IEO: The Next Step in Evolving the Crypto Industry

In the last couple months crypto industry has solid discussions about Security Token Offerings (STO). Noozzle assumes, that STO’s has all the chances to become a new source of revenue for startups after ICOs.

However, before STOs become a big thing, there is a new trend now, so-called Initial Exchange Offerings (IEO). The Initial Exchange Offering is a new approach to crypto-banking, which is slowly catching the interest of ICOs and traders across the world.

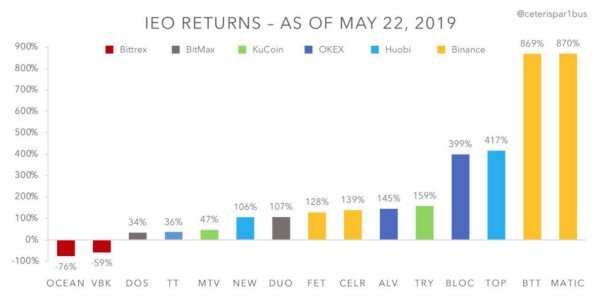

Noozzle Team found an amazing graphic with the IEO returns. Let’s find out, what it is all about and why it is a hot topic right now…

This new system provides a different type of exchange. Exchange simply acts as middle man between projects and contributors. Anyone who wants to participate in the IEO token sale has to create an account on the exchange platform and fund their wallet so they can be ready to buy the token. Quite many influencers in the crypto-world see the potential in this system and encourage others to get on-board.

How it works?

To explain Initial Exchange Offering, as the name suggests, is a kind of initial capital raise which is conducted on the platform of a cryptocurrency exchange. An IEO process is administered and monitored by a crypto exchange on behalf of the start-up. IEO is trying to raise capital with its newly issued tokens, which would ultimately be listed on the exchange.

As the token sale is carried out on the exchange’s IEO platforms, token issuing start-up has to bear the expense of a listing fee along with a certain pre-decided percentage of the tokens sold during the IEO. In return, exchange’s platforms allow the startups to sell their token and coins are then listed on the exchange after the IEO is over. As the cryptocurrency exchange takes a percentage of the tokens sold by the start-up, the exchange is interested in assisting with the token issuer’s marketing operations.

The participants that look to participate in the IEO, like in ICO, do not send their capital contributions to the smart contracts. Instead, their accounts are created on the exchange IEO platforms which are funded by the participants and these funds are used to buy the new tokens of the start-up which is trying to raise capital.

While there are a lot of differences, IEOs are similar to ICO’s in certain aspects, but the most significant advantage of IEOs over ICO lies in the better liquidity provided by the exchange. As once trading starts after the IEO, a large user base is already guaranteed.

What does this system offer?

This two-way system brings a sense of control to proceedings that are essential in a number of ways. This new IEOs can offer the following:

1. Greater security for users

2. Improved transparency compared to previous approaches

3. Fair system that can benefit those that are new to the game

4. The sense that this is a reliable banking system

However, IEOs are also the subjects to the following risks and concerns

Unclear regulations and restrictions. Many countries have issued restrictions or banned ICOs completely, which may reflect badly on IEOs, too. Although it is a slightly different beast, the core principles of an IEO remain the same.

All investors must comply with AML/KYC. The cryptocurrency community is known to be full of privacy-obsessed individuals, so going through AML/KYC procedure may be a big no-no for some.

Market manipulation and concentration of coins. Most IEO tokens are minted beforehand, so you should always double-check the dynamics of token allocation and distribution before investing. Both the project team and an IEO exchange may keep an unreasonably large portion of tokens to themselves, which may result in meddling with prices later on. Besides, it’s no secret that the vast majority of exchanges participate in “wash trading”.

A limited number of investors. There has been many complains from investors that not everyone manages to purchase tokens during IEOs.

Bots. There is a concern about bots that can be programmed to participate in IEOs and beat out human investors.

Nowadays Launchpad trends

While not explicitly termed IEOs, some cryptocurrency exchanges have introduced token launch platforms. The world’s largest crypto exchange, Binance, leads the way in this aspect with its Launchpad program.

Binance Launchpad is the first of its kind in the crypto space, and it has been around since 2017 when the exchange hosted the Gifto ETH and BNB session. The primary idea behind Binance’s Launchpad program is to allow its users to participate in ICOs and receive tokens directly to their exchange wallet accounts.

The Launchpad has so far benefited Binance, project developers, and contributors. The process creates an exclusive use of the Binance coin (BNB) as investors can only use the token to participate in the listed projects. The developers would also be able to reach a broader audience, as Binance is currently the exchange with the highest number of users in the world.

Bitmax Launchpad

Another crypto exchange, Bitmax, recently introduced its Launchpad program. The first ICO on Bitmax Launchpad is for DOS (a decentralized oracle service network). The token launch started on March 10, 2019, with DOS aiming to improve blockchain usability with the help of real-world data and computation power.

Bittrex IEO

Bittrex announced on Monday, March 11, that it would be launching its first IEO on Saturday, March 15. According to the official announcement, Bittrex would have host the RAID token launch on its platform, giving its users the ability to purchase the coins at a set price directly from the developers on the exchange.

This growing list of IEO could signal an end to the previous era of ICO, and become the new way for crypto projects to raise funds; offering a safe playing field between investors and crypto project developers.

KuCoin Spotlight

The Singapore-based cryptocurrency exchange, Kucoin, announced its first project, MultiVAC, to be launched on Kucoin’s Spotlight launchpad.

It aims to assist blockchain projects in raising the needed funds, attracting market attention and improving industrial influence.

Summary

To sum it all up, the Initial Exchange Offering is still a pretty new phenomenon. However, there is no doubt that this will continue to grow with time.

There will be some traders and whales, who worries about this sense of “fairness” and that two-way system. Some may worry, that such a strict approach will take the users away from the original ideals of cryptocurrency. On the other hand, this new approach could bring in a whole new group of users.

Hopefully, IEOs will help to make crypto-currencies and exchanges more appealing to the wider market and as possible result, the IEOs may change the face of crypto-infrastrucutre for the better.

Please give us a thumb up!

- Website: https://noozzle.space

- Twitter: https://twitter.com/NoozzleSpace

- Facebook: https://www.facebook.com/Noozzle.space

- Linkedin: https://www.linkedin.com/company/35614362

- Medium: https://medium.com/@noozzle.space

- Steemit: https://steemit.com/@noozzle/

- Youtube: https://www.youtube.com/channel/UCL07fY3bJCbjQzU_DkQiq7g

- Reddit: https://www.reddit.com/user/noozzlespace

- Official Telegram Group: https://t.me/noozzle_space

- Noozzle Announcements: https://t.me/noozzle_announcement

- Noozzle Telegram Chat: https://t.me/noozzle_live