Swarm to Launch Tokenized Equity From Coinbase, Robinhood, Ripple, Didi

A recently ICOed project that currently operates as an ERC20 token has stated they will launch tokens representing equities in crypto-broker Coinbase, the company behind XRP Ripple, trading app Robinhood, and a Chinese Uber like giant called Didi.

“The launch of tokens representing equity in tech companies is accomplished via Swarm’s partnerships with Silicon Valley venture capital firms and funds with direct and secondary access to this equity.

Swarm’s infrastructure is then used to tokenize positions in these companies, opening up fractional access to a global community of investors.

Staying true to our ‘No Middlemen’ mantra, Swarm never holds the equity in these companies, but rather provides the picks and shovels to build these valuable access points for the community,” they say.

How exactly this works at a technical level is not fully explained in their whitepaper, but once the stocks and shares are acquired from former employees or Venture Capitalists who have invested in the company, the equity will then be tokenized.

The tokenization is through what they call an SRC20, which they describe as “asset backed tokens” which “live on a private blockchain, built on the Stellar protocol.”

“Like ERC20 tokens, a unique SRC20 token is created individually for each opportunity… all of which can be traded on the Swarm Network Exchange,” they say.

The token exchange is not out, making it unclear at this stage whether it will be a closed source proprietary exchange, or whether it will be open to all with the token able to freely move once it is bought.

The latter might court some regulatory attention due to numerous legal requirements which arguably can be built into the token itself in an Ethereum setting, but it is unclear whether a Stellar like protocol can support the same RegTech.

We suspect, however, that the exchange will be more of a closed wall trading platform as the tokenized equity is on a private chain, so arguably it can’t quite have an open network with funds freely moving across the globe.

That’s one of the first screens on the Swarm platform. You have a dashboard where you can look at investment opportunities, with some big names apparently to be added soon. When exactly, they do not say, but they claim:

“Swarm makes traditionally exclusive investment opportunities, such as private equity and hedge funds, inclusive for the Swarm by pooling together smaller investments into larger, institutional-sized blocks.

Swarm gives fund managers access to capital from a new class of investors who want access to institutional-type investments, but don’t have the high minimums many institutional funds require.

By leveraging blockchain technology, Swarm provides an entire platform from which businesses can create cryptocurrency-based enterprises with a wellspring of funding built in.”

As we’ve stated, just how blockchain tech is incorporated here remains very vague. But what is slightly more clear is that you have to be a sophisticated investor and if in US you have to be an accredited investor:

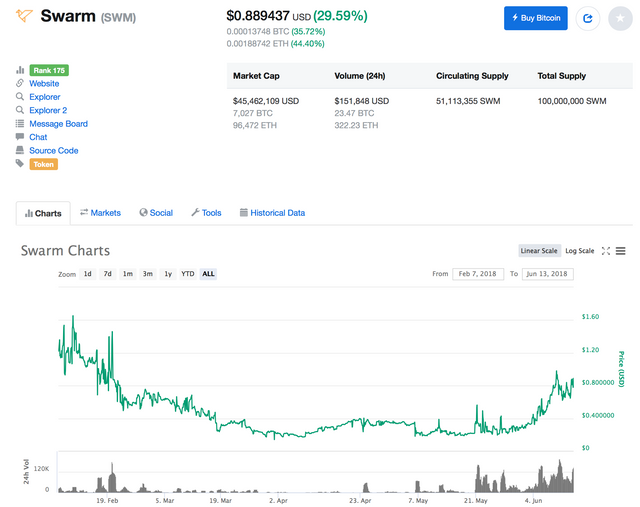

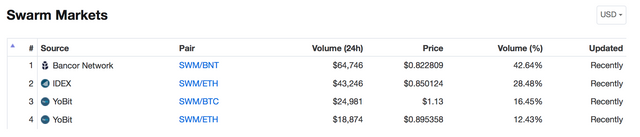

You can invest by paying in bitcoin, eth, or swarm with the latter currently having a market cap of some $45 million.

Swarm price action

They are traded on some decentralized exchanges or brokers handling a trading volume of $150,000 in the past 24 hours.

All suggesting the project has attracted some attention, but execution here is key, and just how they’ll execute remains to be seen.

How, for example, can one be sure that the shares they bought are legally transferred to them with ownership so passing in a way one can prove in court if necessary?

Delaware has now clarified the law to allow for the tokenization of equity, but just how such equity is represented in swarm, as in how the “physical” aspect is connected to the digital token aspect, is very unclear as far as we can discern.

If we had to guess they would probably have some trustee who holds the actual legal ownership, with the token being beneficiary ownership.

Yet it is unclear whether in this set-up the token itself is actual ownership, of whatever kind, or whether it is merely an add-on aspect.

But what does appear fairly clear to us is that many projects may now try to comply with regulations and limit opportunities to the rich only in USA, yet just who will execute in what might be a vast disruption in the equities market, remains to be seen.

Copyrights Trustnodes.com

Thanks for reading! Let us know what YOU think. Share your thoughts in the comment section below!

⭐Join our Facebook Community

⭐Sign up to our Free Daily Newsletter

💰Buy Bitcoin on Coinbase (Get Free 10$)

💰Top 3 Recommended Exchanges to Buy Altcoins:

👍#1 Binance

👍#2 Cryptopia

👍#3 Coinexchange

☛Follow us on Facebook: https://www.facebook.com/Cryptobble/

☛Subscribe to our Youtube Channel: https://goo.gl/YHYi1B

☛Follow our Twitter: https://twitter.com/cryptobble

☛Join the Discussion on Telegram: https://t.me/cryptobblechat

☛Check us out on Instagram: https://www.instagram.com/cryptobble/

Posted from my blog with SteemPress : https://cryptobble.com/2018/06/14/swarm-to-launch-tokenized-equity-from-coinbase-robinhood-ripple-didi/

This user is on the @buildawhale blacklist for one or more of the following reasons:

Coins mentioned in post: