VERTEX : ALL THE RIGHT ICO INVESTMENTS YOU CAN MAKE

INTRODUCTION

.jpg)

Investing in any green horn business is a very risky venture. This is drawn from the premise that investing on a baby project involves a lot of risks that can go both ways, successful or unsuccessful. Blockchain investors undergo such type of dilemma since the rapid development of the decentralized economy. The Bitcoin blockchain was a tremendous success and attracted revenues in billions of US dollars and experienced a growth 1000 times the initial value within a period of 8 years. It wouldn't be out of order to say that the Bitcoin success story gave rise to the development of several other cryptocurrencies and potential investments.

The ICO Investment Risk

Due to the amount of cash involved for the growth of a new crypto blockchain, the developers resort to organizing an Initial Coin Offering for their new tokens and blockchains. The ICO program attracts investors who are convinced that the project will be a success or that it has the probability of growing into something big in the near future, just like the Bitcoin and Ethereum blockchains. The turn of 2017 saw the ICO investment figure reaching a $6billion figure. But unfortunately for investors, most of these tokens do not live up to their hype due to a whole lot of factors. Some of the failure factors may come from scam tokens or poorly equipped blockchain that due not live up to the required 51% hash power requirement for most blockchains. This has led to record losses for investors to the tune of $2 billion that shows statistically that half of ICOs turn out to be a failure.

The investment choice question still remains a torn in the flesh of most investors as more ICOs are developed daily. The need for investors to look before they leap is now a priority in cryptocurrency as new investors are now being hesitant in diving into new projects. The Vertex team came together to fashion out an outstanding solution to one of Crypto's salient issues.

The Vertex Solution

.jpg)

The Vertex platform is a unique network that offers a clear path for low risk investment into new market tokens through a through verification of new ICOs. The vertex team is aimed towards offering users with an aftermarket option of investing on already certified and curated tokens hereby given potential investors a low risk investment opportunity to buy into marketable tokens. The Vertex team initiates projects with a team of certified and experienced investors that will be thorough in its analysis of any ICO project. The vertex team only subscribes ICOs that have been vetted thoroughly by private equity investors.

Vertex also gives investors access to ICOs that are unavailable to public investors. This is caused when tokens are sold out during private sales that it becomes a rare sight to public eyes but will be available to exchanges. Therefore the vertex team finds innovative ways to get privy access of these unavailable sold out tokens.

In general, the Vertex platform is all about restoring the belief of investors in good and promising cryptos which has been lost due to ineffective and fraudulent ICOs

The Vertex Ecosystem Flow Process

The Vertex platform enables continuous liquidity for their investors by proper injection of funds into their system. The hierarchy starts with Vertex Capital, an corporation with investment giants in the cryptocurrency market with over $100 millions investments. They are called the Ultra High Net Worth Individuals(UHNWI). The capital allows seamless exchange between fiat and crypto for ICO investments for its users with 35% tokens guaranteed in the investment process.

Token Access

The ability for individual consumers to access the platform is only through the purchase of vertex tokens. Like I mentioned initially, the vertex platform only admits tokens that has been vetted by their investors at a price that has been already fixed. Therefore the users can now buy into ICOs armed with the vertex token after public sales has been made.

Secure Wallets

Just like in any other corporation in the world, vertex platform prioritizes security of all digital assets belonging to its users. This allows them to store their assets in their own wallet in a secure manner. The ICO funds in auction are stored safely in cold storage and multi-sig wallets and user access is secured in a cryptographic manner that gives users the option of a 2FA security. To ensure a transparent process and avoid cloning of accounts, their vertex process involves a KYC process which checks every registeration and ensures unique access to the platform.

Vertex Market Usage

The process of usage on the Vertex market platform is quite simple and easy to use for both technical and technical users. Every intending user completed his registeration by logging onto the platform and passing the KYC process. This normally takes 48 hours to be approved. A user is certified to use the platform once his KYC registration has been approved. When successfully recognized, a user can now take a view into the Vertex market and track down available tokens and get information about their statistics and market survey. Upon siting the tokens they want, the users are shown a unique ETH address to deposit the vertex tokens in their possession in exchange for the specified token in particular. This particular address is personal to the user and can only be used for the particular token purchase, once. To ensure uniformity, users are encouraged to register the particular address of which they use to make purchase of ICOs using the vertex token. Once a user confirms the intention to buy a token, he must make transfer of funds to complete the transction. A user is sanctioned severely when he deviates from transferring funds three times.

The ICO vetting Process

Top of the vertex network operations is the vetting of new ICOs in order to be able to advice investors properly on which token to invest on. This is guaranteed through a vetting process. The vetting experience is based on the Angle and seed investment protocol to identify investments with good success traits. The vetting team are experienced investors with methods of investigation of ICO. The vetting process will deviate the ICOs into two categories: The ones with potential but requires small investment and the one that can appreciate greatly and hence requires larger investments. The platform makes purchase on both tokens but will favour the ones with good appreciative value.

In order to distinguish ICOs into these groups, the vertex platform does huge investigations into the ICOs including their vision, their feasibility, their finances and their team. They make sure that every contact information checks out including the ICO team's quality and their abilities to deliver on their vision. Armed with the information and data they have, the Vertex team will now drop 75% of the entire ICOs being reviewed. After deeper analysis, the Vertex team goes further to drop another 75% of the ICOs remaining with much better view into their data. The next step involves face to face meeting with the team members of the remaining ICO for a more hands-on approach with their project to be convinced of the ones worthy of investing on.

After this process, a further 50% of the ICOs are dropped and the teams of the remaining ICOs are called again for more fact to face meeting from which the qualified ICOs are drawn from. The team goes ahead and draw out the terms and conditions of their relationship with the vertex platform which includes token prices and discounts.

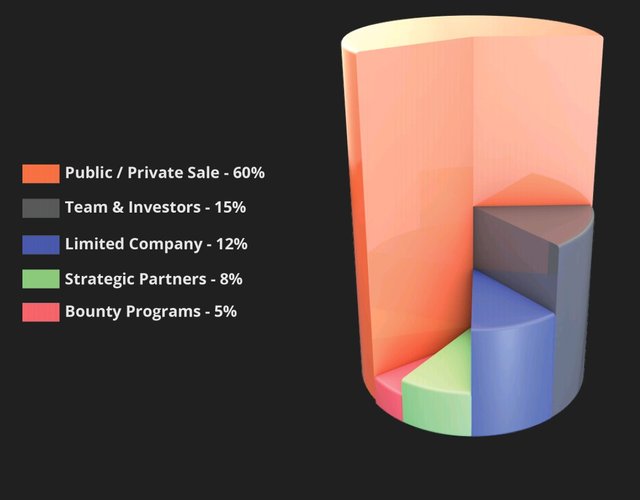

Vertex Token Distribution

The private/public sales of the vertex tokens will involve 60% of them being sold. A further 15% will be assigned to its team and investors. The company is assigned to an untouchable 12% which is a strategic reserve that won't be burned. In order to encourage public adoption, 5% of the tokens are allocated to bounty for public awareness. The vertex strategic part hers that share the same dream with them are rewarded with an 8% allocation.

Meet the Team

INVESTORS

ADVISORS

Vertex Patners

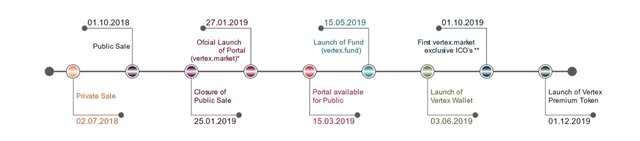

Roadmap

CONCLUSION

The road to ICO investment is a long and tricky one. Knowing what to bank on and what not to bank has been a huge headache for crypto lovers. Investors have been left with losses most of the time from over hyped projects and their portfolios are full of shit coins that adds no value to their portfolios. The vertex platform is a great relief for good crypto investors. This is why its so unique to blockchain development. And yes, we are all aware that business involves risky investments and that fortune only favours the brave, but it wouldn't hurt to take a look where you're leaping. Thanks for reading.

For More Information Please visit

- Vertex Website

- Vertex Facebook

- Vertex Twitter

- Vertex Medium

- Vertex YouTube

- Vertex BitcoinTalk

- Vertex Github

- Vertex Airdrop

This is my entry for the sponsored writing contest organized by @monajam. You can find the contest here

.jpg)

Right thoughts you have @davonicera, and set them cool