Crypto Token Economics Q&A - CargoX

It's good to be challenged

It would be unhealthy if readers lapped up everything that I say without questioning it. That is why from very early on, I have always encouraged my readers to apply the DYOR principle. I also encourage readers to ask me if they require my help, or to feel free to discuss things with me. Constructive debate is healthy and leads to growth and learning on both sides. I may be an arrogant, stubborn egotist (I'm sure I have some negative characteristics too), but I am passionate about learning and self-improvement (it entitles me to become even more arrogant 😜). I jest, but it's true.

My recent post about CargoX attracted such a challenge in its comments section. This post is written as a response to that comment. Read on if you are interested in a little more of the nitty gritty of token economics; CargoX in particular.

Crypto Token Economics Q&A - CargoX

The following is an excerpt from a comment on the above mentioned post:

by the sound of it, it seems like just another high velocity payment token for a dapp, have a look at this article, they break down very well why value can't accrue to those:

https://multicoin.capital/2017/12/08/understanding-token-velocity/

Vitalik also wrote about that back in the days:

https://vitalik.ca/general/2017/10/17/moe.html

The gist is that there is no incentive to hold high velocity payment tokens because they rapidly lose value because users constantly trade in and out of the token (to protect themselves against price volatility). Even if the dapp is successful, they'll probably end up enabling a direct BTC or fiat on ramp way to buy services thus rendering the token useless...

...if it's just payment then it's probably not worth it as an investment.

Interesting.

Firstly - thank you to the poster. This is great interaction, just the kind of thing I want. It will help us to clarify issues and fix any misconceptions.

I want to point out that even though I am sticking to an opposite viewpoint to that of the commenter, it doesn't mean that I regard them to be wrong or stupid or anything like that. Indeed, I applaud them raising their views and supporting their viewpoint. This is how we grow.

In order to get maximum benefit from this post, you should read the two articles that the commenter linked to. Very quick summaries:

https://multicoin.capital/2017/12/08/understanding-token-velocity/ discusses token economics by means of the example of a blockchain system being used to sell tickets for live events. It deals mainly with token velocity and focuses its argument around the fact that nobody will want to hold the tokens for very long due to volatility: e.g. you buy tokens for $10 to buy a ticket, but by the time you go to exchange those tokens for a ticket, they are only worth $9. People thus only hold them a short time, leading to the high velocity.

https://vitalik.ca/general/2017/10/17/moe.html discusses the classical economics equation "MV = PT" as a way to determine the value of a token. It suggests that rapid and efficient exchanges will lead to lower token prices. It deals with one or two side issues like manipulation and token burns.

Response

Fear not good Bit Brainians. Uncle Bit Brain has more than just a little crypto knowledge rattling around in his noggin. I'm not here to lead you down dark paths into Underpants Gnome Economic scenarios. Underpants Gnome Economics? Yes indeed. Reading this comment reminded my of the gnomes. For those of you too cultured or decent to watch South Park; read this short excerpt from a Forbes post:

A classic (but characteristically crude) episode of South Park teaches us an important lesson about policy-making... ...It’s a lesson that is worth repeating, and it's a lesson that has a lot of applications.

It's fair bet that a lot of the policy proposals that come into your field of vision are based on a view of the world more appropriate to the Underpants Gnomes from South Park than serious and reasoned discussion.

A bit of background is in order. The boys from South Park are due to give a presentation to voters in which they explain why the town should prevent a giant corporation ("Harbucks") from opening next to Tweek's Coffee, a local establishment. They encounter a group of gnomes who have been stealing underpants as part of a big plan, broken down into three phases:

Phase 1: Collect Underpants

Phase 2: ?

Phase 3: Profit

When the gnomes are pressed on the question mark and asked how, exactly, they get from underpants to profits, they don't have a good answer.

Picture and text from Forbes.com by Art Carden - https://www.forbes.com/sites/artcarden/2011/07/14/underpants-gnomes-political-economy/#3fce2a014e2e

...and now you know what "Underpants Gnomes Economics" is.

It is indeed true that many cryptos do appear to follow this economic model. In the article above it is applied to general government policies, e.g. (both from the same article as above)

Phase 1: Crack down harder on drugs.

Phase 2: ?

Phase 3: Cleanliness, sobriety, virtue, and prosperity.

OR

Phase 1: Pass a law decreeing that everyone gets free health care.

Phase 2: ?

Phase 3: Everyone has all the health care they need.

Trawling through my list of skills and accomplishments you may encounter a dusty old degree in business management, which includes two (long) years of Economics. Now I will be the first to admit that I treated university like one long drinking session interrupted by occasional short and annoying study and exam breaks. But much of that knowledge did stick in the old Bit Brain brain, enough to get me a highly over valued piece of paper that says I can sit on a chair and ingest large volumes of rote learning, and then write it down the next day with an accuracy of 50% or greater. (My disdain for the academic world and the lunacy of the value placed upon it has no theoretical upper limit.) Rote learning and disdain aside, at least I have the background to understand where these two articles are coming from.

I think that basing an entire argument on either MV = PT or the usage example of a ticketing system is invalid. Their arguments aren't necessarily incorrect, they just don't always apply. Theory works so well, provided that it remains on the pages of a textbook, but trying to apply it to the real world is never really anything like the theory at all.

The MV = PT example is really just looking at tokens as a medium of exchange. The CXO token can be a medium of exchange, but it is more than that and it is also not a traditional medium of exchange. Therefore traditional economics does not necessarily apply. One must always remember that blockchains are disruptive. they are the end of economics, finance, multinational enterprises, fiat currencies, banking and investments as you know them. Apply the traditional rules at your own peril. I guarantee you that they are hopelessly insufficient. These are not penny stocks. They are not currencies. They are not IPOs. The sooner you can ditch that old world mentality, the better.

A word on mentality:

I know that if you're a traditional investor and you read the paragraph above, then you are probably thinking that I'm mistaken and deluded. But you would be wrong to think that. Sadly most of the traditional role players do still think this way. What's more, their thoughts and opinions influence the (rather easily influenced amateur) crypto investors who do not know better. I would estimate that 95%+ of the crypto world thinks this way.

And it is absolutely IDIOTIC!

Allow me to qualify that insulting statement. You need to know why I'm calling you an idiot, so that you can un-idiot yourself.

Bitcoin ETFs, you've no doubt heard about them. They've been in the news a lot lately. In fact, they are just about all you read about in the crypto news these days. The uncertainty about them and negative sentiment towards them dominates the media. What's more, it dominates the price action of Bitcoin - which is sheer lunacy. Because prior to a couple of months ago nobody had even heard of a Bitcoin ETF before! They didn't exist and yet nobody gave a damn, nor did it affect the price! Then all of a sudden, just because the supposedly wise and experienced financial world gets wind of an ETF application, the whole world suddenly believes that the very success and future of BTC depends upon ETFs. Without it surely we will have no institutional investment yada yada yada. Horse $#it! Here is the history of BTC:

Made by Bit Brain with TradingView

BTC was doing just fine before ETFs. Hell, it was, and will continue to do just fine without institutional money if necessary. I've said it before and I'll say it again. Institutional money needs Bitcoin, Bitcoin does not need institutional money! (Unless you are very myopic in outlook!)

Before I get any more worked up about this nonsense, let's move on.

CargoX (again)

I've written about it: https://mentormarket.io/cryptocurrency/@bitbrain/cryptocurrency-spotlight-cargox.

I've written more about it: https://mentormarket.io/cryptocurrency/@bitbrain/a-bit-of-crypto-news.

I wrote about it a few days ago: https://mentormarket.io/cryptocurrency/@bitbrain/ta-of-my-favourite-low-market-cap-crypto-cargox.

I've written a few lines about it in many other posts.

And here I am writing about it again. When CargoX takes off, don't say I didn't tell you! 😁

CargoX has a complex token, far more complex than what I have ever written about it. One should always take great care when selecting a coin, to ensure that the token will grow in value. The arguments presented in the articles above must not be forgotten, then are valid in many ways. The questions of Does it need a blockchain? and Does it need a token? and How will that token increase in value? are important.

The articles above fall short because they do not do what I do best: look at the holistic picture. It's no good looking at just one aspect of a token, or looking at the token or company in isolation, that can not and will not give you an accurate idea of what to expect from it.

You can increase token value merely by limiting supply, creating utility and then releasing it onto the market. This is pretty much the standard model and it will work! It will work because not all investors are the same. Not everybody wants to buy an event ticket token to get event tickets. Not everyone hates volatility, many actually prefer it. Not everyone wants to hold a token for a short time, some want to keep it for years. It's also silly to be dismissive about arguments like token burns (as in the "token velocity" article). Citing increased volatility (the author alleges to be) caused by such burns is not a valid argument. Firstly I would dispute that "fact". Secondly I would question that it mattered in anything but the short-term. Thirdly I would dismiss his argument as a "non-issue".

An investor willing to hodl does not really care about volatility. He or she will sell when their price targets are met. Until then, they'll just hold. (The velocity article does talk about tokens becoming useful if they get used as a store of value in this way - failing to realise that almost any token can be used in this way by the hodl community!) And as long as people are content to hold, supply will diminish. Since decreased supply leads to scarcity, price will end up rising. Compound upon this the fact that increased adoption will lead to increased use and demand will have to grow. Yes, the velocity argument does kick in now, but it's not the perfect circular cycle that it is made out to be. Tokens leave the cycle. New investors buy them as they gain volume, companies hold a few of their own, some people lose their wallets or die with their private keys, tokens get burnt etc. CargoX itself can also influence this process at many levels. No, it's not wonderfully decentralised in any way, but then CargoX was never designed to be that way. It's far more like investing in a traditional stock, one which is going places. Remember: CargoX holds CXO tokens too - they would be stupid to devalue them...

Here is where things get interesting

The CargoX I presented in the past did work this way. It used the token model I described above. But problems did creep in. Not really problems with the token economics, but rather potential problems for the company. The CargoX approach was to incentivise the use of their CXO token by making it 20% cheaper to use than fiat methods. Note that I said "was".

You see; 99% of the world hardly know what a "blockchain" is yet, and of the 1% who do, only a few people know how to work with them. In their risk analysis of the industry, CargoX found that the logistics industry is slow to change and not particularly keen on making KuCoin and IDEX accounts to trade in some weird cyber money that they had never heard of before. So my commenter was absolutely correct when he said that:

they'll probably end up enabling a direct BTC or fiat on ramp way to buy services

... not only because they already had one, but because they will focus more on it, so as to make things easier for their customers who are not yet blockchain proficient.

But where does this leave CXO?

Right where it has always been, and still fulfilling the same functions. Only now it's easier to use, but the company uses it on behalf of the customer if necessary.

How did they do this?

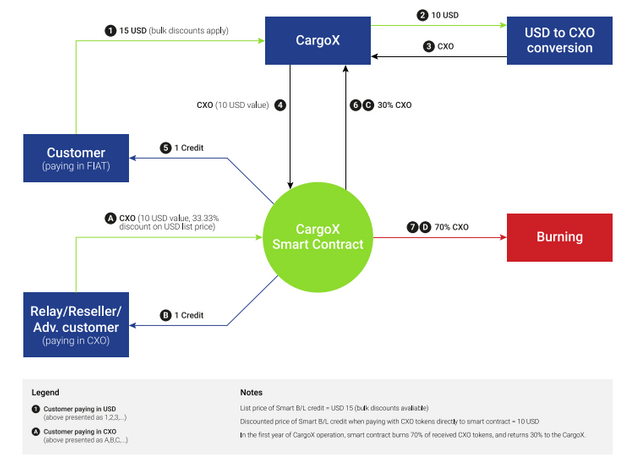

What CargoX did was to allocate CargoX "credits" to their customers - credits being fixed in price relative to CargoX services. This removes volatility from the equation. Then for every "Credit" bought, CargoX buy $10 worth of CXO. Buys are combined and executed at different times in order to avoid market manipulation and gaming. The price of credits (in CXO) is determined daily depending on the exchange rates. 70% of the CXO tokens used in the first year will be burnt. (After that, the burn rate will be reassessed.) The remaining 30% will return to the company.

From the CargoX Bluepaper, pg 54.

I am still only touching on the CXO token here. There is a lot more to it, but what's the point of me rewriting their documentation? I strongly suggest that interested readers read the section on token economics in their Bluepaper. Better still, read the whole paper. You can view it here: https://cargox.io/CargoX-Business-Overview-Technology-Bluepaper.pdf. "CXO Token Mechanics" starts on pg 51.

Final words:

I firmly believe that CargoX has a lot of growing to do. I do not expect that growth to come all at once. It is in this growth that I expect my CXO tokens to grow in value. I don't intend to hold the tokens forever, but I think it would be stupid to cash them out before the company grows, because I do foresee large price increases as they become more rare, more popular and more in demand as utility tokens.

Look at your tokens carefully, preferably before you buy them. Make sure they have valid reasons for increasing in value. Look at LOCI which I presented not too long ago. It has a totally different token economy to CXO, yet it also has solid reasons for increasing in value over time. (https://mentormarket.io/cryptocurrency/@bitbrain/cryptocurrency-spotlight-locicoin)

Fun fact: after receiving my degree, I stabbed my Economics textbook with a marlin spike (a sailor's tool, similar to an awl, for working with ropes). I still have the book, holes and all.

Yours in Underpants Gnome Economics crypto,

Bit Brain

Bit Brain recommends:

Published on

by Bit Brain

Well argued response @bitbrain, it takes some courage to bring economics and South Park in the same breath :D. Here's what I have to say though.

First, while I do agree that a token burn mechanism can exert some upward pressure on the price, i think this will be eventually counterbalanced by speculative activity around the token and made worse by the lack of liquidity in CXO markets (for example: whales dumping their cheap tokens on illiquid exchanges, CXO price being tied to BTC price fluctuations, etc). This speculation will result in wild price swings which will ultimately affect the cost of transactions for users (price slippage).

To remedy that, I believe it's likely the team will update their smart contract in the future to create more tokens or/and implement something akin to a burn and mint mechanism (explained in the article I linked to) designed to tame volatility and protect large transactions against it.

In the end, the token will end up either 1/ being completely abandoned at the benefit of a larger and more liquid currency like ETH, BTC or crypto fiat 2/ completely abstracted away (instantly swapped to a liquid crypto like BTC/ETH) which brings back the velocity problem: a high velocity circulating supply can offset the price appreciation of the locked/hodled supply.

So to wrap this up. The argument that payment tokens can accrue value through deflation (due to the burn) is deceiving in its intuitiveness (Bitcoin is scarce and has gone up therefore my scarce ERC-20 token must go up) and the fact that it has been largely abused by ICO projects to sell tokens to unsuspecting retail investors makes me even more skeptical with regards to its validity.

The ball's in your court my friend.

I don't see that price slippage will be possible thanks to their "credits" system - the cost should remain a constant for customers.

Well yeah, you know we could "go around the buoy" here until we are blue in the face; after analysis on both sides, you believe one thing and I believe another. It would be boring if we all agreed and there would only be a requirement for very few of us! The only way this will be resolved is by watching and waiting. Of course this assumes that CargoX will be successful. I see not reason why the should not be, the odds are heavily in their favour; but things happen to new companies and there is no guarantee of performance. I thought Envion was looking great at one point...

The South Park thing is really funny. Digging around for source material it was surprising to find that the "Underpants Gnomes" lesson has been used by multiple sources as a legitimate training aid. The author I quoted mentions that fact himself. I think it's about time that economics, and business in general, realise that a jacket and tie and a stern expression don't make you any better or more effective than a few guys in T-shirts who joke while they work. Probably quite the opposite. I embrace the stance adopted by major crypto names like these: https://www.youtube.com/channel/UCVVDsIYJBQ_C7Bh_aI3ZMxQ/featured or by companies like Google when you look at how they treat employees and what their office spaces look like. I've been in the military for over two decades. Believe me when I say that things like dressing up incredibly smartly, having impeccable manners and discipline, adhering to a strict hierarchal structures etc don't matter a damn when it comes to working efficiently and effectively.

I agree, that's why I usually write my articles in bed wearing shorts and a singlet :D

The field of tokenomics is so new that it is indeed tricky to make predictions whether or not a mechanism is sound. I personally believe that 99% of dapps built on ETH do no require a token and I believe that the successful blockchain businesses of tomorrow will not include payment tokens unless they are absolutely necessary for the protocol (masternodes, staking). Just imagine if Coinbase had a Coinbase coin that you had to buy before you can get your crypto... that would be odd and affect the UX. Any Ethereum dApp can use ETH for transactions and charge a fee but then they wouldn't get the chance to dump their tokens onto retail investors and make an easy buck... so yeah, these are my views.

Thanks for taking the time to answer my rants though :)

Thanks for the rants! ;)

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.