COOPEX; WORLD FIRST COOPERATIVE DECENTRALIZED EXCHANGE

INTRODUCTION

Crypto exchanges have emerged the tool to profit from crypto asset ownership but they are far from being without their pitfalls. The exchanges as a centralized point of sale do not fit well with the idea of a decentralized financial system, they are a single point of failure but this is not the only issue. Some of the problems associating with crypto centralized trading platform or exchanges are;

LIQUIDITY PROBLEMS

Like all nascent markets, there is a lack of liquidity in crypto markets making it so difficult to exit at the right price. The growth in exchange use has boosted overall liquidity but such an increase in trades is yet to have the ultimately desired effect. In Bitcoin markets for example, this lack of liquidity is compounded by the fact that many BTC holders are sitting tight as the value rises and are unwilling to put their Bitcoins back on the market. Those holding crypto and waiting for their assets to reach a certain profit level subsequently flood the market which accounts for the volatility and massive price swings that we see on crypto markets and this is where proposed futures markets can really help. This will facilitate the shorting (selling) of Bitcoins that are not actually held by the seller but are contracted to be sold and then bought back later at a lower price. This may bring stability to crypto markets as it increases trade volumes and could balance out the current bullish trend on the market. Price slippage woes are compounded by the fact that many crypto exchanges require users to wait for their transactions to be confirmed and these waiting times can be several minutes. Moreover, the lack of liquidity carries two main problems for crypto exchange users which are, large spreads on the thin markets due to the low number of bids for the assets, in addition to demand and supply inefficiencies and the second problem is the large price swings on these thin markets which mean price slippage occurs with trades not executed at the price proposed.

CENTRALIZED NATURE

As mentioned above, crypto exchanges constitute a single point of failure and so are a target for hackers, Mt. Gox the world’s leading exchange of its time is the most publicized and largest hack to date with uncovered Bitcoins totaling 650,000. Mt. Gox later filed for bankruptcy. Another notable hack occurred at one of the world’s most popular exchanges, Bitfinex. In the second largest crypto hack witnessed, 120,000 BTC was stolen. Blockchain data inputted is immutable, it is more susceptible to theft by hacks. This immutable nature means all transactions are final with complainants may as well taking their grievances to the appropriate place to be resolved. In addition to there stolen or lost funds, crypto assets cannot be recovered or frozen without working to reject the transactions.

CLEARING AND SETTLEMENT

Another issue with crypto exchanges is how transactions are cleared and settled through its various platforms. As cryptocurrencies exist within an unregulated space, clearing and settlement cannot occur through traditional, regulated channels, making clearing and settlement risks abnormally high. Moreover, exchanges aren’t willing to act as anything other than a third party that only arranges trades between buyers and sellers. This means that they are not a direct counter-party to every transaction that takes place and so are not bearing much responsibility for what takes place on their platforms. However, it must be said that they do act as a counter-party where they can correctly make margin calls in time to recoup funds from the wrong sides of contracts.

LACK OF TECHNOLOGICAL CAPABILITY

There are many exchanges operating sophisticated platforms but, as an analyst from Bank of America Meryll Lynch noted, “by and large these do not offer the same quality of technology as the large global exchange groups.” The systems the analyst is talking about can cost up to 10 million USD to operate and maintain per annum with prices starting from $500k for smaller exchanges i.e the more expensive and advanced the technology, the more they are able to detect market manipulation and other fraudulent activities.

COOPEX EXCHANGE PLATFORM

COOPEX which stands for Cooperative Exchange aiming to cooperate all crypto traders with its exchange. Initially, this a cooperative that intends on forming a positive and friendly relationship with its traders, anchored in the idea that users should and can reap rewards through the success of the exchange.

At COOPEX , crypto traders and investors have a say in the tokens listed and what protocol decisions we make. The success of the exchange lies in part with you and thus, it's here to make your experience the best it can. Some of the features available on the Cooperative Exchange platform are;

Transparency

The Cooperative Exchange will be transparent with its users about all of its policies and processes, it has a zero tolerance policy for insider trading.

Fee Structure

Coopex has decided to create an exchange that gives the majority of its trading fee back to its users and investors.

Customer Service

COOPEX will be as transparent as possible with projects about listings as it has no interest to deceive or mislead projects. Post-ICO, it will hire a professional and reputable customer service team to handle any exchange issues users may encounter by making use of Zendesk for this task. Margin Trading COOPEX plans to open margin and leverage trading at the end of August, its developing a separate back-end application to handle margin orders.

Liquidity Provision

Liquidity is an incredibly important part of a market because without liquidity, traders cannot trade. Illiquid markets plague many cryptocurrency exchanges today and Coopex intend to help solve the problem through a market making and liquidity program. As COOPEX is partnering with ChainRock, a global advisory and investment firm, for the market making and liquidity program. In the future, its intend to open a liquidity desk to assist other clients i.e exchange platforms with liquidity and market making.

Coins

COOPEX is interested in catering to new and smaller projects fresh out of ICO, that may have trouble being listed on large exchanges. It look to model IDEX in this regard, as IDEX often lists tokens directly after projects finish their ICOs.

COOPEX TOKEN ANALYSIS

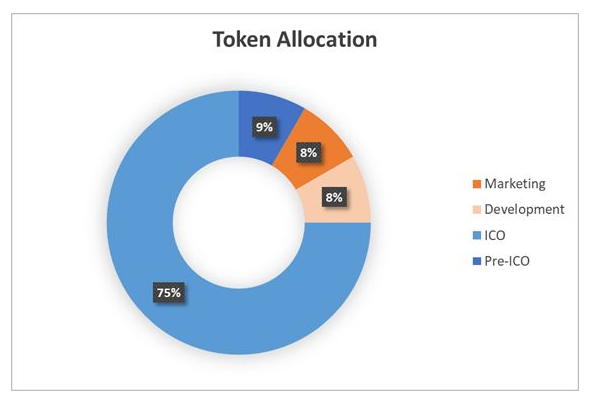

The Cooperative Exchange Token (COOP) is the native COOPEX platform token. Every month, 75% of COOPEX trading fees will be collected and used to buy back the COOP token and burn it. The token will be bought on the actual COOPEX market at market price and we will not perform any OTC trades. The COOPEX ICO will raise a maximum of $950,000 (this is the hard cap The soft cap is $500,000

CONCLUSION

In conclusion, the COOPEX project is committed to decentralization as it understand the security concerns associated with running a centralized exchange. The exchange platform has many steps as possible to ensure exchange security. For more information on this project, kindly make use of the links below.

WEBSITE: https://coopex.market

WHITEPAPER: https://coopex.market/Coopex_Whitepaper.pdf

TELEGRAM: https://t.me/coopexmarket

FACEBOOK: https://www.facebook.com/coopexmarket

TWITTER: https://twitter.com/coopexmarket

ANN THREAD: https://bitcointalk.org/index.php?topic=4545314

WRITER BITCOINTALK USERNAME: lumibaba

WRITER BITCOINTALK ADDRESS: https://bitcointalk.org/index.php?action=profile;u=2151502

WRITER ETH ADDRESS: 0x83b1556667E1A776Db4Eb9e9373c5Ea1F3308a24