How to Get Exposure to the Crypto Markets: Different Options

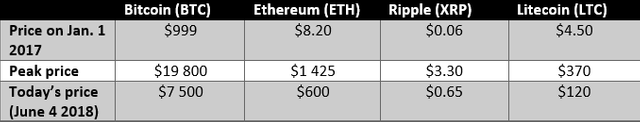

I would guess that most of you reading this are already well aware of the recent phenomal growth of cryptocurrencies’ prices, especially in 2017. Let’s take a quick look at the recent growth of four very common cryptocurrencies. As you can see in the table below, the most common cryptocurrencies delivered completely insane returns incomparable to the returns of all other asset classes. These are the most known cryptocurrencies but some others delivered even more spectacular returns. Like any rational (and a bit risk-loving) person, you may be asking yourself what are the different options available to get exposure to the crypto markets.

Now, while prices have peaked in January 2018, the market reminded us afterward that it can’t go up forever. Since the peak, prices have declined around 75% for most cryptocurrencies. Despite this huge drop, prices are still much higher than at the start of 2017. Given that this is still a young industry, I believe, like most others involved in the space, that there is still a lot of potential in the the cryptocurrency space.

Are you satisfied with the 1% annual interest you’re receiving on the money in your bank account or the average yearly 7% delivered by the stock market? If you are not afraid of high risk and volatility and are seeking a higher return, investing in this industry may be an option for you. For newcomers, it may seem complicated, but it’s actually easier than it seems. Let’s take a look at the different ways to get exposure to the crypto markets.

Do it by Yourself

If you usually like to manage your own money and be responsible of your own decisions, this option may be the best for you. You can directly invest in the market by yourself, either passively or actively. You just have to open an account on a cryptocurrency exchange and buy the cryptocurrencies that you prefer, following your research on the subject. Also, there is always new ICOs that come out in which you could participate. This requires a bit more work but it’s still fairly simple to invest in an ICO and trade the tokens afterwards. Note that this method will be time consuming if you decide to trade actively. Be sure to review how to securely store your cryptocurrency.

The Easy Way

As with most forms of investment, you could decide to simply invest in a fund and let others do the research for you. One interesting option is ICONOMI, a platform where crypto fund managers and investors meet. The funds offered are actively managed by experienced people. The fees vary around 1% to 5%. The main advantage of this option is that, contrarily to passive investment (buying and holding), these funds should be able to reduce the drawdowns during the big drops, as we’ve witnessed so far in 2018. More than 25 funds are available to choose from on this platform and i’m pretty sure other platforms of the sort exist.

The Wealthy Way

If you have a considerable amount of money to invest in crypto, you have more options at your disposal to get exposure to the crypto markets. You could decide to pool your funds with other investors to participate in ICOs. In this case, you would get better prices than those buying after you. It is the same principle as buying stocks in a company before it is listed on a stock exchange. When the company is doing its IPO, the investors pay much higher prices than the previous investors.

If you have a big sum to invest in crypto, another possibility would be to try to invest in big funds such as Hyperchain Capital or Galaxy Digital Assets Fund. Due to their size, these funds are able to get all sorts of advantageous deals.

Other Possibilities

We have covered the most common options to get exposure to the crypto markets. If you’re creative and you don’t want to hold any cryptocurrency but still want to profit from the new developments, there are other possibilities like investing in blockchain related companies on the stock market or funding startups working on blockchain projects. It is also possible to trade Bitcoin Futures. Also, ETFs covering the blockchain industry should be available in the near future.

Original article: How to Get Exposure to the Crypto Markets

Satoshi's Blog is the go-to place to be aware of all the new developments in the crypto space.