TomoChain Review

As usually in my reviews I will first present the very basic data about the project itself and then I will proceed to my pros and cons followed up by a short verdict. If you want to learn more about TomoChain, head to the website (https://tomocoin.io/) as with this article I’m aiming only to review the project — for more complex description of its features please do your own research. Enjoy!

The Basics

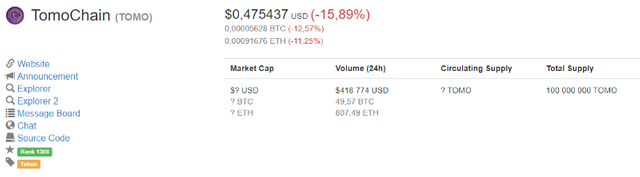

Starting with the price and supply:

Circulating supply is at 55M which puts it at around 33M marketcap currently.

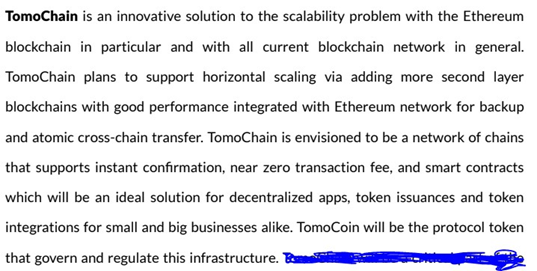

Simply put — what is TomoChain?

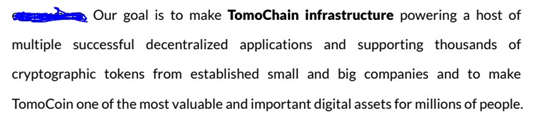

With the goal of:

And they are planning to do it all with 3 elements:

I highly suggest reading the white paper available on the website to fully understand the points I will be making in the following parts of this article.

Without further ado — let’s begin!

The Good

They only had 8,5M hard cap during the ICO — I tend to trust projects like this a lot more since they are not a money grab like 99% of other ICOs. They know how much they need to reach their goals and they respect their investors along with that, giving them a chance to really be rewarded for early support. Speaks for itself especially that the development started in Q2 2017.

Solves big issue of scalability which, if succeeded, leaves huge room for growth in comparison to all the NEO ICX and ETH of the crypto world. Their cross-chain scaling should be attractive to other platforms as well.

Their Testnet is already delivering 2 second confirmations with 0 fees and it supports all ETH smart contracts. Wallet’s demo is also running well — all their propositions already can be seen, a rare view in the current ICO market.

Their app beta works like a charm. Of course, there is not much movement there yet but from the development and UX POV it’s looking good. Available for both Android and iOS.I will divide the team into few parts — core team — a small one but with very strong backgrounds. Long Vuong co-founded NEM and helped with building NXT, both 2 major cryptocurrencies today. The rest of the squad is not lacking in experience either, they are all full-time there with good credentials in respective backgrounds. I feel confident in them leading the project. That is in addition to advisors from Bee Token, Qlink, Devery and WeTrust. That’s a lot of crypto brain power right there.

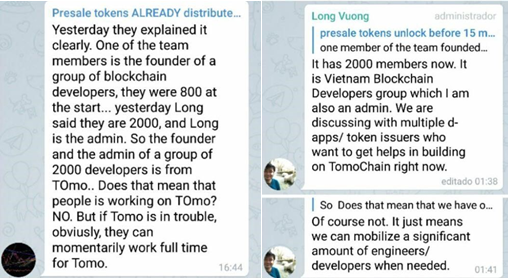

Rest of the development team — I will let the images below answer this one — it’s good

It might not be a huge deal but god damn they got one of the best telegrams out there — instant replies, no “when moon” boys, full professionalism. And that’s with 18k people

Tons of backing in various VCs and for example NEO. That’s always good to see when the project has some real money behind it, it puts the pressure on really delivering the product.

Currently only on IDEX and recently gate.io with one of the biggest volumes out there. New exchanges should be a matter of time.

The Meh

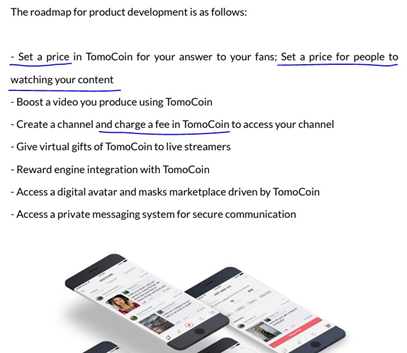

- Their app for a regular user is basically a pumped Quora with rewards (per their Proof of Contribution). It’s a fine concept but it’s definitely nothing jaw-dropping. They have quite a lot of use cases for the token (that’s good) but I’m not really a believer in people paying for small services — I simply have a hard time imagining mainstream users paying for answers to their questions on any platform. I’m more bullish currently on their chain possibilities than the app itself which would be just an addition that might work out if the project itself gains more traction.

Peeps are paying 500$ for a pair of shoes but are not willing to pay 99 cents for an app. You think they will pay for the answer they can probably get somewhere else for free? Maybe, but doubtful for me. Good that they have a lot of features in there, so that might still boost to usage of the app even without few of its functions.

- Alpha chain in Q2, Wallet in Q3. It will help build a lot of hype for it, but that means mid to long-term hold. The roadmap shows a very clear path which would allow the price to steadily increase throughout the whole year but there are risks to it also — look below.

The Bad

Main USP of TOMO is that is solves scalability issues. A problem that ETH is well aware of and I’m pretty sure they will not sit with their arms crossed and wait for others to fix it. If in some way ETH will be able to solve its issues before TOMO launches its main net that will take away a huge advantage TOMO currently presents (not seeing it myself yet but that’s a possibility). It’s still going to be lone standing protocol that can have its own dApps and will still have all its features (cross-chain transfer etc), but the number of reasons to use it instead of other more recognizable competitors would decrease greatly.

As the future value will depend on the dApp ecosystem that TOMO can build around itself there is a big problem of already huge competition. They are still quiet early in their development in comparison to biggest platform out there so their late start into that specific group of projects might limit their ceiling a bit.

Adoption of the app and project itself somewhat lies on the shoulders of marketing. Where is business team and more business-oriented part of whitepaper? Where is the marketing plan and general business overview? There is some info on the market itself but the WP is mostly “technical” in sense that it talks over the infrastructure (the real technical paper will be out along with the chain). I do believe in developers reaching their goals but I also want to believe they will be able to sign great partners and push the project further while there is work done behind the doors.

The Verdict

I will be buying $TOMO since their proposition, as it stands today, has enormous potential. Even if ETH manages to solve their issues before TOMO manages to benefit from it, it still is a good play in my POV for short to mid-term with their road map showing constant development across the year that can be hyped. For long-term? I am not ultra-bullish since I generally think that people forget about ETH also being developed — there is a new ETH killer almost every week and I wouldn’t be surprised if ETH just shut all those mouths up in the end once they are able to scale properly. Competition is good, it’s necessary but most of these platforms, outside of NEO, has shown nothing yet so let’s not crown the new king if the current one still has a lot to say.

But yes, $TOMO should be a good bet for upcoming weeks.

Cheers!

Did you like this review? Follow me on my twitter and telegram for more:

https://twitter.com/cryptorangutang

Want to support my work?

Tipjar ETH: 0x461f53bf50ea0a0b4647eca391bfda6996510bca

Coins mentioned in post:

look close with an open mind with what these people are doing with open source Ethereum ERC-20 smart contracts, decentralized exchange and passive income.

https://powh.io/?masternode=0x32c37e7ca38be1f85cd9e85c81ac9b6730f43e3e