Trading vs. Investing Finance Friday Series #9

Hello everyone! It's that time of the week again, the Finance Friday Series! I believe it's a bit late to sell my alts that tanked, so I'll just wait for a rebound before I'll start selling some of them. Instead, I'll talk about trading and investing. These terms are synonymous but their approaches are different!

I believe most of you guys are like me; we have little to no idea about trading, technical analysis and investments before crypto. To be honest, when I first read about bitcoin, I wasn't thinking of short term gains. I really believed in the change it will give to how the world works. That was before the rally to $20k, which I believe most of us haven't expected.

Trading

Traders use indicators, trendlines, moving averages and other technical tools for their entry and exit prices. Mostly would not care on what coin they are trading at, specially to those who aim for short term gains.

Those who are ahead of the game, financial and knowledge-wise, has made trading as a way of living. Trading is classified as a job, or a business; which one's aim is short term profits. These are the guys who buy and sell for quick 1-3% gains in different coins, and taking out realized profits every week or month. Although there are different styles or approach to get on the same goal. Traders have more frequent activity in the market. The goal mostly, is to make close to 10-20% every month. I once targeted a gain of 1% per day, which I thought it would be easy. I can say I was really way ahead of myself.

Traders are also classified in terms of their frequency of trades. According to Investopedia, there are 4 types of traders: a position trader, swing trader, day trader and scalp trader. Position traders have more long term positions, that buy in key supports and sell in heavy resistances. They can hold a position for months, or even years. This approach is mostly similar to investing. Swing traders prefer to hold trades from days to weeks. On rare occasions they would hold for months. Day traders are concerned with the daily trend and do intraday trading. This means they hold positions throughout the whole day, but never leaves overnight positions. This approach relies on heavy technical analysis. Scalpers(scalp trading) put positions that would last from seconds to minutes. These traders have the least exposure to the market, but take really risky trades. These type of traders have the least care on what coin they are trading on. Most high frequency trading bots are programmed on this type of trading.

Traders rely mostly on technical analysis. Charts, indicators, news and trends; these are their tools to look at when to buy or sell a coin. They are less concerned on the projects' fundamentals, or who owns and runs it, even what it does. When the charts say they should buy, they would.

Investing

The investor dollar-cost averages his entry throughout the market cycle on coins or tokens with great potentials to build up wealth.

Then, there are others who plan to HODL for the next 5 to 10 years. Investors have long term plans, with long term holds. Mostly would not care on their entry prices, but gradually increase their holdings by regularly investing in the market. The main goal of investing is not for short-term gains, but on building up wealth through purchase of coins with good fundamentals and real-world applications.

For investing, mostly in the cases of traditional stocks, these purchase securities that would increase their profits through compounding, dividends and stock splits. This could be correlated in the coins or tokens that would pay similarly, like masternodes and staking coins for increase in holdings. Steem, for example can be powered up into Vests, which would likely increase over time. Another one would be holding NEO on wallets, that would pay GAS. Or a Dash masternode for those who have a lot of money to put on crypto.

Advantages and Disadvantages

These two types on how to make money, of course have their own perks and drawbacks. For short term traders, one example of their advantage is that they are less exposed in the market compared to traditional investors. They realize their profits over the course of the year by cashing out in a timely manner. Another would be the annual rate of returns is higher compared to investors. Investors might gain about 10% per year, but a trader could get that in a month. The drawback would be that traders should be heavily equipped with technical knowledge over the market. They tend to take more risks, and realize their losses from time to time. One bad trade without risk management could be one's end on the game

Investors on the other hand, would have stability in their equity compared to that of a trader. Buying consistently on a timely basis would average their cost and recover all those losses in a single rally. Investing is a long term game. One would not care on the 40% drops on the altcoin markets with good fundamentals, because it has higher probability of recovering those losses over the course of the years. We have seen Bitcoin go down more than 80% of its peak in a cycle and everytime it bounces back, it goes to new highs. Traders would have probably exited early and realized their gains, but would miss on some possible gains when it reaches new highs. But the disadvantage of investing is one's market exposure. We have seen tons of crypto that came, reached new highs and died after a year or so it was built. An investor 'betting' on a wrong coin would be tragic to his overall equity.

It would be possible to mix both of these strategies in building up wealth. This way, one would minimize his risks and catch more potential gains. Learning the fundamentals of trading, while investing long term on this current ecosystem would be beneficial in the long run.

The Portfolio

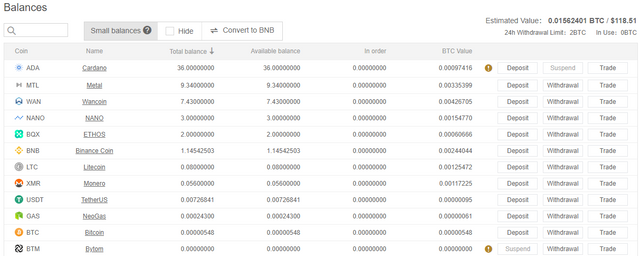

As of now, the market cycle seems that it's closing down to its bottom, but I haven't freed out some of the funds into BTC. My pacheck is delayed up to the 30th of June so I haven't bought and traded some altcoins this week. I have been too busy too building up my Steemit reputation, and earning some Steem power before I go busy again when the classes start next week. But here's my current portfolio value:

Here's my weekly progress in this series:

Initial investment = 0.01 BTC/$68 (estimate)

Previous week value = 0.01601261 BTC / $118.93

Current week value = 0.01562401 BTC / $118.51

Weekly Gains = -2.42% / -0.35%

Total Gains = 56.24% / 74.28%

Interested in trading and haven't traded yet? Try Binance. They trade STEEM too!

You can buy some altcoins not listed on Binance at Kucoin!(Please always check the url and don't get phished!)

Feeling ballsy and wanna do leverage? Save 50% in trading fees! BitMEX allows up to 100x! Don't get burned though, or else the bot will quote your order.

Wanna try Options Trading? Spectre.ai offers options trading with traditional currencies using the Ethereum blockchain! You can try the demo too!

Disclaimer: All information found here, including any ideas, opinions, views, or cryptocurrency picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as an investment signal or a personal investment advice. I am not your financial advisor. Do your own diligence. Investing in cryptocurrencies involves financial risk. Please consult a licensed investment advisor before investing.

Missed the previous weeks? Here's the list

Week 1 | Week 6

Week 2 | Week 7

Week 3 | Week 8

Week 4

Week 5

Banner made from bannersnack.com

Resources: Tradingview

Very useful post

Thank you