SEC targets Crypto Youtube Shills and why most will get away with it!

This quarter the SEC has been incredibly aggressive in their handling of the cryptocurrency space. In some cases, it was fully justified, dealing with scams and fraudulent activity, sometimes though it seemed like the SEC was just looking for ways to tread all over any cryptocurrency project.

In August, the SEC made it clear that airdrops and marketing schemes would be considered securities fraud, giving the startup Tomohawk a lifetime ban and a $30,000 fine to go with it. Then they charged and fined EtherDelta of running an unregistered Securities exchange, costing the company well over $300,000.

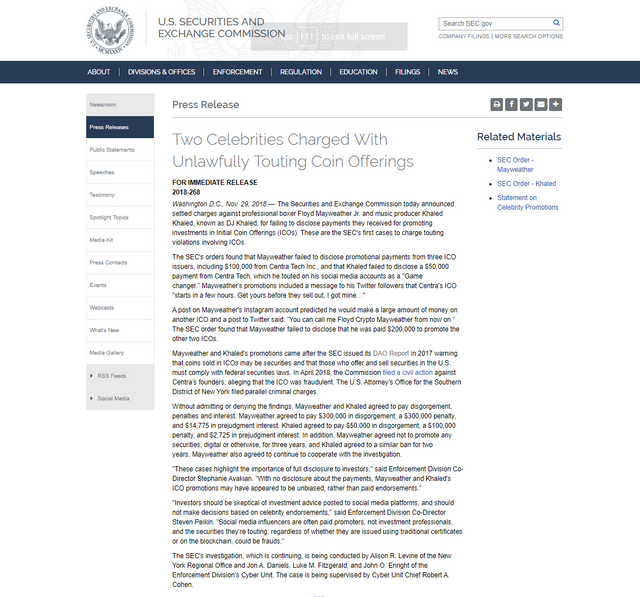

This week the SEC turned its attention to crypto influencers. Floyd Mayweather and DJ Khaled, both charged for potential securities fraud after promoting the token sale of Centra while not disclosing payments. I briefly mentioned this in my intro a few weeks back, and clearly, the situation has come to a head now.

Since the news broke, however, there has been a lot of speculation over who the SEC will target next. Are YouTubers in their sights? Which influencers are at risk? Will we see the SEC go after paid groups? Pump and Dump leaders? Did they actually break the law? To find out let’s take a look.

The SEC has never hidden their disdain for crypto projects, but this week the escalated their war on ICOs and fined boxing pro Floyd Mayweather and music producer DJ Khaled for touting violations. The first such case for a crypto related project. Both Mayweather and Khaled were charged for failing to disclose their payments to the SEC and to their followers when promoting the infamous Centra ICO.

Last year the SEC clearly stated:

“Any celebrity or other individual who promotes a virtual token or coin that is a security must disclose the nature, scope, and amount of compensation received in exchange for the promotion.”

This was then reinforced recently with the following comment:

“Investors should be skeptical of investment advice posted to social media platforms, and should not make decisions based on celebrity endorsements. Social media influencers are often paid promoters, not investment professionals, and the securities they’re touting, regardless of whether they are issued using traditional certificates or on the blockchain, could be frauds.”

With all that being said the recent press statement from the SEC said the investigation was continuing, it didn’t specify their intent to hunt down crypto YouTubers, but the story has been circulating that this puts them in the SEC’s crosshairs.

People took to Twitter to point out that influencers like Ian Ballina, Suppoman, Datadash and McAfee are at risk of being charged but is that completely true?

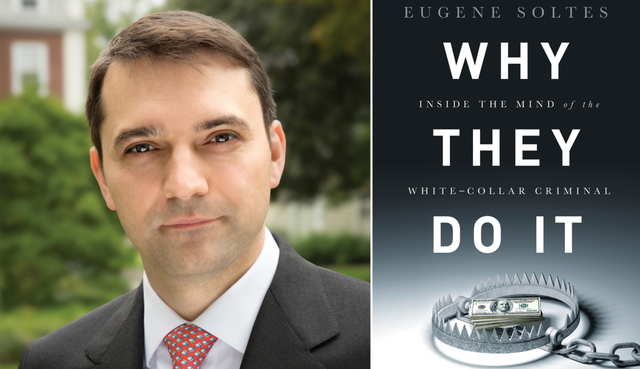

As much as some people would like to see various shillers ‘punished’ for their biased paid for promotions it may be that nothing happens. Eugene Soltes, a business professor at Harvard University and writer of ‘Why They Do it’, a book about white collar criminals, explained how the US Securities and Exchange Commission targets people.

He stated that the important factors are the seriousness of the conduct, the number of victims and then what’s the potential deterrence effect, is this going to change how an entire group of people in the market operate.

It could be argued that fining Mayweather and Khaled is enough of a deterrent. We’ve already seen the crypto community react positively to this news and influencers like Ballina have addressed it in recent tweets. If this is enough to change the behaviour of existing influencers and deter new and upcoming ones, then the SEC may not pursue anyone else.

It’s also worth noting that “Only a small fraction of all securities fraud cases are handled as criminal cases,” Wharton legal studies professor William S. Laufer wrote in an article that the main reason for this, is that even when criminal convictions are obtained, prison sentences for these non-violent, white-collar crimes are not common.

John C. Coffee Jr., a law professor at Columbia University who studies securities cases added that U.S. Attorneys don’t like to indict unless they are 95% sure of getting convictions, and he says this because securities cases can be extremely complex and difficult to explain to juries. Add that to the complex and unclear situation with regards to ICO regulation, having to explain blockchain, cryptocurrency and airdrops, and you are likely to lose the the Jury and possibly the case.

Coffee also explains how it’s not just juries that have trouble understanding securities cases, and that the majority of U.S. Attorneys offices don’t have the expertise to deal with general securities cases let alone ICO’s. In fact, the only standing securities fraud team in the US is based in the U.S Attorney’s office in New York City and those prosecutors might not be willing to dedicate to months of investigation for YouTubers who compared to some of the other securities fraud cases in the financial world are relatively small fry’s.

No offence guys but even with 100 to 150,000 followers, which is no small thing to us, in the world of investment banking and finance this is nothing. The SEC only has around 3000 staff members, which is tiny compared to agencies like the FBI. So their resources are finite and there is already plenty of fraud outside of the ICO and crypto market for them to deal with.

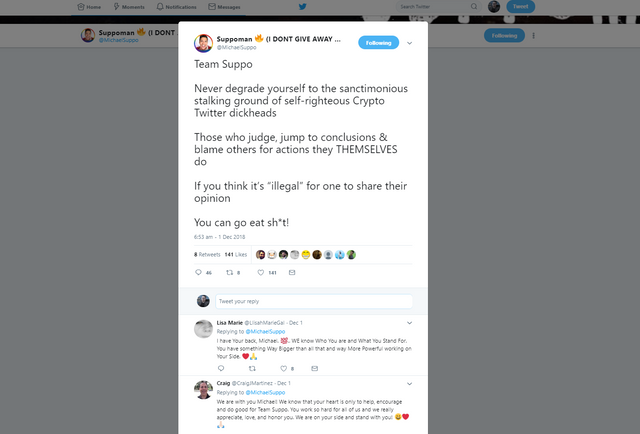

Influencers like Suppoman are for now probably safe. Michael Suppo is actually based in the United Kingdom and not subject to the SEC’s regulations, and the UK’s Financial Conduct Authority hasn’t been nearly as aggressive about cryptocurrencies as it’s American equivalent and the space remains relatively unregulated.

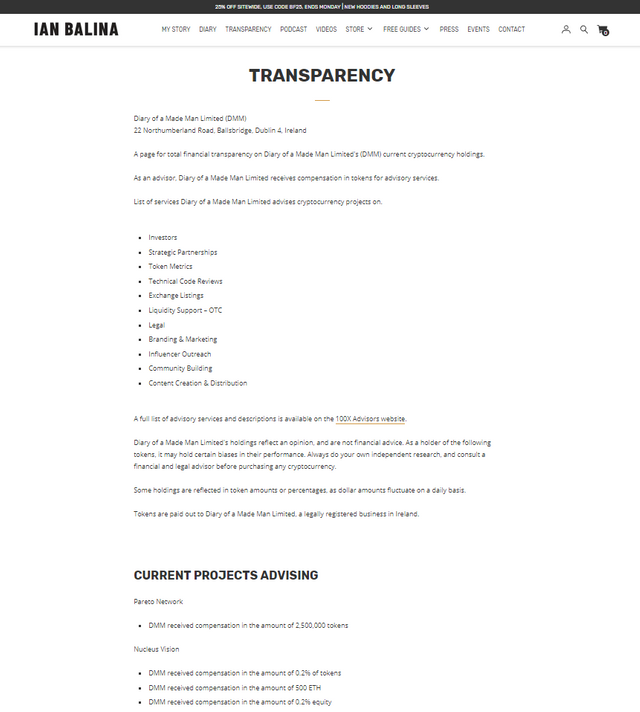

Ballina too is probably safe if his latest tweet is to be believed.

The tweet doesn’t, of course, prove he has followed the law so we will have to wait and see. It’s also important to mention that Ballina has maintained a transparency page that details his crypto holdings and a list of ICO’s he is an advisor for. Regardless of your feelings about Ballina, he isn’t stupid and has clearly been anticipating potential action from the SEC.

One tool at the SEC’s disposal is to offer disgorgement deals to the influencers they suspect of securities fraud. This is where the influencer repays ill-gotten gains with interest to those affected by the action. This in itself I’m sure would be welcomed by the vocal critics of Ballina and others.

One Crypto influencer who is at risk of the SEC’s full attention, however, is the shill daddy himself, John McAfee. If you were looking for an influencer who could meet all the SEC’s important factors of consideration, it would be him. He has nearly 900,000 followers on twitter, he’s a regular media contributor and is often in the mainstream media spotlight. He’s beginning his plans for a presidential run in 2020 and is a vocal critic of the SEC.

In 2016 the SEC subpoenaed McAfee and it sparked a series of videos from McAfee calling the SEC out as a corrupt organisation with too much power. At the time he stated: “The SEC wants to destroy a revolution — a movement of the people — by making an example out of me,” Mr McAfee said. “I cannot allow that to happen.”

The latest move by the SEC to go after Mayweather and Khaled has triggered a further tweet storm from McAfee (show tweets) where he denounces the SEC comparing them to a terrorist organisation. These tweets show that he is either very scared or very angry, I am inclined to believe it is the latter. McAfee has made it clear he would go down fighting either way.

The SEC will be unlikely to get McAfee to make any sort of deal and if Professor Coffee Jr is correct, that the US Attorneys look to be 95% sure of getting convictions, the SEC will need substantial evidence and a solid case before they attempt to bring anything against him.

With all that being said even if all the SEC’s latest press release does is create a panic that gets these guys to think more carefully about how they conduct themselves then it will do the market and the crypto space a whole lot of good.

What do you guys think? Should influencers on social media be held accountable for the projects they are paid to promote? Is it important to you that an influencer discloses that they are being paid to talk about a project? What do you think the appropriate punishment should be or is the lack of regulatory guidance more to blame than the influencers at this point? Let us know in the comments below. We really like to hear your thoughts on the stories we run so, please get involved.

Join us at our Telegram group and follow us on Youtube and Twitter.

https://www.youtube.com/cryptopig?sub_confirmation=1

https://twitter.com/cryptopigmedia

Disclaimer: Cryptopig content is written by a team of blockchain passionate people. We are not registered as investment advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.