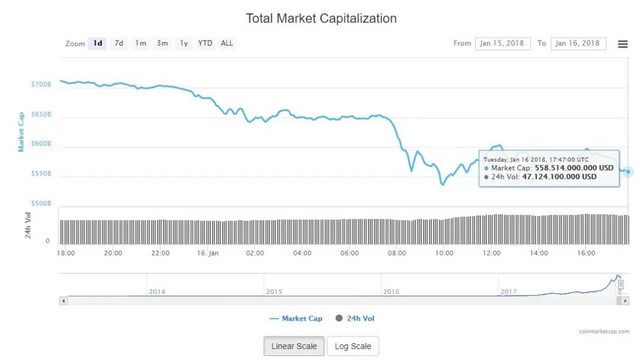

CRYPTOACTIVE MARKET SUFFERS FALL OF MORE THAN 20% IN ONE DAY

On January 16, the cryptoactive markets awoke with even lower prices. A large number of tokens and cryptocurrencies listed in different exchange houses and market measurement sites show a drop of more than 20% against the US dollar.

The web speculates with information ranging from normal market corrections after a marked upward trend, to at least three other possible reasons for this event, more linked to the fundamental analysis of the market. Among these are the proximity to the lunar new year in several countries in Asia, the increase in regulations to the cryptoactives by China and South Korea, as well as a possible manipulation of the market near the expiration, on January 17, of the first Cboe futures.

The market of global capitalization of cryptoactives presents a drop of more than 20% in less than 24 hours. On the other hand, the altcoins market is showing a decrease of more than 23%. With respect to bitcoin, a day ago its price was $ 14,378 per unit and at the time of writing this article, its value is $ 11,586 each, also representing a fall of more than 20%, according to CoinMarketCap.

The highest exchange volume in relation to bitcoin (BTC) is being made against the US dollar (USD) with more than 35%, against USD Tether (USDT) with more than 25% and the Japanese yen (JPY) with more than 21%. These changes are being made mainly in Bitfinex exchange houses with more than 17%, Coincheck with more than 12% (BTC / JPY) and Okex with more than 11%, according to CoinGecko.

By evaluating the volumes of change, it can be seen that the Korean won (KRW) does not stand out among the changes with bitcoin recently; however, there are some unusual high volumes against the USDT, mainly in Chinese exchange houses. Even the price against the KRW continues to have premium values of $ 14,246 and against the JPY close to $ 12,798 for each bitcoin, so it could be assumed that the downward trend is not generated by South Korea, nor by Japan.

Assuming that the largest exchange volumes come from Chinese funds, it could be due to the proximity of the lunar new year; one of the biggest festivities in the Asian country, generally compared to Christmas in the West, so the Chinese could be collecting profits to spend on their holidays. However, more influential could be the news about the Chinese government's intentions to further restrict transactions with cryptoactives to its citizens.

On the other hand, characters from the ecosystem such as Charlie Lee commented through Twitter at the beginning of this 2018, that in the case of Cboe futures contracts, prices are governed only by the Gemini exchange house. This exchange house has very low exchange volumes compared to others with more trajectory in the ecosystem, so the price of BTC in it could easily be manipulated to achieve desired results by individuals on the Cboe futures.

In either case, there is not yet a direct catalyst for the event in the cryptoactive market that took place today, so the community is doing nothing more than assumptions about it. For this reason it is important that they always invest consciously, based on research collected and with money they are willing to lose.