# Will metal battery be the new hope of the world over oil in 2018?

Another means of income all over the world has emerge,people have been asking question about crude oil,if it will be the only mineral that will be dominating means of natural resources in the world.

Some researchers have foretold that metal is been seen to dominate crude oil in coming years that everyone should watch out.

Why do investors have this in mind?

As smart investors have noticed, there is a big push for using renewable energy around the world. Sources like wind, solar and tidal power will be looked at for in metal dominating crude oil. Though there are still some factors that can make metal not to have his way to the top.

Problems that could affect metal from dominating

1 • What happens when a windmill gets no wind?

2 • What happens when the sun disappears behind a cloud and can’t fuel a solar panel?

Without the availability of windmill and sunshine the dominace of metal may fail,because you need a way to STORE the power generated from these grids when production is high...and release it...when production is low.

This is one of the big reasons why renewables struggled to take off. Until, the vanadium Redox battery was invented.

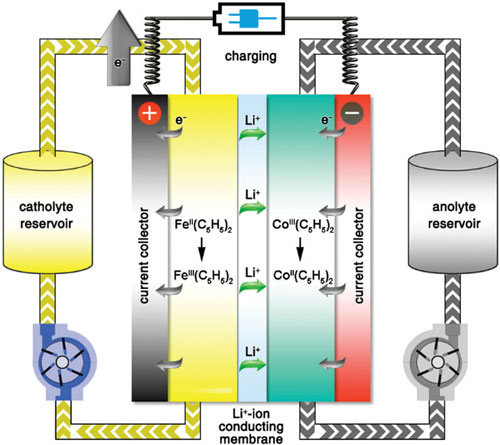

With a vanadium redox flow battery, you can put solar and wind power into the battery and discharge it at the same time. Something that can’t be done with lithium ion batteries.

You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale” — Mr. Robert Friedland, legendary mining billionaire.Vanadium prices, have been climbing for the past 2 years.

As predicted by GTM Research and the Energy Storage Association, vanadium prices are set to quintuple in the next few years. Investors should consider if this metal will follow the rocket-like trend of battery metals lithium and cobalt which tripled in price over the past 10 months.

When you see “Renewable Energy”, think vanadium

It’s important to note the Chinese are chewing through Vanadium supplies right now, to help power their 1 billion plus population. China is now the largest solar energy producer in the world – its capacity reached 77.42 gigawatts at the end of last year, according to the National Energy Administration.

Renewables make up 11 per cent of the country’s energy use, but that number could go up to 20 percent by 2030.

Vanadium prices on on an upward trajectory

For the investor who loves taking a calculated risk with high reward, catching the right junior Vanadium miner right now could be the play of a lifetime.Which is why we think, Spearmint Resources deserves your immediate attention and research.

Here are some important facts to get you started:

Experienced management with a track-record of junior miner success.

Spearmint Resources is under the direction of an experienced management team, which took Cruz Cobalt, a battery-metals resource company, from a share price of 0.04 to 0.34 cents.

Vanadium portfolio gives massive upside

Spearmint’s Chibougamau vanadium prospects are comprised of five separate claim blocks totalling 9,735-acres, bordering the vanadium deposit of BlackRock Metal’s (private) Ilmenite vanadium project, Vanadiumcorp Resource Inc. (VRB.v) and Vanadium One Energy Corp. (VONE.v).

Strong portfolio of gold claims

Spearmint’s current projects also include three gold properties in British Columbia. The ‘Golden Triangle’ prospects are comprised of four separate claim blocks totaling 4,095-acres, bordering some of the most productive gold mines in Canada.

Lucrative lithium samples

with a notice of intent filed

Spearmint Resources has a strong portfolio of lithium acquisitions (the battery metal making headlines). This includes property in the only known lithium bearing brine in North America.

Recently, management was thrilled to announce that of the 91 samples collected during the phase 1 work program, the highest sample value obtained was 1,630 parts per million, with an overall average value of 843 parts per million lithium.

Twenty-three of the 91 samples achieved values of over 1,000 parts per million. The samples ranged from a low of 285 parts per million to the high of 1,630 parts per million.

Before drilling can commence, Spearmint Resources needs approval of the notice of intent submitted to the Bureau of Land Management. Join their insiders list to get the latest exploration news.A rise in gold, lithium (the key metal used in lithium ion batteries) or Vanadium could mean upward moves for Spearmint Resources.

The best way to get started is joining the insider alert list, where you’ll be kept up to date and be among the first to know of mining results and other Spearmint Resources news. Timing is critical. Stay in touch now while this opportunity is on your radar.

You can also read more on

i still remain your loyal boy