Swing Trading - The Easiest Technique For Crypto Profitability

Asset Swinging is the widely-used technique that would make you accumulate more digital assets as time goes by. Time would be the most essential tool that everyone could simply have. A great amount of patience would also play a great role in the profitability of the principal amount invested using this process.

This is also the safest way to earn profits out of our own capital funds which can generate up to 300% or your invested money multiplied into three times over a short period of time. This achievement happened to my own funds last November 2017 so it will still depend on how the market is doing. Sounds really exciting right? But it also entails a certain amount of calculated risk.

Let's always remember that if we are going to let ourselves updated all the time then we can avoid these calculated risk sand prevent our investment diminish drastically. As what I have shared in my previous blog, you're money is protected because of these factors: Please read my previous blog if you do have the time. Resistance And Support In Crypto-Trading - Stability Indicators

Let's now start the most basic process on how to accumulate a certain amount of cryptocurrency through swinging.

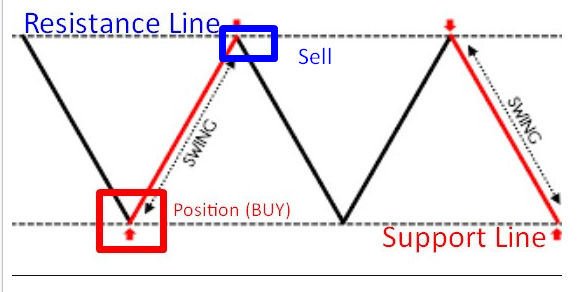

Through Swing Trade, we still need to stick to the basic principle of BUY low and SELL high.

Let's try to imagine we put a bag of money worth $1,000 on an actual Swing from the playground where children use to play.

We push the swing with a bag of $1,000 amount really far opposite from us and wait for a few seconds for the bag to come back to us now with $1,200. It's either we use the whole $1,200 and wait for the right moment to push the bag again away from us or probably get the $200 and proceed to the same process with $1,000 again inside the bag.

Going back to the real deal.

We don't necessarily need to be good with Technical Analysis (TA) of any chosen cryptocurrency to ensure profitability but again as I have said we only need to be updated with our chosen currency all the time (most likely perform a daily check). Technical Analysis may be helpful to predict the market and the value of a certain crypto asset but most of the time when the price already breaks from the resistance and support, it always vary again and would create another interpretation superceding the former technical analysis that were reported by those few experts we are following.

We need to take care of our hard-earned money that we are going to use as an investment at all times. We need to document the time, exact amount we bought the digital asset and the generated crypto we gained from this certain trade batch that we did.

We need to divide or allocate the whole amount that we have as principal investment for suddend anticipation of losses due to the dips of price of the chosen currency in the market.

Let's say we do have $1,200. Let's cut it into $1,000 and $200.

I Will be giving more details why I need to exclude the $200 from the whole $1,200 we have on hand later.

Let's also stick to ONLY one pairing process for this process and let's choose Bitcoin - USD pairing (BTC-USD) or a Stable-coin (BTC-USDT) for example (T in USDT stands for Tether) in which we just put our acquired USD as our savings if we intend to keep our money in a trading platform for quite sometime while being patient to do another trading batch.

If we start buying Bitcoin now using our $1,000 then this is how much Bitcoin we will get.

At the time of writing this post, the Bitcoin value is 0.12 BTC.

If we started buying it then all we need to do is directly look at the BTC-USD charts and notice the position you bought your BTC from the chart.

Let's check the largest volume of trades globally: Binance

To view the real time value and see your actual position if you are going to buy BTC then please confirm it using this link: https://www.binance.com/en/trade/BTC_USDT

The blue arrow shows your actual position if you will buy BTC at the moment using your fiat currency. A dilemma here is evident since at the moment, you will never know if the market is in trending or just being supported @ $8,500 and with a resistance of $8,600.

The primary goal that you would need is to make your 0.12 BTC to 1.0 BTC the shortest period of time through constant Buy-back whenever you have a great position.

This is the preferred reference to see your earnings accumulating BTC and not the other way around using your Fiat to check for it.

When you see a total dip after you were already able to secure your position then the $200 buffer amount can also be added to your 0.12 BTC to ensure that profits from the $200 when you think the price already break the support level and it already stopped from going down. That is the best way to inject the additional $200 you have.

We must also patiently wait for the best time to do a Buy-Back using the whole balance that we accumulated. That's the goal per se. You may want to set your short-term goals for your own capital funds but nevertheless stick to your plans.

When you initially BUY a certain crypto and already seen your position on the graph where you already bought it, you need to be really patient and wait till you see the percentage of the chosen currency's growth. You may set your own preferred profit rate of at least 5.00%. (I always stick to 10%) It would now be up to you to set your own....

Just to check my own analysis if we are in the right track

We were able to see large swings here that happened yesterday May 31. And the dip from the last candlesticks definitely projects a trend that yesterday until now.

Judging the lines generated by the graph, we are really on a trend. So we must really grab this opportinuty to still earn even though we might be thinking we are already too late since Bitcoin has already shown 60% growth since January 2018 up until now.

Going back!

This only means your $1,000 worth of Bitcoin is now already $1,100 with a new profit of 100 minus the trading fee (of 0.10% of $1,100 fee per exchange when you actually SELL your BTC into a USD or any stable-coin). Or just wait for your orders to get filled when you do your own SET SELL.

0.10% trading fee is really minimal so let's just exclude this insignificant amount being deducted to our 10% triumph.

So now you do have $1,100 and was able to SELL in a great position.

What can you do being in the top position now?

You can BUY other cryptocurrencies that are in the BEST position to BUY (or showing LOW on the graphs, and the ones you can see in the crypto blogging platforms such as Weku and any other TRUSTED groups that provide signals.

You muight wanna be patient and check the waters if the price of the initially chosen currency (Bitcoin) to have another dip for about another negative 10% and below. If you are pairing it with a stable-coin which your $1,100 stays and SET SELL it to a certain price that you would want to BUY Bitcoin.

Manual Trading

The best part is to do this BTC Buy-Back if you will just be able to log in to your trading platforms every 24 hours. If you are an extremely busy person and getting online for 48 hours would be impossible for you, then you might want to consider SETTING a SELL order of your chosen stable-coin to BTC at your preferred price. Once the market hits the value that you have set then it automatically fills your order.

You need to create a record of your first ever successful trading batch for documentation so you would actually see all profits you have gained so far from this activity.

Upon buying BTC again, was it able to add a few increments on your original BTC when you bought it the first time with your $1,000?

Congratulations with your triumph accumulating BTC from this process.

Ideally, after identifying the points of Resitance and Support when the price of the chosen currency is somehow stable and not even trending movement.

Upon checking your position from the graph when you bought the asset, it should always be near the support line. Once the last candle stick from the right part is getting near the resistance level or if it breaks out from the resistance line, then you should always consider SELLING your BTC back into USD or a Stable-coin.

If you were not able to SELL when the candlesticks are near the Resistance Line then just be patient and wait for another swing. Though you missed those great chances, it is perfectly fine. The market is in the bull run so it will most probably resume to a trending pattern and then get the most out of it.

Then just repeat the same process until you reach your goals.

Convert your BTC back to your local wallet and enjoy the fruits of your labor.

Swing Trading: Buy, Accumulate, Sell, Buy-Back

If the market is on Trending mode or on the Bull-Run then you might wanna actually get the most out of it by securing your position (BUYING) because it is not always going to pump most of the times but still has a chance to BUY considering slight dips of the USD value.

This post will be shared to a lot of newbies in the cryptocurrency world. The link that this post would generate will be ultimately useful for these newbies to create their own pattern and own techniques too.

Disclaimer:

It should be known that I am not a Financial Advisor and this is not at investment advice but purely a guide for people who are new into cryptocurrency trading. I am just sharing my best practices in which I was able to gain a lot using this strategy last Year-2017 and up until now.

The content of this blog is solely my successful trading experience delving into cryptocurrency. Buying Cryptocurrencies poses considerable amount of risk. Past experience does not indicate same results in the future. Just invest the amount you can afford to lose. Consult your own professional adviser before dealing with cryptocurrencies.