Lattice Exchange - new breath for DeFi

DeFi has grown rapidly over the year. The rapid growth of the range of DeFi coins has only fueled market interest in this segment. At the same time, the DeFi market remains very volatile, and the cost of conducting transactions at peak times is substantial.

Lattice Exchange was a breakthrough in the DeFi sector. The developers of this exchange have proposed and implemented a number of revolutionary ideas. The main idea is to create a new type of DeFi liquidity pool. It will run on a Decentralized Coordinated Non-Cyclic Chart (DAG) / Hypergraph. Due to the use of a microservice structure and simultaneous approval, the speed of interaction and savings in transactions will be ensured.

The Hypergraph will be used to pool liquidity from other decentralized exchange (DEX) protocols. This will enable Lattice Exchange customers to exchange their crypto assets faster and more reliably without fluctuating the value of the benefits.

Lattice Exchange - new breath for DeFi

At the moment when the liquidity of a particular coin in the pool is at a low level, slippage constantly occurs. This negative phenomenon leads to unnecessary transaction costs.

For this reason, it is best to exchange at Lattice Exchange where you can minimize slippage as much as possible.

The way Lattice Exchange works is very different from what is used on other cryptocurrency exchanges.

The Constellation Network has developed the concept of a Directed Acyclic Graph (DAG) to achieve efficient distribution of data across a blockchain network.

Revolutionary DeFi Solutions

Here are Lattice Exchange top ways to improve current DeFi challenges

Total liquidity

Liquidity is known to be essential to the growth of DeFi payment systems. That said, very often, real-time data is simply not available for many of the top DeFi structures, such as Uniswap and Curve.

This will cause you to spend and lose more money when trading DeFi assets.

This problem will now be addressed with pooled liquidity, which is exclusive to Lattice Exchange.

In terms of liquidity conditions, Lattice Exchange offers the most beneficial solutions for all participants.

Constellation organization

Lattice Exchange should be the best cryptocurrency exchange in the DeFi sector. The Constellation Organization will provide consistent interoperability with the various DEX protocols.

Experts point out Lattice Exchange is the best deal for DeFi resources. Its structure eliminates the vast majority of the flaws in the Ethereum organization.

The Constellation Organization creates additional structures for DeFi, of which serious hubs are an important part.

The Constellation Organization is dependent on Hypergraph, a decentralized primary organization (Mainnet) that operates 44 hubs.

This will ensure the maximum level of decentralization of exchanges on Lattice Exchange. For this, 100 utilitarian nodes will be used.

Profitable solution

Can large fees be avoided when exchanging crypto assets in the DeFi market? Can you avoid paying huge fees for using DEX protocols like Uniswap?

Yes it is possible. This is especially convenient at Lattice Exchange, where you are offered low prices and additional bonuses.

The conditions that will be on the exchange for its participants will make it possible to provide significant savings. This is a very profitable solution that the DeFi sector has long been looking forward to.

Speed of Transactions

Lattice Exchange uses the Constellation Network as a distributed database that distributes and scales transactions faster than other blockchain protocols.

2 Ways Constellation Network provides fast transactions on Lattice Exchange.

- the use of parallel consensus mechanisms that monitor the parallel scaling of transactions. It is worth mentioning that these mechanisms do not burden or slow down the network, even with high volumes of transfers.

- adding several nodes to the network. When more nodes join the network, it becomes faster than it used to be.

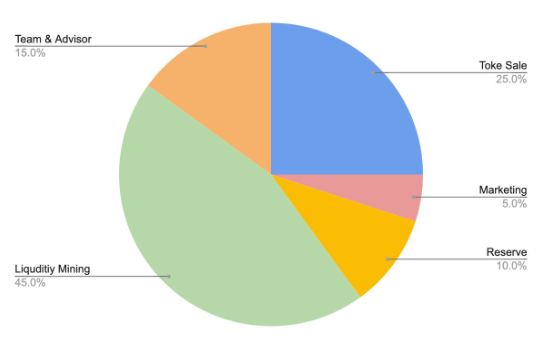

Token distribution scheme

During the private sale process, 15% of the tokens will be sold.

For the team and consultants, 15% will be reserved, but with vesting for 24 months.

Marketing promotions to attract users will be 5%.

Liquidity Mining For Daily Participant will be 45%.

Tokens, which will be locked for 24 months, are awaiting the decision of the Governing Committee: 10%

Distributed to users and investors through public sales: 10%.

All tokens that are not sold will be burned.

Conclusion:

The decentralized finance (DeFi) market is now worth billions of dollars. At the same time, experts believe that its cost will increase sharply in the coming months.

Lattice Exchange launches at a critical point in time for DeFi. It will open up many opportunities for private and institutional financial investors. Soon they will be able to take full advantage of the platform for easy and cheap exchange of DeFi assets.

To find out more about this project, follow the links below:

Site: https://lattice.exchange

Whitepaper: https://lattice.exchange/Lattice-Exchange-Official-Whitepaper-pdf

Linkedin: https://www.linkedin.com/organization/lattice-exchange

Facebook: https://www.facebook.com/LatticeExchange

This is a sponsored article written for a bounty reward.

I plan to take part in exchanges on this exchange, it will be beneficial.