How to Choose a New Crypto

Note: This article assumes you have a current understanding of cryptocurrencies. The following is not financial advice, you are responsible for your own profits and losses. I do own at least one of the coins listed.

In light of the recent downturn of the markets I have decided to focus on the steps that should be taken when choosing a new coin in which to invest. In this article I will outline the criteria for researching new coins and give examples.

Currently the Crypto Market Cap is below $300 billion and Bitcoin is below $8,000. While many retail investors are panic selling and disparaging Bitcoin, the smart money is grabbing cryptos hand over fist.

When evaluating a new coin/token there are 3 factors that should be taken into consideration before laying down your hard-earned post-tax dollars.

- Use Case

- Team

- Community

1. Use Case

First and foremost, what does the coin do? Is it focused on Privacy? Does it serve a specific niche? Are there other coins that can do the same thing at a lower cost, or faster?

If a coin proclaims itself to be the "New Bitcoin" its technicals must be scrutinized: speed of transaction, comparative security, open source status, etc. For example, when Bitcoin Cash (Bcash) was released, its claim was that it was faster than Bitcoin and solved the on-chain scaling problem. While this may have been true at the time it was released, the wide use of Segwit and release of the Lightning Network will invalidate these claims to a large extent in the near future. I do not think Bcash will die anytime soon, but I am yet to be convinced that it is a better protocol than Bitcoin.

This of course begs the question: Kaltoro, what is an example of a good Use Case coin? There are three that immediately come to mind:

Polymath - Creates infrastructure for new security-based tokens (ICO's are categorized as securities by the SEC) https://www.polymath.network/

Monero - Privacy based coin that conceals both sender and receiver addresses https://getmonero.org/

Salt - Blockchain backed loans, receive cash using cryptos as collateral https://www.saltlending.com/

Each of these coins fills a specific niche, focusing on delivering a usable product. While Bitcoin may be able to fill these roles in the future, it currently does not. Having said that, code does change over time and it is possible that another coin will be able to serve in these roles.

2. Team

A coin lives and dies by its team of developers. Developers are the unsung heroes who spend countless hours writing, testing, and revising code. For a coin to succeed long term, the team needs to be inconstant development and improving the codebase of the coin. A coin that has been abandoned by its dev team is effectively dead. For a list of dead coins please look at http://deadcoins.com/ (RIP Coinye)

When investigating a development team one should focus on individual member accomplishments, track record, and advisors.

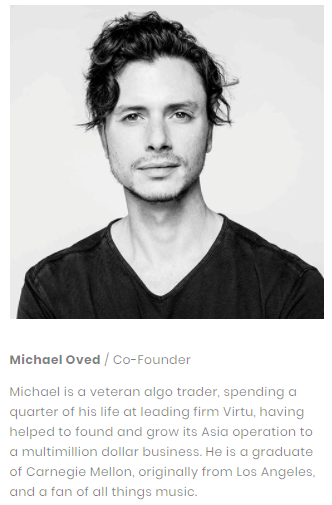

Let us take a look at Airswap Token (AST) and one of their founders Michael Oved https://www.airswap.io/team/

I had the opportunity to meet with Michael at a meetup and pick his brain concerning his background. He has a strong background in programming and algorithm trading (automated trading of currencies and securities). Michael has years of experience in the traditional markets where he worked in the US and overseas in Singapore.

This skill set lines up directly with Airswaps goal of becoming a decentralized exchange on an international scale.

If you cannot find public information on the team (or if their skill set seems antithetical to their position), this is a red flag; Marketers should not be in a working as a CTO.

Airswap also benefits from a strong team of advisors including Mike Novogratz, a former hedge fund manager and crypto enthusiast serving on the board of the Federal Reserve Bank of New York's Investment Advisory Committee on Financial Markets.

Lastly, Airswap regularly communicates with its audience via Telegram and Twitter; this leads us to our final criteria.

3. Community Involvement

While the a solid code base and team are essential, they are of little use if everyday users are not aware of the coin they are developing. It is for this reason that community involvement (social media) are important for choosing a coin. One of the reasons that Bitcoin went unnoticed for its initial years of development is due to the fact that the team kept to themselves and focused on creating a usable product. This example is commendable from a use-case scenario, it does nothing to spread awareness and build a community. Of course Bitcoin currently has zero marketing now, but has grown to become the premier store of value in the crypto space.

Community size will ultimately play a factor in the adoption of the crypto, affecting the price positively or negatively.

At this point I need to emphasize the fact that community outreach can ramp up and reach "Irrational Exuberance" levels of hype. Press releases, Memes, and Coin giveaways are all useful in developing a community but it is important that they do not outpace the actual development of the asset. For examples of such hype, see Dogecoins meteoric rise in visibility in 2014

For the record, I am a perma-hodler of Dogecoin.

Another counter example of community involvement is Reddcoin.

Reddcoin's goal is to create a social cryptocurrency that is spendable on all social media platforms: Facebook, Youtube, Instagram, etc. through a protocol called "Redd ID." The code has been in production for years and yet very little information has been relayed to the community in recent years.

For months (years) Reddcoin holders speculated, bought and sold coins with little to no updates from the developers. This led to a number of community members to lose faith in the coin and move on to other tokens. This is the worst case scenario for a coin, especially for one that supposedly specializes in social interaction.

Only THIS MONTH has the team become more coordinated and released an actual roadmap for the planned releases (previous roadmaps were speculative at best and did not deliver on time): https://trello.com/b/qH9Eq2Lu/reddcoin-public-roadmap-mar-02-2018

While Reddcoin hodlers may ultimately see the coin be profitable in the end, they have suffered a huge opportunity cost by waiting so long for the developers to manage their expectations for a full product release.

Is there a coin that satisfies all of these requirements 100% ? Perhaps.

But I have yet to find it.

Coins mentioned in post:

Interesting article kaltoro, You’ve added interesting criteria beyond my own. Here are some I use, but note I only aim for a decentralized cryptocurrency that is censorship resistant and deflationary and anonymous- some tokens are very useful for other purposes such as smart contracts : all code should be open source, the coin should have a blockchain and anyone should be able to run a full node at home, there should be a limit on circulation (BTC limit is 21 million) the coin should not be premined (which is why I like Rhett Creighton’s zclassic idea over zcash and of course I look forward to getting bprivate), and I don’t do ICOs. Last of all, it’s an obvious criteria but a couple years ago lots of people were scammed: it should not be an MLM token. Now Reddcoin May be a very good token, based on what you described. For now, I am focused on accumulating more BTC and LTC. Ethereum has no limit but I own some because of smart contracts. I forgive some of its ICO nature so I am a hypocrite that way. I agree on Monero and own some, but like you say, BTC might steal its use case some day, like when atomic swaps are built into phone apps.

Excellent points all around. I cannot argue with your emphasis on decentralized-only coins, and any die hard crypto enthusiast should tell you the same thing.

I was careful to not endorse Reddcoin outright, but use it rather as a cautionary example of bad community feedback. Truth be told I do own some, so the lack of communication on the devs affected me personally.

I forgot to ask, what are the main coins you are focusing on at the moment besides BTC and LTC?

I have to say ethereum, because that is the third token I’ve been buying the last twelve months. I own Monero. And have BTG. You know my real name, by the way. I’ll pm you. I haven’t ever bought Bcash or BTG or bitcoin rhodium. Sold all my Bcash for BTG in December at the spike.

Good, rational advice, bud. Even after a few years, I'm still tickled pink to be investing in something that I can have a direct impact on. I can get involved in the community and get my hands dirty for any work that needs doing.

You can't walk into the Wall Street trading floor and ask a broker, "What's the low-down? Cool, where's the shovel?" Something about early Blockchain feels like a once-in-a-lifetime experience to me.

I still can't get over seeing my work getting deployed for the benefit of this epic point in history. F*** YEAH!

I share your enthusiasm! I feel the direct line of communication to devs is an often overlooked benefit of a healthy community. I am a member of several crypto Discord groups, and getting a direct response from a dev (or seeing them talk to a user) makes me feel more connected to the community as a whole.