Litecoin (LTC) hinting new altcoin rally?

Litecoin (LTC) hinting new altcoin rally?

- Litecoin is often a metric for the health and movement of the altcoin market.

- Litecoin is showing exceptional performance against Bitcoin as well as against the USD (United States Dollar)

Litecoin (LTC) bucking the trend higher

I often call Litecoin the ‘Nasdaq’ of the cryptocurrency market. Litecoin is part of what I call the ‘Big Three’, which includes Bitcoin and Ethereum. I usually compare Bitcoin to the Dow and Ethereum to the S&P 500. Litecoin, like the Nasdaq, is the ‘speculative’ side and risky side of the cryptocurrency market. It represents the most amount of reward with the highest amount of risk. And it can often lead the market in a new direction and/or hint at what direction the market may be going. More importantly, it represents the amount of risk and optimism participants have in the whole crypto space. So, when I see Litecoin moving differently than Bitcoin and Ethereum, I take note – and so should you.

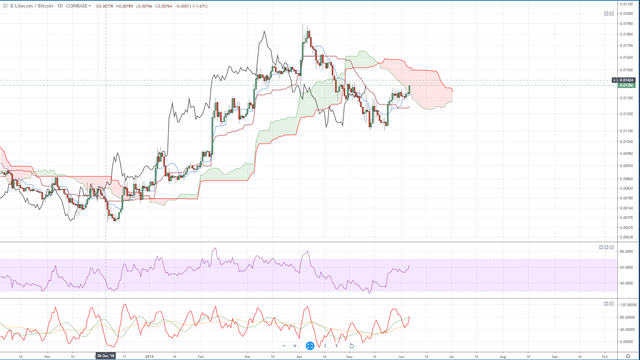

The chart above is Litecoin’s Bitcoin pair (LTC/BTC). Basically, we’re looking at the performance of Litecoin against Bitcoin. If we’re bullish on Litecoin and believe it will outperform Bitcoin, then buying the LTCBTC pair is what you’d want to do. If we were bearish, we should short the LTCBTC pair. The chart above shows the daily chart of the LTCBTC pair. At the time of taking this image and writing this article, Litecoin was up against Bitcoin by +4.16%. That’s significant, especially since the rest of the market is in a big slump against Bitcoin. Litecoin is also up +3.30% against the US Dollar – one of the only cryptocurrencies today that has had a positive performance against the USD. I think it is important to grasp the significance of this market condition.

Firstly, the market generally follows Bitcoin’s lead. If Bitcoin is trading down, then the majority of the aggregate market is down as well – with other cryptocurrencies often performing to the negative against Bitcoin as well as almost double the negative performance against the USD. So when we see one of the Big Three outperforming Bitcoin and the USD, that’s a big deal. It’s a big deal because not only are people converting Bitcoin into Litecoin, but there is also enough new capital in USD to keep Litecoin floating higher than the rest of the market. This is a significantly bullish event. The Ichimoku system also convinces me of the bullishness of this move.

I did have some concerns that Litecoin would experience some further downside pressure against Bitcoin given that it has spent some time below the daily Kumo – I was even more concerned when the Chikou Span dropped below the Kumo as well. Instead, we got some muted bearish price action which told me the movement down was going to be limited in the short term. But as we look at Litecoin’s performance from the 16th of May to today (June 6th, 2019), we see Litecoin predictably bucking the current trend. It has moved with exception strength against Bitcoin by crossing above the daily Kijun-Sen and Tenken-Sen. In fact, it didn’t face resistance. The only pause Litecoin has made was when it got closer to the bottom of the Kumo (Senkou Span A). That was until today where it movie up above the bottom of the Kumo and is continuing to press higher. The momentum here is very strong and we can see how strong it is by looking at the Chikou Span: it is above the candlesticks and is above the Kijun-Sen. The next zone of resistance is a good move higher towards the 0.16 value area.

Its just the halving, the hash rate is booming etc etc. It will rally on its own and eventually people will realise that mining is part of the economic model that gives these currencies value.

@captainquenta You have received a 100% upvote from @botreporter because this post did not use any bidbots and you have not used bidbots in the last 30 days!

Upvoting this comment will help keep this service running.