Bitcoin's Pullback - buy it?

A lot of stuff to review today - most importantly how crazy bullish the weekend was despite the violent pullback. Which brings up the first topic of this article. After any significant rise over a short period of time, a pullback is normal and warranted.

Fast and big rise = violent drop

One of the common sayings in the stock market is ‘markets take the stairs up, but the elevator down.’. Bitcoin’s price action is certainly a perfect example of that phrase. From the most recent swing low of 3340.8 on February 6th, 2019 to the most recent (and new yearly high) swing high of 4188.79 on February 24th, 2019, we see a significant +25.38% gain in an 18 day period. While that rise may not be a historically fast or abnormal move for Bitcoin, it is certainly somewhat of an aberration given Bitcoin is in the longest bear market in its history. But any such rise is usually met with a predictable pullback. And that is exactly what happened to Bitcoin on Sunday, February 25th, 2019.

I’ll get to why the move is still extremely bullish for Bitcoin – but the response to these moves a very violent drop in a very short amount of time. A massive -7.08% drop occurred in one hour – however, the great majority of that move occurred over a 15-minute period. After the participant(s) quickly dropped price, it halted. On the current chart with the current Gann geometry, I had previously predicted that the pullback zone would be against a number of support zones, the primary being the 35-degree angle which is exactly where Bitcoin has found support.

Buy the dip?

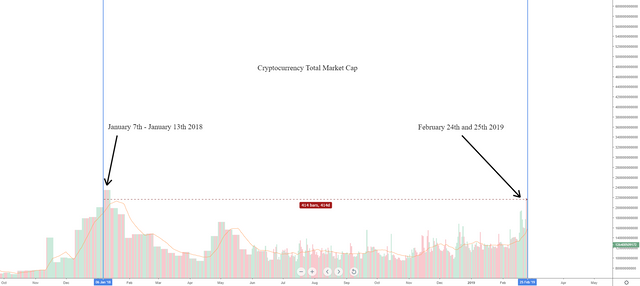

One of the clear technical indications of an expanding market would be for participants to step into the market and buy up the lower prices. A clear picture of a new and expanding market with rising prices would be a swift reversal of the flash crash. That scenario has never been more likely that it is today. The aggregate volume that has been traded in cryptocurrencies is staggering. Both Sunday’s trading and today’s (Monday, February 25th, 2019) represent the highest trading volume since January 7th to January 13th of 2017 – the all-time cryptocurrencies total market cap high. In fact, the amount of participation, volume wise, has been at over 360-day highs for almost the entirety of February.

Bitcoin hasn’t done this is in 7 months.

As I’ve written before, the monthly candlesticks for Bitcoin have been the ugliest of any markets in recent memory. Not only have we had 6 consecutive months of monthly candlesticks where the close was below the open, but we’ve had 7 consecutive months where the monthly high has not matched or exceeded the prior month. The last time we saw a monthly high exceed its prior month was in July of 2018. Both of these streaks may be broken, but one is for certain broken. The massive move that culminated over the weekend saw Bitcoin create new 2019 highs by barely crossing above January’s high. Depending on the data you use, the amount that Bitcoin surpassed the prior month’s high was as little as $20 or as much as $60. Not a huge amount, but nonetheless, we have some bullish sentiment with this happening. And there remain only 3 more trading days in the month. If Bitcoin can maintain a value above the February open of 3437.5, then it will have snapped that 6-month losing streak.

Prediction for March 2019

February may end fairly flat with a close very, very slightly above or below its open. But regardless, February has been the most bullish month in over 220 trading days. And because the volume that has come in is some of the highest in history, March could become a massive catalyst for some very strong and sustained moves in the future. I have not written about any of the proposed Bitcoin ETF’s and their probabilities of being approved – it’s a foregone conclusion that they will be approved. Anyone can predict the outcome here – but there will be a Bitcoin ETF approved in 2019, more than likely sooner rather than later. I don’t mean to be political here, but the SEC’s commissioners are made up of solid open market, anti-government, anti-regulatory Trump appointees– two of which are open advocates of letting cryptocurrency ETFs into the market.

Yes, March might be a good period for the price of Cryptos... At least I hope so.

I'm already fully in position. There is nothing for me to do now but read articles like this one :)

Ha! Good to hear :-) I'm doing them daily Mon-Fri

as long if you hold long term i dont think few months price actions matter....

except for margin trader

BTFD

A bullish point of view. Higher lows are building but it needs confirmation these coming days. Or else it shall go down ....agaiiin...and aaagaiin....

Future will be beautiful 👍

Posted using Partiko iOS

I am hoping to see bitcoin hit 15,000$ before april

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Haaaaaa 🤣

Posted using Partiko iOS

It appears that this pullback is also impacting Steem

Big time - saw it up over +8% today one point.

You got a 41.89% upvote from @brupvoter courtesy of @captainquenta!