Ripple (XRP) Lawsuit

Disclaimer: The information provided by the Blockchain Musketeers is our own opinions and should not be taken as investment advice, financial advice, or any other sort of advice. Nor should this information be used to determine if you should buy, sell, or hold a cryptocurrency. Please conduct your own due diligence and consult your financial advisory before making any investment decisions. Only invest money which you are willing to lose, as cryptocurrencies is not suitable for all users.

In recent news, Ripple (XRP) has been handed a class-action lawsuit alleging the company the sale of unregistered securities. Earlier this year, we saw the downfall of Bitconnect with an internal fallout. Tether was suspected for fraud and ultimately audited, but was shown to be actually legitimate. With the crazy world of cryptocurrencies, it is not common for companies to be put under scrutiny by regulators due to the sheer amount of money that they are handling. Some cryptocurrencies like EOS is a prime example for this scenario as they have a larger market cap than Tesla, but haven’t yet launched on mainnet. In this article, we take a look at what is Ripple, how they have emerged over time, and what the lawsuit entails.

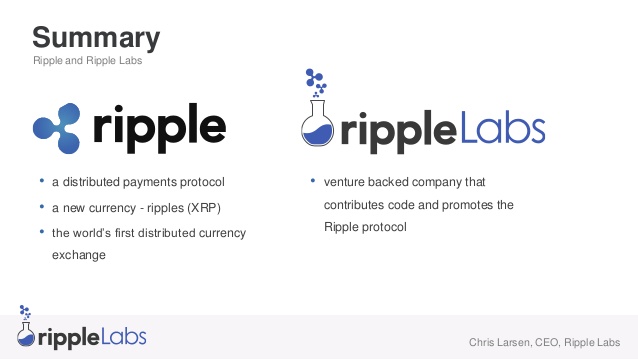

What is Ripple?

Ripple is founded by David Schwartz, Arthur Britto, and Ryan Fugger. The project boasts a real-time gross settlement system (RTGS) and the Ripple Transaction Protocol (RTXP). These two protocols are built on an open source project and also has its own native token called XRP. Ripple was first released in 2012 with the goal of having “secure, instantly and nearly free global financial transactions of any size with no chargebacks.” In the world of RTP payments, chargebacks and fraud costs are two areas that hinder transactions. Ripple is currently being used by UniCredit, UBS, and Santander, while having reach in Italy, Swiss, and Spain markets. At this time of writing, Ripple is currently the third largest cryptocurrency in terms of market caps with a price of $0.901931 per token. An important note to keep in mind is that Ripple (XRP) as a token has no utility to the Ripple network as it is an asset created to support Ripple Labs as a company.

How did Ripple emerge as an asset?

Ripple, as an asset, has publicly acclaimed to transform how RTP payments are conducted around the world. Recent updates shown that XRP can deal 50,000 transactions per second (TPS) compared to Visa’s 24,000. With having this technology behind Ripple, it is no surprise that banks have been in talks with partnering with Ripple for its technology. Keep in mind that there are also numerous cryptocurrencies out there that market themselves as having high TPS, a marketing claim almost to prove the utility of it’s token. In March, Ripples price shot from $1.21 to almost $3.46 in a matter of a few days. CEO Brad Garlinghouse also made an appearance on CNBC’s Fast Money, describing how Ripple is disruptive to financial sectors.

What is the lawsuit?

With Ripple having a firm stance on being the 3rd market cap coin around the world, the recent allegations against Ripple is nothing to glance over at. Law firm Taylor-Copeland has filed a class action lawsuit against Ripple Labs for “the sale of unregistered securities.” The case claims the plaintiff, an individual named Ryan Coffey, who purchased 650 XRP in Jan 5th and tethered it in Jan 18th, sustaining a loss of 32%. Main points of the lawsuit state that the individual did not believe Ripple Labs were conducting proper promoting practices of Ripple Labs, including references to retweeting, attendance of Garlinghouse at conferences and CNBC, and did not expect to his his money. One pivotal quote follows:

“XRP purchasers reasonably expected to derive profits from their ownership of XRP, and Defendants themselves have frequently highlighted this profit motive [...] Given its reliance on sales of XRP, it is unsurprising that Ripple Labs aggressively markets XRP to drive demand, increase XRP’s price, and thus its own profits.”

The lawsuit challenges Ripple Labs with violations to both California Corporations Code and the Security Acts. The plaintiffs requested that the court declare the sale of XRP as an unregistered securities sale to prevent further violations of security laws and payment for the costs of the suit, punitive damages, and attorney fees. A spokesperson for Ripple had defended that Ripple Labs is not considered a security under U.S. law.

In conclusion, it will be interesting to see how this high-visible class-action lawsuit against Ripple will settle out. No matter what direction this lawsuit takes, it will be a pivotal moment of blockchain technology, where despite being decentralized, people can still be summoned in court by federal regulators. We will keep an eye out on this lawsuit and report back after it has concluded.

Cheers,

The Blockchain Musketeers