Napoleon Trading Issue No. 1

(Cool Logo, coming Soon)

NAPOLEON TRADING

Article 1 (October 26, 2018)

Written by: Douglas Luna

Edited by: Napoleon the dog (No formal education, but digs good holes and a champion sock chaser)

It's midnight and I'm beginning a project that I have been trying to fine tune for several months now. Having jumped into cryptocurrency markets in early 2017 had me for the next several months feeling invincible as every time I made a call money was made not only by me but close friends from seeing the explosive potential of BitcoinCash and finding the diamond in the rough ICO Dentacoin to calling the Antshares rebranding, I mean I even made money on Bitconnect and the more sleazy “Laser Online”. I felt like I had been born with a gift which I had just only found out about. Unfortunately As I later learned from Kim Paul's book, What I learned from losing a million dollars, the same euphoria and sense of invincibility that was brought on by gains which would have happened anyways in such a year where the crypto market rocketed from a MC of several billion to almost tapping 1 trillion in a matter of months. Like the Legendary investor Benjamin Graham once said , “While enthusiasm may be necessary for great accomplishments elsewhere, on Wall Street it almost invariably leads to disaster.” Perhaps it was those same wise words which he used to mold his greatest student, Warren Buffet.

My ego blinded me to the fact that it was not me making the right calls, the market was doing what the market does and I was just lucky. Proof of this began to hit home as 2018 came rolling in and the 200KUSD I had grown up from a couple thousand dollars began to slowly melt away and I would not wake up and smell the coffee so to speak.

My account dwindled from 200k to about 160K and I was actively trying to sell it, but as is always happening in cryptocurrency exchanges technical issues hit when those like me who had massive quantities of a specific coin, which prevented us from being able to deposit and trade for USD and take profits. This Technical issue lasted for about 4 days as the value of DCN plummeted. I was so emotionally invested in this particular coin that I had an extreme case of tunnel vision and forgot even the most basic rules that I had learned when I first jumped into the markets head first. By the time deposits were functioning again my holding had dropped to about 95K, this type of money to me would have been life changing. I have never made 95K on one thing ever in my life, I grew up lower middle class, was in the army and did free lance video and photo work, so 95 thousand dollars is the kind of money that you take. But not me, not this time. My reality had become so distorted in the previous months that I believed that I could read what could happen next, and I could not accept that fact that this particular exchange, “screwed” me over like that. How dare they allow my holding to drop by half before being able to have the ability to take my profits out, I knew they did it on purpose. So out of illusion, frustration, thick headedness and a skewed perception of my own abilities I decided that 95K was unacceptable and that the market was just slightly correcting and another run was about to happen any day. Any day now...just got to “HODL”. Ok maybe a week....or a month. The reversal never came ( as of writing) I had let my account dwindle to sub 20K and then 10K before I realized I was doing it all wrong. I had right before the peak of the 2017 bull run decided to trade full time and like 2017 was all green, 2018 hit me like a ton of bricks as I began to only see red, red and more red.

My story could go on and on with so much more in the details. But I know pieces will come later on at times when it will be more beneficial to those of you who care to read this. I have been through the psychological highs and lows and everything in between. I'd been thinking of a format to work with though. I do know from my interest in business and marketing that I can't just jump into something without filling some demand. There were already too many bitcoin price predictors, Technical Analysis Gurus and a million other shills like Craig Grant and Treyvon Martin. A lot of these guys are good and I particularly like Data Dash's content & Coin Mastery. I also love a lesser known trader from the Forex markets whose name is Tom Dante, a Brit with a no none sense way of sharing his knowledge. I could not think of a way to provide good Quality content that is not just daily noise with guys making 45 minute videos with absolutely nothing of value to say on a daily basis with click bait titles like, “Will bitcoin hit a trillion dollars in 2019” & “Ripple to “$100?” All that none sense I have come to realize is nothing but a distraction and attention grabs by you tubers who obviously were not given enough attention growing up. I've decided on a weekly written format where I share valuable content which can be digested appropriately and give those reading real value for the time they take in reading. Chasing daily hype videos is a quick way to ruin your trading or investment account. And those who say crypto is not an investment are absolutely wrong , and that is at the base what we crypto traders believe, we are investing in technology which will change and better the world tomorrow regardless of how we individually choose to interpret that. I had fallen into the trap of hype videos in 2018, sadly forgetting about the patience which lead me to my greatest returns in 2017.

So enough about me for now let's get down to why you are here. But before I go I want to make a last note, I consider myself a decent crypto trader and understand trading as a whole pretty well but I am not an expert in stock trading and or Forex. These are 2 markets I am dipping my feet into and trading is more or less the same across the board as far as the fundamentals but every market is unique enough to be navigated in different manners. I will share knowledge of these markets to the extent as to how it could affect the crypto market because everything in the world is entangled and only by understanding the macro view will you be able to fine tune your micro decisions.

October 27 2018

Market Cap: 208 Billion USD.

We have been holding at about these levels since August. No major jumps or drops have stood out in this time and as you can see from the January 7th high of 822 Billion USD the entire market has been steadily declining over the last several months as euphoria and delusion has left the market and more sensible valuations are returning to the charts. Coins which at the time could have sold for 4$ and have a Market cap of $300 million USD have been brought back to their senses with corrections of prices in this range going back to 25 cents and market caps more sensible for what are more or less “start ups” with very few having working projects but a lot of potential.

It is fair to say that overall we are at or near the bottom as price evaluations are more justified in terms of the amount of human time and effort which is being put into prepare the world not only for the tech but for liquidity and regulation which are all necessary in order for long term sustainability.

What many forget to realize is that we are at the dawn of a creation of an entire new asset class. Anyone now is still getting in at the ground floor, imagine being one of the first in the New York Stock Exchange.

Although I tend to sway towards the side of caution, the current market and political situations globally are setting up a perfect storm for a crypto bull run which could begin as early as December 12, 2018 when BAKKT launches and Bitcoin ETF's will launch and it will be the first step towards institutional investors pouring billions into the markets as a hedge, a hedge for what you might ask well.

What do you see here?

Here we see the NASDAQ's massive growth from mid 2015 to now.

Now with the most basic knowledge of buy low sell high what would be the rational decision to be made here.

The markets are currently 12% down which could be just a slight blip on the radar if it was not for Price to Earnings ratios, or the dreaded P/E ratios.

What is a P/E ratio?

The profit to earnings ratio as described by Investopedia is

“ The price-to-earnings (P/E) ratio is one of the most frequently used and trusted stock valuation metrics. It is calculated by dividing a company's share price by its earnings per share. This provides a measure of the price being paid for the earnings. A high P/E ratio signifies greater investor confidence in a company's future prospects, but it can also be a sign shares are overvalued. “

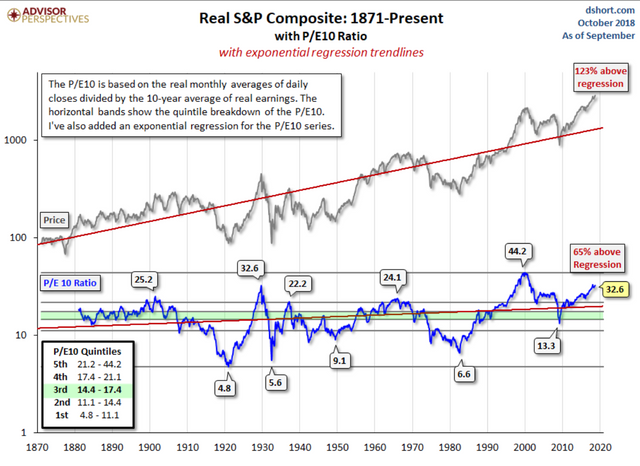

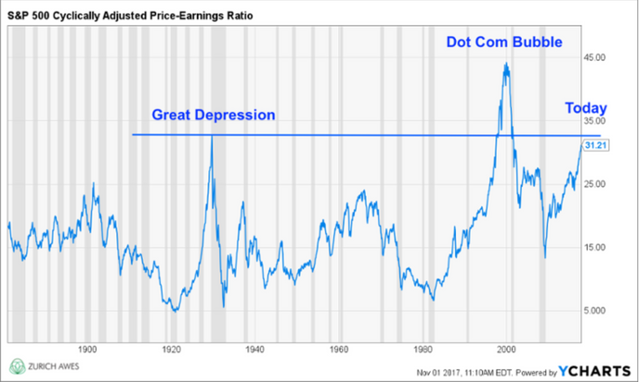

or to put it in mathematical terms. the price of an asset divided by the profits per share of stock. If a stock that is trading for $50 a share has earnings of $2.50 per share, it has a P/E of 20. ($50 / $2.50 = 20). Now this is example is most commonly used by potential investors doing research on potential buy situations. But the same can be done for an entire market to try identify buy/sell opportunities. So at current rates for Major Exchanges (American) of S/E ratios hovering over 30 or 31.5- 32.6 depending on the person or institution running the numbers can be considered dangerous tipping points. Look back to 2 infamous market bubbles which any adult can resonate with, the “Great Depression” and the “DotCom Bubble”, in which both had P/E ratios over 30 with the latter spiking to an eye watering 44 before the market reversed.

The following are 2 graphs demonstrating current levels by two different sources.

The Following................

Taking all of that information into account it can be seen why

Investors may begin to transfer profits from a peaking market to a market which is going through a bear market and offering bargain prices for coins at prices for some which are only 10 % of their All time highs. But again, not to get too excited as the educated investor has other more traditional assets or commodities, specifically Gold or Silver which are always a solid hedge. I will be sharing next week my findings for how P/E ratios equate to the crypto market as many of these “companies”, are unregulated, making absolutely NO PROFIT and or are outright scams, but it does not take away the fact that there is an opportunity there to be had any more than those who screamed that buying Bitcoin at $1,800 in April 2017 was a stupid idea. Had you bought Bitcoin at that price a year later despite the “Bear Market”, you would still be profiting more than double with Bitcoin seeming to have found a stable price at a range between $6,000USD-$7,000USD.

Current Silver prices are just under $15.00USD an ounce, the lowest prices we have seen in 10 years with 2011 peaking at $50USD an ounce. This is a prime example of buy low sell high, anyone who has rode the wave of stocks would be smart to take profits and move towards silver or gold. Remember silver is not just used in jewelry but is absolutely vital in parts for in everyday electronics and the demand will inevitably cause a need for the asset. At the moment I do not have a big stake in gold or silver but have been for the past few months accumulating physical Silver ounce by ounce during these amazing prices. I have even been able to sell off small bars during particularly difficult moments to local buyers here in Nicaragua where buying pure silver is not as easy as logging into a website filling your information, pay and wait for it to arrive at your doorstep. Gold has not experienced such an immense drop as silver but it is at a low since April 2018 and the charts are a strong BUY at just the right time.

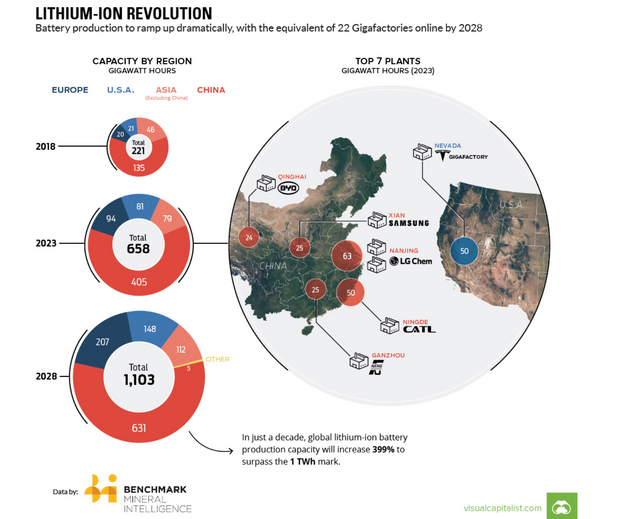

A step away from Gold and Silver and some basic research on websites or reading articles by economists and futurists (yes that is a title) you can read and find charts about potential contested resources in the future. I had a thought about this a few weeks back when I was reading Elon Musk's biography. When describing one of the major issues plaguing the original Tesla models, the battery. The reality was that most of the Technology needed to build an electric vehicle existed, except batteries which would be small enough yet powerful enough to move such a car. In steps in Lithium Ion. Lithium Ion has brought Tesla to life and has spearheaded to revolution in car making that is the Tesla Motor Company. The ONLY successful new car company to arise in the United States in nearly 80 years. So what does this mean for the average investor? It means that Lithium Ion is still in it's infancy with little competition and a demand which will only surge over the coming years. Every one knows this but it is not something you actually actively think about, after all our phones just “charge and shit”, you know, when we plug it into the wall. Even more distanced from this are people who actually use wireless charging, and who knows what the fuck that is all about and if it will turn them in to mutants within 2 years (cough, VAPE BROS).

So I found a chart of a relevant stock which can be purchased at a “relatively” low price. Deeper analysis will come in my article next week, but I leave it here as a thought stirrer, and perhaps you as the reader will care enough to research and compare your data to mine next week and decide I am complete fool, which is ok to.

Besides this is just a form of therapy to me. I think. Maybe. I don't know.

“We go to Starbucks everyday so we buy Starbucks Stock”

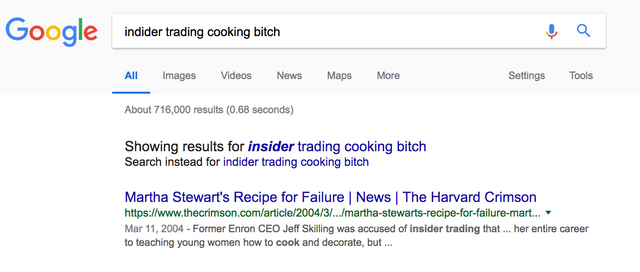

-Martha Stewart-

Now there is some insight, I think she also forgot to say I buy stock based on illegal information I shouldn't have.

My actual Google search when I had forgotten Martha Stewart's name as I had read this quote a while back and it had an impact on me. Not just on the practicality of it, but later on realizing how it could also be short sighted. More on that next week.

(Note: peep the way I spelled “Insider”, I don't care my Mac is fucked and the keys are breaking, yet I refuse to give apple another dollar until they get their shit together, now that's a stock I would stay away from right now. How about them power chords -.-)

So this has been my first issue of what I am calling Napoleon Trading, not because of thee Napoleon from France who although I find inspiring but from my Chihuahua, Weiner dog mix, Napoleon; he is named after the French hero. Napoleon has helped keep me sign in what has proven to be one of the toughest years for me not only financially, but personally. Losing so much value in crypto these months, a failed and bloody political coup which has hit home in many many ways which I would rather not share everything about right now and the death and birth of relationships, or in investment terms a dead cat bounce where I thought a new dawn was coming, but it was more of a bit of good surrounded by bad but followed by even more bad. But I am hopeful, as you should be. Like 2017 was a great year, 2018 was more difficult. But the goal is to create higher highs and higher lows as a trend in life. It is a lie that everything will always be great , but it is not a lie that you can't do great things always.

once again it was Benjamin Graham who wrote Without a saving faith in the future, no one would ever invest at all To be an investor at all you must believe in a better tomorrow”

Alright peace everyone. Here is my other information so you can send death threats to me in the future when everything I say is proven to be bullshit.

Steemit: Lunasvision

Twitter: @luna5vision

Instagram: @Lunasvision

Facebook: Andres Luna

Email: lunasvision@getwithknowledge

*Note: Official Napoleon Trading accounts will be coming, but as this was a sudden answer to a several month long debate in my head I jumped into writing material I wanted to get out before getting the name and everything else settled, as with anything in life, don't think, do. Don't have every excuse in the world not to START something, keyword: start. Even if it's not polished at first, in time it will be, the important thing is to get your ideas out there and the rest is history, even if you have terrible grammar... ←At least I know that it's only 3 periods and the difference between theres and theirs. Hahaha Have a great week!

HAPPY HALLOWEEN!