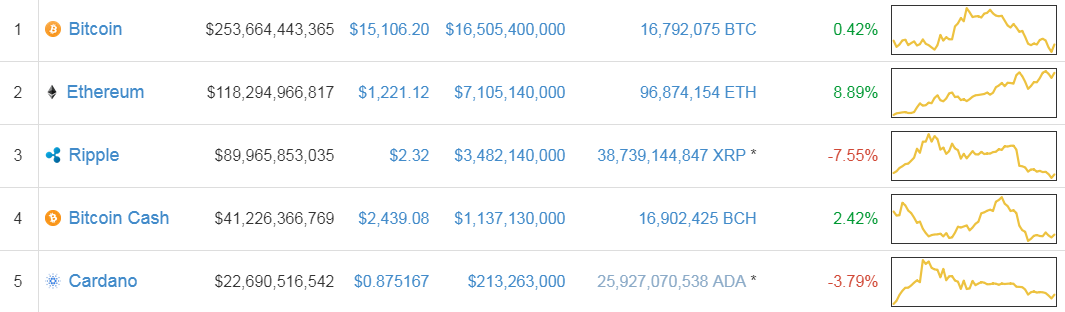

Long-Term Predictions For The Top 5 Cryptocurrencies

Foreword:

In this article I will examine a number of major cryptocurrencies and evaluate their long-term values (Investment horizon: 1 year or more). It should be noted that I am not a crypto expert, nor do I have substantial holdings in any one cryptocurrency. My background and work are in business and computer science. My total investments in crypto are less than $2000.00.

Take everything I say with a grain of salt. It's all opinion and speculation.

Let's get started!

1. Bitcoin (BTC)

Long-Term Forecast: Stable or Down

Bitcoin has no major underlying product to sustain its value, so its only value is as a currency - And it's not even good at being a currency! Too much fluctuation in value from day-to-day, and heavy transaction fees plus slow processing times make for bad overall liquidity. The whole point of a currency is that it's relatively stable, and cheap/free to trade, which Bitcoin is not.

Furthermore, the main stakeholders in Bitcoin often have a hard time getting consensus when it comes to upgrades to the network. There have been several times where the technology could (and should) have been upgraded, but simply wasn't because the majority shareholders didn't want to improve the currency at the expense of their holdings. This has resulted in several hard forks including Bitcoin Cash and Bitcoin Gold, while the upgrades still haven't been applied to the original Bitcoin branch.

New cryptos have been developed that are significantly better than Bitcoin at being currencies - They have better processing times and lower transaction fees. There is no reason to still be using Bitcoin as a currency. Bitcoin is holding its price because of its well-known name, historical value, ability to swap it for other cryptos, and investors who are playing the markets for a quick buck. Eventually it will die out, but it might be a long road to get there.

2. Ethereum (ETH)

Long-Term Forecast: Up

Ethereum has a large market cap which should mean a fair amount of stability in prices. In the same way that Bitcoin holds historical value, Ethereum does too.

Ethereum employs smart contracts, allowing software developers to create automated transactions when certain conditions are met. This is an actual use of the coin outside of just being a currency, which already gives it a leg up on Bitcoin.

The downside? Ethereum doesn't have a main product. Yet. As of early December, a game called Cryptokitties is dominating the Ethereum blockchain, accounting for around 15% of all transactions on the network. When your biggest asset is digital cats, you might have a problem.

However the Ethereum blockchain is showing promising growth with projects like WeiFund, Augur, and many others.

3. Ripple (XRP)

Long-Term Forecast: Up

Unlike the coins I've talked about so far, Ripple has a single important underlying product that gives it value.

Ripple is a payment protocol used by banks and credit unions for cross-currency transactions, and it has many partnerships with large banks ensuring long-term value will be maintained even when (or if) the crypto bubble bursts.

Also unlike most cryptocurrencies, a small amount of Ripple is destroyed by each transaction. This will cause a very gradual inflationary effect on the price of the currency over the long-term.

4. Bitcoin Cash (BCH)

Long-Term Forecast: Stable or Up

Bitcoin Cash is an upgraded Bitcoin with larger block size which allows it to scale better and to serve more users.

I feel that it has the same problem as Bitcoin - it doesn't actually have a major underlying product, so there's nothing underpinning its value beyond its use as a currency. If the bubble bursts, nothing's holding up that value.

Still better than Bitcoin as a currency.

5. Cardano (ADA)

Long-Term Forecast: Up

I don't hold any Cardano, but I'm thinking about picking some up. Cardano was developed by Charles Hoskinson, a co-founder of the Ethereum project.

Cardano can do the same things Ethereum does, with Smart Contracts, but is much more scalable, future-proofed against quantum mining, and is looking to integrate into the online gaming market as well as setting up its own debit card.

Definitely one to watch.

Conclusions?

Investments in any of the top five are probably solid for holding onto until 2019.

Bitcoin could see a bit of a dip as consumers get more educated and put their money toward more advanced cryptocurrencies. I expect Bitcoin to be bumped out of the #1 slot sometime during 2018.

Cardano and Ethereum are definitely my favorites.

Do you think I'm right? Do you think I'm an idiot?

Let me know, and thanks for reading!

-Matt

I'm in on both Eth and Cardano - and generally agree with you on the above

@originalworks

The @OriginalWorks bot has determined this post by @weaselhouse to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!