The Origins Of Cryptocurrency: From eCash To Bitcoin And On

Cryptocurrency is a little more than 11 years old, but it has already managed to trigger a revolution in the global economy that no one was expecting. Bitcoin serves as the new gold-like safe-haven asset; Ethereum runs hundreds of decentralized apps that allow users to access financial services in a trustless way; Ripple facilitates remittances by eliminating numerous intermediaries between banks.

But how did we get here? Cryptocurrency is based on cryptography that was known even in Ancient Egypt (a coded message was found in the Egyptian tomb of Khnumhotep II which dates back to roughly 1900 BC). With the advent of electricity and radio, it became easier to make encrypted messages and transfer them. And when the technology was applied to money in 2009, it launched a shift in the global economy that is gaining traction today.

How did it become clear: cryptography is the way to revolutionize money?

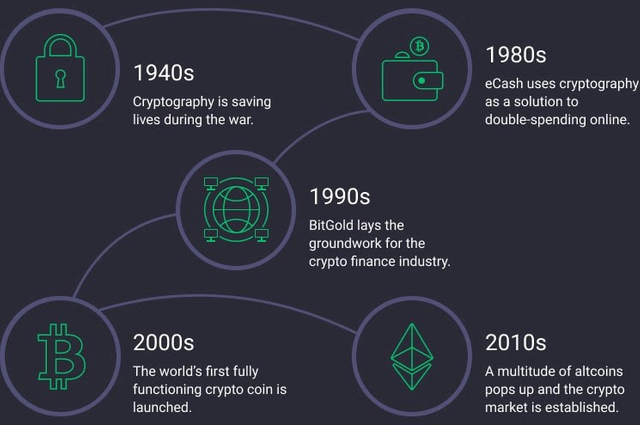

In the early 1940s, Germany was dominating in the Battle of the Atlantic. Its U-Boats had a big advantage over the Allied forces which had lost hundreds of ships during the war. However, there was one weapon that helped Allies win this war, and it was cryptography. A humble young cryptographer Alan Turing managed to decode the signals of Enigma — a cipher device used by the German army, thus saving roughly 14 million lives as the war ended earlier than it could. That example showed humanity how important cryptography is, and today, it is accountable for the biggest financial revolution ever happened.

Today, money mostly exists in two forms — cash and fiat money that moved online. As for cash, many operations include transferring it from one place to another, which is slow, insecure, and prone to human error. Also, cash is popular among money launderers and tax evaders on a bigger scale than cryptocurrency, unlike it is usually thought. The money that is used online is more transparent, but it is fully controlled by banks and governments that can process it arbitrarily: they can freeze one’s bank account or emit more money thus boosting inflation.

Today, cryptocurrency can change all this. The concept of digital money has been around long before Bitcoin, but there were a number of unresolved issues. How do you prevent people from just copying and pasting money (the double spending problem)? How do you ensure a consensus of a distributed network of nodes? In the early 1980s — the pre-Bitcoin era, enthusiasts began to understand that at least the double spending problem can be resolved using the methods of cryptography.

The “Before Bitcoin” era

Before Satoshi Nakamoto invented Bitcoin, there had been many specialists who realized the potential of cryptography for money. The first digital currency emerged in 1983: an American cryptographer David Chaum introduced eCash — anonymous electronic cash, which was 25 years before Bitcoin went live. However, back then, the world was not ready to embrace digital money: only one bank, the Mark Twain bank in St. Louis, Missouri, used the currency, and the project was scrapped in three years. The key reason for that was that in the 1980s, the internet was a very rare thing, compared to the 2000s.

However, the idea didn’t go in vain, and Chaum was not the only one to grasp the potential of cryptography. A decade later, in 1996, America’s National Security Agency (NSA) published a paper in MIT describing the possibilities of “electronic cash”. The fact that an agency of such a high level was considering the matter was a good sign for cryptocurrency. Two years later, Nick Szabo — a computer scientist who will be working on Ethereum with Vitalik Buterin in the 2010s — introduced “bit gold”, something that we can consider a precursor to the first cryptocurrency. Its design was so similar to Bitcoin’s that some even argue that Szabo is the never identified Bitcoin founder Satoshi Nakamoto.

Same as in Bitcoin, in bit gold, there were miners who applied computing power to become the first to solve a mathematical problem. The solution is inscribed in the distributed ledger and carries information about the previous block. Finally, this solution has to be recognized by the network of nodes as a correct one. Sounds familiar, doesn’t it?

Yes, bit gold is very similar to Bitcoin, but that doesn’t necessarily mean that Szabo is Satoshi Nakamoto. First, Nakamoto may have just read Szabo’s works and implemented a similar design with some changes. Second, this might have been a case of parallel thinking where the same solution came to two minds independently. Third, there are other contenders for Satoshi Nakamoto. And finally, there’s a 10-year difference between bit gold and Bitcoin — who would wait so long to introduce their revolutionary project?

Bitcoin’s early days: from humble pizza purchases to becoming legal tender

In 2007–2008, the subprime mortgage crisis hit the USA and then later the whole world. The housing bubble exploded which followed the financial mismanagement. With the criticism of the existing financial system (which, among other things, implies that governments can print money and boost inflation at their will), Nakamoto launches Bitcoin. This happened on January 9, 2009, and the first transaction of 10 BTC was sent three days later to Bitcoin developer Hal Finney.

For one more year, Nakamoto was present on Bitcoin forums, but then suddenly vanished in 2010 after mining 1 million BTC (roughly $50 billion today). Back then, Bitcoin wasn’t considered a real currency — it was just an interest of a handful of geeks discussing transactions on forums. One of such transactions was sent by Laszlo Hanyecz, a programmer, to pay for a Papa John’s pizza: this 10,000 BTC transaction was the first real-world use case of Bitcoin and is now celebrated as Bitcoin Pizza Day.

After Nakamoto disappeared, the new Bitcoin’s public face was Gavin Andresen, the coin’s chief developer. Soon after he took Nakamoto’s position, he had to deal with the consequences of a large Bitcoin scandal: on August 15, 2010, hackers exploited a bug in the Bitcoin code and generated 200 billion BTC. A few hours later, the transaction was erased from the blockchain, although leaving a trace in Bitcoin’s reputation. However, since then, only one more hack has happened: in May 2013, an unexpected fork occurred, splitting the Bitcoin’s network in two. Most nodes have successfully agreed on one version of the blockchain, and the network continued to work normally. Since then, no major flaws have ever happened to Bitcoin.

But while there were no problems with Bitcoin itself, there were many actors trying to exploit the anonymous nature of Bitcoin and technologically imperfect exchanges where it was trading. In 2011–2013, one black market was popular in the darknet — Silk Road where guns and drugs were sold, money was laundered, and so on. Bitcoin was widely used as a payment method in this market. In 2013, the FBI cracked down on Silk Road, and its founder Ross Ulbricht was sent to jail for life. In 2014, a crypto exchange Mt. Gox that was handling 70% of the world’s Bitcoin trading volume was hacked for 850,000 BTC and went bankrupt. In 2016, hackers exploited a vulnerability in the Bitfinex exchange’s code, stealing 120,000 BTC.

Despite all this, Bitcoin adoption was rising fast, same as people’s demand for it — so many new secure crypto exchanges emerged such as Binance, Coinbase, ChangeNOW, and others. In 2011, WikiLeaks started accepting Bitcoin for donations. In 2015, over 100,000 merchants worldwide allowed customers to pay them with BTC. In 2021, El Salvador became the first country in the world to recognize Bitcoin as legal tender.

Not only Bitcoin. How altcoins emerged

Many developers got quickly convinced into crypto, and new coins started to emerge from its very beginning. In 2011, the first altcoin was created — the now-abandoned Namecoin forked from Bitcoin. In the same year, Litecoin also forked from the first cryptocurrency and now remains firmly in the Top-20 coins’ list. These developments proved that there is demand for other cryptocurrencies than Bitcoin and thus opened the floodgate: new coins started to emerge once in a few months, trying to introduce a better version of Bitcoin, and later — the brand new use cases.

This is how blockchain of different types emerged — particularly with other types of consensus mechanisms. One of the first alternatives to cumbersome Proof of Work was Proof of Stake — nodes didn’t have to compete in terms of computing power anymore, and the right to validate blocks was assigned to them depending on the size of their stake. Today, many outstanding coins leverage PoS, among them — Cardano, Solana, and Polkadot. Ethereum is also transferring from PoW to PoS — a blockchain that was initially designed to enhance the speed, scalability, and functionality of Bitcoin, and now is the basis for thousands of crypto projects and whole industries such as decentralized finance and NFT.

In the early 2020s, cryptocurrency offers dozens of use cases that no one could even think of back in 2009. These are safe-haven assets (Bitcoin), means of everyday payments (Bitcoin, Dash, Nano), platforms for dApps (Ethereum, Solana), governance tokens for managing crypto projects (Maker, UNI), privacy coins (Monero, ZCash), tokens of decentralized games (MANA, SAND). Today, the number of cryptocurrencies and their diversity is growing faster than ever before.

What next?

There are thousands of cryptocurrencies today, and their total market capitalization exceeds $2 trillion — quite a robust way from 10,000 BTC for a pizza. This indicator keeps growing as institutional investors come into crypto and digital assets become more mainstream and clear to the general audience. Given the last 10 years’ blazing dynamic, it’s even hard to imagine today what cryptocurrency will look like in another decade.