ALERT: Crypto Data / Exchange Data mostly FAKE – where to go from here-- Article out by ZeroHedge / GlobalIntellHub

Well, I am not a techy like a lot of people here and in crypto/blockchain but I cannot say something like this, if true with the conclusions and things / evidence presented -- would shock me, seeing all the posts and comments and issues going on with scams, exchange problems, market issues and news and volatility, etc.

What to Believe, Why, Data Sets,

... and more Questions.

I will insert some of the article snippets here and the related links.

Is the Crypto Currency “Market” about to have a Fakebook moment? That’s the moment that people realized that 90% of users, traffic, and content on Fakebook was bots, spam, and other fakes (and ultimately stopped using it). As we explained in Splitting Pennies, the financial world is not as it seems, but now it appears that Crypto is a mirage wrapped inside of an enigma. It appears data quality in the Crypto Currency world is much more fake than faked Government economic data (there is at least substantiation for it), the falsely inflated stock market, and other market anomalies. First let’s start with this article that originally appeared on Medium, from a Crypto trader that was suspicious about fill quality:

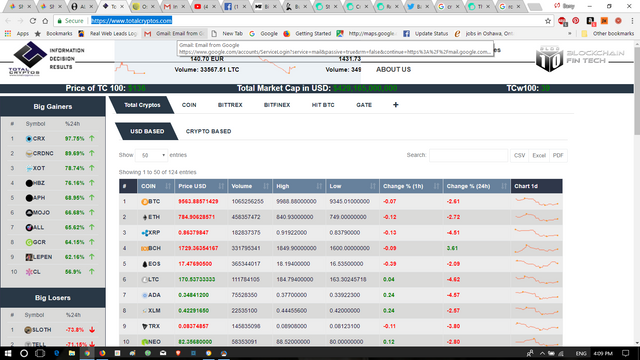

Now I will say, mentioned in this article is Total Cryptos.com -- a site dedicated to Crypto Data, price Data, information, and more--- it's numbers and metrics differ from sites we use like CoinMarketCap.com, OnChainFX.com etc -- but has a lot of the info, look and feel we are used to in the crypto markets space:

We continue on:

In this piece I will expose why I believe more than $3 billion of all cryptoassets’ volume to be fabricated, and how OKex, #1 exchange rated by volume, is the main offender with up to 93% of its volume being nonexistent. I’ll endeavour to prove it by analyzing publicly available data. When I set out to datamine for this piece, I had no idea I would end up talking about fake volume. I initially meant to gather data about cryptoassets liquidity, that could be a complement to volume. I thought it would prove an interesting indicator when assessing the value of an asset. Read the whole article here.

This article deserves a full read. The results are astounding. Now as far as independently confirming them, we haven’t done that – but it confirms what we’ve been experiencing ‘in the field’ so to speak. Without revealing much we’ve been developing what we can call Crypto HFT. This is now a running joke as HFT in Crypto is impossible. Crypto exchanges mostly use REST API which is for web servers:

Representational State Transfer (REST) is an architectural style that defines a set of constraints and properties based on HTTP. Web Services that conform to the REST architectural style, or RESTful web services, provide interoperability between computer systems on the Internet. REST-compliant web services allow the requesting systems to access and manipulate textual representations of web resources by using a uniform and predefined set of stateless operations. Other kinds of web services, such as SOAP web services, expose their own arbitrary sets of operations.[1]

See an example here from ITBIT.

Before we get into our REST bashing, REST is OK for many functions such as updating apps with data, web server interaction such as RESTful Web APIs and other HTTP related handling. REST is not designed for trading and is not appropriate to trade over. Just like it’s not appropriate to trade on your mobile phone, because data can be delayed, orders can be rejected, it’s just unprofessional. Why the exchanges offer REST API was at first puzzling but after reading this article and doing some background research it all started to make sense:

Crypto really is a pump and dump scam from many angles. First, the exchanges inflate their volume to lure customers as if there is ‘deep liquidity’ when in fact, you can’t place an order for more than 2 or 3 BTC without getting fill issues. That’s not to say that ALL exchanges are fake, the article goes on to mention Bittrex is mostly clean. The point is that there is no ‘data source’ like there is for other markets, so it leaves many to rely on sources like coinmarketcap.com which are good sites but hardly institutional grade (sorry, dude). That’s why Bloc10 founded Total Cryptos, a site dedicated to Crypto Data, price Data, information, and more. The sad news is that we are only beginning to unravel this enigma. There is no Bloomberg in Crypto. So there is no way to really audit information from these exchanges except for this ad hoc statistical analysis done by this trader. And that’s not the only problem!....

.....

Here is the link to the article today, where you can read the other half of the article, see the links and thoughts.

https://www.zerohedge.com/news/2018-05-06/alert-crypto-data-mostly-fake-where-go-here

Thanks for Reading