Investing in High risk assets: Isaac Newton's Example

Dear Friends,

Would gladly share an article from Zerohedge on Isaac Newton's experience with stock market in 18th century:

"The year was 1720. And one of the smartest people to have ever lived had just made one of the dumbest financial mistakes imaginable.

Sir Isaac Newton was a genius in every sense of the word.

He practically invented the science and mathematics that is at the foundation of nearly every bit of modern technology that we enjoy today.

Newton was such an intellectual superhero that even Albert Einstein idolized him.

In fact Einstein wrote in a 1919 paper that “[Newton’s] clear and wide ideas will forever retain their significance as the foundation on which our modern conceptions of physics have been built.”

Yet Newton was a complete moron when it came to investing.

During his lifetime, the British Empire was becoming a major superpower and had colonies all over the world.

With so much new international trade under its control, Britain’s prosperity soared.

A handful of companies like the East India Company provided opportunities for investors to share in that prosperity. But the public was always clamoring for more.

So in the early 1700s, the British government chartered a new company– the South Sea Company– and awarded it a total monopoly on British trade in South America.

It seemed like a veritable goldmine, and investors clamored to buy shares.

Isaac Newton was one of those investors.

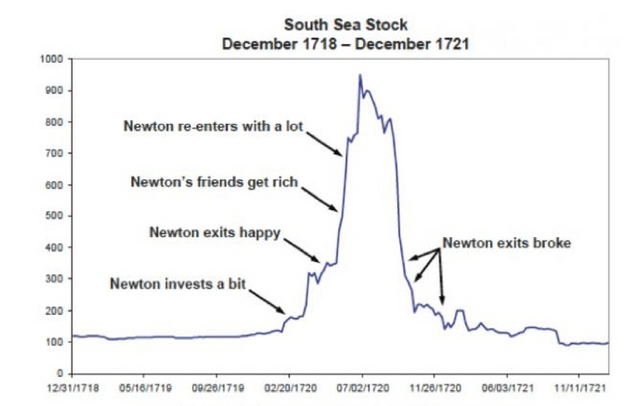

And initially it was a fantastic investment; Newton bought in early 1720, and within a few months he’d doubled his money. So he sold his entire stake.

Then something interesting happened.

The South Sea Company’s share price kept climbing… higher and higher.

In fact, almost right after Newton sold out, the South Sea Company’s share price climbed exponentially, reaching a peak of nearly GBP 1,000 by mid-1720.

(That would be worth nearly $300,000 today.)

Newton felt like a total buffoon for sitting on the sidelines while all of his colleagues were still makings tons of money in the stock.

So he got back in.

And, anxious to make back the profits he’d missed out on, Newton doubled down, investing an even bigger amount in the shares.

You know what happens next–

The South Sea Company turned out to be a complete bust. It turns out that Britain never really developed much trade with South America.

Yet the company had blown through most of the money, and there was nothing left for the shareholders. So the stock price quickly crashed.

Newton was broke. He lost his life savings, just seven years before his death."

Full article is available here: https://www.zerohedge.com/news/2018-01-23/cryptos-slide-there-any-new-information-didnt-exist-two-weeks-ago

The key point: "Control your risks, always assume a probability of loss (a temporary hit which will not destroy you, but empower you with a vast experience which you will use to regain lost capital and continue to multiply it), have a plan, buy during panic and depression and sell during maximum optimism phase"

Hey p2p noticed you were loyally viewing my posts regularly so came to check you out, and you have some really great posts here too. Just followed you, looking forward to more content :)

Thanx. Hope to provide only interesting stuff, Block! ;-)

@OriginalWorks