The DAO Report 9/11/18

Swarm Fund @TheSwarmFund

Swarm named #1 of Top 5 Crypto Projects to Watch in September https://bitcoinexchangeguide.com/top-5-blockchain-projects-to-watch-in-crypto-market-for-september-2018/

Swarm Fund @TheSwarmFund

New Product Team explains Market Access Protocol (MAP) - Swarm’s milestone protocol for compliant trading of security tokens. Watch the 30-min Video Here:

JP Freeman @JP_Freeman11

Wondering how #SecurityTokens will be traded and transacted in a frictionless manner, while still adhering to KYC, AML, and accreditation laws from various jurisdictions, and still be able to maintain user privacy? Here is a clear breakdown of a very elegant solution.

Swarm Fund @TheSwarmFund

Enjoyed our Social Impact Live Stream? Learn more about social impact funds on the Swarm platform, like the FARM Coin investment opportunity by @BlockComm_BLCC and @FinComEco:

DDEX @ddex_io

DDEX offers #DAI based markets! Check out our blog post for more information on DAI trading and how stable coins provide a more natural decentralized trading experience https://medium.com/@ddex/ddex-now-offers-dai-based-markets-stable-coin-base-pair-tied-to-usd-ee4258cee384 …

Maker @MakerDAO

Really great write-up from DDEX, who is now offering #Dai as a base pair on their exchange!

Maker @MakerDAO

It's a big week for Maker as the Governance Vote for Foundation Principles is taking place. Read on for an explainer on the voting proxy contract and an in-depth look at the setup process: https://medium.com/makerdao/the-makerdao-voting-proxy-contract-5765dd5946b4 …

Maker DAI Bot @MakerDaiBot

100,000 DAI were freshly minted by CDP #2654 https://mkr.tools/cdp/2654

CanYa @canyacoin

CanYa has built the first hedged-escrow system to protect users from price volatility. This is fundamental to CanYa's adoption. Our Escrow Price Oracle uses the Bancor network & Dai Stablecoin. https://medium.com/canyacoin/canya-releases-hedged-escrow-to-protect-platform-users-from-price-volatility-7fca7a0aad32

DAOstack @daostack

Curious of what's under the #DAO stack hood? Dive into the code.

https://github.com/daostack

Maximilian @fiege_max

I'll be live tweeting @sfcryptomondays Security Token event this evening ft. @coinalpha1 @TheSwarmFund @sharespost @orrick

@John1wu connects the recent $eth sell-offs with treasury liquidations from last year's ICOs. Security token liquidity will begin to take off in the next six months as regulations catch up.

@timolehes dismisses the death of the utility token as a US trend, accrediting the SEC's regulatory uncertainty as its cause. Believes that European and Asian markets will continue to drive development of UT platforms.

Larry Kane of @Orrick suggests that as long as security tokens need to issue under Exemption D, we'll see a lack of liquidity due to the one year lock up clause associated with it.

John believes certain asset classes lend themselves better to tokenization. E.g. Real estate illiquidity, foreign stock investment restrictions are use cases that come to mind immediately.

@carlol12 of @CoinAlphaInc credits Malta's regulatory sandbox as the main reason for the company's relocation. Gibraltar is outside of EU, Singapore's banks have stopped opening bank accounts for crypto companies

He stresses that they're still registering with FINCEN as a MSB because American investors will inevitably invest in the tokens they launch. Believes that a lack of DEX liquidity can be attributed to concerns over eventual US prosecution of KYC-less transactions

Larry still believes in SAFTs as being proper vehicles, whereas SAFTEs have questionable tax implications. Private ICO placements are still occurring as well. More companies are going down traditional VC route, but with side notes guaranteeing nebulous token rights in the future.

@timolehes can't see the current exchange landscape continuing, between the outrageous listing fees and house-of-cards internal organization that tends to characterize it. Shakeups will definitely weed out those without compliant internal systems

@timolehes sees security tokens as a key on-ramp for family offices to get comfortable with the crypto space in general.

Gnosis @gnosisPM

We're super excited to be hosting a workshop on integrations with the DutchX—the first fully decentralized exchange at #Web3Summit! We'll present interesting potential use cases for developers to build on! See you 22-24 Oct. in Berlin https://web3summit.com/about/

EOS @EOS_io

Former Credit Suisse Managing Director and Head of Corporate Communications Sheel Kohli to Join http://Block.one as Global Chief Marketing and Communications Officer

Stake & Nodes @StakeAndNodes

Want to know what's going on with one of the leaders of the #masternode space? Check out my podcast with @Dashpay. We talk about what's going on with $Dash Evolution, the #Dash team, governance and much more.

https://soundcloud.com/stakeandnodes/episode-11-discussion-with-dash

Mark S. @HeyoMarkS

Two new #stablecoins launched by @geminidotcom and @paxosglobal Days before those announcements, I created a video that goes over the importance of stable coins, but leans toward the completely onchain @makerdao ... these new ones are regulated though...

Maker @MakerDAO

Love the time and effort Mark put into this video (including the dramatic reenactments!). It's a good explainer of stablecoins and CDPs, with some lessons learned:

The Crypto Dog @TheCryptoDog

If we are to break yearly lows on $BTC, it would make more sense for us to meander in the $6,000s and drive up more bull confidence and trap longs before taking the plunge. Today open margin funding for longs is rather low compared to the rest of the year.

360Trader @360_trader

360Alert: Doubled my $XLM position.

AntAJ @AJbithub

How long we pumping for?

360Trader @360_trader

Long term invest

Tim Hirschmann

Are there any serious, long term concerns regaurding ada's current price drop. I know everything is suffering right now but cardano's current drop seems a liitle more hefty.

Dino Biorac

Not that I know of- as I do not follow Cardano. The past two days did have a lot of volume go into different alt companies. The best thing to do is actively check Cardano’s twitter and telegram; in addition to their website and any news you can search. This space is moving faster than ever before and I always advise to know the competition that the company you’re invested in is and where they are at with developments, execution of the white paper, projects, etc.

The more you’re informed and know where to look for it- the better you’re prepared. Also, technicals or FUD may cause sell offs- or current investors of Cardano trying to chase after the profits of some of the high gainers for the day.

Also, I wanted to mention- in addition to official channels, social media, etc. GitHub.com is one, if not, your best business partner in a things crypto. Specifically, those ICO companies still developing to be their own coin/blockchain in launching the test-net and then main-net, etc.

There is so much to this space that we all are learning and watching happen for the first time. No one knows it all and luckily- the know it alls- have gone and left (as many looking back and reading the horsesh* they stepped on)

Alex Kadarauch

ADA is a winner but purists look at it sideways. It's seen as a tiny bit riskier because of this, and even though I don't like it myself it'll probably do fine from October-Jan

Because it's down so much it'll probably have more people trading in to get the "killer deal" once BTC looks like it's headed up decisively.

Jimmy Hanford

Since HITBTC stole $2500 off me last year I haven’t stopped warning people on reddit, Tw and fb. Some people I’ve spoken to had over 200k worth of BTC stolen. They’ll keep stealing until the jig is up then they’ll exit with millions. If you’re holding crypto on this criminal exchange REMOVE IT ASAP.

Was glad to hear McAfee saying the same thing today.

https://www.facebook.com/groups/218612071968287/permalink/531062780723213/

Ash Roulston

"please enlighten us on how the crypto market cycles work"

What have I been doing here for the past year?

I've explained countless topics many times.

"Think like a whale" he says then follows it with a screenshot meant to be a whale talking, apologizing for you losing money, talking about cheap prices, and so on.

Think. Like. A. Whale. So deep. much wow.

Let me take a moment and tell you how a whale thinks.

- Whales don't give a damn if they separate you from your money. That's the entire game. A market is literally a zero sum game.

- Whales don't whine online about a bear market. Every market stage is an opportunity.

- Whales are better than you.

They're better at you at trading.

They're better than you at controlling their emotions.

They're better at reading markets.

They're better than you at spreading whatever sentiment they want spread.

- Whales are profiting in this market, maybe even more than they did in Fall 2017.

- Whales are not "out" until ____ (insert whatever the hell price/regulatory/trend fantasy you have there).

- Whales are in and winning with every market movement. Volatility is whales making money and noobs forking it over.

- Whales were never charged high prices. ICO's? You mean those token sale things? Oh no honey, they buy equity not digital gift cards for services they'll never use. They even got some tokens fo free on top! Ah yes, do you feel the post ICO dump? Whales do "seed round" and not "token sale".

- "Restock", my friend, no one is "restocking", at this point in the game, their cost is damn near zero. Whales may be "accumulating", but they aren't "restocking". This isn't the grocery store. Whales aren't low on pop and crisps.

- Whales aren't playing the FA game, they're known for painting the TA game, and spreading sentiment in the SA game, but FA is just a way for you to buy things you'll never use.

- Whales know FA in a tech without major adoption is bullshit. You can have the greatest thing ever and at the end of the day, a network is only as valuable as the connections it creates.

- Whales know how to short. Bears or bulls, no matter, there's profit for that.

Now, are you ready to learn? You ready to stop forking it over? Ready to stop whining? - Stop listening to people shilling you their shitcoin of choice.

- Stop trading against whales. Trade with them or lose to them.

- Stop thinking whatever you bought is the next Bitcoin, the next Ethereum... (FFS even saw someone asking for the next Bitconnect recently).

- "But it could be, you just don't know how amazeballs ___ is! Do you even know anything about ____?!" ... If you ever find yourself saying something like this, look in the mirror and repeat "Stop putting a ring on shitcoins" until it sinks in.

- As I'm known for telling Joe Blackburn during Fall 2017, "When you're happy and you know it, sell."

- Read the Wolong GoD pdf, yes it's 7 pages, but you'll learn to stop being separated from your money chasing pumps.

- Learn how to recognize a hype cycle. Learn the stages and how to exit in a good place.

- FA? Ha. FA is used to push sentiment. TA is just a mathematical representation of sentiment.

- Take profits, protect your capital. Get your capital out and lock in profits. Lower your costs and not by buying more.

- Accept losses. Accepting and cutting losses quickly is your BFF. Losses are hard to recover from when you let them run.

Lina Hong

Market Update

The Cryptocurrency market has been moving sideways since the dump-age from $7400 a week ago. Panic and fear is everywhere, people wondering what’s next?

We all believe in the blockchain technology and adoption one day, that’s why we are in Crypto. But I am just expressing the reality of a short term dumpage. 80% of ICO’s are reported to be below their ICO prices. Most low cap coins on Binance now only have 5-10 BTC trading in them. ETH just broke $200 and $165 is next.

Selling now would be stupid since $4-6k is accumulation zone. But we all know ATH is not in sight yet. We need a catalyst, whether it’s for ETF approval or Bakkt. There has to be a reason for these “retail investors” to come into the market.

Here’s what I’ll be doing, and by no means is this financial advice. I’ll be accumulating BTC from $5800-6250. Of course this comes with the risk that if $5800 breaks we will see $4900-5400. But the upside is if we hold $6240, we can possibly retest $6600.

If you believe Bitcoin can hit $10k+ in the next 5 years, just HODL.

EXCHANGES

Aurora (IDEX) Not Giving Away ETH @Aurora_dao

$EEE (Elementh) by @Ahooleeman has been added to #IDEX

$DFS by @dfstoken has been added to #IDEX

Gemini @GeminiDotCom

The Gemini dollar is now global. @Bibox365 has announced plans to list the Gemini dollar! https://www.bibox.com

Cboe @CBOE

Learn more about this .@Cboe listed #ETF at https://bit.ly/2p12Wzo $GCOW

Cboe @CBOE

Today, Cboe Futures Exchange began listing for trading Cboe iBoxx iShares $ High Yield Corporate Bond Index futures, now the only exchange-listed futures product linked to U.S. corporate bonds. $IBHY For more information, visit https://bit.ly/2oUVndu .

CryptoBridge @CryptoBridge

$BTXC @Bettex_coin is now trading on the #CryptoBridge Decentralized Exchange!

Stocks.Exchange @StocksExchangeR

We are glad to announce that today we start cooperation with @Aidos_kuneen ADK

Stocks Exchange is so proud to start partnership with WXC

Stocks.Exchange @StocksExchangeR

Important warning! In case the following coins volume in pair with BTC will not increase within 1 week, the coins will be removed from BTC market. XSC, TUN, MOC, BITG, STAK, BBK, BTCP, ABJ, DSR, CSTL, XLQ, POLIS, CRU, TPCC, DRV, MUSD, WSP, BTCS, ONEPAY, DOVE, GMCN, EMRO, B2B, INC, TFC, FLX, STONE, BBN, RE, XBCN, PRI, CRC, BTW, SGL, ARA, DEC, ZNY, BABA, FOR, DEAL

Yobit.Net @YobitExchange

Cortex Coin [CTXC] is listed

Storiqa [STQ] is listed

Genesis Vision [GVT] is listed

Linkey Token [LKY] is listed

ChainLink Token [LINK] is listed

RoBet Token [ROBET] is listed

Satoshi Coin [SATO] is listed

Coinsquare @Coinsquare

Coinsquare Coin (CSC) was a native reward token we offered to Advanced Trade users, but we are phasing out CSC as we move into the next phase of growth, no longer offering it for reward or sale. If you hold CSC, you can still sell. Sorry for any inconvenience this caused

OKEx @OKEx_

Suspension of EOS, IQ & ADD Depositing and Withdrawal http://bit.ly/2NxJ1WG

MERCATOX @MercatoxCom

Posscoin (POSS) market added POSS/BTC and POSS/ETH markets are available for trading.

Vestoria (VSTR) market added VSTR/BTC and VSTR/ETH markets are available for trading.

Aurora (IDEX) Not Giving Away ETH @Aurora_dao

***Notice: #IDEX is working with the $VXCR team on reimbursing those affected by the old contract bug. We will inform everybody once we have reached a solution. w/ @TokenVxcr

KUCOIN @kucoincom

DeepOnion (ONION) Deposits and Withdrawals Temporarily Closed See the official announcement here: https://news.kucoin.com/en/deeponion-onion-deposits-and-withdrawals-temporarily-closed/ …

Bitpanda @bitpanda

Trading of @zcashco is now live on the Bitpanda website! Start buying and selling $ZEC

C-CEX.com @CryptoCurrEncyX

EBH and BIZ 51% attack. Coins removed from trading.

Bit-Z.com @BitZExchange

Dear traders, Bit-Z will launch DCT on BTC market soon, hope you will enjoy it! Click here to check details: https://support.bit-z.pro/hc/en-us/articles/360009020354 …

TOPBTC @topbtc_com

VIPS Deposit is available on TOPBTC now, and we will open trading at 6pm, 12/09 GMT+8. We're glad to cooperate with VIPS.

COBINHOOD @COBINHOOD

Update for TRX on COBINHOOD: https://cobinhood.com/announcements/1df78a69-6ed2-404e-a8f8-2734f86727db …

Binance @binance

#Binance Will List #GoChain (#GO) on 2018/09/12 https://support.binance.com/hc/en-us/articles/360015598692 …

EXX Group @ExchangeXGroup

qun is live on EXX on Sept. 12th! A big surprise for qun fans!!!

Cryptopia Exchange @Cryptopia_NZ

Project Coin is now listed on Cryptopia! Deposits and withdrawals are now open, and trading will begin 24 hours from now (3 AM UTC). Find out more about $PRJ here: http://ow.ly/6WQM30lLyeh

CoinMarketCap @CoinMarketCap

New listings! http://coinmarketcap.com/new YouLive Coin (UC), AMO Coin (AMO), EvenCoin (EVN), CYCLEAN (CCL), Dinerocoin (DIN)

Implementing Aragon on Tezos

by saalda

As the title suggests, how easy/difficult would it be to transfer the Aragon’s code base from ethereum to Tezos/neo/any other smart contract platform whilst keeping the balances of Aragon’s token holders? I feel the value behind Aragon would benefit multiple platforms rather than just being specific to one (ethereum). All ideas appreciated.

Lightcoin

Aragon is built on aragonOS which is written in Solidity. So if you wanted to move aragonOS and the whole Aragon Network to another blockchain it would have to support Solidity/ EVM compatibility, or else the contracts would have to be re-written. And the blockchain would have to support the same kind of keys as Ethereum so that the balances could be owned by the same addresses.

Tokens generally need to use one blockchain as a source of truth so that the supply and balances can be managed to prevent double spending and unauthorized inflation. Although with some kind of bridge software another blockchain could be used as a kind of "side chain" to the Ethereum chain that tokens could then be transferred into.

READ MORE: https://old.reddit.com/r/aragonproject/comments/9evohw/implementing_aragon_on_tezos/

12.3 PrivateSend rocks!

by stevenraj

A couple days ago I tried mixing a few coins and was baffled when in almost 36 hours only a fraction had been denominated and mixed. Then I realized I was still using 12.2... so I updated and the coins were finished mixing in an hour and a half.

I’m also super excited to see all the work being published on the DIPs, especially the building out the functionality of masternode quorums and the like. Thanks for all the great work, Core Devs!

thethrowaccount21

It's been consistently fast for me for about 5-6 months now. But it's never been a burden. Never been longer than 8 hours, overnight or during work.

JTrader126

Check out https://mydashwallet.org/Mixing

The Dash is premixed and ready to go. Super fast! They are funded by the Dash network! Check out their latest proposal. I have used them many times and it works like a charm. Of course you are relying on a 3rd party. But even with Monero if you want to use a litewallet you have to use a 3rd party node or download the massive 60GB blockchain to use the GUI wallet.

But if you are using crypto for legal transactions and all you want to do is hide your balance/history, mydashwallet is excellent.

READ MORE: https://old.reddit.com/r/dashpay/comments/9et3ks/123_privatesend_rocks/

ELI5 The governance wallet control

by slimebloc

If I understand right, on every block there is a 10% share of each block rewards that go on a specific wallet dedicated to be spent on different proposal after a governance approval. (I may be already totally wrong, but this is the way I've always imagine this) So, if this is the right assumption, how those funds are liberated to the the people who won their project proposal? how the private key of those funds is protected from theft ? If we are on a multisig wallet scheme, are all masternode the co-signer of this wallet and need a certain % of the masternode to sign the transaction ? If you have a specific paper on this question and don't want to bother with a ELI5 I would be glad to get it too. Thank you.

Quansen

The funds don’t move to a wallet. Their creation is postponed until the super block is mined. The super block then creates these funds for the addresses based on masternode voting

READ MORE: https://old.reddit.com/r/dashpay/comments/9evo1n/eli5_the_governance_wallet_control/

Dash @ IRC ?!

by metalXtractor

C'mon guys we have tons of crypto channels on Freenode such as: bitcoin-forks, bitcoin-pricetalk, bitcoin, monero, monero-pools, ethereum-mining ... but no dash

Isn't dash have IRC community anywhere at least master node owners?

Even Cardano started a small channel on Freenode, you shouldn't be left out. Only idiots are using facebook, all nerds and hardcore IT guys hang out on IRC.

READ MORE: https://old.reddit.com/r/dashpay/comments/9ev8wb/dash_irc/

AgroCognitive Venezuela Sep. updates

by jesccs

AgroCognitive project held its second meetup with entrepreneurs and sugar cane’s customers in Acarigua, Portuguesa State. This people uses molasses and sugar to elaborate cakes, beverages and typical desserts.

They got our training about crypto currencies and how to download wallet and use Dash to send and receive payments. 2dn_meetup_pic1! 2dn_meetup_pic2!

This month we will be launching our next proposal: AgroCognitive sugar route adoption! a coherent plan to build a commercial tissue using dash in all sugar route

READ MORE: https://old.reddit.com/r/dashpay/comments/9eu4sa/agrocognitive_venezuela_sep_updates/

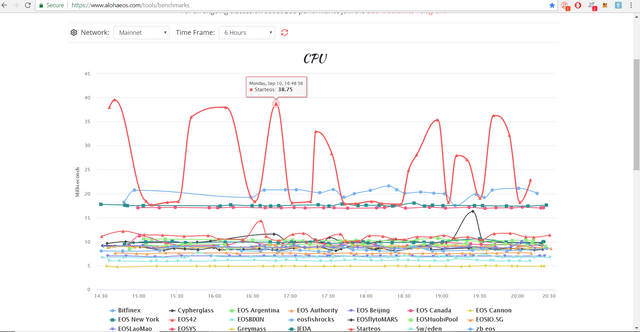

StartEOS is consistently the WORST performing BP on the EOS mainnet, Greymass is consistently the BEST.

by JohnMcCoffee

StartEOS is voted into the top 4th position in BP rankings and is consistently the WORST performing BP.

https://twitter.com/JMccoffee/status/1039260229731528704

https://www.alohaeos.com/tools/benchmarks

blockchainant 7

Also very China top heavy. Not saying this is good/ bad. Just an observation.

READ MORE: https://old.reddit.com/r/eos/comments/9erevb/starteos_is_consistently_the_worst_performing_bp/

Thought Experiment: How to hack EOS?

by Crypt0nimous

Before I start this, I want you to know that I’m a big fan of EOS. I’m convinced that, given the choice between security or convenience the general population will choose convenience. EOS’ speed is extremely convenient as a payment system. I think it’s less secure than a peer-to-peer currency platform but I’m not sure exactly how much less secure and I want to challenge my assumptions.

Let’s say hypothetically, I’m a whale who loves EOS. I own a million coins and also decide to start my own small block producer as well. I also convinced a few other of my millionaire friends to jump on the EOS bandwagon early on. I’ve deployed 1 BP so far and with the help of my whale friends it’s in the top 21. Now I get ambitious! I deploy 16 more BP’s and get my friends to vote them into the top 21 as well. Let’s say I pull it off and I now control 17 BP’s… I can now create consensus. Is that it, is EOS actually powned at that point? With my 17 servers could I now print money without anyone noticing?

If I deploy custom software onto 17 BP’s the announced version might look the same but the checksums are different, wouldn’t the other BP’s (primary or secondary) recognize that I’m running non-standard software? Wouldn’t it be suspicious if consensus converges through the same servers a disproportionate number of times? The blockchain grows in real-time but are their non-real time systems that evaluate the trustworthiness of past transactions. Is there any other mechanism that protects you the commoners from me and my elitist plans of world domination?

READ MORE: https://old.reddit.com/r/eos/comments/9ex18p/thought_experiment_how_to_hack_eos/

NodeOS high memory usage

by uosiek

Hi, I'm running a box shared between many cryptocurrencies. NodeOS consumes a large part of it. Can I limit it by cgroups in systemd or by any other way? Let's say I can assign to it a 2-3G of RAM.

james_pic

I'm pretty sure it's got memory leaks. On my local machine, memory usage will just keep rising until it brings the system to a halt. But it'd take more time than I've got to track them down, or even to raise an actionable bug report, so I just added a cron job to restart it every 6 hours.

READ MORE: https://old.reddit.com/r/eos/comments/9ewajf/nodeos_high_memory_usage/

Warning: Phishing Website Disguising EOS Authority - CoinNess.com

by CoinnessPress

According to IMEOS, a phishing website has disguised EOS Authority and asked users to input their public/private key to verify the EOS account policy.

IMEOS warned EOS investors of the following website: https://eosauthority-accountpolicy.omastral.org

READ MORE: https://old.reddit.com/r/eos/comments/9eucuz/warning_phishing_website_disguising_eos_authority/

Positive DAI balance on etherscan.io zero on Metamask

by wunlove

I noticed a dai balance showing on Etherscan.io and ethplorer.io but I see a zero balance on Metamask. Myetherwallet also shows a 0 balance. Anyone know why these two block explorers show a balance? I am on main net.

FourthStreetx

some of my accounts have this going on as well. I think etherscan is just missing some of the smart contract transactions or something. Whatever metamask says is correct unless you know for a fact you had DAI and did not send it anywhere.

READ MORE: https://old.reddit.com/r/MakerDAO/comments/9f0ded/positive_dai_balance_on_etherscanio_zero_on/

MakerDAO Qs Part 5

by coltonrobtoy

(Part 1, Part 2, Part 3, Part 4 [The Most Important Q])

Y'all know why I'm here.

Can anyone send back Dai to a CDP to retrieve the Collateral?

Who pays the accrued Stability fees when Global Settlement happens?

In Multi-Collateral Dai, will all Dai still be fungible with every other Dai? I think no, because there is a different discount for each Dai, due to the risk of the assets backing it in a CDP. For example: Dai backed with ETH will have a different Market Value than Dai backed by Tokenized Vanguard S&P 500 Index Fund Shares, due to the difference in ‘relative risk of a black swan event’ of those 2 assets. Do you agree with this? Why/Why not?

READ MORE: https://old.reddit.com/r/MakerDAO/comments/9eqelf/makerdao_qs_part_5/

The US government (and others) can seize any transaction on the Swift interbanking network.

by mineoneone

This is not theoretical, it has been done numerous times since 2002.

One example is of a cigar seller in Denmark sending money to a German importer of Cuban cigars. An entirely legal transaction between two European citizens using two European banks, Swift charged him for the privilege of having his money stolen.

That is just one example of the reasons your money could be seized, like a bent cop using Civil Forfeiture laws to steal from a motorist numerous bad actors can take your money in transit without any recourse to courts to retrieve it.

Donald Trump is currently escalating a trade war with China, if he was to sanction China then any potential business transaction with China from any other country has the attached risk of monetary seizure.

READ MORE: https://old.reddit.com/r/CryptoCurrency/comments/9etfth/the_us_government_and_others_can_seize_any/

MEDIUM

The MakerDAO Voting Proxy Contract

MakerDAO

This post provides details about the voting proxy contract that is being used in the dapp for the governance vote about the Foundational Principles for Maker.

We will describe the background for having the contract, what it does, and what happens “behind the curtain” during the one-time setup of the voting contract.

Background

The reason for having the voting proxy contract is two-fold: to support two different voting mechanisms and to minimize the time that MKR owners need to have their wallet online.

Two types of voting

As described in the MakerDAO Governance Risk Framework, voting will take two forms. The first will be a vote where a resolution is required. The second will be a vote to enact that resolution into the system. The first type of vote is called a Governance Vote, and its objective is to represent resolution on a matter or collection of matters. As an example, the inclusion of new Oracles or a new risk team. The second type of vote is called an Executive Vote. Its objective is to change the state of the system. An example of this could be to ratify risk parameters for a newly accepted collateral type.

READ MORE: https://medium.com/makerdao/the-makerdao-voting-proxy-contract-5765dd5946b4

Community Update

Cypherglass

Happy Monday EOS Community from the Cypherglass Team. We start this week with an upcoming calendar. Cypherglass CEO Rob Finch and Community Manager Adrianna Mendez will be in London for a few EOS events, including the official EOS Hackathon. You can reach out to Rob & Adrianna on telegram or twitter if you’d like to meet up and talk shop or just say hello.

The Future of Blockchain presented by SVK Crypto — Sept 19th

For more information about SVK Crypto make sure you check out the Everything EOS podcast # 15 with Rob Finch and Zack Gall.

EOS Hackathon — Sept 22nd — 23rd

Dan Larimer & Brendan Blumer will be there to judge the 3rd installment in the Block.one EOS Global Hackathon. They have hinted to a big announcement!

READ MORE: https://medium.com/@cypherglass/community-update-sept-10-2018-4e7a76bdeacc

Attic Lab presents EOS Web Wallet!

Attic Lab

We are pleased to announce that our own wallet!

We created the simplest and the most user-friendly wallet for EOS Community!

First of all we want to ask everyone to help us with testing our wallet, we will be very thankful!

What you can do now!

Connect to Scatter

Sending EOS to anybody

Check your Balance

Exit and connect to otheer account

Enjoy the best interface!

READ MORE:

https://medium.com/eosatticlab/attic-lab-presents-eos-web-wallet-9656e12fad2d

Multi-Key Support for EOS Ledger: Bloks.io Desktop

EOS Cafe Calgary

We are excited to present our new Bloks.io Desktop Wallet with a full block explorer and Scatter + Ledger support.

It is the first wallet to have multi-key generation for Ledger Nanos!

You can download it for MacOS, Windows and Linux at: desktop.bloks.io

READ MORE: https://medium.com/@eoscafe/multi-key-support-for-eos-ledger-bloks-io-desktop-7fde5dd7339

Security Tokens are Revolutionizing Venture Funds

Helene Servillon

The blockchain revolution has introduced an array of innovations into society, among them are cryptocurrencies, also known as digital assets or tokens. Tokens can serve three functions; a token can be an asset token (security), a payment token, or a utility token. By offering a new approach to equity and investment, security tokens are poised to revolutionize venture funds.

What are Security Tokens

Security tokens live at the intersection of two technologies. They are a mix of blockchain technology, tied with concepts from traditional financial products. Similar to shares of stock, security tokens represent a piece of equity, giving the holder ownership of the issuing company. Since these tokens derive their value from an external, tradable asset, they are classified as security tokens and become subject to federal securities regulations. Thinking on a much broader scale, the technology behind security tokens enables anything to be tokenized, including debt, real estate, public & private equities, etc. If something can be owned, it can be tokenized.

READ MORE: https://medium.com/orthogonal-thinker/security-tokens-are-revolutionizing-venture-funds-8fc60dd02961

CRYPTO COMPARE STATE OF THE CRYPTO

Bitcoin is up 0.61% at $6,346.710 with a volume of Ƀ47.2k - $298.9M on the USD pairs.

Ether is down 1.54% against Bitcoin at Ƀ0.03069 per Ether and down 1.04% against the dollar to $194.35 with average volume Ƀ46.1k on the ETH/BTC pair.

Bitcoin Cash is down 2.35% to Ƀ0.07433 with volumes of Ƀ15.5k and down 1.55% against the dollar at $470.72.

Ripple is down 3.19% to Ƀ0.00004216 with volumes of Ƀ6.6k and down 2.7% against the dollar at $0.2666.

Zcash is down 1.74% for the day to Ƀ0.01861 per ZEC and down 0.73% against the dollar to $118.22 with an average volume of Ƀ3.8k for the 24 hour period.

Litecoin is down 0.44% against the dollar for the day at $54.01 and down 1.14% to Ƀ0.008529 on volumes of Ƀ8.1k.

Dash is down 3.01% at Ƀ0.03126 with Ƀ9.1k volume and down 2.25% against the dollar at $198.45.

Iota is up 0.32% to Ƀ0.00009026 on Ƀ1.2k volume.

Ether Classic is up 0.56% to Ƀ0.001786 with volumes of Ƀ9.9k and up 1.79% against the dollar at $11.37.

Monero is up 0.98% against the dollar at $107.72 and up 0.06% against Bitcoin at Ƀ0.01699 on volumes of Ƀ2.6k.

Neo is down 0.78% for the day to Ƀ0.002935 per NEO and down 0.59% against the dollar to $18.51 with an average volume of Ƀ3.2k for the 24 hour period.

Waves is up 17.61% to Ƀ0.0003713 on Ƀ4.4k volume.

Stratis is down 2.43% to Ƀ0.0002167 on Ƀ225.239 volume.

Cardano is down 4.77% to Ƀ0.00001137 on Ƀ2.3k volume.

NEM is down 6.42% to Ƀ0.00001457 on Ƀ717.705 volume.

EOS is down 0.84% to Ƀ0.0007906 on Ƀ9.8k volume.

Tron is down 2.88% to Ƀ0.00000303 on Ƀ2.2k volume.

Stellar is up 0.69% to Ƀ0.00003046 on Ƀ3.5k volume.

RELEVANT READS

[Sept. 10] Was the Core Protocol Development in EOS Outsourced?

https://hackernoon.com/was-the-core-protocol-development-in-eos-outsourced-169f435030ce

Dash Price: Return to $200 is Imminent As Masternode Pooling Comes Closer

https://nulltx.com/dash-price-return-to-200-is-imminent-as-masternode-pooling-comes-closer/

72% of Cryptocurrency Holders Plan to Buy More, Dash Masternode Counts Rise

https://www.dashforcenews.com/72-of-cryptocurrency-holders-plan-to-buy-more-dash-masternode-counts-rise/

Dash Leverages Innovative Capabilities to Revolutionize Quorum Technology

https://www.dashforcenews.com/dash-leverages-innovative-capabilities-to-revolutionize-quorum-technology/

Hacker wins jackpot 24 times in a row after exploiting EOS betting platform

https://bcfocus.com/news/hacker-wins-jackpot-24-times-in-a-row-after-exploiting-eos-betting-platform/22823/

EOS Tri-Weekly Update 9/10/18 — Dapp Updates, Finding Dan & Job Openings

https://medium.com/@eosalliance1/eos-tri-weekly-update-9-10-18-dapp-updates-finding-dan-job-openings-1fb8850d5975

MakerDAO Community Meeting - September 11, 2018

Nasdaq is Building a Crypto Price Movement Predictor According to Report

https://blockmanity.com/news/nasdaq-building-crypto-price-movement-predictor-according-report/

Ethereum's ASIC Rebellion Heats Up With New Effort to Brick Big Miners

https://www.coindesk.com/ethereums-asic-rebellion-heats-up-with-new-effort-to-brick-big-miners/

Canadian Bitcoin Fund Receives Status as Mutual Fund Trust

https://cointelegraph.com/news/canadian-bitcoin-fund-receives-status-as-mutual-fund-trust

Major French Soccer Club Plans to Launch Its Own Cryptocurrency

https://coinhub.news/cs/article/coindesk-major-french-soccer-club-plans-to-launch-its-own-cryptocurrency

Lightyear acquires Chain and plans on merging Public and Private Blockchains on the Stellar platform

https://cryptolinenews.com/2018/09/lightyear-acquires-chain-and-plans-on-merging-public-and-private-blockchains-on-the-stellar-platform/

Bitcoin’s dominance attains new 2018 high prompting positive changes in the market

https://cryptolinenews.com/2018/09/bitcoins-dominance/

New Gemini Dollar, The Final Nail In Tethers Coffin

https://coinhub.news/cs/article/thecryptoverse-new-gemini-dollar-the-final-nail-in-tethers-coffin

Technical analysis – 11 September 2018

https://coinatory.com/2018/09/11/technical-analysis-11-september-2018/?utm_source=FB&utm_medium=Official+Page+News&utm_campaign=SNAP

With trading volumes dropping, crypto exchanges are resulting to controversial practices to attract users

https://cryptolinenews.com/2018/09/crypto-exchanges/

South Korean Banks Are Limiting Services for Crypto Traders without Identity Verification

https://oracletimes.com/south-korean-banks-are-limiting-services-for-crypto-traders-without-identity-verification/

Bitmain Activates Controversial ‘AsicBoost’ for Antpool

http://cryptographybuzz.com/asicboost-for-antpool/

Australian Prime Minister on Blockchain technology: There are huge opportunities in financial sectors

https://blockmanity.com/news/australian-prime-minister-blockchain-technology-huge-opportunities-financial-sectors/

Binance Labs Sets Sights on the Vast Untapped Opportunities in Africa

https://bitcoinke.io/2018/09/binance-labs-eyes-africa/

Star Xu, founder of OKEx, arrested in Shanghai for fraud

https://www.maxcryptonews.com/star-xu-founder-okex-arrested-shanghai-fraud

TRON continues to grow at speed, already at a third of Ethereum’s transaction rate

https://telegra.ph/TRON-continues-to-grow-at-speed-already-at-a-third-of-Ethereums-transaction-rate-09-11

The Crypto IPO Race Is On: From Mining Companies to Exchanges

https://cointelegraph.com/news/the-crypto-ipo-race-is-on-from-mining-companies-to-exchanges

This is not investment advice, this is information culled from the web today. Please do your own research.

You're Beautiful