RE: Are Most Cryptocurrencies Doomed to Collapse — because they’re “ICO-issued”?

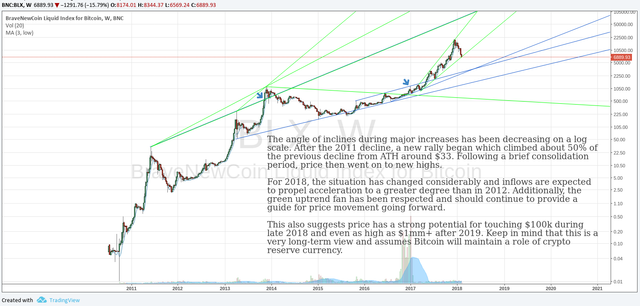

One of my trader friends shared the following chart with me, which he presumably produced after reading my prior post and based on my statements over the past month that the logarithmic chart gives a long-term perspective. When the linear and log chart interpretations agree, that could be a strong indicator of the interpretations being correct. He employs better datasets and software than I do, because he is very professional about his trading (I’m a computer scientist not a professional trader).

It’s interesting that he identified a funnel from 2011 which was more steep than the funnel that appears to be forming now for 2018. This interpretation would mean that we’re not replicating 2013, but rather 2011 on a 50% reduced slope! Wow. So we could by summer be at new ATHs. And it also consistent with a much more steep and deep crash after hitting $100k than 2014 (replicating the 2011 crash), which is consistent with my expectation of a massive theft of SegWit transactions (aka donations) by the miners thus bankrupting many of the centralized exchanges. My conspiratorial theory (which I’ve linked to in my prior post) is that nation-states won’t even need to regulate centralized exchanges, because the Zionists funded Blockstream in order to be able to destroy the centralized exchanges algorithmically. Or at least the crash coming after the $100K peak can be induced by G20 coordinated crackdowns on listing of ICOs on centralized exchanges, failure of Tether (which btw the aforementioned trader and I brought to the attention of BCT early last year yet we were scoffed at).

click to zoom

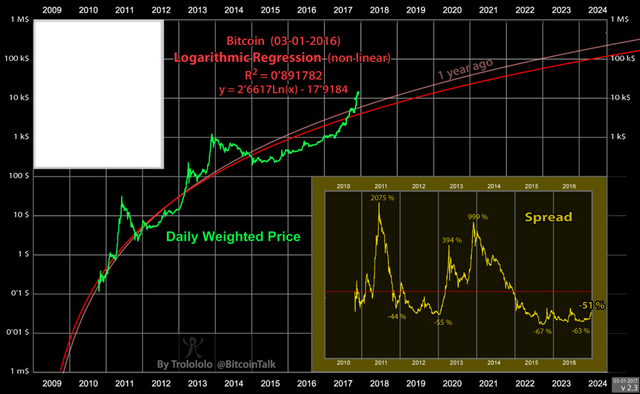

Compare the above chart to the long-term regression chart fit trend (←follow that to this link for the actual chart):

click to zoom

Note the above chart was needs to be updated. The current regression fit trendline would be higher than the “1 year ago” pink curve (my guesstimate is it would cross $100k in 2021) and significantly higher than the red curve, because that regression fit was computed in early 2017 when the price was much lower. The update extending the green line was hand drawn by myself to a rough approximation. Note the regression fit does not mean $100k can’t be reached until 2021, because of the massive overshoot above the regression fit line on speculation mania peaks as shown in the 2011 and 2013 peaks. So we could indeed touch $100k on a peak possibly in 2018 or early 2019, and then $1 million looks plausible roughly 2024 – 2026.

I’ll respond to @finitemaz’s comment post with my thoughts about the testimony at the Senate hearing. I will include there any additional thoughts about G20 coordination. Essentially the European securities regulation unification under the EU regulator is I think not yet fully in place, thus I think it’s going to take them some time to get a highly coordinated crackdown on ICOs globally. Based on the chart above, the move to $100k (and subsequent crash) will likely get out in front of their efforts and thus when they go cracking down on all the ERC-20 ICOs, the principals of those securities offerings will be unable to make restitution because surely the securities regulators will base investment valuations on fiat and the crash in the cryptocurrency prices will mean these principals will be lacking sufficient funds. It will be a bloodbath of ERC-20 fraudsters going to jail and/or fined (with clawbacks of their homes and other assets), along with their affiliates (e.g. promoters, brokers, and potentially legal counsel). The worldwide clawbacks, extraditions, etc will go on for years and decades as the nation-states coordinate their activities over time (and remember Russian Federation is a member of the G20). These idiots who are offering, promoting, advising ERC-20 ICOs are going to have their fingertips burned up to their armpits eventually.

It’s useless to make ICOs legal in the tiny nation of Belarus, because securities regulation jurisdiction is the jurisdiction where the buyers of your securities are. ICOs need to be global or significantly near to global in order to garnish the investment interest they do. If Belarus refuses to cooperate with the G20 on crackdowns against such violations, they will become excluded from the financial system with sanctions.

I’m still on crypto.cat as user ecash. Send me a buddy request. Please to other individuals don’t spam me with buddy requests because I’m too busy programming and researching. No time for discussion with numerous individuals. For the other computer scientists and programmers, add me on LinkedIn (link is in my first blog post on this system) if you’re sure we are peers otherwise general contact is email me shelby at coolpage dot com; and I will get around to responding there as priorities allows. Note I get a lot of spam in my email, so I may not see every inquiry because I don’t check it every day (maybe once of a week).

thanks will install crypto.cat later this week. too tired now. have to sleep.

I won’t go into more detail here because you may not wish for me to discuss or even hint at details of health issues in public, but please remind me to discuss intravenous vitamin C treatments with you. I did this 5 times thus far. I will explain to you what I think the benefits might be. I have a blog on my Medium which discusses IV vitamin C for treating Tuberculosis, which is presumably not an illness you have.