AAB Token metrics and Exchange Utility

There is a new exchange in town, and it’s called AAX. As a relatively new player in the financial service industry, AAX uses proprietary software, that has proven to be reliant, fast, safe and able to achieve a high-throughput. It is in fact the same software the London Stock Exchange (LSEG) uses for its platform. LSEG Technology’s Millennium Exchange offers a cloud-based ecosystem that is the starting point for AAX.

AAX exchange offers both traditional finance products as well as cryptocurrency-based products. It wants to become a one-stop shop for individual and institutional investors that want to trade in various assets. In order for the exchange to thrive, AAX will launch a utility token that is an important feature of their ecosystem.

AAB Token Utility

AAB is the motor of AAX. It provides the oil to keep the exchange running. As an integral part of the exchange, token holders receive benefits and they profit from the growth of the exchange. AAB is an ERC20 token on the Ethereum network.

Token holders are able to use AAB for paying their trading fees. Settling fees with AAB, will provide a 20% discount. In the future, when lending services are offered on the platform, AAB will be used to drive promotions across these features. AAB token holders can unlock special features, like trading bots and signals, as well as receive special deals on competitive API rates and FIX connectivity. If a client holds more than $100,000 in AAB tokens, it will unlock another set of advantages.

AAB daily buyburn

A unique feature of AAB is the daily buyburn. After each trading day, 100% of the trading fees for the futures contracts on BTC and USDT will be used to buy back AAB on the market. All the AAB that is bought through the buyback program will automatically be burned (this is verifiable through the blockchain). This will continue until 50% of all the AAB tokens has been burned (25 million tokens).

AAB token metrics

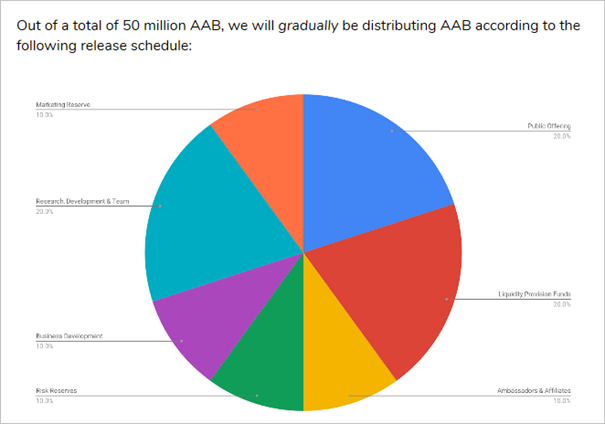

With the eminent launch of AAB token, it is now time to look at the tokenomics. A total of 50 million AAB tokens will be created. Of which, 20% is allocated to the public sale. 10% will go towards the Marketing Reserve fund. To ensure liquidity, 20% of AAB tokens will go into the Liquidity Provision Fund. Ambassadors and affiliates will receive 10% of AAB tokens. To make sure there is a fund to pay out clients if there were to be a hack, or malfunction, 10% of tokens will be set aside. Furthermore, 20% goes toward Research and Development as well as 10% for Business Development.

AAB Public Token Sale

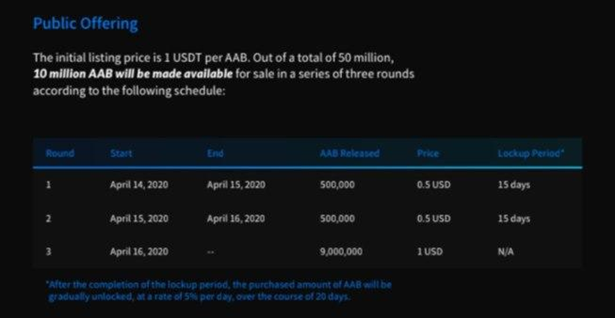

Starting the 14th of April, the first round of the public token sale will start. In both the first and the second round an amount of 500,000 AAB tokens will be sold at a price of 0.5 USD each. The first and second round both last one day, followed by the third and final round of the token sale, which commences on the 16th of April. In the third round 9,000,000 AAB tokens are offered and the price increases to 1 USD per AAB token. Except for the last round, all tokens have a lockup period of 15 days and will be gradually released. When the unlock date has been reached, the tokens will be released to its buyers, gradually at a rate of 5% each day, during a total of 20 days. The website for the AAB token sale is: https://aab.aax.com/en/

If you would like to know more about trading strategies or trading terminology, just enter the Crypto Trading Dojo on the AAX website. Things you can learn are, trading the H&S pattern, applying the Elliott Waves theory, and Japanese candlestick basics.

Conclusions

Exchange tokens are hot right now and have been ever since Binance launched its exchange and its Binance Token. During ‘crypto winter’ exchange tokens proved to be able to stand strong in this industry. I predict AAB token to follow the same path and be a successful integration into AAX.

Disclaimer: This article is not intended as investment advice. It is just my personal opinion about asset exchange AAX and it’s native token AAB. You should always do your own research #DYOR. AAX incentivizes me for writing this article and encourages me to express my own opinions.

Subscribe to my channels: Medium, Twitter and Steemit if you enjoy my articles and would like to be informed about blockchain, cryptocurrency projects, and news. You can also read my articles on LinkedIn.

If you have any questions about this article, please comment in the comment section below. Please do not forget to clap if you found this article helpful. Thank you!

CryptoShowdown