Coinbase

Coinbase is the world’s biggest bitcoin broker. It exchanges bitcoin, ether, litecoin and bitcoin cash for 32 fiat currencies, and can be used in 190 countries. It’s quick and easy to use, secure, and comes with relatively low exchange fees (although not the lowest). Yet its use by over ten million customers can sometimes mean that, at times of heavy activity, its website goes down temporarily (as it did several times in December 2017).

Pros

Easy to use; simple interface

Available for over 30 fiat currencies

Secure

Cons

Only two payment/transfer options

Website can suffer from heavy traffic

Relatively low fees

Trusted

Average Fees

Fast

Easy to use

Screenshots

Screenshot

Screenshot

Screenshot

Fees

Coinbase charges fees to buy and sell cryptocurrency. These vary according to payment type (e.g. card or bank transfer), according to the amounts being transferred, and according to location.

That said, Coinbase’s support pages explain that it charges a minimum flat fee to exchanges under $200 in value. For those over $200, it charges a variable percentage fee, as shown below:

Region Standard Buy/Sell Credit/Debit Card Buys Bank Transfers (SEPA) – in/out

Europe 1.49% 3.99% Free/€0.15

UK 1.49% 3.99% Free/€0.15

Australia/Canada 1.49% 3.99% Free/€0.15

To take some concrete examples, someone wishing to buy bitcoin in British pounds and with a debit or credit card would have to pay the following fees to Coinbase:

Total Ammount Coinbase Fee Conversion fee Ammount spent on bitcoin

£100 £1 £2.41 £96.59

£200 £1 £4.85 £194.15

£300 £2 £7.26 £290.74

£400 £3 £9.68 £387.32

£750 £7 £18.11 £724.89

And for the sake of comparison, Coinbase’s 3.99% fee for credit/debit card transactions is cheaper than BitPanda’s and BitStamp’s respective fees, for example. These both stand at 5%.

However, compared to CEX.io and Kraken, for instance, Coinbase is a bit more expensive. CEX.io charge 3.5% (+ €0.24 or £0.20) for credit/debit card purchases of bitcoin, while Kraken – who aren’t quite as user-friendly and accept only bank transfers – charge around 0.26% for bitcoin purchases.

In other words, Coinbase is cheaper than many other of the large crypto exchanges. But if the buyer is willing to shop around a bit, they can usually find cheaper fees elsewhere.

Background

Established in June 2012 and opening the first regulated cryptocurrency exchange in the US in January 2015, Coinbase has since gone on to serve over thirteen million customers and exchange over $50 billion in digital currencies. This makes it one of the biggest exchanges on the web, with its reputation being cemented towards the end of 2017 when its mobile app became the most popular download on the Apple App Store. Such popularity is largely the result of its easy-to-use interface, competitive transaction fees, its availability for 32 fiat currencies, and its offering of ether, litecoin and bitcoin cash (in addition to bitcoin).

Security

Coinbase offers robust security measures. Users register for an account and login using two-factor authentication, while they have to verify their identity using a passport or driver’s license in order to buy or sell any cryptocurrency. More importantly, Coinbase takes the follow measures to increase the security of its operations:

98% of customer funds stored offline

Bitcoin is distributed geographically in a variety of vaults around the world

All website traffic is encrypted

Customer wallets and keys are all encrypted (AES-256 encryption)

Coinbase employees undergo criminal checks and must encrypt their hard drives

Coinbase runs a bug bounty program, incentivising coders to alert them to any bugs

Usability

Usability is one of Coinbase’s biggest draws. Setting up an account is a quick and easy process, requiring nothing more than a name, address, bank details and proof of ID.

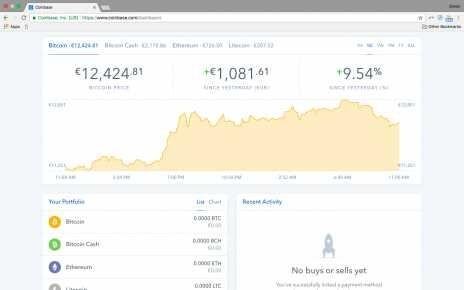

Added to this, the website itself is clearly laid out, with easy to navigate pages and interfaces. Its dashboard shows the user the changing value of bitcoin (or the other three tradable cryptocurrencies), it shows them their recent transactions, and it shows them their portfolio of currencies.

This kind of intuitive layout is also available on the site’s mobile app, which can be download via the Apple App Store and Google Play.

Deposit/Withdrawal Methods

Buying bitcoin is an instant process with a credit or debit card. Meanwhile, buying through a bank transfer takes 1-3 business days, so long as the user is doing it through the Single Euro Payments Area (SEPA).

However, other than these two deposit and withdrawal methods, Coinbase offers no others. Users can’t buy or sell cryptocurrencies via PayPal, and they can’t use any of the various bitcoin processing services (e.g. BitcoinPay or OKPay).

USD

EUR

GBP

BTC

ETH

Supported Currencies

Buy / Sell

Bitcoin (BTC)

7566.29 / 7680.79

Ethereum (ETH)

597.00 / 607.70

BitcoinCash (BCH)

1092.99 / 1139.55

Litecoin (LTC)

118.75 / 120.86

NEM (XEM)

0.24916 / 0.25807

Dash (DASH)

304.31 / 313.299

Exchange rates

and other info

Exchange

Payment methods

Bank Transfer, Credit Card, Debit Card

General info

Web address: coinbase.com

Support email address: [email protected]

Company address: 548 Market Street #23008

San Francisco, CA 94104, USA

Global users: 13.3 million (as of Nov 2017)

©Cryptonews.com

Telegram

Facebook

Twitter

YouTube

Bitcoin

Adoption

Blockchain

Cryptocurrency

Regulation

ICO

MARKETS

Ripple

Bitcoin Cash

South Korea

Exchange

Ethereum

Ether

Japan

Mining

Community

Trading

China

Society

Hack

Investing

Litecoin

Security

Market

Scam

USA

Banking

Bithumb

Russia

Fraud

Investment

Investments

Legal

Ban

Altcoins

Coincheck

Monero

Coinbase

Crime

Venezuela

India

NEO

Petro

retail

Tax

NEM

Binance

Facebook

EU

Vitalik Buterin

About Us

Contact Us

Terms & Conditions

Privacy Policy

Disclaimer

News

Bitcoin News

Ethereum News

Altcoin News

Blockchain News

Exclusives

People In Crypto

Opinions

Features

Videos

Ethereum Videos

Altcoin Videos

Bitcoin Videos

Blockchain Videos

ICO Videos

Market Videos

Trading Videos

Security Videos

Guides

Blockchain

Bitcoin

Cryptocurrency

ICO

Ethereum

Reviews

Events

Price Tracker