UNDERVALUED CRYPTOCURRENCY 🤑 This week: NEX - Decentralized Exchange

I do NOT introduce you to any "cheap" pump & dump shitcoins! I cover only coins and tokens whose technology I like, who have potential in the future and which are currently offered imo below their value. This is of course a subjective opinion, but I try to bring you my arguments. Whether you see it this way or not, you are welcome to leave it in the comments.

Disclaimer: This is not financial advice. Do your own research before investing

.png)

Source: https://neonexchange.org/ + Emoji

This week is about NEX, an ICO. Yes, an ICO, but as I see it, one of this year's most promising ICOs. Okay, everybody says that... just make up your own mind!

1. What's NEX?

A brief overview...

Decentralized & Centralized Exchanges

NEX is a new decentralized exchange. And anyone who is around in the cryptoworld will have noticed that decentralized exchanges (short: DEX) are "the thing of the year 2018". The biggest advantage of a DEX: When the exchange gets hacked, your coins are safe, because you own the private key and not the exchange. The two largest hacks on central exchanges were MtGox in 2013 and Bitfinex in 2016 where cryptocurrencies worth millions of USD were stolen. Central exchanges serving as a major target for hackers due to the large fortune of their assets.

NEO

But now back to NEX: No, it's not an ERC20 token, because it is based on the NEO Blockchain, which is becoming more and more popular for ICOs. There are many reasons for this:

- NEO can perform many more transactions per second (about 1000 compared to 15 at Ethereum). Cryptokitties has already shown us the effects of the lack of scalability.

- Furthermore, you don't need any special solidarity programmers, you can code with all common programming languages. This makes the search for new programmers easier and yes, this is a real problem at the moment. Solidity programmers are very hard to find and extremely in demand.

- Whoever may have used EtherDelta (a DEX based on Ethereum) may have noticed that dealing with Metamask is anything but pleasant and entails transaction costs every time. There are currently no transaction costs for NEO and in the future - if I have understood correctly - this NEX will take over, which makes it much more pleasant for the daily user.

But enough about NEO, you can also find more advantages with a Google search or in the whitepaper.

2. The Challenges of Decentralized Exchanges (DEX)

DEX have so far (in chronological order)

- placed your order books directly on the block chain

=> very slow and consume a lot of network bandwidth - used an automated market maker (AMM) Smart Contract

=> slow + artificial restrictions to prevent arbitrage - used state channels

=> Expensive to open and close - used off-chain relays (a further development of the state channel)

=> cheaper + faster (but not as fast as a central exchange) + no limit orders or similar possible

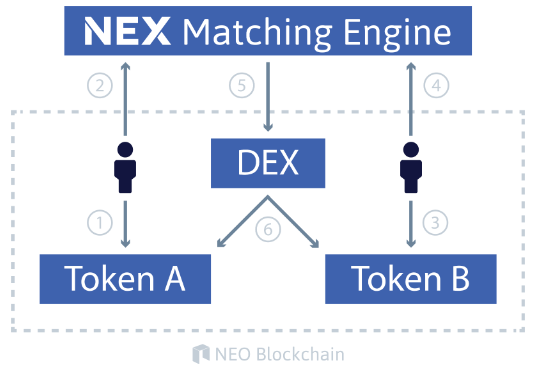

NEX uses a new off-chain Matching Engine. The Matching Engine itself works like tho one from a central exchange. However, it only has access to the active orders. This means that NEX does not have the above-mentioned disadvantages of other decentralized exchanges and is fast, inexpensive and also enables limit orders etc. However, with the disadvantage that it is not 100% decentralized, since the Matching Engine runs on a central high-performance server. All tokens are still secure in the event of an attack! The resulting trust problem is also addressed in the whitepaper and a solution is presented.

The NEX architecture enables fast, decentralized exchange using off-chain engineering. Here we show a sample user interaction with NEX trading.

Source: Screenshot from the whitepaper

- First, a user authorizes a trade to exchange token A for token B

- and sends the order to the appropriate engine.

- Next, a second user authorizes a trade for token B

- in exchange for token A.

- The engine adjusts the orders

- and transfers it to a Smart Contract for execution.

Note that the steps (1-2) and (3-4) can be initiated either via the API call or the NEX trading website.

In short, NEX solves the previous challenges of DEX by providing a very minimal central element. This allows them to compete with the centralized exchanges, with a much higher level of security.

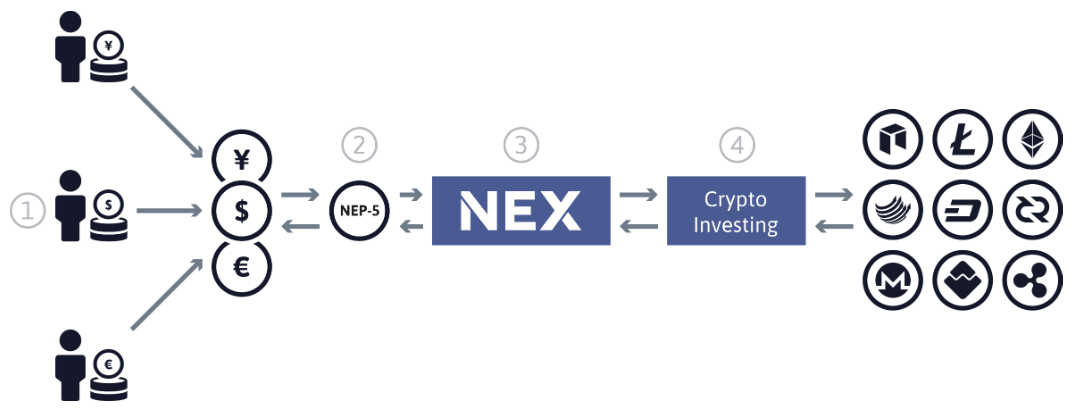

3. Decentralized Banking

In addition to the DEX, a long-term goal of NEX is decentralized banking. And if they established themselves as DEX, that is frankly a logical conclusion. NEX provides a long-term vision of decentralised banking through intelligent contract-based fund management.

Source: Screenshot from the whitepaper

- Users buy assets from traditional services

- then interact with them via the NEX Smart Contract with the NEO Blockchain.

- These assets can also be traded via NEP-5 pairs to allow for a comprehensive exchange.

- Funds stored in the management contract have access to other services such as indexed investment accounts or peer-to-peer loans.

4. Tokens

The most interesting part for most people.

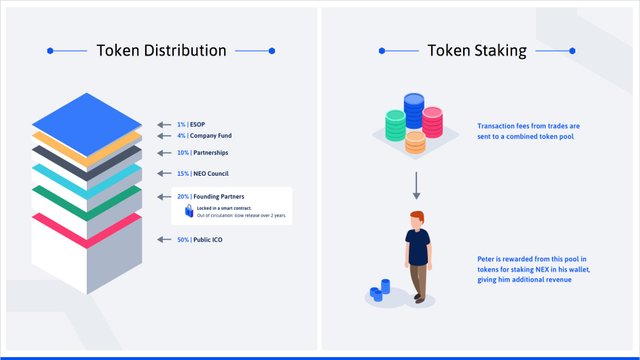

There will be a total of 50 million tokens, of which 25 million are for sale in the ICO. There is no bonus / presale / affiliate link or something like that which might bother some of you. I think it's great, equal rights for everyone! There were also few investors, but they did not receive any price reductions.

Source: https://twitter.com/neonexchange

As you can see in the picture, it is possible to stake tokens. You place them in a Smart Contract and the longer you place them, the higher your return on investment. In a video with Crypto Lark the co-founder talked about a 50%-75% participation of the fees, which is really a lot. And based on the calculation example in the whitepaper I assume a trading fee of 0.1%, which is below the exchange average. The remaining 50% to 25% of the fees, i. e. 0.05-0.025%, then go to NEX. But such figures have also changed often in the past... see TenX, for example, which spoke of a 0.5% yield in their white paper at the beginning and now it has turned out that they may not be distributing any yields at all, as this has been in conflict with various laws of the US and also of the EU. As soon as a coin yields a return, it is no longer a utility token, but a security token and these are subject to much higher standards, especially in the US. So keep in mind the risk that there might be no return.

5. Passive Income

Calculation example: Let's assume that NEX will reach a daily volume of about $100M in 2020, like KuCoin currently owns, the yield is 50% (0.0005) of the fees and all 50M tokens will be used as stakes:

$100.000.000 * 0,0005 / 50.000.000 = $0,001

Thus, you get 0.1¢ per NXT token daily converted with the assumed values. So if you hold 1000 NEX tokens (approx. $1000 investment during the ICO) that's $1 per day, $30 per month and $365 per year. And let's face it, $100M trading volume is not much for a good exchange. Binance, as the current number 1, has about $3,000M (3 billion) daily volume. And if the crypto market continues to grow, as we all hope and expect, then 10 billion or even more is possible. That would then mean a daily return of 10¢ and an annual return of $36 per token (Note: The current purchase price is $1 per token!). I'm a little surprised myself right now. That would be one of the best legitimate passive incomes I've seen in the crypto market so far. On top of that, I assume that all 50 million tokens are actually used for staking. After deducting unstaked coins, the yield will be even higher.

further examples with different assumptions (low / realistic / very high)

| Volume | Participation | Coins | ROI/day | ROI/year | Break-Even |

|---|---|---|---|---|---|

| $100M | 50% | 50M | 0,1¢ | 36¢ | 2,7 years |

| $1.000M | 60% | 35M | 17,1¢ | $6,25 | 1,9 months |

| $10.000M | 75% | 20M | 37,5¢ | $136 | 2,7 days |

Volume: The 24 hour trading volume of an exchange converted into USD; Participation: Percentage Reward for staking the coins; Coins: Number of staked coins (the less, the better); ROI/day and ROI/year: Interest per day/year converted to USD based on the assumptions; Break-Even: Time to recover the investment of about $1 for a token based on the assumptions.

Of course, such a volume - even $100M - is not reached overnight. This is definitely a long-term investment and I expect at least 1 year, more like 2 years until this is achieved. This is also in line with the roadmap.

But there is also a disadvantage. You do not receive the returns in USD, NEO or NEX, but in the respective cryptographic currency. So if NEX offers 100 different currencies to trade on, you will get a small portion of each of these currencies. This is annoying, because you always have to wait until you have collected enough and then trade them to pay out the profit.

6. Risks

To wash the dollars out of your eyes: Remember the risk that NEX may not be able to pay out the return! That would invalidate all the calculations. They also mention this in the white paper:

Please note: legal and regulatory policy may require changes in this token model. We aim to be as transparent as possible with the NEX community, and will share any updates as they occur.

Another challenge is the EU legislation:

- The token holder must do a certain amount of work in order to obtain a return on investment. The size of this work is decided by the EU. What could this work look like? At present, there is nothing in the whitepaper on this subject.

- The EU wants the identity of each token holder or trader to be known.

There are no concrete plans for this yet. I don't know what the rights look like in other countries myself. If you know more, please let us know in the comments.

Sure there are more risks, but I want to point out the most significant ones.

7. Conclusion

The numbers are almost too good to be true. If everything runs smoothly and you have enough NEX, you may never need to work again, but as with every ICO, there is an extremely high risk involved! That's why I think it's more likely that you'll lose all your money than all this goes as planned. Good risk management is therefore the be-all and end-all, and no one can take this account off your hands. My result was that I will try to grab a few coins, but not more than 2% of my portfolio.

I didn't mention the team, the advisors, the roadmap and stuff like that. Do your own research!

My research: Team looks decent (they have good UX designer which is a key element for a exchange), the advisors are insane (in a positive way) and the roadmap looks tight but feasible.

Related Links:

- Start time of the ICO: Q1 2018 - no exact date known yet

- Website: https://neonexchange.org/

- Twitter: https://twitter.com/neonexchange

- Whitepaper: https://neonexchange.org/pdfs/whitepaper_v1.1.pdf

- AMA with Crypto Lark (Youtube):

You got a 0.92% upvote from @postpromoter courtesy of @chkoenig! Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!