Getting the most of investing in EOS

source: https://unsplash.com/photos/LeqCI5v81-c

This is not financial advice. The decision to invest in EOS tokens or not is yours entirely. Price is subject to supply, demand, institutional/government intervention, and external events. Should you decide to invest, here is how to maximize returns in EOS. Fiat currency returns will vary depending on the token price.

Eos is a token. It represents a fraction of the Eos network. Leaving it on an exchange allows you to make trades in other traditional cryptos. But as with Bitcoin and other cryptos, you don't own it unless it's on your own wallet.

This network as three primary resources: CPU, RAM and NET (bandwidth).

This network is meant to be used for running DApps. Decentralized applications.

Now if you hold (or hodl) Eos, you are entitled to these three resources. Because most holders do so for investment and/or portfolio diversification, they have no practical use for them.

Enter REX. Resource Exchange. Anything on that subject is here:

https://eosrex.io/

Skipping on technicalities, it rents the resources associated with your Eos to people who will use them and pay a little bit to do so. Your EOS are safe as they are staked into REX - you remain the owner of your EOS. You only delegate their computing power and allocated resources to the REX exchange. This means that nobody can run away with your EOS. They remain yours, but are staked. This means frozen for as long as you want to generate a very small passive income on the tokens you hold. Before you stake be aware that the Resource exchange will not make you rich. But if token price appreciation does make you rich, staking them on REX will make you a little richer. It will use your Eos that you would otherwise not have used yourself. The rate of return varies but the good news is: you won't loose Eos. You can only gain, again, in Eos. You may lose in USD if the Eos token price goes down so it's important to distinguish.

After you've staked your Eos and let them mature into REX token for 5 days, you can leave them there where they will be lent and generate the income. The withdrawal process takes 2 days. You need to take that into account, again, the REX exchange is not meant to be traded short term. It is meant for your Eos to be left staked for months if not years. You can view it as a way of getting a small return on your crypto asset.

That return is very small. Now how do we get a higher return you might ask? By picking a proxy that will give you the highest rate of return of all proxies.

This means supporting block producers that will reward people for electing them. Now that's a tricky one for two reasons. You have to pick between voting for higher daily returns versus voting for token value appreciation. Both are not mutually exclusive but there is a difference.

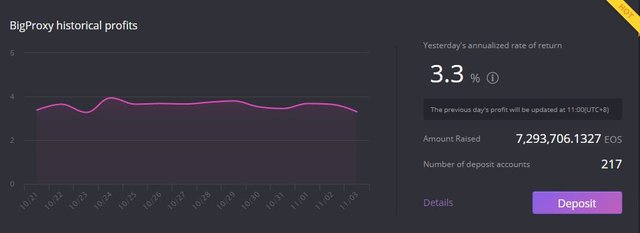

Reason 1: the highest rate of return means voting for large exchanges or producers so massive that they are corporations. They will however require the least amount of resources - they are given block producers rewards for maintaining the network. Therefore they are the most likely to redirect these rewards towards their voters. The proxy with the highest yield that I've seen can be found on the website: big.one

Of the 5% block producer reward you will be entitled to somewhere between 3.0% and 4.0% annual return. This is the observed rate. What some might consider an issue is that most are located across Asia and therefore without the full decentralization benefits that other proxies may provide.

Source: https://big.one/eosproxy

Votes: https://www.alohaeos.com/vote/proxy/bigoneproxya

If you know proxies with higher returns please let me know.

Reason 2: the price of Eos depends on the technical innovation and resourcefulness of its block producers (BPs). Because large BPs are by definition large, they don't necessarily have the same incentive to innovate and create ground-breaking protocols and technology. This in turn can make the EOS token price increase at low pace, stagnate or decrease. There is no way to know for sure but that's a possibility. A way of supporting growth and innovation would be to cast your votes for proxies that support token value appreciation without any other consideration. For more information on this check https://eosnation.io and https://www.alohaeos.com/. On top of promoting BPS that deliver the most to the network, these proxies have the added benefit of providing an increased geographical decentralization. They provide an annual percentage rate of return usually between 2 and 3%.

https://www.alohaeos.com/vote/proxy/voteforvalue

https://www.alohaeos.com/vote/proxy/proxy4nation

After doing so you will have the compounded interests of REX and proxy vote rewards.

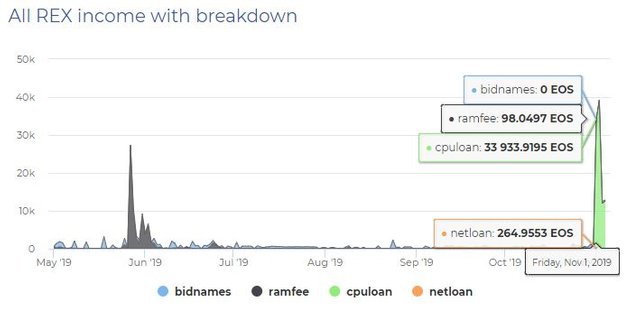

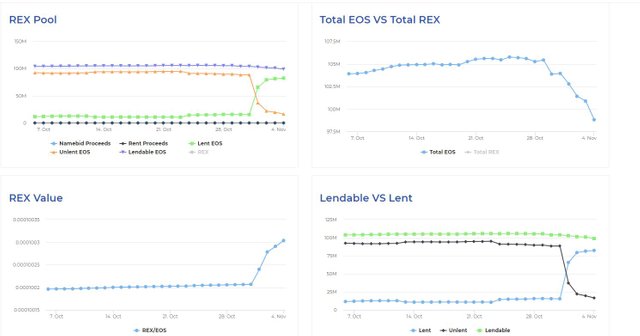

I write this article now for one essential reason: the REX exchange was mostly unused for a long while until 3 days ago. Eos saw its CPU network strained due to a sudden and large demand for this resource. This means an unusual (but still relatively small) increase in REX returns for stakeholders. As spikes have by definition a relatively short existence, it may be a bit late to benefit from this particular occurrence. But what it means is that there is somebody willing to pay in order to use a good share of the resources provided by REX. Something previous stakeholders were betting on but that had not been demonstrated as something that would necessarily happen. Because it did happen, the likelihood of a similar scenario reoccurring becomes more than idle speculation. For this reason we may see REX yields increase again in the future, thus rewarding long term holders.

Source: https://eosauthority.com/rex/statistics

The comparison that I would make is with a term deposit at the bank. Go to your bank and ask what rate they'll give you for staking 1,000$ for one year in a term deposit. That rate will be low but after one year you will (?) have 1,000$ plus interest. Provided no banking apocalypse occurs.

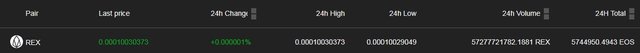

Now compare this to buying Eos now, making your own wallet, picking a proxy and staking into REX. The USD rate of return one year from now will be tied to that of the underlying - the price of Eos. But if you believe that it will appreciate, that would be the way of maximizing your returns on this asset. There has been an inflow of Eos being staked into Rex recently:

source: newdex.io