The reason Wall Street is looking into crypto

The major question echoing in Cryptoland for the past couple of months has been: when will Wall Street finally enter the market and make an end to this horrible bear market? However, nobody seems to be concerned with the question of why would these huge institutions with almost endless resources even invest in such a risky and immature market? If the returns on crypto are so appealing, they could just trade in other risky assets like penny stocks or another OTC market? Some major institutions are definitely not in the position to make risky trades and thereby comprise their capital, for example, a pension fund, whose job it is to minimize its risk and guarantee its capital as much as possible.

The preconceived notion of many individual/retail investors is that the lack of safeguards in the crypto market for institutional funds is what is withholding these big investors from entering. As soon as regulation is complete and the market is deemed safe enough to enter, institutional investors will inflate the crypto market with trillions of dollars for a chance to be able to take advantage of the upcoming “blockchain revolution”.

Even though this sounds logical because a lot of participants in the cryptocurrency (bear) market are in it for this exact reason and want to be a part of something that could possibly change the way societies will function in the future, this is not exactly the case for these big funds.

Having studied investment funds on Wall Street for the past couple of years I have noticed that these institutions really only care about minimizing their risk as much as possible. It’s not about making huge returns on investments or trying to discover the next Amazon or Apple in its infancy phase. A steady moderate annual return for their share holders will do. So with that being said, let’s discuss the real reason Wall Street is taking a better look at cryptocurrencies.

The Basic Indicator That Rules The Financial Markets

Correlation Coefficient: a measure that calculates the relationship between two variables. The value of this relationship can be negative (-1), neutral (0), or positive (+1). When the outcome of a calculation is positive it means that the two variables move in the same direction. A negative correlation means that the two move in the opposite direction and the value 0 indicates that there is no correlation at all. Now let’s say your entire investment portfolio is in cryptocurrency. You hold some Bitcoin, Ethereum and a few other altcoins. News comes out that a Korean exchange has been hacked and a lot of Bitcoins have been stolen. People all over the world sell their BTC in a panic and it falls by 30%. BTC usually takes (almost) all the other coins with it and the crypto market decreases by a few billion dollars in total market cap. Your portfolio will not be looking too good because your investments are all strongly correlated. Exactly how positive (value between 0 and 1) differs per coin. Now, what you could have done was hold some assets that move in the opposite direction of crypto and thereby hedge your risk. This is what Wall Street does (sometimes).

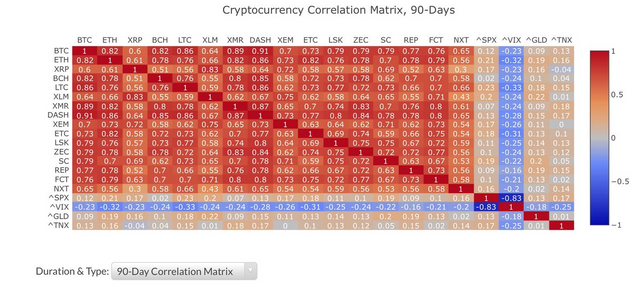

This is where cryptocurrencies come in for these institutions. Take a look at the chart below. This chart shows the relationship between various cryptocurrencies, the stock market and the market for precious metals (in this case gold). Here you’ll see that the correlation between crypto and the S&P 500 (stock market index) is either close to zero or negative. This makes crypto, and its deflationary quality, the perfect hedge for major institutions to hold.

This is, in my opinion, the most important factor to attract Wall Street and its huge resources to the cryptocurrency market. Every institutional fund competes to have the best and most efficient portfolio management and holding cryptocurrencies will increase their chances. The combination of return, potential risk and volatility makes crypto a far more attractive option than other assets. It would improve their portfolio simply because of its uncorrelated nature.

Of course having faith in the technology associated with crypto goes a long way but these additional qualities could give you some peace of mind to HODL tight.