In-depth analysis on SONM (SNM)

One of the major point of criticism in regards of Bitcoin is, that it is not possible to obtain them, if you are not investing as huge amount of money. If you have the money, you also need to have access to cheap electricity. And then, you also need to get your hands on some ASICs, which sole purpose is to mine Bitcoin. On top of that, you need specific surroundings to set up the miners – setting them up e.g. right besides your bed is quite a bad idea, as their cooling is quite loud and you most likely will not be able to sleep. So, either you already have the spot to place them, or you also need to rent/buy the place to put them.

No good conditions to start mining, if you ask me. Also, it is a huge waste of energy, now that alternative consensus methods like PoS are known. And even when the ASICs get outdated and are not profitable anymore: the computing power and therefore the hardware is still there. Sometimes, you can sell it, as it has another purpose (in the case of GPUs). But in the case of ASICs, the equipment became nothing more than useless pieces of metal, that might work with altcoins – but bring the risks of mining altcoins with it.

SOMN (acronym for “Supercomputer Organized by Network Mining”) wants to solve this problem and give outdated ASICs a new purpose with “fog computing” – distributed computing power among the participants in the network. They promise to go even further: the possibility to mine with “CPU, GPU, ASIC, even gaming consoles and smartphones” . Quite a big promise, as this would make mining once again possible to do for the average guy.

There are however some implications, that make me doubt this ambitious goal a bit. Let’s see, if these doubts will prevail – or prove to be obsolete.

Behind the project is an international team of about 17 employees, of which 12 are working in full time on the project. They are mostly located in Russia, but also has advisors e.g. in Germany (Max Kordek, who is also involved with Lisk), Ireland (Reuben Godfrey) and USA (Jaron Lukasiewicz). Names and detailed information about their past is researchable quite easy on their website. Most of them seem to be proficient in active development in several programming languages in several fields. Their specific fields range from AI (“artificial intelligence” – Anastasiya Ashaeva), DAO (“Data Acess Object”; needed to have an interchangeability of an underlying database, which is important for implementing APIs – Max Taldykin) over to PaaS (“Platform as a Service” – Anton Tiurin) to server management and cloud integration (Michail Ivanov). As for the technical capabilities and historical background of the team, there is little to desire. Same goes for their advisors. I am however somewhat puzzled, why the CTO of SONM (Igor Lebedev) is not listed on their website, even though he attended a conference for SONM in Barcelona just recently.

SONM is a singapore based company, but the team is operating in Moscow, Russia. Meaning that they should be quite mobile from a legal standpoint, when it e.g. comes to legal issues in russia. Wise decision.

I unfortunately cannot assess Russian sources (as I do not speak Russian), so I cannot tell, if SONM received any attention in regular Russian media. In English speaking blockchain media however, SONM received some praise as a super-computer blockchain project with a wider usage than its two competitors Golem or iEXEC, who are more focused on computing processes itself. It is also good to see, that almost none of their coverage are paid press releases, but actual interest of the news outlets to cover SONM. Outside of blockchain media however, the public awareness on SONM is nonexistent so far.

There are no partners mentioned on their website so far. But it is not the case, that SONM has no partners at all: Selectel, a Russian internet hosting provider showed interest to partner with SONM, to create blockchain-based IT-infrastructure solutions for businesses.

While I consider any partnership useful to a certain extent, I would not consider this partnership a major one. Reason is that 1st the launch of the first product coming from this partnership will not be released until somewhere in 2018, 2nd the size of Selectel itself is so big (Owler.com estimates the annual revenue of Selectel at ~6 million USD and lists them to have ~45 employees ) and 3rd because it is really hard to assess the future prospects of russian companies in general. International sanctions on the Russian economy and the strict Russian laws regarding data ownership and location of servers (any data on e.g. Russian individuals are only to be stored within Russia) could not only severely hamper the progress of the products developed but also the success of the product could be severely endangered by this. I however appreciate, that there is no overboarding hype because of this partnership, neither from the team nor from the community.

Publicity: 6.5/10 (6 – while their team is not known in the community, their qualifications are impressive, they however are in need of partners)

In regard of their public communication, they use several ways: reddit , telegram , facebook , twitter as well as a blog and a youtube-channel . I don’t know why their Slack is not listed on their [ANN] – post on Bitcointalk, but they use it actively regardless . The activity on these platforms is good – not outstanding, but far away from inactive and not overly spammed by FUD or FOMO.

There seems to be a little bit of “hate” from some community members against the competitor Golem however. Activities like AMAs were somehow conducted in the past, but left me a bit unsatisfied. Questions were gathered between 11th and 13th of July, answers were then provided a day later in a 3-minute video. It is not that the video is bad or not informational at all – I just have the feeling that an AMA on reddit would have been way more productive with more detailed information that can be screened way faster and efficient by potential buyers.

What their Whitepaper is about:

- the technical part in quite some detail

- 5 easy to understand use cases

- Some words regarding safety concerns (as the computing power of the miners could be abused)

- Development roadmap (ranging from the point in time the timeline was written up to 2020)

- pointing out their unique points, when compared with Golem and iEXEC

I would consider their Whitepaper quite astonishing in detail and understandability, as I expected more of a heavily abstract and technical one, after seeing the majority of the team and their qualifications. But many things are even documented with sources and links. In some cases, it is only a link to Wikipedia, but it makes the paper itself way more readable and understandable for people from a non-technological background.

Besides their informative Whitepaper, they also published a “business overview”. This can be interpreted as a “business plan”, as it touches on some issues, that is usually found in them. It is about:

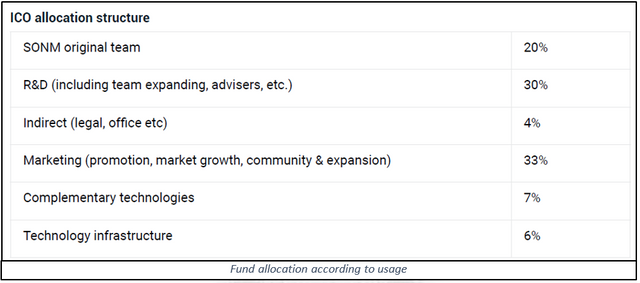

- detailed token allocation ratios

- ICO-fund distribution by usage

- market size

- financial model with two scenarios included (optimistic & pessimistic)

- financing

- marketing roadmap

I admit, it is easy to become excited over this, as such plans are usually the first one an investor looks into, when considering an investment. It shows, that the team behind a project had put some thoughts not only into the product itself, but in topics surrounding the company/project. It is about liquidity for next years, research into the existence of demand in the product, possible competitors, marketing issues & plans etc.

And they did quite a good job on this paper, I have to say.

Right now, SNM is traded at 7 exchanges:

- Binance (~65%)

- Liqui (~34%)

- EtherDelta (~0.5%)

- YoBit (<0.5%)

- HitBTC (<0.5%)

- COSS (<0.5%)

- Tidex (<0.5%)

As 99.5% of all trading is focused on Binance and Liqui, I would not recommend using the other exchanges but stick to these two.

Activity - grade: 7.5/10 (6 – active communication channels, that could see a bit more community involvement; +0.5 for the extensive but still understandable whitepaper; +0.5 for the business overview; +0.5 for not neglecting QQ and WeChat)

To understand, what SONM is trying to achieve, it is important to understand a couple of terms:

IoT (“Internet of Things”)

Internet of Things is explained quite fast: anything (hence the term “Internet of Things”) is connected to each other. Every information surrounding these things is to be gathered and made available for use on the internet. This way, it is e.g. possible for your printer to tell you, that he is running out of ink by sending you a message on your mobile.IoE (“Internet of Everything”)

The Internet of Everything takes this a step further. Here, the printer might not only texts you a message that he is running out of ink, but:

1st: calculate, when exactly you will most likely run out of ink, based on your past printing behavior

2nd: determine, if you need to print only black/white or with colors – also based on your past printing behavior

3rd: check if you have enough money on your bank account by consulting your bank

4th: look for the cheapest and/or fastest delivery for a new toner, depending on your preferences (which is also calculated from your past buying behavior, e.g. by pulling data from Amazon)

5th: send you a text-message, that you are running out of ink and asks for confirmation, to buy a new toner from your most favored seller

In IoT, the data got transferred from the device to you. In IoE, there is a useful connection in between you (as a human), your printer & your smartphone (as things), your data (past behavior & present state) and buying new ink for your printer (the process). All these information is aggregated by an algorithm and then presented to you, considerably fastening the process of you getting a new toner.Cloud computing

“Cloud” is usually a term for IT-services, provided via the internet from a centralized service provider. Netflix is an example for this: the movie is not on your PC but on the servers of Netflix, but you can still see the movie. So, cloud computing is either providing Software (e.g. Outlook), Infrastructure (e.g. Amazon S3), or Platforms via a centralized service provider. Imagine the cloud in this regard literally as a cloud in the skies, unreachable by you without any plane.Fog computing

Fog is – other than clouds – usually close to the ground. It is close by, you can reach it, be enveloped by it. Same goes by fog computing: your printer could process computing tasks, that would be done centralized by the cloud before. Or your smartwatch. Or your coffee machine.

In short, SONM wants to create an easy to use platform, where you can offer or buy computing power of such devices for various computing purposes in the decentralized fog, not in the centralized cloud. They want to achieve this by combining existing technology like torrent peer 2 peer file transfer, smart-contracts on the Ethereum-Blockchain as well as the open-source PaaS (Platform as a Service) platform Cocaine . Inside the Whitepaper, the final functionality it is outlined schematically:

If you want to dive into the basic trust-relationship in between hub, miner and buyer, I however recommend reading the paper “Multi-agent systems and decentralized artificial superintelligence” by the CEO of SONM (Sergey Ponomarev) and Dr. Voronkov.

Basically, you can imagine the SONM-platform as the exchange, where only 2 commodities are traded:

- Computing power (provided by the miners)

- SONM (currency to buy the computing power)

SONM can be bought or sold also on the exchanges, just like a regular crypto currency. The team however also aims to implement an exchange-like mechanism, so a buyer can also use conventional methods to pay for the power – be it other crypto currencies or fiat via e.g. Paypal.

Therefore, what the miners do is not “mining” itself in a narrow sense, but actually doing productive computing for another party, who is in need for computing power to solve a specific task. The implications for such a service is quite grave, as it solves one major point of criticism in crypto currencies (in regard of PoW): waste of energy.

Let’s get to the worries I had regarding the security.

a) Legal security

Imagine yourself being a citizen of Saudi Arabia and running a small mining rack and someone wants to calculate something related to porn. As anything related to pornography is forbidden in this country, you might run into legal problems. Same goes with general illegal computing processes – nobody wants to offer his computing power to criminals.

Such processes will be handled by the DAO (decentralized autonomous organization), which will set the standards on whitelisted hubs and miners and deal with fraudulent offers. This DAO to create internal rules and the “blockchain government” itself is no priority, but I can imagine that the idea will find lovers.

b) Technical security

The security of the miner’s machine is provided by having the to-be computed files isolated in docker machine with restricted access. I cannot assess, if this is enough to ensure security for the working machines.

When it comes to their calculation regarding the possible computing power, that serves the network of SONM, the calculation is a bit more complicated and needs to be split up into two major parts:

1st: GPU (Graphics cards)

Used mostly by altcoin-miners, this is the major way of PoW that can be done by an individual without dipping into ASICs. The computing power with GPUs is calculated at ~8 ExaFLOPS (8x1018 = 8,000,000,000,000,000,000 Floating Point Operations Per Second). The strongest single GPU on the market can process ~11.47 TerraFLOPS (11.47x1012 = 11,470,000,000,000) at the moment. So, 8 ExaFLOPS computing power is equal to ~700.000 running GForce 1080Ti. This however is not the total computing power of GPUs bound by mining, but the one bound by ETH alone, meaning it will become obsolete or shifted to mining other altcoins, as soon as ETH switches to the PoS consensus method. It can be assumed that it is actually even more, as not every GPU-miner is mining ETH.

2nd: ASICs (Application-specific integrated circuit)

ASICs are mostly used for mining specifically Bitcoin and might have the biggest share of potential computing power. However, ASICs are not the average computer and the team is aware of the fact, that it is not possible to compare deterministic hashing power to non-deterministic computing power. I really would love to read more about how exactly they want to include ASICs into their processes – after all, the capabilities of an ASIC basically is restricted to a simple loop.

In case of the ASICs, they first need to get them working for their purposes, otherwise the biggest share of computing power cannot be included in the system. In regard of the GPUs, they need to be appealing enough for enough miners to switch to SONM after ETH switches its consensus method to PoS.

As for now, the predicted 8 ExaFLOPS of computing power of the GPU miners mining ETH is exceeding the total computing power of the best 500 supercomputers together (748.371.889 TerraFLOPS) by about 10.6 times. In relation to the most powerful single one, it is about 86 times.

So, computing power of SONM would potentially exceed the one of single supercomputers by far. However, it is not only the computing power but the price that might ensure a market share for SONM, compared to the possibilities used now. They calculated to be able to undercut Amazon Web Services by 90%.

Regarding their market analysis, there is little to desire – they consider the past size, actual and projected future growth by data, which were gathered by the IT consulting firm Gartner Inc. The baseline in this market is, that services will merge into the cloud further and further – they predict a market growth of ~55% from 246 billion USD (2017) to 383 billion USD (2020) and use these numbers for calculating their two scenarios.

There is one thing however, that worries me a bit: while the whitepaper initially talked about fog-mining, it was not mentioned in the later sections. Also, from a logical standpoint, I would raise doubt in the profitability in this method, as the increased computing power of e.g. a smartwatch would need to deliver, would harshly shorten its ability to stay switched on, let alone the issues regarding shortening lifespan, higher heat consumption etc. Like I said: the idea is appealing, but why exactly should I offer the computing power of my Playstation for, when there are more than enough GPUs in the market, that are way more powerful and better suited?

Technology - Grade: 7.5/10 (7 – very solid fundamentals & the tech they are working with is basically already existing, they just need to combine it; +1.0 for the more than detailed business overview – the numbers are reasonable, the scenarios overall not unrealistic and it shows, that they had a significant expertise put into the business-related fundamentals, I would love to see similar stuff from other projects; -0.5 as the idea of “fog mining” is appealing, but has logical faults)

SONM is a young project, that gained enough attention to have their ICO raised 117.337 ETH after 4 days in June, which is roughly 40 million USD – they also had a pre-sale, where they raised 10,000 ETH in 14 hours. The cap itself however was not public until the 11th of June.

So far, there are no dramatic changes in the team composition.

The allocation of funds and SONM – token itself is outlined in their business overview:

Regarding their roadmap, they fall behind their original time schedule, as far as I can tell. V.0.3 – Arch was announced for September 2017 on their blog, but still needs to be implemented today. On the other hand is Arch scheduled for “fall-winter 2017” according to the business overview. The Blog entry was released two days after the business overview, so it is not possible to say that the September release of Arch is outdated. I would wish for SONM to communicate this a bit clearer – it is not good to fall behind the time schedule, but it is worse to be vague and not disclosing this to the investors, as it can hurt the trust into the project severely.

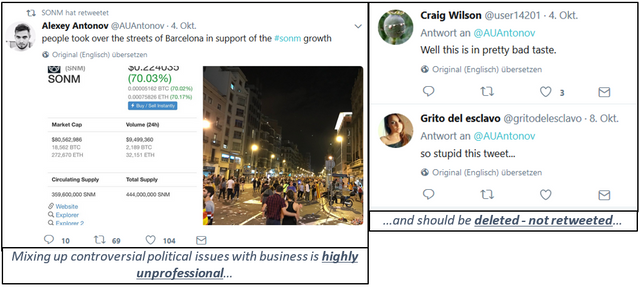

The price of SONM had only one major “pump” so far – the 2nd of Oktober 2017, where they attended the “Blockchain solutions forum” in Barcelona. It is nothing new that the price of coins takes a rally in anticipation of the team participating in conferences, forums or fairs. Such speculation is driven by bigger attention, the hopes of big news after the conference and anticipation of possible result shortly after. Usually, this euphoria dies down back to past values or slightly above these levels, after this event is over. SONM is not different in this regard and luckily found its support on former support levels slightly below 2,000 satoshi. I do not expect it to go significantly lower.

Speaking of the conference, I need to write about one topic: Barcelona. The conference “Blockchain solutions forum” took place at around the same time, as the referendum for the independence of Catalonia. Obviously, the team of SONM was aware of this, as Barcelona is inside of Catalonia and it is unavoidable to not see people on the streets. But if you do business, you avoid getting mixed up with political issues. You do not make political statements aside from reasonable ones, that you are sure to profit from (and even then, you need to be cautious, as it can backfire horrendously).

Therefore, you do not make statements like this:

Such tweets can severely hurt the reputation of a company. Alexey Antonov is responsible for the marketing of SONM and should therefore be aware of this fact. I really hope that such stuff does not happen in the future – because for now, this can be exculpated by the young age of the project and missing experience with the persons involved. If such tweets however happen if SONM is a big company, it can have significant negative impact on the price of SONM. Even now, such tweets can deter local partnerships from companies in Spain.

From this conference however also seems to come the partnership with Selectel. They seem to have used this opportunity to network actively – the team made SONM not only more known in the blockchain industry, but also among possible future users of the SONM network for renting computing power.

History - grade: 5/10 (6 – the most recent history with the conference resulted in a actual partnership (Selectel); -0.5 for the Barcelona tweet; -0.5 for being late on Arch)

They ran a two-scenario analysis in their business overview, based on the data of Gartner Inc. mentioned earlier. It is quite detailed and might be too much for someone without any understanding in business and finance. However, the numbers add up – there is not much to be desired from a financial perspective, even the WACC is appropriate for Russia. Their market share on the optimistic scenario is a bit too optimistic, if you ask me – but other than that, it outlines that even with a smaller market share than expected, they are able to operate for the next couple of years.

According to their roadmap, Arch should be released last month, but seems to be still in development. It can be expected, that the release of Arch itself in the next couple of weeks/months might cause another small rise of SONM. But while Arch might be an important step on making the network functional on a technical level, I see no reason that a higher price should be sustainable because of it, as it does not release anything of commercial use.

So, aside from non-predictable partnerships, that may or may not happen in the next months, the next major event on the roadmap would be the release of V.0.4 – Power in March 2018.

Future - grade: 6/10 (6 – so far, nothing big can be expected at the moment; there is however always the possibility that they announce similar partnerships like with Electel, as the Blockchain solutions forum was just recently and talks from this might still be under the cover of a non-disclosure agreement)

Publicity: 6.5/10 (6 – while their team is not known in the community, their qualifications are impressive, they however need more partners)

Activity - grade: 7.5/10 (6 – active communication channels, that could see a bit more community involvement; +0.5 for the extensive but still understandable whitepaper; +0.5 for the business overview; +0.5 for not neglecting QQ and WeChat)

Technology - Grade: 7.5/10 (7 – very solid fundamentals & the tech they are working with is basically already existing, they just need to combine it; +1.0 for the more than detailed business overview – the numbers are reasonable, the scenarios overall not unrealistic and it shows, that they had a significant expertise put into the business-related fundamentals, I would love to see similar stuff from other projects; -0.5 as the idea of “fog mining” is appealing, but has logical faults)

History - grade: 5/10 (6 – the most recent history with the conference resulted in a actual partnership (Selectel); -0.5 for the Barcelona tweet; -0.5 for being late on Arch)

Future - grade: 6/10 (6 – so far, nothing big can be expected at the moment; there is however always the possibility, that they announce similar partnerships like with Electel, as the Blockchain solutions forum was just recently – and talks from this might still be under the cover of a non-disclosure agreement)

Overall score: 6.5 / 10

Conclusion

In the foreseeable future, the success of SONM depends mainly on three factors.

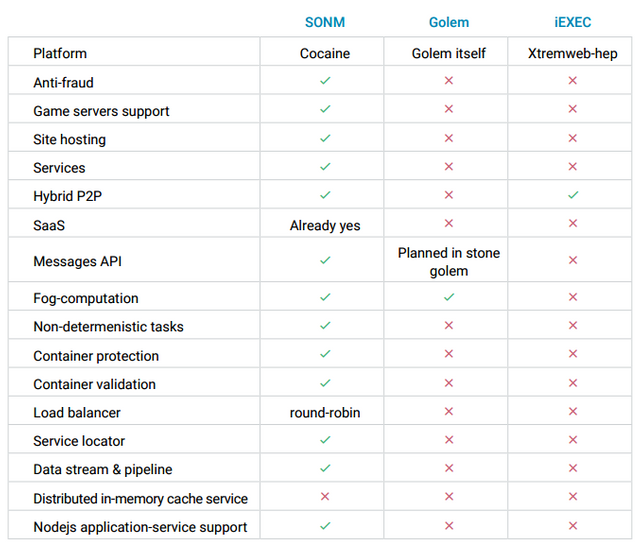

First, on how SONM fares compared to its main competitors Golem and iEXEC. They themselves explained the advantages of SONM in comparison to them in a graphic:

It is hard to tell, which of these competitors is technical superior over the other, without looking in the whitepaper of these projects. In regard of versatility, SONM indeed seems to be superior at the first glance. But we need to take into account, that Golem has a significant head start ahead the other two projects – and sometimes, this is all it takes for a product, to get a superior position in the market.

I consider the second factor however far more relevant, in respect of the price of these coins: the roadmaps. The faster the projects can throw a working product on the market, the more can they profit from e.g. Ethereums change from PoW to PoS. If many GPU-miners suddenly need to change from mining Ethereum to another PoW-coin, they usually look out for a coin, which they can mine for a longer period, as switching every day (or even week) consumes time, power and therefore: money. The earlier the projects can establish a solid and well requested network of computing power for offering computing power, the more likely is their success.

The last factor is the fact, that the need of computing power itself might prove to be not stable enough to be appealing for the miners. One week, a group of scientists might need 6 ExaFLOPS, to calculate the most possible movement of Malaysian Mountainsnails in Australia during the winter. The other week, only a couple of hobby-coders need to rent a dozen a part of the network for rendering the 8-bit-intro of their indie-game. It is an issue, that is not concerning the technology of the three teams – it is a concern about their targeted market.

Another risk (or uncertainty) on the macroeconomic level specifically regarding SONM, is again their location. Russia is in the blockchain news for weeks now – and is constantly flip-flopping on this topic. This could – in addition to the existing problems of Russia (high corruption, low legal certainty etc.) – add up to a significant amount of problems for SONM.

All in all, the project itself looks indeed promising for mid-term investments, as I deem it very possible, that the value of SONM can approach the value of Golem (albeit not match it). However, in the wake of Russian legal uncertainties (they still operate in Moscow) and yet another competitor in the same field (iEXEC), I consider the overall package of SONM quite risky. Before investing, I would advise you to look into Golem as well as iEXEC and decide, which project looks more promising for you. But please consider, that the success of SONM might also be linked to what Russia will do in the foreseeable future with crypto currencies.

The PDF with footnotes and sources will be added after their Q&A

Feel free to visit my blog, where you can find even more analysis on altcoins

If you like my analysis & want to give something back – vote here on steemit or treat me a beer with BTC, ETH or LTC.

After all, I am a German penguin.

BTC: 12dTyxchdGhYjGBi1QFVPWbagQrRSJssWT

ETH: 0x3D8e6B27F7ab389888791ABEe6FA62F4718A1164

LTC: LT6qfsrxPhVxcYPbNgT267W1aVRd6n5AFq

This post was resteemed by @steemitrobot!

Good Luck!

The @steemitrobot users are a small but growing community.

Check out the other resteemed posts in steemitrobot's feed.

Some of them are truly great. Please upvote this comment for helping me grow.

SONM is so undervalued. I hope more people to see the potential in SONM soon.