Add Crypto to Speculation Portfolio: Upgrade Return, Diminish Hazard/Unpredictability

As a rising resource class, digital money and blockchain innovation related speculations are picking up resenting regard among back experts. Market slides aside for the occasion, an investigation discharged by Grayscale Speculations endeavors to present the defense financial specialists ought to genuinely consider adding crypto to their individual portfolios, as they bring better returns and, nonsensically, diminish hazard and unpredictability.

Grayscale Urges Current Financial specialists to Fuse Crypto into Portfolios

In truth, it's an abnormal time to make such a contention: crypto showcases as of this written work are ridiculous, and one just need voyage over to Satoshi Heartbeat keeping in mind the end goal to see the gore. In any case, Grayscale Ventures (GI), a noteworthy player in the biological system as it identifies with mainstreaming crypto in the more extensive universe of back, discharged, Another Wilderness:

How Computerized Resources Are Reshaping Resource Distribution by Matthew Beck.

It's an intense endeavor to convince present day financial specialists of the requirement for digital currency, and their related posterity, in any adjusted portfolio. They "see advanced resources as a fresh out of the box new resource class that can upgrade key resource allotment and help speculators assemble portfolios with higher hazard balanced returns. We will give a couple of various focal points through which the peruser can pick up a more profound comprehension of the part that advanced resources may play in building more productive portfolios."

All through the paper, Mr. Beck alludes to the crypto marvel as "computerized resources," which he accepts "give presentation to extraordinary market openings and dangers, in this way making a broadening return stream for speculators. In that capacity, they ought to be viewed as a part of the ideal beta portfolio nearby customary resources, for example, values, bonds, and land."

GI is a backup of Advanced Cash Gathering (DGC), an investment firm situated in New York City. Grayscale really goes before DGC by two or three years, started and kept up by Barry Silbert, a prominent fund figure in the crypto space. DGC's umbrella incorporates GI, obviously, yet additionally Coin Work area as its free media arm. Grayscale itself is viewed as a pioneer in the limbo between spot markets and over-the-counter supposed periphery contributing and conventional values. GI oversees Bitcoin Venture Trust (GBTC), the first of its kind to offer licensed financial specialists traded on an open market shares estimated in the cost of bitcoin center (BTC). Authorize financial specialists have earned more than $200K the most recent two years, with affirmation s/he will do a similar this year, or has over $1 million in total assets.

An All around Contended Update

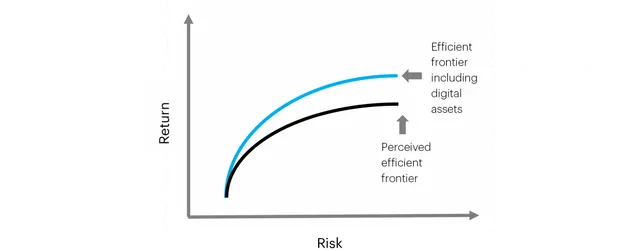

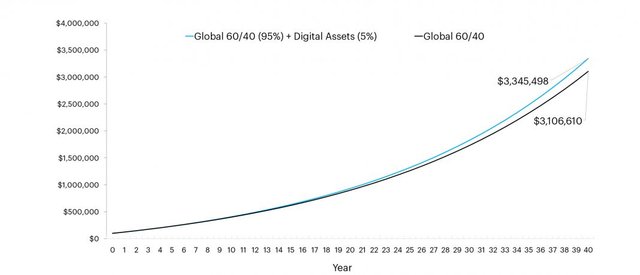

Fundstrat's Tom Lee praised Another Boondocks, tweeting, "This report is a very much contended update that adding crypto to a portfolio improves return while lessening general portfolio chance/unpredictability. Not certain there are some other rising resource classes that advantage an adjusted portfolio thusly." And at the start, Mr. Beck's endeavor is to first square computerized resources with Present day Portfolio Hypothesis (MPT). To put it plainly, he trusts "huge numbers of the present resource allocators are passing up a major opportunity for a 'free lunch.' That is on the grounds that (I) computerized resources speak to a fresh out of the plastic new venture opportunity that is uncorrelated to other resource classes and (ii) financial specialists are by and large under-distributed to this part. It is our view that the ideal beta portfolio lies some place higher than what was already accepted to be the productive outskirts, and advanced resources are the notorious 'missing bit of the perplex.'"

Energetically, Mr. Beck demands "computerized resources are solidly at the crossing point of probably the most noteworthy patterns reshaping the worldwide economy, including: another market worldview, described by moderate monetary development, low loan costs, and unique national bank arrangements. Fast progressions in money related advances and installment foundation, which presently make it conceivable to move, settle, and clear esteem/resources at an indistinguishable speed from data in a computerized arrange. Administrative movements, modifying money related industry financial matters and altogether expanding the cost of consistence and monetary activities. Statistic shifts, driven by (I) the up and coming age of financial specialists entering their prime winning years (i.e., recent college grads) and (ii) gen X-ers entering retirement and tapping underfunded benefits designs," and this last part Tom Lee hit on a couple of months back in his own introduction.

As to and including computerized resources, Another Wilderness focuses on "the normal moving one-month connections go from somewhat negative to marginally positive, with a normal relationship of zero. This gives prove that computerized resources can be viewed as an expanding part in multi-resource portfolios. In addition, numerous advanced resources are defectively associated to each other, which implies there may even be broadening benefits inside the advantage class itself." A solid piece of the paper goes through theoretical venture situations, and keeping in mind that they're 'mathy' and diagram loaded, they're to some degree less persuading.

A general decent dependable guideline when contemplating cryptographic forms of money is the manner by which nobody, not one individual, comprehends them. Without a doubt, they have parts of the condition, and that can be intense, in any case advanced resources still face mammoth obstacles as to standard selection, the kind Grayscale trusts. Direction, which they're on record as welcoming, could choke the brilliant goose, as was observationally the case with New York's Bit Permit. Add to the above whether institutional cash will at last discover its way into the space with the liquidity since quite a while ago envisioned by any semblance of GI, and preservationist mother and pop financial specialists most likely won't be so enthusiastic about consolidating crypto long haul. Mr. Beck finishes up, recognizing it is "still right on time in the lifecycle of advanced resources, however we trust our multifaceted way to deal with survey their investability puts forth a convincing defense for financial specialists to have some segment of their portfolio dispensed to this new resource class. A great deal can occur throughout the following couple of years, however recall: enhancement is a 'free lunch' and resource portion is about the long-amusement."

Do you think crypto upgrades return and decreases hazard? Tell us in the remarks.

Keep steeming

@parrotmouth

@Parrotmouth, thank you for using the naijapidgin tag.

We encourage and support minnows.

Join us on discord: https://discord.gg/5SR8CH4 for more fun and to submit your posts for curation.

You like what we are doing and would like to support us? Join our trail here: https://steemauto.com/dash.php?i=15&id=1&user=naijapidgin

Hello! I find your post valuable for the wafrica community! Thanks for the great post! @wafrica is now following you! ALWAYs follow @wafrica and use the wafrica tag!

Congratulations @parrotmouth! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes