BEYOND BITCOIN. The Future of Digital Currency. Part II Blockchain vs. RAIDA

BEYOND BITCOIN. The Future of Digital Currency. Part II Blockchain vs. RAIDA

The theory of a perfect money by Sean H. Worthington

Monetary systems have a job, and money has a specific role within monetary systems. The job of the monetary system is to track what value an individual adds to the economy and ensure that more value is received than is put in.

If a monetary system does not do this, then it is unjust and people will “defect” from using it .They may use it if forced to, but they will avoid it if they are able.

With the invention of digital currencies such as CloudCoin, many more people will be able to enjoy high-integrity monetary systems as they defect from the fiat currencies that governments and banking cartels offer.

What a perfect money would offer

The perfect monetary system would be run by system administrators, not bankers, governments or even computer scientists. This is because monetary systems are information systems, and have little to do with banking, government or computers.

The perfect money has perfect integrity. This integrity can be classified under three headings:

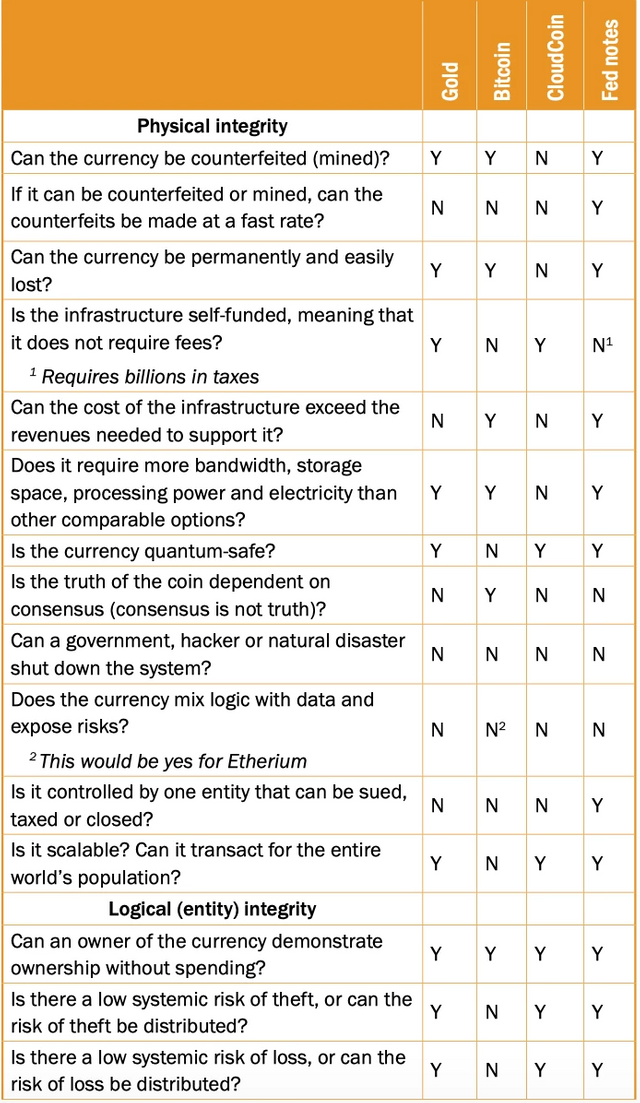

Physical integrity

Logical integrity

Preferential integrity

Integrity

In practice, physical integrity means:

No counterfeits

No loss

No theft

No possibility of system-wide failure

Logical integrity addresses:

Users must know who the money belongs to (entity integrity).

The money must all be of the same stuff (domain integrity).

The money must refer to something that is actually there (referential integrity)

With preferential integrity, the system must:

Be private

Be scalable

Be fast to transact

Use whole numbers (or at least fractions that are easy to understand)

Have high availability (no downtime)

Physical integrity

A monetary system must allow people to prove to others that they added value to the monetary system, and that they deserve to get some back. If a person gets money through counterfeiting or theft, or by taxing, they are able to prove something that is not true.

Data and money must be true. That is what integrity is about.

And if the system becomes unavailable (fails), then no one can know the truth. That must not happen in a monetary system.

Money has to be there to do the job. If the money just disappeared, we would not have a monetary system. If some of the money disappeared, then it may still be usable but flawed. The money must not disappear, must not be able to be destroyed, lost or unreadable, and must not appear out of nowhere to be perfect.

Loss

As of this writing, over 17 million Bitcoins have been mined, and over 4 million of them have been permanently lost.

What happens when the losses exceed the coins mined? The monetary system dies.

The major problem with loss is that it fails to accurately reward people who created value. You may not think of this as a big problem until it happens to you.

Anyone can lose money, but it is unfair when it happens. In a perfect monetary system, it is impossible to lose money.

Theft

Some currencies are more susceptible to theft than others. The cryptocurrencies are probably the most susceptible because of their private keys that control the money in the accounts. We can dramatically reduce theft of most currencies by simply not putting all our eggs in one basket - by reducing the systematic risk. We could go into great detail about this, but now we are in the process of making CloudCoin unstealable even with quantum computers. In a perfect monetary system, there should be no theft.

Shutdowns

In the 1990s, people in California put their gold together in one vault, then issued digital currency against it. They did billions of dollars worth of trade using this e-Gold. But then some state government bureaucracy decided to kick down the doors and take the vault and all the gold. The system did not have physical integrity.

If your currency can be shut down, then it does not have physical integrity and it will not last. Bitcoin was the first digital currency to achieve this physical integrity, but it will not last for long. Quantum computers will put an end to this and other cryptocurrencies.

The cloud can be made quantum-safe. A perfect monetary system is always available, and works right every time.

System risk

There are two types of risk: systemic (the risk of collapse of an entire financial system or market) and unsystematic (risk contained within a single company or industry). Digital currencies must be able to eliminate all systemic risk. CloudCoin has done this.

Logical integrity

There are many parts to logical integrity. The first is entity integrity.

Entity integrity means that each money must belong to an entity.

This also assumes that an entity must be able to prove that ownership. Money without an owner is lost, and loss is not allowed in a perfect monetary system. Entity integrity is only an issue when it comes to transferring ownership. In a perfect monetary system, ownership is clear.

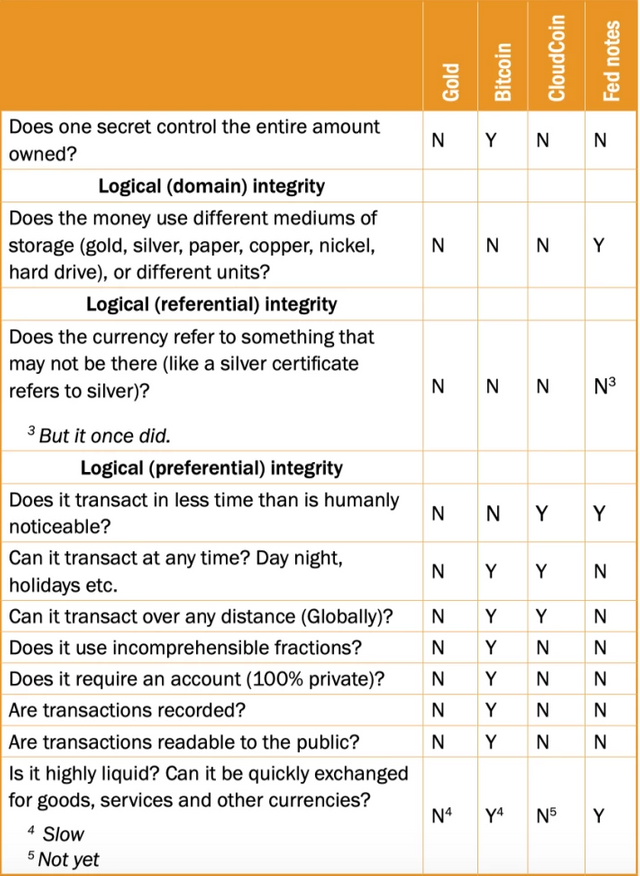

Another part is domain integrity. This means that all the money must fall within the same “domain.” Systems based on silver, copper, gold and nickel coins do not have domain integrity. They are all made of different stuff (domains), and this stuff does not have the same value.

Even systems that mix paper money and coins lack domain integrity.

It is possible that the metal in the coins could be worth more than the numbers printed on them and much more than the numbers printed on the paper.

Digital currencies generally do not suffer from lack of domain integrity. In a perfect monetary system, the money is all cut from the same material - it belongs to the same domain.

Regarding referential integrity: Often with money, the data is written on something with physical properties that reflect the value.

For example, a dollar was originally defined as the modern-day equivalent of 24.057 grams of less-than-pure silver, so with a silver coin that’s labeled as a dollar, you would expect that coin to contain 24.057 grams of silver.

However, you can write the word “dollar” on anything, including pieces of toilet paper. If we accept the original definition of a dollar, then put the word “dollar” on paper and that money loses all referential integrity.

If we change the meaning of “dollar” to a monetary unit used by the Federal Reserve Bank, then we get the referential integrity back.

We have seen referential money like the U.S. silver certificates, which are no longer in circulation. These pieces of paper referred to an ounce of silver that was supposed to be safely vaulted away. The problem was that it was not true - the silver certificates did not possess referential integrity.

There are now many digital currencies, such as Tether (Tether is a blockchain cryptocurrency that is backed one-to-one, by fiat currencies), that claim referential integrity by binding to a currency such as the U.S. dollar. But, as history has shown, monetary systems that work on referential integrity always fail sooner or later. In other words, if you invest long in referential money, you will lose your ass.

Perfect money has 100% referential integrity. This means that it says what it is and there is no doubt as to what it is. A CloudCoin is 100% a CloudCoin. Bitcoin also enjoys 100% referential integrity.

Preferential integrity

It may be possible for a monetary system to keep all of its data straight, and to track who added what and who should get what out. But there are other important things that must be addressed.

What people prefer might not fall under the strict science of data, but these are also important. One aspect of this is privacy.

Imagine that when you went to buy something it was posted on Facebook so that everyone could see everything you bought and where you bought it.

Imagine getting lectured by your boss, coworkers, family members and even your kids on what to buy and what not to buy, where to shop and where not to shop.

The better the privacy, the better decisions we make, the more we economize, the more civilized we become. If you have to sign up for an account to use your money, it’s not private.

You can obtain a pseudo privacy with cryptocurrencies, but if someone finds your private key, they can prove how much money you have and all the trades you have made.

Real 100% privacy means no accounts, no logins, no passwords, no private keys and none of the other things that publicly attaches you to the money you own.

Scalability means that a system does not slow down when more people use it. Think of cars on a bridge. The bridge is not scalable - the more traffic it gets, the slower the traffic moves.

The world is looking for a global currency that can handle the entire world’s trades. It would be a crushing blow to get invested in a currency that stops working because everyone else wants to use it too. But that is what happened to Bitcoin and Etherium.

Blockchains in general are just not scalable. We would even suggest that if you are using a currency that claims to be blockchainbased and scalable, it is either not really blockchain or not really scalable, because the two don’t match.

Perfect money is scalable.

Speed of transactions is also very relevant. During the height of the Bitcoin bubble, it took an average of 20 hours for a transaction to complete. That is not going to work for someone who wants to buy a soda at the corner store. People don’t care if it is 500 milliseconds or 250 milliseconds, but the slower you get, the more people will complain. We assume that anything over 20 seconds is dead when it comes to retail.

Perfect money trades fast.

The fractions a coin can break down to is also a vital point.

The most important part of a monetary system is the human mind. We need to be able to think about what the numbers mean to us. We have to know how much we have, how much we need, and how to plan our spending. Thinking in whole numbers may be easier than mixing whole numbers and fractions. It is easer to think of 5 CloudCoins than 5.6789958443 Bitcoins.

What level of precision (number of decimals) does a monetary system need to be accurate? That, I admit, I do not know. But I am putting my money (CloudCoins) on whole numbers.

In terms of preference, a perfect money should be easy to use. It should always be available, transact at any time, and have high portability.

A perfect money must meet the preferences of its users.

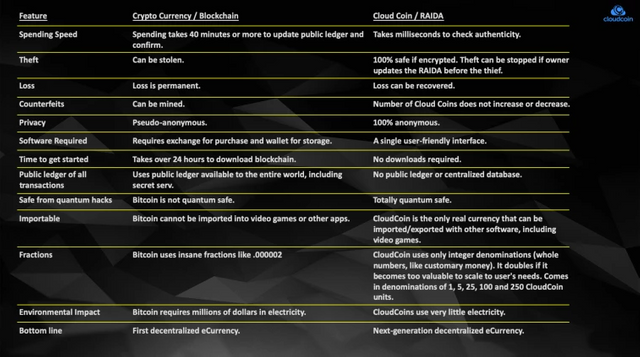

Blockchain vs. RAIDA

The table below will give you a better idea of how to measure their fundamental values

Comparing integrity in different money systems

The next table shows how CloudCoin stands up against other familiar monies:

To be continued..........

Sean H. Worthington PhD ABD for CloudCoin Consortium.

Resources

https://cloudcoin.global/

http://seanworthington.com/

https://raidatech.com/

https://www.amazon.com/Beyond-Bitcoin-Future-Digital-Currency-ebook/dp/B076MQCRG6

https://cloudcoinconsortium.com/use.html

https://t.me/CloudCoinGlobalCommunity

http://t.me/GlobalCloudCoin