Top 5 Passive Income Streams in 2021 Crypto Market

Do you keep a stash of HIVE/LEO/STEEM/TRX/BAT or other altcoins sitting IDLE in your Wallet, or in the "Savings" Wallet, that you haven't powered up with yet, in order to maintain some liquidity?

Well, if your "liquid" assets are just sitting idle and not making you any interest or profit, then you have to ask yourself, (A.)"Am I making the most of this investment?"

This question, in my experience, is usually followed up with, (B.)"How can I make this money work for me?"

Of course there's a number of different factors to take into account when trying to answer this question. Position size, unrealized gain/loses, technical analysis, market health and trajectory, investment strategy etc..

For me, in todays market there is only 3 coins I am currently Hodling and adding to my positions regularly. Everything else, in my mind, is an altcoin. A bold statement, I know, but this is my current perspective.

Sure, technically 1 of the 3 coins I'm Hodling is an altcoin but that's my high risk, low position size, speculative play. I have a timeframe in mind as well as enter/exit strategies deployed. I've done my research and am willing to take on the risk.

So, to Jersey Shore it up for you, "You got your 'Main' (in this case, my 3 Hodl coins) and you got your 'Side-Piece' (All other altcoins)"

Your Main has always been there for you. You live together, eat together, work together, a main part of your life and investment strategy.

Your Side-Piece you are not personally or emotionally attached to. While it may be fun to play around with them from time to time, there is ultimately no real substance. The spark quickly fizzles out and you both go your separate ways. Hopefully you've taken all the proper precautions, wore protection and set your stop losses and you're able to walk away a little bit richer and disease free.

Now it's time to figure out what do do with all these coins and what is the best way to get them to start working for me.

In the crypto landscape of 2021, there are really only a few viable options that I have found for truly making your money (crypto or fiat) work for you.

Here are my Top 5 Passive Crypto Income Streams

1.) First, of course, we have Mining - the OG of passive crypto income.

Both physical and cloud mining.

Physical being you physically own and operate the equipment on location.

Cloud mining is where someone else owns and runs the equipment, you simply rent it from them.

Mining is a validation of transactions using specialized machines such as FPGAs, ASICs and GPU's running complex hashing algorithms like SHA-256, Scrypt and Ethash. For their effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network.

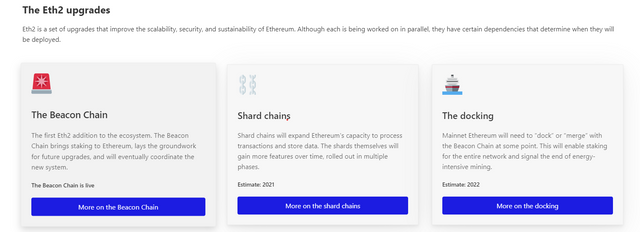

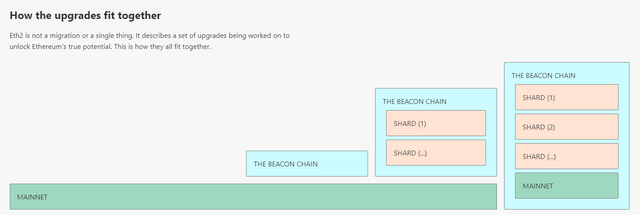

All info seems to lead to late 2021 early 2022 with some hopefuls speculating more like 2023 for the Ethereum 2.0 release.

Once this happens, the Ethereum network (Proof-of-Work = Mining) gets moved to the Ethereum 2.0 network (Proof-of-Stake = Staking), making mining (Ethereum anyway) obsolete. Miners have their fingers crossed here, hoping for a 2023 start date because mining Ethereum is super profitable right now. The questioin is, "For how long?"

There's still plenty of value in other minable coins!

With that being said

If you DO have a GPU strong enough to mine Ethereum, hook it up and start mining ASAP. What are you waiting for?

BUT, if your card DOES NOT cut the mustard (4 GB min.) and buying a card is too big of an investment for you at the moment with too high of a risk, as you have know idea if it will pay itself off before 2.0 release, then maybe right now isn't the best time to get into mining for you.

If you can find an algorithm that works for your card and can start accumulating something, anything, maybe then that's where your mining focus should be. You can use those coins to fund more profitable ventures.

Keep your eyes open though. If you can get your hands on GPU's at retail prices, snatch them up. If you don't hook them up and start mining with them, you can EASILY sell them for a markup right now. If you did buy some to flip, hook them up and have them mine until the sale comes in, increase profit margin.

Just a thought.

There are a number of different cloud mining services out there now, some of which have been operating for years and have proven themselves to be trustworthy, such as Genesis Mining.

Not all cloud services are created equal, however, so use with a great deal of caution. Some of them are an outright scam, never actually paying out or not even having any mining equipment at all. They just collect the money and then they disappear.

While at one point in time, cloud mining was a profitable option. The return from the mining contracts were in the green and paying out regularly. As time went on, pool difficulties increased so profit margins decreased which meant contract prices had to increase which led to slim margins on contract returns. And that's in an up market. In a down market, your already slim margin gets eaten by the loss of value as prices travel south.

Cloud mining is no longer a viable option in many regards. Not for profit anyway. If you see value in it for passive accumulation, by all means, feel free. I'm here to tell you though, there is a much better way with much better, much higher returns, paid out whenever you want, and just as passive. This method has a far greater upside with a completely adjustable, controllable and manageable risk/reward ratio. Keep reading to find out what it is..

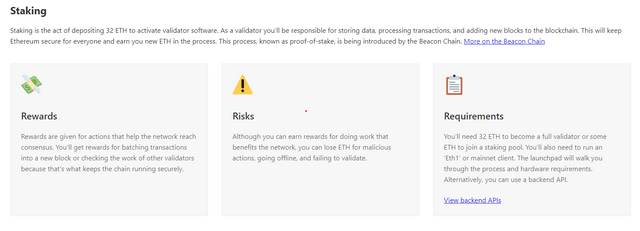

2.) Next we have, Staking.

Well, the future of Ethereum for sure but quite possibly the future for mining as a whole. I wouldn't be surprised if more coins strayed away from POW and starting adopting POS instead. One thing is for certain, this passive crypto source is here to stay, so get in early and get in as cheap as possible.

Staking is a long term strategy - that is best described as the process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. Anyone with a minimum-required balance of a specific cryptocurrency can validate transactions and earn rewards for their participation.

To put it simply, staking is the process of purchasing and holding a cryptocurrency in a wallet to support the operations of a blockchain network. Your encrypted wallet is mining to itself. Can't get much more effortless or secure than that.

Soon after its introduction in 2012, staking became a popular alternative to cryptocurrency mining and trading for those looking to earn profits from crypto mining but without the risk or high input cost.

Staking is considered by many to be the easiest, most risk-free ways to make money with cryptocurrencies.

Different coins having different staking programs with different rules, minimum balance for qualification, sometimes it has to be in a wallet with no outgoing transactions. If you remove coins from the wallet your rewards for that month are void and you have to wait 30 days with no outgoing transactions until you requalify for rewards again.

Know your coins, know and obey the rules, then just sit back and let that sweet, sweet virtual currency rain down over you. That's right, we're making it rain.

3.) That brings us to, my personal favorite passive income source, Crypto Trading Bots.

The best way I've discovered to truly put your money to work for you is with Crypto Trading Bots.

Trading bots give you an advantage over the fluctuating market with minimum risks with automated trading algorithms generating a profit on every market move.

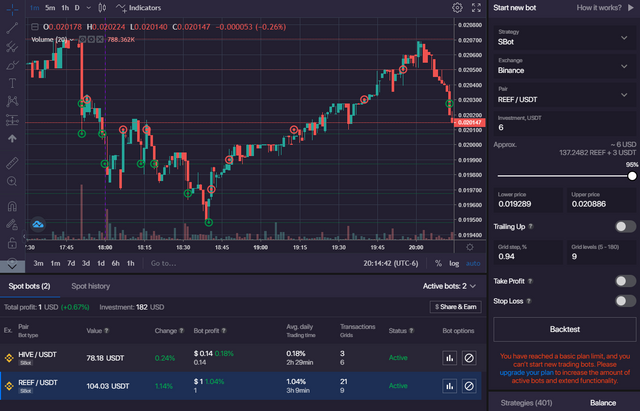

I find the Bitsgap trading bot to be the most comprehensive and versatile bot on the market. They use Trading View's charting software, which, to a large degree, has become the industry standard for chart viewing.

Trading View has been a go to of mine for a long time now, not just for crypto but for stocks as well. This made it easy as I didn't have to learn new software. There is no shortage of tutorials out there on how to use Training View, so definitely get yourself familiar.

The best part about Bitsgap is that you don't need to be super proficient at chart reading or technical analysis to use the bot and be profitable.

A monkey with enough coin in his wallet, basic math skills and the ability to recognize general market trajectory (is the market going up or down?) can be very profitable with this bot.

Bitsgap Trading Bot

You simply slide the upper and lower price limit bars up and down to focus on trendline. Hit 'Adjust Grid' to auto adjust grid step % and grid levels. Back test for however many days you want to. Not satisfied, readjust price levels and other parameters. Back test again. Satisfied? Hit Start and the bot automatically places buy and sell orders on your behalf, based on the parameters you choose. That's it. It runs itself.

A truly passive income stream

The best part is that the crypto market never sleeps. Unlike the stock market, there are no market hours. Crypto markets are open 24/7, allowing you to generate a passive income in your sleep..

You can place smart orders, taking profits at predetermined price points you set, as well as set stop loss.

All features and functions that you would expect in any trading platform are present and available with this trading bot.

4.) Hodl A.K.A Hold

This is the most basic and primitive of all investment strategies. Basically it's a long term hold strategy. You buy low and you sell high. Pretty basic, right? Well, when you Hodl, you are basically saying that you think the asset is completely undervalued and you are willing to wait until both market value and your perceived value of the asset intersect.

Take Bitcoin for example. The first Bitcoin traded for fractions of a penny, next to nothing. Bitcoin just recently reached all time high less than a month ago at $42000 per coin. If you at that time knew that the value of that coin was worth so much more, and you were diligent enough to hold on to it for the last 11 years, your ROI ratio would be tremendous. This is the power of the Hodl.

This, in my book, doesn't actually qualify as a "passive income" source because any gains you see are never realized until you sell it, but you wont sell it because you are Hodling, because you value the asset at a higher rate. You see? It's not really income until it's realized and it's never realized because of the Hodl strategy. Sure, once it is realized you would have made a lot of money, hopefully, but this isn't a constant income source that you can draw from and live off of. You're just Bitcoin rich in theory until it's realized and it actually happens.

So What coins are you HODLing or see value in this year?

Let me know in the comments below.

5.) The best investment you can ever make is in yourself.

This means different things for different people.

I'm a firm believer in buying the dips in anything in life. So when your trend line is low, your RSI is indicating an underbought status and MACD shows a great deal of sell pressure, in my mind that would be the perfect time to at least double down on yourself, if not go all in.

That's the thing about being on the bottom, there's only one way left to go, and that's up!

That could mean going back to school, starting some new side hustle, learning a new skill or trade or simply devoting more time to creating content or funding your account with addition crypto here or on your other chosen blockchain.

HIVE coins are cheap right now, todays low dropped down below $0.13. A $20 investment at $0.13 = 153.8461538461538 coins. That goes a long way when you power up with it. And if the price of coin goes up even a little, your account would be worth so much more, $1.53 per penny the price goes up, to be exact.

"I believe that Crypto is our future. Treat it well and let it lead the way.."

-Michael J-Hole - RIP

And that brings me to the BONUS passive crypto income source

Wait for it...

6.) BITCONNNNEEEEECCCCCCCTTTTTTTTTTTTTT!!!!!!!!

Hahaha.. I'm kidding.

But seriously. Everyone that is not you is a scammer. If it seems to good to be true, that's probably because it is. They're all out to get you and their trying to take your money, so hold on to it tightly. Encrypt and backup your data, use 2FA when available, always be sure to set your stop loss, never enter a trade without an exit strategy, never eat the yellow snow and always wear protection.

If you read this far, be sure to smash that Upvote button and Reblog.

Follow me @doc-gonzo for future trading bot guides.

If you wish to tip a fellow contributor you can send coins here:

USDT - 0x2eb4aba5442b0bd43ba5342eddaa97e50f36618f

BTC - 16LBX3sA8NpAYfss6dsatt3NvUgaXXTN9f

BAT - 0x2eb4aba5442b0bd43ba5342eddaa97e50f36618f

ETH - 0x2eb4aba5442b0bd43ba5342eddaa97e50f36618f

Have any other additions to the list? See anything I may have overlooked? What coins are you currently HODLing?

Let me know in the comments below.