In-depth analysis on Ripple (XRP)

When people first dive into crypto currencies, the first coins they encounter are usually Bitcoin (BTC) and Ethereum (ETH), followed by a myriad of other coins. But not even once, someone asked me about Ripple – even though its market capitalization is about 10% of that of Bitcoin (at the time this analysis is written), placing it third at the list in market capitalization for all crypto currencies, right behind Bitcoin and Ethereum.

Also, the “father” of Ripple is the American web developer Ryan Fugger, who had the vision of creating a "community credit system". But while Satoshi Nakamoto published his ideas of decentralized exchanges with his famous paper in October 2008, Ryan Fugger had this idea of a free credit system already back in 2004. The first Bitcoin was then created in January 2009, Ripple as a crypto currency however did not came to life until 2012.

The blockchain community is also quite torn over Ripple – and not only due to the centralized nature of the currency. Some straight up hate it, for violating the basic principle of decentralization, other praise it as the future technology, that will even replace SWIFT in the future (“Society for Worldwide Interbank Financial Telecommunication” – basically what interconnects banks around the world, making it possible to transfer money from a German bank to an American bank or vice versa). But this might a bit of a long shot, right now.

Or not? Let’s see, what is behind Ripple.

(Clarification: when XRP is mentioned, it is about the currency; if Ripple is mentioned, it is about the company.)

Ripple is not only a big crypto currency, but also a big company with about 150 employees, located in San Francisco, USA and offices in North America, Europe, Asia, Australia and India with the last branch established in Singapore just recently. So, research on the background of the team needs to be focused on the leadership, as it would be a bit tedious to stalk every single employee.

The background of said leadership ranges from being a financial analyst, former CEO, professor, economist, entrepreneur, former national advisor of the US administration, CTO, lawyer etc. – some of them have more than a decade of experience in their respective field. There is prominence and professional competence as well as a huge amount of workforce itself behind ripple. I spend a couple of hours, trying to find something to desire, but could not find anything regarding the team.

As Ripple is such a big company, they of course received extensive coverage in the media, be it from blockchain media or regular media outlets. This ranges from Cointelegraph and Coindesk to repeated articles on Huffington post, CNBC and Bloomberg. On top of that, companies like Deloitte and KPMG are aware of Ripple. Links to these articles, their press releases and “industry perspectives” (releases of companies regarding e.g. the state of a certain technology) where Ripple was mentioned can be read on their own website.

Regarding their investors, it is almost the same case:

- Accenture (management consulting)

- Andreessen Horowitz (venture capital company)

- CME Ventures (venture capital company)

- Core innovation capital (venture capital company, invested early in November 2013 with 3.5 million USD )

- Google ventures (venture capital company, daughter company of google)

- Santander InnoVentures (venture capital company, daughter of Santander Bank, invested early in May 2013 with 4 million USD)

- SBI Group (venture capital company from Japan, biggest investor with 55 million USD, entered in September 2016)

- Digital Ventures (venture capital company from Thailand)

- Seagate (tech company, mostly known for producing hard drives)

- Standard Chartered (bank from England)

According to crunchbase the investor IDG capital, a Chinese venture capital firm, entered the group of investors in May 2015 with 28 million USD – but they are not to be found among the list of the investors on their website.

Back in October 2016, all investors combined so far invested about 93 million USD into Ripple. But not in form of an ICO but into the company itself – the regular venture capital investing way. Even though we do not know exactly, if they did receive XRP or not, I would not bet money on the fact that they do.

My reasons for this assumptions are:

1st: if it would go public (e.g. via leaks), it could hurt the reputation of Ripple severely, endangering the investment as whole (meaning, that all venture capital investors would need to aggree with this & share the same level of risk awareness, which I would deem unlikely)

2nd: venture capital firms normally(!) take their profit from selling their share after the targeted exit .

Thanks goes to Tiffany Hayden who corrected me on this.

The difference in between these investing methods is rather important. Because when someone is invested in the ICO and receives coins / tokens, they want to let the currency gain value. But the currency can get manipulated. It can be the target of pump & dumps, FUD and FOMO can enlarge the volatility that make investing unattractive for more conservative investors. It can also severely hurt the brand of the project itself. See e.g. Digibyte, which is highly controversial within most crypto currency investors, due to an unreasonable bull run back in June – and the subsequent downfall to ~20% of the value of its all-time high today. In almost any case, the value would be also most likely dependent on the price of Bitcoin itself, as most currencies show a high correlation in with it.

But if investors are invested into the company behind the currency itself, they are interested in the actual company becoming more valuable. This is – in most cases – more sustainable than the value of a coin, which is subjected to many parties, more irrationality and more external influence. Venture companies also can support the company they bought into by e.g. giving them advise or transfer know-how from one company to another. This is often way more valuable than the monetary investment.

It is of course a double-bladed sword: venture capital investors usually ensure that they gain a certain degree of influence in the company they invest into. Also, the timeframe they stay invested in is usually fixed. In the case of Ripple however, this is not as dangerous as it is for other startups. As their focus is the finance industry anyways, the connections of their venture capital investors could be considered even more valuable than the actual monetary investment. AND they also prevent the disadvantages a ICO based financing poses – like not needing to rely on the price of the token, to keep their business going.

Publicity: 9.0/10 (9 – to be honest, I could not find anything to be desired: big partners, broad coverage in every major news outlet, good transparency & big names in the team etc.; for a 10 however, I miss their communication on technological details)

As for the interaction with their community, they work a bit different. Usually, when I review their community interaction, I check the communication channels like Slack, Reddit, Twitter, Bitcointalk etc. And even though they have a subreddit and an active twitter account for public communication / announcements, they also use their own forum for communicating with anyone, who wants to discuss on Ripple . Slack however is not used, but I do not consider this a bad thing – with the amount of people invested into XRP, it would be way too big to be usable anyways, I guess.

Also, they have no classical whitepaper you normally expect from a project.

Thanks again to Tiffany Hayden who pointed me to the whitepaper on their concensus method, that vanished completely under my radar.

There is a “ripple solutions guide” on their website, explaining the current situation with transactions in between banks and how Ripple would be beneficial for everyone to use. Base line for this: international transactions in between banks are expensive, complicated and take long to execute, as they need to use an intermediary. We will focus on this in the technological section of this analysis.

Events regarding Ripple are advertised on their website on a calendar, available for everyone to see. It makes the price of XRP a bit more predictable and softens the impact of hype, FUD and FOMO to a certain degree. It is less likely for the holders of XRP to be surprised by e.g. a badly communicated conference and therefore such events are priced in way earlier as when they are only announced once one month beforehand on twitter.

They also had an AMA with the CEO just recently , where he answered many interesting questions, which will come into play in "future".

As for where XRP is traded is the answer: basically everywhere. Most of its trading takes place on Bithumb with ~40% of all trading volume. Next is Coinone, Poloniex and Korbit with slightly below 10% each, Kraken & Bittrex with ~5% at the bottom end of the large exchanges having bigger daily amounts of volume of XRP. The volume itself however is highly volatile, ranging from 20 million USD to over one billion USD on some occasions. But due to the volume as well as the fact that there are many exchanges, it is unlikely to be the target of organized P&Ds or manipulation.

Activity - grade: 6.5/10 (7 – the communication is comparatively active; -0.5 for no existing public roadmap)

Now let’s see, what problem Ripple wants to solve in the first place. Imagine you are from the US and like to transfer 100 USD to a friend in Japan. Japan has another currency, the Yen (JPY).

So somehow, these 100 USD need to become JPY, so it is spendable by your friend in Japan. It is not like that the USD will be somehow transmuted into the other currency - it needs to be changed, someone needs to be willing to give the equivalent amount of JPY for the 100 USD.

In theory, it is easy: the receiving bank just gets the 100 USD from you and gives your friend ~11,300 JPY. But the reality is often more complicated. The bank in the US and the bank in Japan need to either have existing business contacts or create them by opening up bank accounts for each other, so called “nostro accounts”. Then, both banks need to be compliant with regulations, as both are obliged to do their best to not accidently launder money for a criminal organization.

But what if the bank of your friend is be not willing to accept USD, because they do not want to expose themselves to the risk of losing money in case of the USD losing value in relation to JPY? Or because they fear that the other bank goes bankrupt while holding their funds? Especially smaller banks just do not have the capacity to dedicate themselves to expose themselves to the risks.

In such cases, another bank with e.g. a branch in Japan as well as a branch in the US will act as complementary bank, taking your USD in the US and just giving the JPY in Japan to the bank of your friend. They of course charge a fee for it, as well as extending the time it takes to complete the transaction, because one single transaction becomes now two or three (as up to 4 banks can be involved). It is usually also processed in batches at fixed times during the day.

All in all, it is a process that will take days. On top of it, you need to expect at least about ~0,15% of the total amount to be deducted as fees, but for lower amounts, it is usually fixed to 5-20 USD (depending on the bank, it can also consist of several fees), which would leave you with only about 80-95 USD after the transfer of 100 USD. In some cases, it is even hard to assess the amount of fees, as the other banks often do not make these public and only tell them to you, if you ask them directly. This makes it not appealing to send smaller amounts to another country with a different currency.

So, Ripple wants to solve this problem by providing two things:

1st: RippleNet and xCurrent

“RippleNet” is the network which banks and other financial institutions will be part of. xCurrent will be built around the Interledger Protocol (ILP) and will achieve a higher speed of transactions (as it is not pegged to opening hours & fixed batch processing times), more transparency in regard of the fees and transaction conditions (as they are known beforehand) and therefore overall lower cost of transactions. You could say, that this is the “line” or the “car” that makes it possible to transfer the information from one bank to another.

Bidirectional messaging by the messengers provide the transparent information between both banks, the IPL ledger tracks all transactions over the network. The FX ticker facilitates the exchange between both ledgers & manages the exchange rates. All the while the validator either confirms or blocks the transaction.

The validator is the decentralized part and they are also something, that give me a bit of a headache. Five of these validators are run by Ripple Labs themselves, some by employees of Ripple (Joel Katz & nikb (pseudonym)) and others range from unconfirmed to unknown or even questionable origin, which makes it strange that Ripple admitted them to become validators. It can be expected that while the network grows, more trustable participants will become validators and enlarge the possible choice. On top of that, it is possible to choose the preferred validators. But banks are likely to want to know exactly, who are these validators and if they are trustable. If not for security reasons, then for publicity reasons to assure their customers, that their data and money is 100% safe.

2nd: XRP

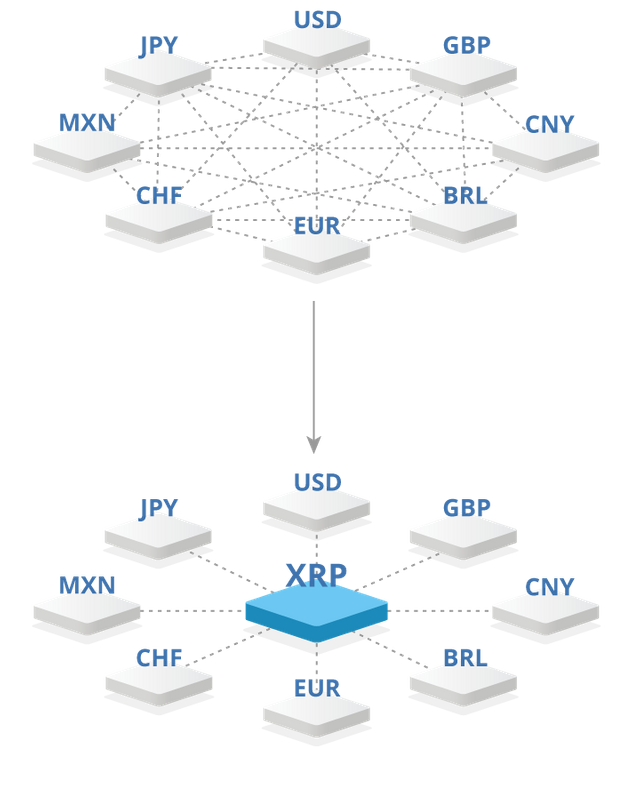

If RippleNet and xCurrent are the “car”, XRP can be the “driver”. XRP can be the one consensus as the central store of value. I think this graphic from Ripple themselves explains it quite well:

The part above describes the situation right now, the part below the situation Ripple aims to create. Instead of the banks needing to deal with several other currencies, they just deal with two: their own preferred currency and XRP.

Let’s take the same example as we did before: you want to transfer 100 USD to your friend in Japan. Both banks are part of the RippleNet. Therefore, they just take the 100 USD, take the equivalent of XRP from their XRP account and send it on your behalf to the bank in Japan. There, the bank of your friend will exchange the XRP into JPY and credit his account with the amount in JPY accordingly. Both banks would not even need to hold XRP for a long time – just for the short time it takes to complete the transaction of XRP in between the two banks. It however needs at least a single liquidity provider (or a market) in each respective currency to exchange XRP into said currency or vice versa.

XRP would therefore replace all other currencies, which banks needs to hold right now for servicing their customers, freeing a significant amount of liquidity (Ripple itself talks about 20-27 trillion USD being bound in such accounts ).

Right now, Ripple Labs seem to have a working technology, as transactions already took place in between two banks in Canada (ATB) and Germany (Reisebank).

Basically, we look at 2 different factors: a fast working crypto currency and a network that includes financial institutions. And because the network itself can work without the crypto currency, it all comes down to Ripple Labs to ensure that the usage of XRP is the preferred choice of the banks. We will talk more about this in the subsection “future”.

As for the industry Ripple wants to target, it is hard to guess. SWIFT is used by about 11,000 financial institutions, so it would be reasonable to take this as a reference point. But at first, it needs to be mentioned that the most frequented currencies are excluded for now by Ripple Labs, as they are – at first – focusing on “niche” currency pairs. If we exclude the top 5 currencies and assume a similar coverage of banks trading in these niche markets, we end up with “only” 20% of the market. This would leave us with 2,200 financial institutions – still a quite high number. Even though I would not (actually cannot) pinpoint a specific number of institutions or even potential future revenue from it, I see no reason to worry a lack of market. In combination with their venture capital investors, I also would not see this as a too ambitious goal but indeed realistic.

So far, there are some competitors who also want to utilize blockchain technology to achieve the same or a similar goal:

- Stellar

A fork of Ripple with a similar focus, but another target group – while Ripple aims to be appealing for financial institutions, Stellar targets more the individual person. - Bloom

A smaller project with similar goals, but a stronger focus on the market in south-east Asia to bring it together with the US market. - Paycomerce

Another project that is quite similar to the goals of Ripple, but failed to attract a similar attention in the finance industry for now.

In this regard, Ripple can be seen as the strongest competitor in this field so far. They are well ahead in the lead and becoming the market leader in this regard is indeed possible.

One important thing to also mention is the fact, that XRP is a deflationary currency by nature – every transaction burns a certain amount of XRP. The implications of that will be discussed in “future”.

Technology - Grade: 7/10 (7 – the technology is there, solves an actual problem and seems to “only” needed to be adapted by the banks; -0.5 for the unknown / dubious validators, which might deter conservative executives to actual consider adapting xCurrent in the first place; +0.5 for having a working product & being the most advanced competitor on the market)

In the time I spent with these analyses, it is not really possible to screen if steps on their roadmap were not reached or if the development was severely set back by something. After all, the company exists for more than 10 years and the coin is around since 2013.

What is possible to review however, is the fact that the founders of Ripple – Chris Larsen, Arthur Britto and Jed McCaleb – had divided about 20% of the total existance of XRP (20 billion XRP) among them. Larsen gifted most of his share to the Ripple Foundation for financial innovation. Britto locked up his share, so it does not come into circulation. McCaleb however left Ripple Labs to start Stellar, the other major currency of major interest to break financial borders in between currencies and countries. Regardless of what differences they had or had not: he still has his share of these 20 billion XRP. The total amount of his XRP would be ~13% of the active circulation right now, but he seemed to hold a bit more earlier. To prevent these coins flooding the market, the case went to court, where it was settled that his sales will be dependent on the daily volume of XRP traded, to not influence the price.

The average correlation in between the price of BTC and XRP is visible with a correlation coefficient of 0.607 (data between 01.01.2016 to 10.06.2017), meaning that there is a good positive correlation with BTCs value.

Just recently, the price of XRP rose a bit in the wake of an AMA of Brad Garlinghouse, where he answered some very valid questions regarding the future of XRP and Ripple.

An analysis on the graph will be done later maybe – it would be a topic for itself to analyze the happenings in 2017 for ripple anyways, I guess…

History - grade: 6.5/10 (7 – there is no major bad event in the past (there may be – but I just do not have the time to do research on 4 years…); +0.5 for the good handling of McCalebs share of coins; -0.5 for actually distributing so much power in the hands of so few people in the first place; -0.5 as it was in a bearish phase from May to September, recovering from an insane bullrun in just the first two weeks of May)

First, I feel the need to address a rather important issue: on a regular base, some people like to mention, that the success of Ripple Labs (the company) might be not linked to the success of XRP (the currency) and therefore, Ripple Labs has no inherent incentive to make XRPs value go up. Reason is, that the system of Ripple (xCurrent) that the banks may use for their transactions, is not actually needed to utilize XRP. They also can use other crypto currencies, create their own or even not use a crypto currency at all.

But let me be clear in this aspect: saying “the evaluation of XRP and Ripple Labs has no connection whatsoever” is equally wrong as saying “XRP and Ripple are completely dependent on each other”. Ripple Labs received venture funding in the past, but at the same time is still holding about 60% of the total supply of XRP (of which 91.6% is locked for more than 4 years ), making the value of Ripple Labs indeed dependent on the value of XRP. And not by a small amount. It is actually 150% of the value of the whole market capitalization of the currency (60% XRP owned by ripple / 40% of the circulation right now = 150%). This number is far away from insignificant and indicates, that not only Ripple Labs as a company has an incentive to let XRP prosper, but also their venture investors.

To put this into perspective: XRP right now is at ~0.20 USD. Meaning that – in theory – Ripple is sitting on 60.000.000.000 XRP x 0.20 USD = ~12.000.000.000 USD (12 billion USD) in value right now.

Again: in theory. It is impossible, to get this value, as the price would plummet to worthlessness, as soon as they would try to sell this much. But it shows, that the statement “Ripple Labs has no inherent interest in XRP getting adapted by the banks” not logical from a pure business viewpoint. The big position Ripple Labs has in XRP in fact makes them the most interested party to see XRP getting adapted by the banks and gain value. And not only them: all their investors have the interest to see XRP prosper. Any executive of their venture companies would be completely unfit for his job, if he/she even thinks of disregards XRP.

And now we are not even touching the technical foundation, that xCurrent will favor XRP being used. Or that Ripple Labs is providing even incentives to the banks to use XRP.

It however needs to be pointed out, that the need of banks checking the respective other bank for being compliant with e.g. AML (anti money laundering) regulations will not be changed by ripple.

So, the usage of xCurrent and XRP would be beneficial for the banks, if the following equations are true:

1st: cost effectiveness

X+c1 <Y+ c2

X = value of XRP equivalent to the biggest transaction needed

Y = value of all currencies held in Vostro accounts right now

c1 = costs of running xCurrent

c2 = costs of running the current system

This is logical – if the new system is more cost effective, it is worth considering implementing it & disregard the old one.

2nd: volatility risk

A<B

A = short-term volatility of XRP

B = long-term volatility of all currencies the bank is dealing with

The issue of this equation seems simple, but is actually a bit more complicated and at the first glance not in favor for XRP. As we all know (hopefully), crypto currencies can be heavily volatile. I always like to point to the drop of Ethereum in June, when one single big sell order triggered several other stop-losses and subsequently let the price end up at merely single dollars for a couple of seconds, before it bounced back up. Right now, a change in value of XRP from 4600 to 5400 satoshi, a change of value of 17% like we saw in the past 4 days is not acceptable for any bank.

But: if there are several banks behind the price of XRP, the price will be more stable. The problem is: they won’t be using it, if it is heavily volatile. But when they use it, it will be less volatile. The crucial point is, that it needs to be used to be usable. And also, at this point the speculators and short-term investors will jump the wagon, as low volatility also means less profitability for them. This is where the “liquidity providers” come into play, according to Ripple – they will shoulder the risk of the remaining volatility.

Like already pointed out in “technology”, XRP is a deflationary currency. I read a lot about how XRP will become insanely valuable because of that. But the minimum of XRP burned is about 0.00001 XRP per transaction. Of course, it can rise, if e.g. multi-signed transactions take place. However, this amount is not significant enough to cause deflationary tendencies in the currency itself. If we assume 26 million transactions taking place per day, it is only 260 XRP burned. Even if we multiply it by 10, it would not even burn one million of XRP per year – 0.0001% of the total circulation. Please do not be deceived by these who tell you, that XRP will gain value by this: the burn rate is not intended for deflationary reasons but to prevent network spam. We are all most likely dead, before the burn rate would show any influence on the price. At the moment, only slightly over 6 million XRP are burned in the past 4 years and I don’t expect it to hit one billion of burned XRP in our lifetime.

In the near future, Ripple will hold a conference called “SWELL”, where not only they will talk with major leaders of the finance industry and also prominent guests like Sir Tim Berners-Lee (if you don’t know this name: without him, we would basically not have the internet). Brad Garlinghouse hinted in the AMA a couple of days ago, that they will make some “significant announcements during the SWELL event”.

Future - grade: 7/10 (7 – the future ahead is not actually endangered by an unpredictable rise of circulation but still needs to deal with a slight inflation due to McCalebs XRP; other than this, it will all boil down to the ability of Ripple Labs to convince the banks to use xCurrent with XRP in the future)

Publicity: 9.0/10 (9 – to be honest, I could not find anything to be desired: big partners, broad coverage in every major news outlet, good transparency & big names in the team etc.; for a 10 however, I miss their in-depth communication on technological details)

Activity - grade: 6.5/10 (7 – the communication is comparatively active; -0.5 for no existing public roadmap)

Technology - Grade: 7/10 (7 – the technology is there, solves an actual problem and seems to “only” needed to be adapted by the banks; -0.5 for the unknown / dubious validators, which might deter conservative executives to actual consider adapting xCurrent in the first place; +0.5 for having a working product & being the most advanced competitor on the market)

History - grade: 7/10 (7 – there is no major bad event in the past (there may be – but I just do not have the time to do research on 4 years…); +0.5 for the good handling of McCalebs share of coins; -0.5 as it was in a bearish phase from May to September, recovering from an insane bullrun in just the first two weeks of May)

Future - grade: 7/10 (7 – the future ahead is not actually endangered by an unpredictable rise of circulation but still needs to deal with a slight inflation due to McCalebs XRP; other than this, it will all boil down to the ability of Ripple Labs to convince the banks to use xCurrent with XRP in the future)

Overall score: 7.3 / 10

Ripple is the third biggest crypto currency at the moment and perhaps the one with the most prominent team. In general, I would say that a small package of XRP is never wrong, when creating a portfolio with coins of projects, that solve actual real world problems and do not solely focus on other blockchain usability. On top of that, it is very beneficial that XRP found its support at solid 4500 satoshi last month.

Regarding the question to buy or to sell XRP right now, I would ask in which time frame you would like to invest. It is unlikely, that the price will drop down to its former levels of April or even February, where it was at its lowest for years. Since September, a solid support at 4500 satoshi seems to hold – and if you want to hold XRP for some months or even years, it should be a solid investment even at 5500 satoshi now, as adaption of banks will drive the need of XRP higher (be it by usage or by hype). In the short run, I would consider the small possibility that the SWELL conference is already priced in in the bullrun of the past 4 days. But as the conference is still 10 days away, the driving hype does not have seem to set in yet, opening some percentages for those that feel confident that said hype will set in before.

In the long run, exceptional price expectations like “$1 at the end of 2017” is of course a very unrealistic overestimation, but anything in between 4000 to 5000 satoshi should be a solid mid- and longterm investment, that is very likely to yield good returns with a comparatively low risk.

PDF with footnotes and sources

My blog

If you like my analysis & want to give something back – vote here on steemit or treat me a beer with BTC.

After all, I am a German penguin.

BTC: 12dTyxchdGhYjGBi1QFVPWbagQrRSJssWT

ETH: 0x3D8e6B27F7ab389888791ABEe6FA62F4718A1164

LTC: LT6qfsrxPhVxcYPbNgT267W1aVRd6n5AFq

This is how I feel about that Banker shit. Resteemed!

Hahah. Nice. Thanks for the resteem. Good analysis here. Had to give it an upvote and a follow.

Great post about Ripple. Learned a lot.

Congratulations @randallmaller! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI will vote you and you vote If agree say deal

I haven't been a fan of ripple, but I must say this was a well put together article. I skimmed some of it but will refer back to it later. Good stuff. Followed.

Thank you, my friend.

I will adjust the content a bit, as Tiffany Hayden made some adjustments to what I might had get wrong.

amazing