Working out Cryptocurrency Capital Gains in Australia

Wheee...tax time! Which using Mygov is a fairly straightforward process right up til you get to the capital gains part.

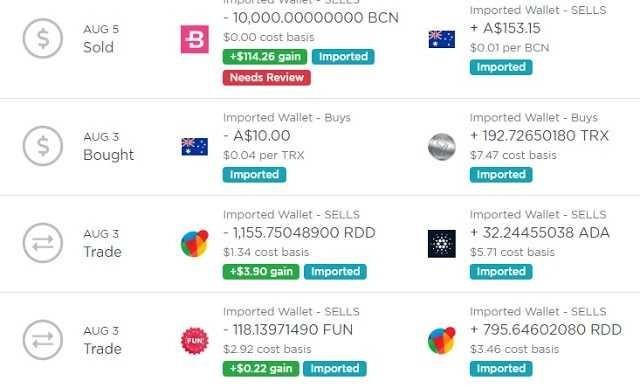

Because if you're anything like me, you have hundreds of transactions and trades (even small ones) that according to the ATO have now caused a capital gains event and therefore have to be added to your gains section.

If you're doing tax yourself this year, then this might help: I've created a guide to working out your gains using excell and a handy website. All it costs is time (and after trying a few processes, it seemed to be the only one that worked for me) and will crunch the numbers far quicker than general data entry (if you're like me and haven't been keeping records along the way)

https://almigo.blogspot.com/2018/07/calculating-cryptocurrency-capital.html?m=1

It involves modifying a .CSV file to be accepted by a coin counter that works it out for you. Like I said, all you need is time and some basic maths (a minor knowledge of excel or Google sheets will help too).

Here's hoping you score a big return even with a tonne of capital gains this year!