February Crypto Commentary

This is not Financial Advice. I am not telling you to buy or sell anything.

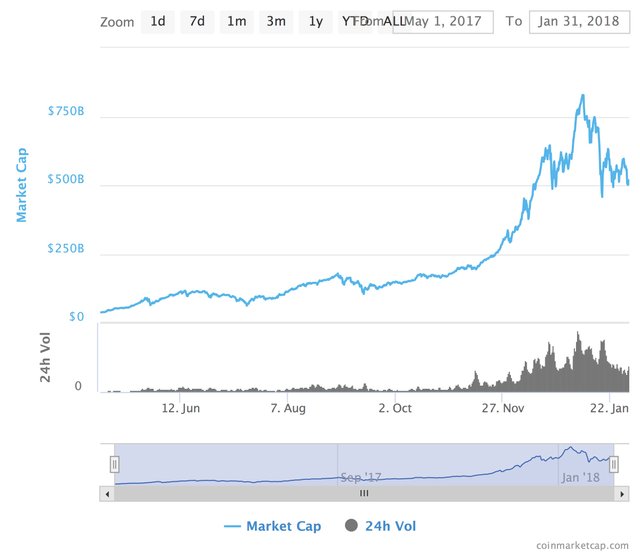

From my perspective, crypto went through a bubble at the end of December and the beginning of January. The market cap for all cryptos was about 800b. It’s fallen back to 500b.

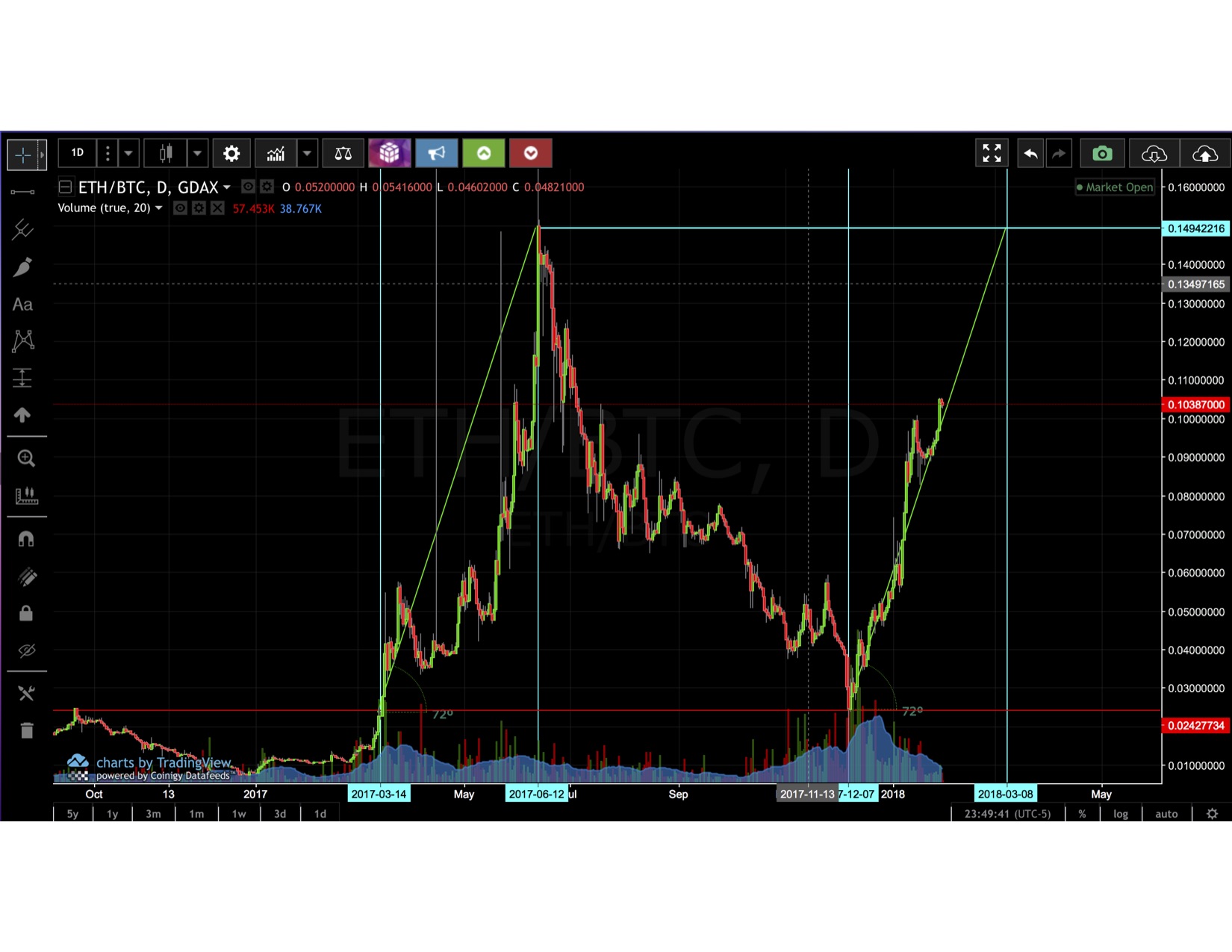

We are in a period where most coins are in a volatile downward trend. ETH has an inverse relation to BTC. At BTCs peak in Dec ETH was a at a low. At ETHs peak in June BTC was at a low. As BTC rose ETH fell.The following is simply a guess based on previous patterns. I obviously can’t say I know what is going to happen. ETH is now in an upward trend which will likely continue until it reaches a peak around 15,000,000 satoshi. At that point BTC will likely be near it’s stable low. BTC is in a downward trend which may settle as low as $7500, finding support at previous resistance. Based on previous patterns this will probably play out in late February. If BTC drops that low many alt coins will pull down with it. Late February and March will probably be a great time to buy BTC and other altcoins.

ETH should have a higher market cap than BTC. It’s better tech with broader use and a higher probability of long term wide scale adoption. ETH has been gradually working its way towards taking the lead in market cap. It is possible that we will see the market settling in to an 1/3 split between BTC, ETC and Other Coins.

The tether thing seems simple to me. Supply must increase with demand. Otherwise the value would exceed a dollar. The coins in circulation must be the same as the market cap. The scam part is that they are claiming to hold a USD for every USDT which seems to be obviously impossible. I don’t understand why they would need to. The problem is that they aren’t transparent and they are a corporation. The same thing could be done with a decentralized smart contract. A guaranteed stable currency that automatically mints and burns tokens based on demand. Call it OneCoin, it has a 1:1 ratio (market cap : circulating supply) so its value would always be 1. With wider trust and adoption the volume would go up and it would be more useful. I don’t like usdt. I don’t see how it could have any great affect on the price of bitcoin. The concept is extremely useful though.

Overall I see crypto as having a lot more room for growth and adoption and we will likely see overall market cap exceeding 1trillion in 2018. Bitcoin might join the ranks of AOL and Yahoo. Crypto will continue to flow into mainstream and achieve wide scale adoption, unless it is a useless fad, something akin to a digital figit spinner. Based on what I have seen, I think it is a useful tech that has room for further growth and adoption. Though blockchain could get adopted by government, corporations and banks while at the same time free market crypto could be squashed.

What do you think? I would love to see what others have to say.