off a list of deeply troubled Chinese financial institutions that had delayed their 2018 annual reports...

... and noted that the #2 bank on this list, Bank of Jinzhou recently met financial institutions in its home Liaoning province to discuss measures to deal with liquidity problems, and in a parallel bailout to that of Baoshang, the bank was in talks to "introduce strategic investors" after a report that China’s financial regulators are seeking to resolve its liquidity problems sent its dollar-denominated debt plunging.

Just a few days later, that's precisely what happened, when in late July, Industrial and Commercial Bank of China (ICBC), the country’s largest lender by assets, China Cinda Asset Management and China Great Wall Asset Management, two of China’s four largest distressed debt managers, said on Sunday they would take stakes in Bank of Jinzhou.

To be sure, there was some token debate over the semantics: was this bailout a nationalization or a state-bank funded takeover:

“For Baoshang Bank, the government took a state takeover, while for Bank of Jinzhou, the government introduced some state-owned strategic investors,” said Dai Zhifeng, analyst with Zhongtai Securities Co; in reality both were government rescues, only in the latest case Beijing used state-owned bank intermediaries.

“The latter approach is more market-oriented and showcased the determination of regulators to resolve problematic banks, while injecting confidence into the market,” Dai said, although when stripped of all the pig lipstick, what just happened in China is that another major bank, one with $100 billion in assets, just collapsed and received a government-backed rescue.

The bigger problem, and the reason why Chinese bank stocks have tumbled ever since the Baoshang Bank bailout, is that investors (and depositors) were worried that now that Beijing has started down the path of bank bailouts, it was unclear where it would stop.

And so, fast forward to this week when overnight, the SCMP reported that China’s sovereign wealth fund has taken over Heng Feng Bank - the bank at the very top of the list shown above, one with roughly $200 billion in assets - a troubled lender linked to fugitive financier Xiao Jianhua, in the third case in as many months of the state exerting its grip over wayward financial institutions.

According to the report, Central Huijin Investment, a subsidiary of the China Investment Corporation that acts as the Chinese government’s shareholder in the country’s four biggest banks, emerged as a strategic investor in Heng Feng, according to a brief report overnight by Shanghai Securities News, published by state news agency Xinhua.

The investment was a breakthrough in Heng Feng’s debt restructuring led by the Shandong provincial government, the state-owned newspaper said, without citing a source or providing financial details. Huijin’s investment would increase Heng Feng’s capital adequacy, improve the troubled bank’s management and enhance its operational capability, the paper said.

In short, a 3rd Chinese bank in as many months received an implicit (or explicit) state bailout, and with the dominoes now falling, it's just a matter of time before most if not all of the banks shown in the list above collapse.

Some more details on bailout #3:

Heng Feng, based in Yantai city, was founded in 1987. It operated 18 branches and 306 sub-branches across the country. It is among more than a dozen city-level and rural lenders that had been put on notice by the authorities for a shake-up, as regulators step up their programme of cleaning up financial malfeasance and profligate lending.

It’s also the second of several banks in Xiao’s financial empire to be put under state ward, after the May 24 nationalisation of Baoshang Bank in Inner Mongolia’s Baotou city. As we reported back in May, Xiao’s Tomorrow Group, which owned 89% of Baoshang, had misappropriated large sums from the bank, triggering serious credit risks that prompted the government to step in, the central bank said. Xiao himself had not been seen in public since he was persuaded to return to mainland China from Hong Kong on the eve of the 2017 Lunar New Year to help with investigations into his financial affairs. Like so many other former oligarchs, he simply disappeared somewhere deep inside China's "corrections" apparatus.

As the SCMP notes, at its apex, Tomorrow Group owned stakes via proxies in hundreds of Chinese listed companies, including at least 10 banks, the China Banking & Insurance Regulatory Commission said on June 9.

It all ended with a bang, however, with the Baoshang Bank seizure in late May.

Then, as we reported two months later, Baoshan was joined on July 29 by Bank of Jinzhou, which received the backing of three Chinese financial institutions, including Industrial & Commercial Bank of China. ICBC put 3 billion yuan (US$436 million) into Bank of Jinzhou, and assigned at least four senior executives to manage it. Cinda Asset Management and Great Wall Asset Management would also pour funds into Bank of Jinzhou.

The change in strategy, where Beijing was now openly seizing or bailing out insolvent banks - Baoshang was the Chinese government’s first nationalisation of a private bank since 1998 - led to a collective collapse in the stock prices of China’s listed banks, driving their valuations to record lows, amid fears that the shakeout would affect more lenders, and that the largest and best capitalized institutions would be called upon to bail them out.

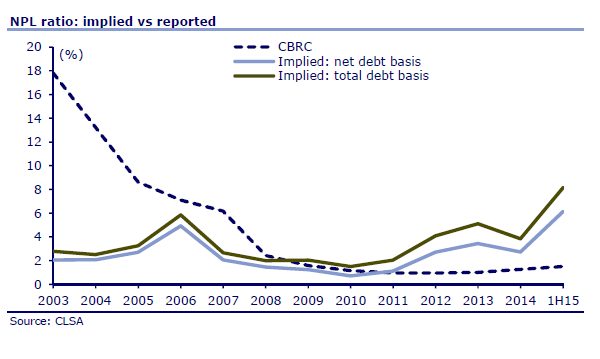

That's precisely what is happening right now, and unfortunately it's about to get worse for a simple reason that was all the rage back in 2015 - namely the soaring amount of Chinese NPLs, a number which has been drastically massaged by the banks, regulators and politicians, to make China's banking system appears safer than it was (see "

CLSA Just Stumbled On The Neutron Bomb In China's Banking System"). As the SCMP notes, the level of non-performing loans among local lenders licensed to operate within city of urban centres were at 1.9% of their total lending at the end of March, worse than their larger peers, according to CBIRC data. The real number is likely orders of magnitude higher.

These local, city banks were also the least capitalised among all bank categories, with 12.6% capital adequacy ratio, compared with 18.3% in foreign banks.

It gets even worse when one looks at China's rural commercial banks, which are licensed to serve villages and smaller towns, and which had 4.1% of their lending classified as bad loans, CBRC data showed. That compared with the 1.1 per cent average among larger nationwide commercial banks, and 0.8 per cent among foreign banks, the data showed. None of those numbers is remotely close to reality, and with China's economic growth now sliding, it is just a matter of time before things get far worse.

Incidentally, just days before the Heng Feng rescue, JPMorgan correctly downgraded China's banks due to increasing pressure for banks to support growth agenda as macro risk escalates:

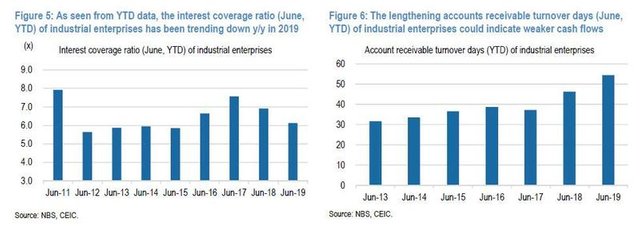

The J.P. Morgan economics team revised down its GDP growth forecast for 2020 by 0.1ppt due to the recent sharp turn in Sino-U.S. trade negotiations. But even prior to that, declining PPI and industrial profits growth, suggesting declining debt-servicing ability and weakening cash flow for Corporate China, increase the risks that banks will be asked to support macro growth at the potential expense of profitability. Recent official PBOC comments on an accelerating interest rate liberalization process are illustrative of such rising risks.

Additionally, JPM cautioned investors to stay away from Chinese banks as, "(1) we cut our NIM and earnings estimates to factor in potential NIM compression due to interest rate liberalization; (2) banks’ re-rating path comes to a halt, at least for now, due to the re-leverage of Corporate China leading to debt concerns; and (3) rising concerns of failed small banks contaminating the balance sheets of large banks may lead to de-rating pressure on large banks."

It now appears that Beijing has indeed picked a model where concern (3) is especially valid, as large banks will be brought in to bail out smaller, insolvent ones (think JPMorgan and Bear Stearns), in the process "contaminating" their balance sheets, as what until now was a localized financial weakness diffuses across the entire banking sector.

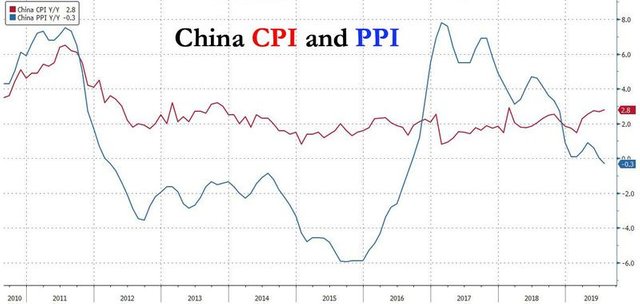

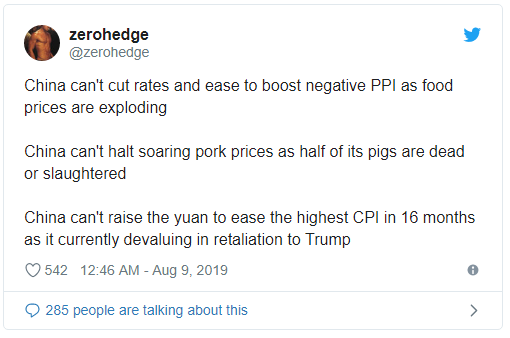

But what may be worst for China, is that it as of this moment its options to boost the economy are severely limited following the latest inflation data which was "the worst of both worlds", as PPI prices posted their first decline in 3 years, while CPI jumped to 16 month highs as food prices continued to soar.

This, as Bloomberg's Kyoungwha Kim wrote, is "an ominous sign for equities because it underscores the difficulties the PBOC faces if it wants to boost policy stimulus", or as we summarized it last night:

The bottom line: Trump now appears to be winning the trade war with China, whose economic contraction is accelerating and between slowing trade, sliding corporate profits (PPI), rising inflation (CPI), a devaluing Yuan, a record debt load, and now a sudden crisis in its banking sector, Beijing has found itself paralyzed and with zero credibly options how to kickstart the economy.

The only thing that's left is for China to admit that this is indeed the case, so sit back, relax and watch as bank after bank on the list above fails and China's financial cancer spreads across the country with the $40 trillion in assets (which is certainly not bad news for either gold or bitcoin).

https://www.zerohedge.com/news/2019-08-09/bailout-3-chinese-bank-200-billion-assets-nationalized

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Well that escalated quickly looks like state backed currencies are starting to feel the heat! It’s going to be fun to see now that people have the opportunity to opt out or kind of keep a stake in something else!

The next global financial crash is going to one hell of a ride

Posted using Partiko iOS

71.49$ has been spent to promote this content using Steemium.

Learn more here!