What is Ripple? How Does it Use XRP to Leverage Instant Liquidity? | Ripple Explained 2018 | Cryptocurrency

To date Ripple has established relationships with more than 100 major institutional clients (and the list seems to grow daily). Recently adding notable major brands JPMorgan and Bank of America. Most people consider Ripple to be a centralized open network, which makes crypto enthusiasts cringe, but maybe a needed function to support the technology so that banks can move large amounts of money at a rapid rate.

Early days of Ripple

Ripple was originally started in 2004. Years later, after advanced conceptual development, a corporation named OpenCoin was founded in 2012. OpenCoin developed the Ripple Transaction Protocol (also known as RTXP) and the Ripple payment & exchange network, all done in open source code. OpenCoin changed to Ripple Labs Inc. in 2013, shortly thereafter the company changed the name to Ripple in a rebranding attempt in 2015. Ripple is a privately funded company; noteworthy investors include Google Ventures, Seagate Technology, Accenture, Bitcoin Opportunity Corp & Standard Chartered.

What is Ripple?

Ripple is an open payment network for digital and fiat currency, as well as a holding company. Ripple is a privately held, cash flow positive company, that aims to create and enable a global network of financial institutions and banks to use Ripple software to lower the cost of international payments. Ripple calls this global network using Ripple software, the 'Internet of Value'. The internet of value refers to the ability to transfer payment as easily as we transfer information today.

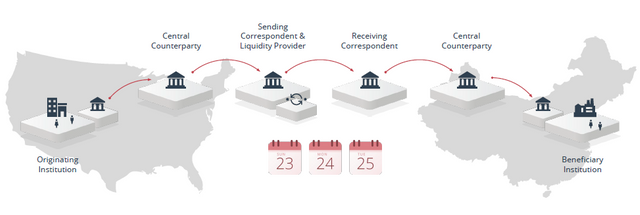

The main problem that Ripple tries to solve is best understood by examining the illustration below. To make things simple imagine this is a man in the U.S. trying to send some money back home to family in Asia:

As we can see in the above image, there are many stops between Start and Finish, each one of these stops not only slows down the transaction but also takes a transaction fee.

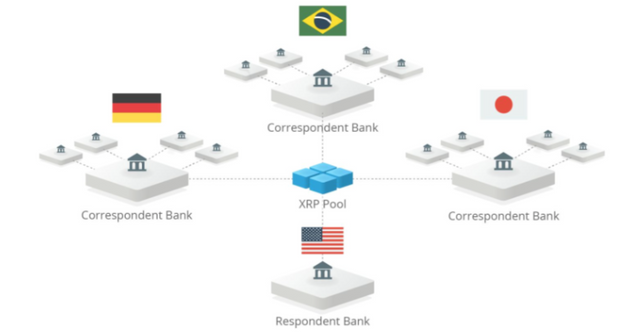

The solution from Ripple is to provide a Global payment platform that is faster and cheaper and looks like the diagram below:

In the diagram above the XRP Pool represents the transaction validators within the Ripple platform.

What is XRP?

The XRP Ledger (or xRapid) is an open source project created by Ripple. It was created to solve a major point of friction in international payments. XRP can be used by banks to control liquidity on demand in real time. XRP boosts faster payments, instant settlements, and lower transaction fees. The state of global payments is far behind when you consider how advanced payment technology is becoming domestically.

Consider the fact that I can be camping in the middle of the forest, streaming live music and downloading video games or reading news articles. All at a very fast speed, with no transaction fees. On the other hand, if I want to send $100 to my grandmother in Poland for her birthday, I will spend 15-20% in fees and will be crossing my fingers that the money arrives on time. The technology for easy global payments already exists, so why is the global payments industry so far behind?

The answer is simple, and won’t surprise you, Greed. Banks and Financial institutions already have the game set up exactly how they want, they make trillions of dollars on transaction fees and until now have seen little value in improving the solution. In short, rather than spending time and resources on new regulations that would improve the Global payments system. They allocate these resources to implement new legislation that will just end up with more money back in their pockets.

Ripple vs Bitcoin

The main difference between Ripple and Bitcoin is that Ripple aims to work with the Banking system that we already have in place, whereas, Bitcoins main goal is replacing the current system. An estimated $155 trillion dollars travel across borders every year, if you can find a more efficient means of executing these transactions, that’s a lot of savings in transaction fees. For example using the number of $155 Trillion, if you assume a 3% transaction rate for a normal credit card transaction. That equates to 4.65 Trillion in transaction fees every year. With the Ripple platform, it is not unreasonable to believe the fees will be 1% or less, which equates to a savings of over $3 Trillion in fees every year. In addition to the fees, there is also the time it takes to process the transactions and have them settled by the bank (generally 3-5 days).

How does Ripple work?

In order to gain a better understanding of how Ripple functions, it is useful to understand RTGS and RTXP. RTGS is Real Time Gross Settlement, for example, when you send Bitcoin to someone, the value is settled in Real Time meaning it is available to them to use. Ripple introduces the concept of ‘Gateways’, which are the businesses that link the XRP Ledger to the rest of the world. Any existing online financial institution can expand to act as a gateway in the the XRP Ledger. This gateway is a digital portal that Governments, Companies, and Financial Institutions use to join the Ripple Network. Ripple expands on the concept of RTGS, using the Ripple Transaction Protocol or RTXP (formerly known as Ripple Net). When a new company or financial institution joins RTXP it will allow them to transact with another ‘gateway’ (also on using the Platform) at much higher speed while maintaining a lower fee. RTXP also makes it possible to receive payment from ANY fiat currency or cryptocurrency, thus the Ripple network is theoretically designed to be a true Global Payment System. This is ideal for any type of entity that regularly has to move large sums of money or value across borders.

What is the role of XRP?

The Ripple Network also functions as a currency exchange between all types of fiat currency. However in order to make this happen, it has to be able to guarantee liquidity, this is where XRP enters the picture. XRP is a digital coin that was designed to provide a source of instant liquidity to payment providers, market makers, and banks.

The Ripple network makes sense for large corporations, at this point there is less of a use case for the average consumer. That being said, you may not feel the direct effects of Ripple or XRP with regards to how you transact and buy using cryptocurrency. However, their goal is to revolutionize how large amounts of money move around the world. Ripple has proven and continues to prove in case studies that their network can handle an incredible amount of transaction volume. At the time of writing this article the BTC network (this is pre Lightning) can handle about 7 transactions per second. Ethereum can handle around 15 transactions per second. The Ripple network can handle 1,500 transactions per second.

According to Ripple,

“xRapid (XRP) is for payment providers and other financial institutions who want to minimize liquidity costs while improving their customer experience.”

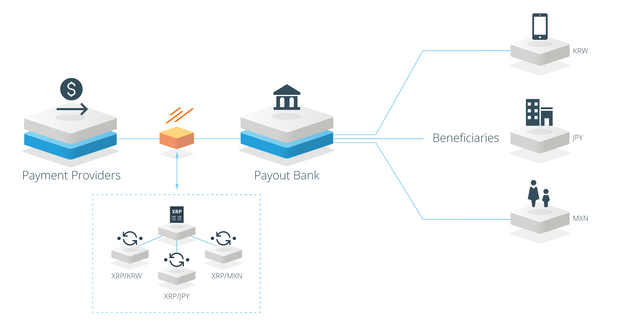

The illustration below provides a visual on how this process takes place.

Ripples Supply Structure

Another thing that separates XRP from other cryptocurrencies is the fact that ALL XRP coins have already been created, and there will never be more created. The total supply of Ripple is 100 billion coins. As of the date of this article, there are about 40 Billion XRP coins in circulation, and the value of each coin is 28 cents. Ripple Labs holds the rest of the uncirculated supply.

Consensus vs Proof of Work

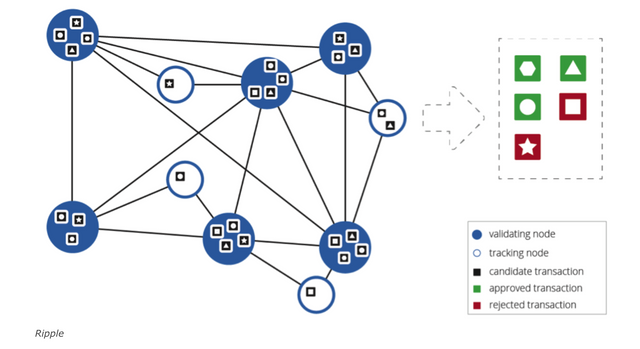

Consensus is the way that the XRP Ledger solves the ‘double spend’ problem without proof of work. We can all agree which transactions are valid or invalid, the basic rules of a transaction are simple. Transactions need to be properly signed or authorized, you can’t send money that you don’t have, etc. The problem is when Jim has 1 XRP or 1 Bitcoin or 1 Dollar, we want Jim to be able to send that to Julie if that’s what he wants to do or we want him to be able to send it to Bobby if that’s what he wants to do. But if Jim can do both options then we have a huge problem. Even though by itself both transactions are valid, there needs to be consensus on the order of transactions, so that it can be agreed upon that one is valid and the other can’t be valid. Historically, the bank has played the role of approver of transactions. For example, if I write a check, my bank will either say that I have the funds or I don’t. And if I write 2 checks for $100 and I only have $100 total in my account, they will process 1 first and the other will be declined. In a decentralized system, by design, there is no central authority so another method is needed to reach an agreement. Bitcoin uses the Proof of Work, Ripple does not.

Ripple uses a Distributed Agreement Protocol, which is essentially just a way for everyone on the network to say “I say this transaction first.” And if you have a super majority agreement on the decision with no way to go back on the decision, that is sufficient enough for Ripple to order the transactions. When you combine the majority vote with their deterministic validity rules is enough for Ripple to say the one that we agreed comes first is valid, and the one that was agreed came second is forever invalid.

There are a couple of advantages of Consensus over Proof of Work (PoW). The most obvious one is that there isn’t this massive need for computing power to mine transactions. Thus, the network is not costly to maintain. The other less obvious advantage is that there is no dictator that gets to choose what is in each block. Each block (or with Ripple, each Ledger), is determined by a consensus of participants so no single gets to determine the contents of each block. This functionality is what makes some of the other features of Ripple possible. Such things like the decentralized exchange and arbitrary assets, these things require a system that is built with inherent fairness rather than having people or a central authority decide the outcome.

Is Ripple Decentralized?

My answer would be kind of… Given the fact that Ripple Labs holds about 60 billion XRP coins, therefore they control the supply of the currency. However, according to Brad Garlinghouse, CEO, and Founder of Ripple,

“Ripple is not centralized. To be clear, if Ripple disappeared today XRP would continue to function. To me, that’s the most important measure of whether something is decentralized.”

In May 2017, Ripple released their own decentralization strategy. The company announced they will diversify the validators on the XRP Ledger, and expand the platform to 55 validator nodes in July 2017. Ripple also added 3rd party validator nodes, that eliminate and replace a majority of Ripple operated nodes. In the current system, there is no single entity that operates a majority of the validator nodes on the XRP Ledger (thus eliminating 51% attack). Getting back to the question on centralized vs decentralized, it seems like Ripple is a hybrid of both. On one side you have a holding company that owns more than half of the coins in existence with plans to distribute the rest. The method for validating transactions is centralized to the point where if Ripple is removed, the system would still operate exactly the same way. This debate is one that is widely contested throughout the crypto community, and truly only time will tell with regard to how Ripple plays out. Being centralized to some extent is not necessarily a bad thing, however in the crypto community even partially centralized networks are the subject of much criticism.

Is it wise to invest in XRP?

I don’t offer financial advice, and you should do your homework before any investment. One this to keep in mind, while the Ripple platform seems to be a very powerful tool with a huge potential that is attracting the eye of many global banks. This does not mean that the same banks that partner with Ripple for the platform will also end up adopting XRP. Ripple, as mentioned earlier in this article, works with any currency (both cryptocurrency and fiat currency). Just because banks and financial institutions partners with Ripple to use their platform does not mean they will necessarily use XRP. That being said, the coin has some built-in advantages with regard to instant liquidity that was designed to work specifically on the Ripple platform.

I hope you have enjoyed this exploration of the Ripple platform and a deeper look into XRP. It is worth noting that Ripple has also launched two additional products, xCurrent and xVia. I may go into deeper detail on these in future articles. If you learned anything or have any questions please feel free to comment below.

At the time of publishing XRP is at 28 cents. Bitcoin is at $6,200, and Bitcoin Dominance is at 52.5%. The total Market cap is $204 Billion and there are 1,833 total coins.

This is my original blog post, if you enjoyed this article please feel free to upvote/comment/Read More Here: www.achainofblocks.com

References:

www.ripple.com

https://en.wikipedia.org/wiki/Ripple_(payment_protocol)

www.coinmarketcap.com

https://perc360.com/ripple-xrp-massive-conference-october-disrupt-international-banking/

https://www.blockchains-expert.com/en/ripple-the-protocol-that-connects-banks/

great info about xrp.. thank you

Thank you.

@chainofblocks, I do not understand anything written

Sorry to hear that. You don't understand the concept? Or trying to say my writing is bad?

Hi friend i know this coin but how to earn this coin ...please tel me?

You are looking to purchase?

I bought into XRP last year at $0.33. I'm a long and a believer. I think that Ripple Labs has the potential to change the global banking system and provide efficient, timely cross-border money transfers to help facilitate the growth of the world economy. The XRP token isn't intended to be volatile in price, otherwise the cost of carrying out transactions would have no consistency, and thus make it more expensive for banks and businesses to move money. XRP's price needs to be higher, just to stabilize the "value" attached. Making money transfers consistently cheaper will lead to higher volume of transactions, and therefore, more money to Ripple Labs in revenues, and wide acceptance of XRP as a digital token to facilitate more trade!

Great Insight, thank you.

You are sounding like a king in the world of cryptocurrencies👍 @chainofblocks. You're good, keep it up!

Maybe just a guy who is interested. Thank you, appreciate it.

Thanks for share as its great news / post !! I hope to be all cryptocurrency will be linked to banks worldwide !!

Thank you. And I agree.

In plain English, Ripple would be the current corrupt system but on steroids😎

There will be corruption in any system, the key is regulation. It's very important to be able to trace the first transaction for crypto, or the transaction where fiat is converted to crypto. This is essential for regulations within the AML Anti Money Laundering arena.

At least it's bringing blockchain into major play economically. Even though I'm not a fan of Ripple, it is doing crypto some favors as a whole.

At this point, we are all deciding which platforms will be the winners in the next 5 years. I like Brad Garlinghouse and David Schwartz, they are proven and well versed in the space. We will see.

the question is, how we can gain from this?

Very vague question. Not sure how to respond?

how can we play the bank at their own game.

citizens and netizens should be PAYED by the BANKS for US using their so called security measures ,and not suck on like a vampire to everyone. with fees and other nonesense.

Ripple is my favorite coin but don't know when it will hit $ 10 mark.

Hey @chainofblocks , great article. If you dont mind me asking, why did you promote this post? It doesnt look like advertisement to me. I am new to Steemit and trying to understand how all the tools work, namely promotion feature.