5 TIP$ FOR CRYPTO NEWBIES & POTENTIAL INVESTOR$

So you want to invest in cryptocurrencies? Maybe because you’ve being hearing about it all over the news, online and on social media, there’s a few things to consider before you dive in head first. I am going to give you 5 basic but highly profitable tips based off my own personal experience.

Important Disclaimer: I am not a financial advisor or expert and not responsible for any losses you make or gains you don’t make because of this article. Your choices are your own.

With that being said, let's begin!

1 “INVEST YOUR TIME BEFORE, YOU INVEST YOUR MONEY: DO YOUR OWN RESEARCH (DYOR)”

The very first and most important tip on this list, you must be willing to put in the effort to thoroughly educate yourself before you even consider investing a penny. This step is crucial to achieve the success that we all desire. If you aren’t willing to do this simple but extensively tedious task, the realm of cryptocurrency isn’t for you, in my honest opinion. I studied & researched relentlessly for 2-3 months, until I was comfortable enough to slowly start investing small chunks of money at my own pace.

Technical analysis, market cap, circulating supply, cryptocurrency exchanges, digital wallets, altcoins and the list goes on. I’m not saying you have to master everything but rather get a general understanding of as much as possible, so you can have a better idea of how to approach the market. I like to call investing, “Strategic Gambling” and the more you know overall the better you make your odds. There is no right or wrong way, so over time, through trial and error you will figure out what works best for you!

When I first heard about Bitcoin and cryptos in general, I was having trouble understanding the functionality of BTC & why it was so popular. Even though I had a slight grasp of the concept. That ordeal convinced me to purchase “The Ultimate Bitcoin Business Guide” by author Kirk Phillips. I used the Amazon Kindle app & paid the extra $2-$3 for the audio version so I could listen to it while driving. That is to date, one of the best decisions that I’ve made in my entire life.

Once I was able to get through the first two chapters I was completely hooked. My mind was positively overwhelmed with the ambitious vision of cryptos and how they will change the way we think of money. This was more than just an ingenious new currency, this was a way to show the world that I’m not a slave to the system of inflation & debt, which our society unfortunately accepts. You don’t have to listen to me, but I highly urge you to understand what exactly you’re supporting when you decide to invest. Do you agree with their fundamental ideals? Do you like the way in which the development team interacts with the community? Do you agree with their marketing strategy? You must know what it is that you’re putting your hard-earned money into.

With that being said, I began to immerse myself into the world of cryptocurrency by reading & researching as much as I possibly could. I mean from articles to books to videos to personal testimonials. There’s so many different options available, which are all extremely helpful in their own way. I consider myself a “Senior Noob” who meticulously dissects many different sectors of a subject once my interest is peaked & I’m still learning something new every single day. There’s an array of sites to visit when trying to find the information you need, this list is just a few to get you started…..

-Investopedia.com “The world’s leading source of financial content on the web, ranging from market news to retirement strategies, investing education to insights from advisors.” Information on traditional stock markets & cryptocurrency as well.

-Tradingview.com/markets/cryptocurrencies/ “An overview of cryptocurrency markets, prices and charts.”

-CCN.com “The latest in Bitcoin & cryptocurrency news and ICOs”

-Cointelegraph.com “Bitcoin & cryptocurrency news, analysis and review about technology, finance, blockchain and markets.”

-Coinmarketcap.com “Cryptocurrency market cap rankings, charts and more.”

-Coinmarketcal.com “A free collaborative calendar for all upcoming crypto events. Evidence-based & Community-driven.”

2 “DON’T FOLLOW THE HYPE TRAIN OR THE CRYPTO EXPERTS: CREATE YOUR OWN IDEAS & THINK FOR YOURSELF”

I know this one is going to make people a few people upset, so be it. I’ve always had pride in myself for being different from the herd, for thinking distinctively. With the uprising of so many different social media platforms now and days, just about anybody can make a video or freely post their ideas. This is a true double-edged sword in the fact that some people genuinely don’t have a clue what their talking about or don’t even bother to fact check the source of the information they’ve gathered. Which is why I continually stress to DYOR on anything you consider. There is some amazing content out there available but first you must find it. Even with that, just because it worked for them doesn’t mean it will work for you.

We all have different situations, income brackets & personal characteristics. I’m a father of two, I have a wife and my life is already very demanding without crypto being thrown in the mix. For that reason, I don’t believe that I’m the best candidate for day trading, I’m more of the buy and HOLD type. This strategy has repeatedly worked for me as I’m in this for the long haul. You must analyze your criteria & choose your method accordingly. I’m telling you from personal experience, there is no “One Size Fits All” strategy that will grant you instant success.

3 “STAY INFORMED & KEEP AN EYE ON THE NEWS: ALWAYS BE AWARE OF WHAT'S HAPPENING”

Traditionally when it comes to stocks or any type of investments it’s in your best interest to keep up with what’s going on in the markets & the company/team/platform your invested in or are considering. There are many different news related factors which can cause the price to rally or crash, so join twitter, slack, telegram or any other platform that will keep you up to date on the latest news. This statement especially applies to the cryptocurrency market which never sleeps.

I happen to be a news junkie and just naturally enjoy reading daily. About a month ago I read an article about all the backlash going on because of the FCC’s decision to repeal net neutrality. I was genuinely frustrated that something like that could even happen, it struck a nerve in me and then I had a light bulb moment. I thought to myself, hmmm I wonder if there is a crypto that’s focused on decentralized internet or something to that extent. I started researching like a madman and was able to find two very promising candidates. I decided to invest a couple hundred dollars into each one and it ended up paying off extremely well. The returns were more than I could’ve ever imagined and if felt amazing because nobody gave me that idea.

4 “DON’T FALL FOR THE FUD (FEAR, UNCERTAINTY, DOUBT) OR PANIC SELL: YOU ONLY LOSE MONEY IF YOU SELL”

If you look at a genuine line chart of any well-known company in the stock market you will see it goes up and down almost like rigorous mountain terrain. You’re going to have up’s and down’s that just the reality of the situation, this especially applies to crypto. Think about it for a second, if the market only went up non-stop without downtrends don’t you think literally everyone would be investing? Well you have to take the good with the bad and that’s another reason for having to stay on top of the news, announcements, updates so you can have an idea of what’s going to happen based off of the information you have. Remember you can only lose money if you sell. When things are in the red I try to just focus on other things like my hobbies, going outside or spending time with my family. You don’t want to be sitting there continuously staring at the computer screen stressing out because your more likely to sell at a loss!

5 “ONLY INVEST WHAT YOU'RE WILLING TO LOSE: DON'T PUT ALL YOUR EGGS IN ONE BASKET”

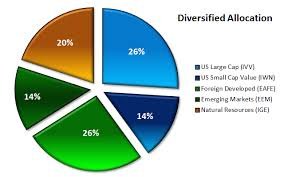

This one is very simple…DIVERSIFICATION. You have to spread out your risk just in case one things flops the other can pick you back up. I live by this strategy!