Bitcoin / Crypto medium term analysis - Past, Present & Future

It is said that Emperor Nero fiddled while Rome burned. Let me not fiddle while Bitcoin burns

For starters I don't have a fiddle, and even if I did I wouldn't know how to play it.

I've been busy with a series about CoinMarketCap (despite my injured arm - still sore by the way). While it is not yet complete, I would be remiss to ignore the movements of the crypto market over the last few days.

I have predicted the current dip and I have predicted what comes thereafter, but when markets drop suddenly, people tend to panic. I'm not trying to belittle or berate anyone by implying that investors panic too easily, quite the opposite in fact. Today I aim to analyse the market, to reassure investors and to update my predictions (if required). I'll get back to my CMC series soon enough, the information in this post is more time sensitive.

Hubert Robert - "Incendie à Rome" (Public domain), via Wikimedia Commons

Bitcoin / Crypto medium term analysis - Past, Present & Future

After reaching highs in the $8500 region less than two weeks ago, a level that it had last attained two months prior, BTC once again started to drop rapidly directly after last weekend. Hopefully you were expecting this, because I have been saying it for a while.

I think that BTC is headed back down to somewhere between $5700 and $6700. After that I expect it to slowly become (very) bullish again. That can happen in three ways:

- Build upwards momentum without revisiting sub $6700 levels - unlikely - 15% probability

- Proceed sideways first, before building up bullish momentum - possible - 35% probability

- Another small up and another small down (a repeat of the market from the start of July to present day) - 45% probability

- Something unforeseen - 5% probability

The Past:

For those who need a recap of my recent precdictions and my best guess at the future of the market, let's see what I said in the last month or so:

From this post 8 days ago: https://steemit.com/cryptocurrency/@bitbrain/btc-medium-term-analysis-latest-update :

Or look at this picture from this post: https://steemit.com/cryptocurrency/@bitbrain/btc-long-term-pattern-analysis

It ties in strongly with my 35% probability prediction above.

And from that same post:

Then 16 days ago I wrote a post about BTC regaining market dominance (which has been happening during the most recent climb) https://steemit.com/cryptocurrency/@bitbrain/there-will-be-blood . In that post I said:

...which is exactly what I'm reminding you of today.

In the post https://steemit.com/cryptocurrency/@bitbrain/this-is-fine I wrote that:

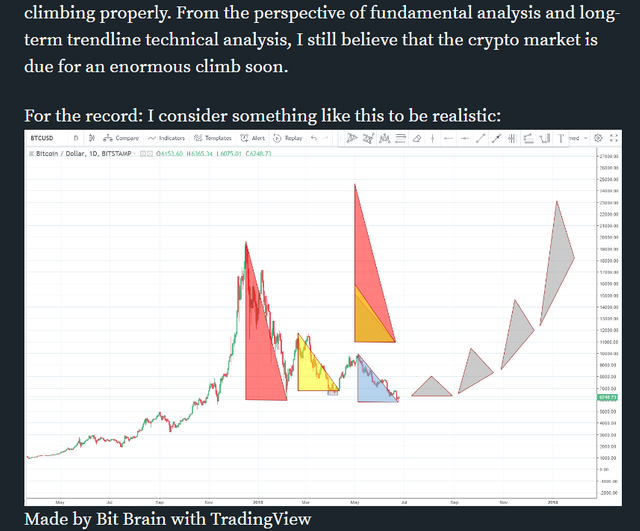

Finally, from around 40 days ago, I wrote this post - a post which is still doing a pretty good job in terms of predicting market movements: https://steemit.com/cryptocurrency/@bitbrain/the-bear-is-over-at-least-for-now

It contained this (somewhat non-standard) chart which I have since reposted several times. I continue to regard it as a good approximation of possible future price movement:

The Present

Those were older predictions, let's look at now:

BTC is dropping in price - sure, I know that. But look at what it is doing between price drops. Each time it drops, it becomes more bullish! It is easy to see this on the charts, look at the angle of the trendline arrows; I really don't have to say anything else. you can see it as plain as the nose on your face:

Made with TradingView by Bit Brain

Zoom in on the most recent period:

In fact: the support at the current level is so strong, that I wouldn't be surprised if the drop in prices halts here. I don't think it will; I'm just saying that I wouldn't be surprised. I think the market will continue lower for the next few weeks. In charting terms, I think the market should continue lower until the Stoch on this chart crosses into oversold territory:

Note that I am using a long-term Stoch indicator, so I have "K" set to "50". Using it with default settings (K = 14) will not yield the same results, but I'm not looking at the micro market.

The Future

I've already told you what I think and we've just looked at the market from a technical perspective. Now let us shift gear to a more fundamental perspective and see what other people think. We shall do this by means of a few headlines and extracts from Late July until now:

Breaking: World’s Biggest Stock Exchange Operator is Launching a Bitcoin Market

...has announced that will list a physically-settled bitcoin futures contracts and form a new company whose mission is to make bitcoin a mainstream financial asset.

In other words: who cares about CBOE ETFs and the overreactions to all the excessive hype surrounding them? Bit Brain doesn't.

But because people do get over-excited by news: Mt Gox Creditors Are Preparing to Claim for Bitcoin Repayments

The court's approval of the civil rehabilitation petition means that Mt. Gox will no longer need to liquidate any BTC or BCH assets. Nobuaki Kobayashi, the rehabilitation trustee, said in July that a new system for creditors to file proof for claiming repayments is expected to be released in August.

Forward thinking companies like IBM (who seem to have gone bezerk for crypto!) and progressive governments are adopting crypto. Those who find themselves in more oppressive jurisdictions are merely moving to countries with such governments and operating from there: e.g. Malta, Sweden, Australia. Where the climate is suitable, the population start to embrace cryptos: CRYPTOCURRENCY ACCEPTANCE RAPIDLY RISING IN COSTA RICA

I've told you before that hedge funds are getting into crypto. Here is another famous hedge fund manager who thinks along those lines: Billionaire Hedge Fund Manager Bill Miller is Bullish on Bitcoin

Miller notes that the best way to think about bitcoin at this moment is as a non-correlated asset most similar to gold.

He explains that with the right investment calculations, investing in the current bitcoin market can be viewed as a positive-expectation lottery ticket rather than otherwise.

The NYSE's Owner Wants to Bring Bitcoin to Your 401(k). Are Crypto Credit Cards Next?

Backed by Microsoft and Starbucks, Intercontinental Exchange is launching a startup called Bakkt to make the cryptocurrency safe for your retirement fund, and maybe for retail, too. Bitcoin could be on the verge of breaking through as a mainstream currency.

SEC OPINION: “Bitcoin ETF Is Innovative And Should Move Forward; Advances Investor Protection"

Coinbase Announces Custody Plans for 40 Digital Assets, Including XRP

As cryptocurrency becomes more mainstream, pension funds and other big institutions are seeking to add it to their portfolios. This represents a potential opportunity for investors but also a new business line for the likes of Coinbase, which charges funds to be the custodian of their crypto assets.

Final word:

I doubt we will see another BTC ATL this year - for reasons already detailed in this post: The insanity of bearish expectations . Try to stay ahead of the market, instead of running to catch up.

In other words: keep following Bit Brain 😉

And never, never forget to DYOR!

Yours in crypto,

Bit Brain

Bit Brain recommends:

Published on

by Bit Brain

always a good read on your posts. btw how do you do the overlay of chart of same ticker for different timeframe ?

Thanks.

The answer to the overlay question is: manually. I wish it was quick and easy, it isn't. I use an image editor, multiple screenshots mapped to their own layers, colour selection, transparency, deletion of everything but the curve on one layer, scaling to fit, merging down and finally an image export. It's laborious at best.

wanted to do something like, was comparing them their screenshot side by side and so hard to see. thanks you so much for the effort =)

i wonder if there's a season and cycle pattern for btc. i tried chopping down mth by mth over the last few years but not good enough. Do you happen to know of any software or anyone that has already done it ? =)

Eyeball it. But I'll tell you this, I've spent days staring at that chart - the entire history. If there is a cyclic pattern, then BTC isn't old enough for it to be apparent yet.

yeah can see from your post, you put in alot of effort and time crafting them. If you do see a cyclic pattern, do share with us =)

Let's talk again 10 years from now

Chic article. I learned a lot of interesting and cognitive. I'm screwed up with you, I'll be glad to reciprocal subscription))

Nice post BB. Not sure how I missed it before, but thanks for pointing it out. 👍