Ronald Reagan Was the Worst President: Why Tax Cuts For the Wealthy Destroy Economies

Ronald Reagan, the favorite President of conservatives everywhere, is representative of the economic policies that have ruined America. I must admit that the title is an exaggeration. The worst President, by far, was Andrew Jackson, Donald Trump's favorite President, who committed unspeakable atrocities against Native Americans, as well as having terrible economic policies. In reality, Ronald Reagan is merely representative of what a bad President is. The Reaganomics-style conservative economic policies that have devastated the American economy really started in the mid-1970s under Richard Nixon. Reagan only serves as a stand-in to represent every conservative President and advocate of trickle-down economics. Today, conservatives are merely pushing a more radical and politically incorrect version of Reaganomics. I'm only going to mention a few points to establish that Reagan was morally despicable, then I will focus more on the science of economics and how conservatism leads to stagnating wages, high unemployment, and economic instability.

Like Donald Trump, Ronald Reagan was an actor and a celebrity. As a celebrity, he contributed heavily to McCarthyism, helping to get actors, writers, musicians, and directors blacklisted in Hollywood. Anyone who was not a conservative was a "communist" who deserved to be deprived of an income and decent living. He also provided the FBI with names of other celebrities whom he suspected of having communist and socialist sympathies. His McCarthyism ruined the lives of hundreds of innocent people whose only crime was holding different political beliefs. He also testified before the House Un-American Activities Committee. The people he reported were blacklisted, no longer able to find work, and put under government surveillance. During the Berkeley protests for People's Park in 1969, as governor of California, Reagan gave the authorization for the police and national guard to use deadly force against unarmed, non-violent protesters. In his extremism, he claimed that the creation of Medicare was the end of liberty in America. His administration purged names from the Social Security disability rolls in order to save money by cutting benefits going to disabled people, while subsidizing the wealthy at the same time. Throughout his life, Ronald Reagan put ideology above ethics. I am doing this badmouthing of Reagan simply for the sake of shattering the myth of Reagan as a great person. Reagan was certainly no Dr. Evil. He probably believed all of his own bullshit, but the road to hell is paved with good intentions. Reagan probably did believe that his actions were all justified, but he was mistaken. However, this is no excuse because ignorance and immorality are entangled, so that it is impossible to be entirely ethical whilst being ignorant. The Puritans believed that "witches" used magic to harm children. That belief was false. If their belief had been true, they would have been totally justified in executing witches. However, they were wrong—both in their convictions and in their actions—, insofar as witches who harm children with magic simply do not exist. There is no is/ought dichotomy. Instead, there is a fact-value entanglement. You cannot take the right course of action without first discerning the facts of the situation!

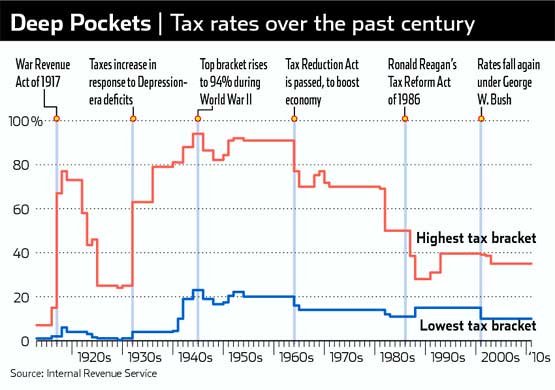

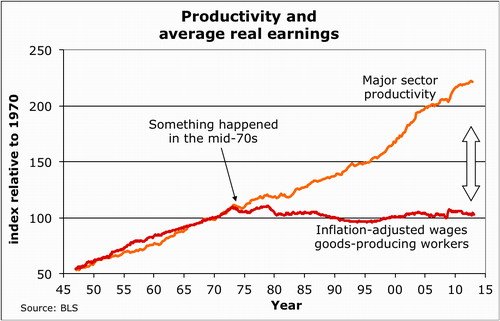

But the real problem with Ronald Reagan is his economic policies, which have devastated the American economy and, of which, we are still feeling the negative consequences today. It is true that Reagan increased taxes during his time in office, but it is also true that he cut taxes on the wealthy. The Tax Reform Act of 1986 dropped the top income tax rate to 28% (compare that to 70% in 1980). Such tax policies, although generally favored by conservatives, are economically unsound and unethical, and result in stagnating wages in spite of increased productivity. The end result is that while workers produce more, corporations and wealthy individuals end up taking more of a share of that wealth rather than raising wages for the working populace.

Allow me to reintroduce an economic observation from Karl Marx. Marx observed that the capitalists/bourgeoisie (owners of capital and the means of production) under capitalism have an incentive to maximize their own profits. They are motivated by their own self-interest. In a totally unregulated market, employers will attempt to maximize profits by cutting costs. This can be done by cutting wages, refusing to spend money on safety measures, etc. Consequently, in an unregulated market system, wages have a tendency to fall to the subsistence level and working conditions tend to get worse over time. Thus, Marx predicted the immiseration of the proletariat, a gradual worsening of the condition of the working class, so that wages would fall until they become starvation wages and working conditions would become increasingly worse and less safe over time. The condition of the proletariat (or working class) would gradually get worse as capitalism progressed. This immiseration is what Marx predicted would lead to the revolution, when the working class spontaneously throws off its shackles and takes over. Marx's analysis is totally correct if markets remain unregulated. However, this is not how things have historically played out. Revisionist Marxists and social democrats, like Eduard Bernstein, pointed out that in reality government policies tend to mitigate the negative effects of unregulated capitalism and thereby prevent such a total immiseration from occurring. Throughout Europe and America, governments imposed minimum wage laws, workplace safety requirements, and social welfare programs (e.g. Social Security, Medicare), and progressive taxation (i.e. taxing the income of the wealthy at a higher rate than that of the poor) as ways of staving off the immiseration of the proletariat. Because of such policies, capitalism ended up raising the entire populace rather than just the upper classes. Minimum wage meant that wages were not allowed to drop below a certain point. OSHA meant that employers could not cut corners on maintenance and cleaning in order to cut costs and maximize profits: if working conditions become hazardous due to mold or faulty equipment, employers are required by law to rectify the situation and ensure that their employees have safe working conditions.

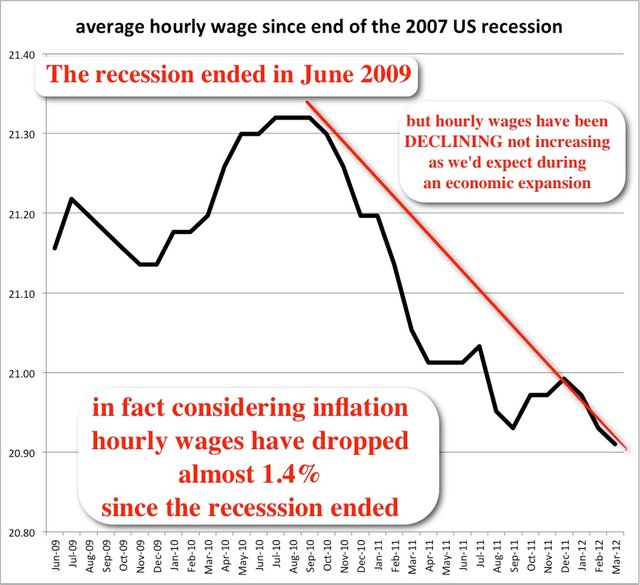

The recession ended in June of 2009, the economy started to grow again, but the average person still feels like they're stuck in the recession. While GDP has increased since 2009, unemployment remains high and wages have been declining. While the economy is expanding and wealth is increasing, none of it is trickling down to the people. Instead, the newly created wealth is all going to the top 1%.

So, why do we simultaneously have growth in GDP, an increase in real wealth overall, alongside declining wages for the vast majority of the populace? Well, the answer lies in Marx's analysis of the immiseration of the proletariat and the role that government policy has in mitigating the immiseration effect. The creation of a minimum wage and safety standards kept the immiseration from increasing, but it was entitlement programs like Social Security, Medicare, Medicaid, and VA programs that helped raise the condition of the working class. Furthermore, high income tax rates on the top earners led to rising wages overall. When tax rates are high for the people at the top, the people at the top tend to keep less of the profits for themselves in order to avoid raising their own tax rates. Instead, they will raise the wages of their employees. When profits exceed the amount that the rentier/capitalist class can siphon off without government confiscating it via tax policy, the owners of industry will use that excess to raise wages for their employees rather than increasing their own income and thereby losing the money to higher taxes. The higher the tax rates on the top earners, the higher the average wages in the economy are. When top earners have lower tax rates, all new wealth goes to CEOs and other people at the top. When conservatives cut taxes on the wealthy, it causes wages to stagnate. By imposing a high income tax rate upon the wealthy, the government circumvents the immiseration of the proletariat and ensures that wages rise as productivity and wealth increase.

In the 1920s and the 1950s, the economy was booming. The whole populace in America seemed to be rising from the ashes. In 1916, the top tax rate was just 15%, but that was raised to 77% in 1918. The result was the booming 20s. Wages rose throughout the economy. Since workers are also consumers, the higher wages for the workers meant more spending money for consumers. This stimulated the economy and sparked unprecedented growth. In the latter half of the 1920s, however, the government cut the tax rate for the highest earners down to 25%, which led to the disaster of the 1930s and the Great Depression. The Great Depression dragged on as long as taxes on the wealthy remained low and wages, consequently, remained low. World War II pulled the United States out of the Great Depression, not because war is inherently good for the economy as Keynesians suggest, but because it induced the government to increase the top tax rates. When the United States began preparing for war in the late 1930s and entered the war in 1941, it had to raise the tax rate on the wealthy in order to fund the war effort. They couldn't just tax the working class since the working class didn't really have any money, so they raised the top tax rate. By 1944, they had raised the top tax rate to 94%. It is true that government spending for the war created jobs and helped to stimulate the economy, but it was the increase in tax rates that led to rising wages for the working class and allowed the economy in general to recover so that the 1950s could be the Booming 1950s. The war and government spending only helped the situation insofar as they affected a redistribution of wealth downwards, thereby counteracting the immiseration effect.

Starting in the mid-1970s, the top tax rates were reduced under Richard Nixon. These tax cuts have never been undone. American wages have not risen since these tax cuts went into effect. The Trump tax cuts are going to exacerbate this problem, making another Great Depression nearly unavoidable, and will ensure that American wages won't rise in the foreseeable future.

Henry Ford was an advocate of paying workers enough to buy the product. At the end of the day, the workers are also consumers. If all of the businessmen in an economy begin to pay subsistence level wages, so that the working class majority cannot afford to purchase luxury items, then the economy will enter into a depression. If the workers can't afford to buy things, the economy will go bad. That's essentially what causes recessions. There are many different factors that contribute to the creation of situations wherein the consumers cannot afford to purchase the products they produce. I am aware of the other contributing factors to recessions/depressions, but the role of monetary/fiscal policy in allowing wealth to trickle upwards is by far more significant than any other. Economic recessions have several causes and contributing factors, so I do not mean this to be seen as contradicting classical Ricardian, Austrian, and Monetarist theories of the business cycle. Most business cycle theories are correct but incomplete. Contraction of the money supply, malinvestment sparked by artificially low interest rates, and foreclosures are contributing factors, all of which lead to more money concentrated in the hands of a few people at the top and less income for the average working class people that make up the majority of the populace. The recession occurs because there is a lack of spending or a substantial reduction in spending as a result of the general populace becoming poorer in real terms. When the average consumer/worker becomes poorer, aggregate demand falls, creating a general glut as the consumers fail to buy up all the products they have produced as workers. As a result of the decrease in aggregate demand, industries will start cutting back on production and laying off workers. As a result of conservative economic policies, we end up with recessions, stagnant wages, and high unemployment.

America has been ruined by conservative economic policies. America will not become a decent society until the day that no conservative ever holds any amount of political power ever again.

I don't think Reagan was the best or the worst president or very close to either one. I think he has probably been the best in my lifetime but that isn't saying much. As far as the McCarthyism thing, that was long before he was president and he later regretted his role in that, for what it's worth.

Taxation is theft. 70% certainly is a confiscatory rate. No matter how much you make, the government should not be entitled to 70% of it. Economically speaking, all taxation is bad for the economy because the government is not an efficient allocator of resources from a market perspective. There are many things that have negative effects on the economy (such as the artificially low interest rates you mention - these should be set by the market just like other prices) but lower taxation is not one of them. You seem to be linking higher taxes with higher wages but you don't say how you think they are linked.

There will always be economic ups and downs, it's just that government interference usually makes it worse, not better.

Well, we simply disagree on this. I started as an Austro-libertarian, but evidence piled up against that position.

Imagine the highest tax bracket is 70%. Your corporation currently pays executives and shareholders well, but profits are going way up. You know that a pay increase for the folks at the top will result in them being bumped into the highest tax bracket. It would, therefore, be a better use of your money to increase the pay of folks at the bottom. So, rather than increase wages at the top, you decide to raise the wages of your lowest paid employees. When a handful of large companies raise wages for the lowest paid employees, it induces other companies to have to raise wages too to compete. Their competitors' employees will either seek employment elsewhere with higher pay or they will unionize, go on strike, and demand higher pay. This is why high tax rates on top earners leads to rising wages overall as profits and productivity increase. As I showed in the above post, the statistical data does show that higher taxes at the top does result in rising wages. Generally speaking, everyone is better off under more social democratic policies.

But companies will only pay higher wages when it benefits them. If there are currently plenty of qualified workers willing to work for you at current rates then you are not going to increase wages. There are better and more efficient uses of that extra money that will benefit the economy more in the long run. It doesn't really matter what end of the scale you are talking about. Prices are a result of supply and demand. Wages are just another price. Also, even if you bump someone up to this 70% tax bracket it is only the money they are making above whatever arbitrary value is set that gets taxed at that rate. Not the whole salary. They still get more money if they get a raise.

You just correlated two data points. Correlation does not equal causation and if you pick your time ranges differently or choose something else to correlate, you will see different results.

Generally speaking, the freer the markets the more efficient they are and the better off everyone is.

Typically, the government interferes with the economy, ends up causing problems that leads them to more interference ad nauseum. How could evidence pile up against austro-libertarianism when we haven't had austro-libertarianism or anything close to it?

Even I were to agree that a 70% tax rate is better for the economy (which I do not), why does that give someone the right to forcibly take the fruit of someone else's labor?

"why does that give someone the right to forcibly take the fruit of someone else's labor?"

Generally speaking, the wealthy don't actually acquire their wealth through labor. They acquire wealth through monopolizing natural resources (e.g. land in the case of landlords), earning interest through capitalistic fictions (e.g. speculation on stocks, lending at interest), or through special privileges granted by the State (e.g. copyrights, patents, monopolies)... There's no such thing as a person who became wealthy entirely through their own labor.

For the record, I hold that labor should not be taxed. Only unearned income should be taxed.

The problem with that logic is that there are many who start with very little in life, work very hard with little or no return early on only to earn their money later when their business, invention, whatever is successful. The income is still earned primarily by the fruit of their labor even though it was long delayed. Regardless, if wealth is acquired in a moral way (through voluntary transactions), regardless whether you personally consider it to be through labor, then no one else has a right to it. Monopolies can only exist if granted by the government, whether directly or indirectly, and I am all for ending those. That doesn't require taxation.

Why is lending money at interest or speculating on stocks a "fiction"? Being successful at lending money for interest or speculating in stocks actually requires labor. It isn't random. A share of stock is nothing more or less than a share of ownership in the company it represents. I agree that special privileges granted by the state are a problem (and a big one) but the solution isn't more regulations (or taxes) by the state, it's less. Growing the state is not the solution as it will only be corrupted. The bigger it is and the more money they collect, the worse it will be.

Property is theft. Capitalism is unethical. So-called "voluntary" transactions are predicated on violence and the threat thereof. Wealth accumulation to people at the top is always predicated on legal privilege of some sort. https://steemit.com/anarchism/@ekklesiagora/property-as-theft-the-libertarian-socialist-critique-of-property-summary-anthology

If it is predicated on the threat of violence then it isn't voluntary. Now taxation, THAT is predicated on violence and the threat thereof. Try not paying your taxes and see.

No shit, but property rights are equally predicated on violence. Land is free to all by nature. People build fences and enclosures and use violence and the threat of violence to drive other people off "their" land and enforce their exclusive right—actually, States enforce those rights. My point is, don't complain about taxation being theft unless you are equally opposed to private property...because both are predicated on the threat of violence. Both are ways of extracting wealth from other people through violence or the threat of violence. By monopolizing land and natural resources (means of production), owners of those resources exclude others. Consequently, the dispossessed end up having to work for the owners of land and resources in exchange for wages in order to survive. Wage-slavery is predicated on theft, enforced by private property privileges enforced by the State. If taxation, then, is used to steal from the original thieves (those with private property allowing them to accumulate unearned income) and redistribute some of their wealth into the hands of the dispossessed, then taxation is no longer theft but rather justice.

Personally, I think private property makes society better off, so it is a necessary evil, and consequently I think we ought to embrace the institution of private property but also use fiscal policy to mitigate the negative effects of it. (Cf. Thomas Paine's "Agrarian Justice")

Great information and great Writing contents thanks for sharing this great content with us keep it up you are a great writer I wish you all the best

your comment is very great, thanks for your great writing comment , you are an inspiration to us all

Great informative post

You wright one of the best keep it up sir

thanks for sharing

it was so great to analyse along while reading the post that is the best post of the day literally