What You Need to know about the Bitcoin Gold Hard Fork... Pros & Cons

Introduction:

I am sure many of you recently have heard first rumors of the upcoming Bitcoin fork on October 25th, and now have a lot of questions about how it will affect things. You have a lot of thoughts about how strongly a Bitcoin fork impacts the markets especially seeing the consequences of the recent Bitcoin Cash hard fork in August. I myself also had negative feelings about the upcoming fork until I really started to really did some research into what exactly is happening with the upcoming fork. I dislike seeing value bleed out from quality crypto's but upon further evaluation. I actually believe that the Bitcoin Gold hard fork will be beneficial for the community. I will try to provide insight into the fork, the pro's and con's moving forward, and the impacts it will have going forward.

What exactly is Bitcoin Gold?

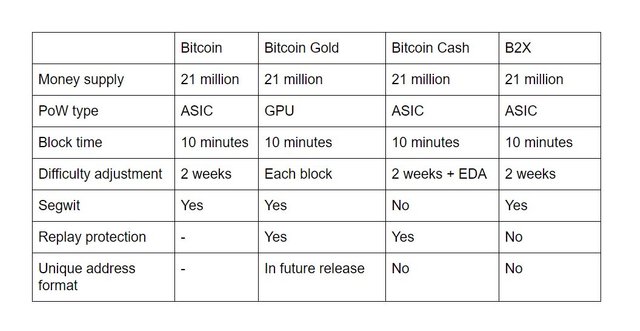

Bitcoin Gold is an upcoming hard fork of the bitcoin protocol devised by a small group of bitcoin miners and developers. Leading the effort is Jack Liao, CEO of of Lightning ASIC which is a Hong Kong based mining firm. Bitcoin Gold (BTG) is going to use the Equihash algorithm which is memory intensive meaning that it cannot be ASIC mined. Thus Bitcoin Gold will be mined using GPU's. Bitcoin Gold will keep the current 1 MB block size, and will have a mining difficulty that adjusts with each new mined block instead of the current 2 week difficulty adjustments with Bitcoin and Bitcoin Cash. The block time will remain unchanged at 10 minutes between blocks. The max supply will remain 21 million. The developers speak of the possibility of adding smart contracts later into the development.

Why is this fork happening?

The team behind Bitcoin Gold believes that the current status-pro with bitcoin mining is very centralized, and keeps the prosperity from mining in the hands of the few. Bitcoin is ASIC mined which can be cost prohibitive to smaller scale miners, and thus majority of the bitcoins mined are currently being mined by a select few large scale mining operations in China. The Bitcoin Gold team aims to decentralize mining efforts by allowing smaller-scale miners to participate in the prosperity gained from mining efforts. GPU mining has a much lower entry price making it more feasible for the average person to participate. The developers believe that this is more in line with Satoshi Nakamoto's original vision for bitcoin.

How will the fork affect miners?

I believe that the fork will be a win for smaller-scale GPU miners. Bitcoin Cash (BCH) the most recent hardfork, is very centralized with majority of the coins being mined by a select few, thus possibly hurting the adoption of the currency itself. It served no benefit to any of average small-scale miners. However since Bitcoin Gold (BCG) will be GPU mined, if a significant amount of people get behind this project and begin to mine Bitcoin Cash, most of these miners will be taking hashpower away from other currencies such as Ethereum, Z-cash, Monero, etc. This may result in a decreasing of the mining difficulty of many various projects, thus increasing profitability for all GPU miners across the board. If Bitcoin Gold becomes irrelevant, then perhaps no change will be seen.

How will the fork affect the market?

If we look to history, and evaluate what happened in the Bitcoin Cash hard fork, there was huge impacts on the market. Bitcoin had recently hit all-time highs, and then news of the fork started affecting things. Lots of value was sucked out of alt coins in the lead up to the fork with people moving value back into Bitcoin to ensure that they would receive the Bitcoin Cash on the fork. There was lots of fear and uncertainty in the market, and there was also a sell off of Bitcoin as people moved back into USDT, and other fiat currencies. In the week leading up to the fork, the Bitcoin price ran up in price as people bought back into Bitcoin. Shortly after the fork, money started to return to alt coins as confidence started to return. Lots of people did make money, and Bitcoin Cash did spike in value hitting $900 before setting down the the sub $400 levels we see today. Many people likely lost money by selling their alt coins with bad timing.

You should expect most altcoins again to lose value short-term in the lead up to the fork but re-gain value following. Bitcoin may test and possibly break out to new all-time highs. Money will come back into alt coins as soon as the market believes the bottom has been hit. This could happen prior to the fork as people try to pick cheap alts versus free Bitcoin Gold. There will be lots of opportunity to acquire coins from your favorite projects this month. I would not panic, look for the opportunities. Some alt coins will be affected much more severely than others, and there will be lots of opportunity and risk in these upcoming days. Moving a portion of your positions into Bitcoin and Tether may be beneficial in attempting to accumulate more cryptos at lower prices and position yourself for increased gains when the value comes back into the coins. I myself will be setting aside some fiat to take advantage of some coins on sale, and probably won't sell my alt's chasing the Bitcoin gold. Although, I may consider mining it if it proves to be profitable.

Conclusion:

While the fork will cause a lot of uncertainty in the markets the short-term. For those with weak hands, it may be easier in the short-term to forget about crypto and sleep easy knowing that all this value will come back. Day trading during these days could serve to lose people a lot of money if they make mistakes. However stressful they are, I believe that forks do have their place in the crypto space. It increases competition and spurs innovation in the space. I think that if Bitcoin Gold could become just as relevant if not more so than Bitcoin Cash with its positive intentions to decentralize mining efforts. This may result in a wider adoption than what we saw with Bitcoin Cash. GPU miners serve to benefit if Bitcoin Gold does gain support. I believe that we are headed soon to hit new all-time high's in the Bitcoin price. Bitcoin will still continue to be the base currency in crypto, with Bitcoin Gold becoming another top 25 alt coin.

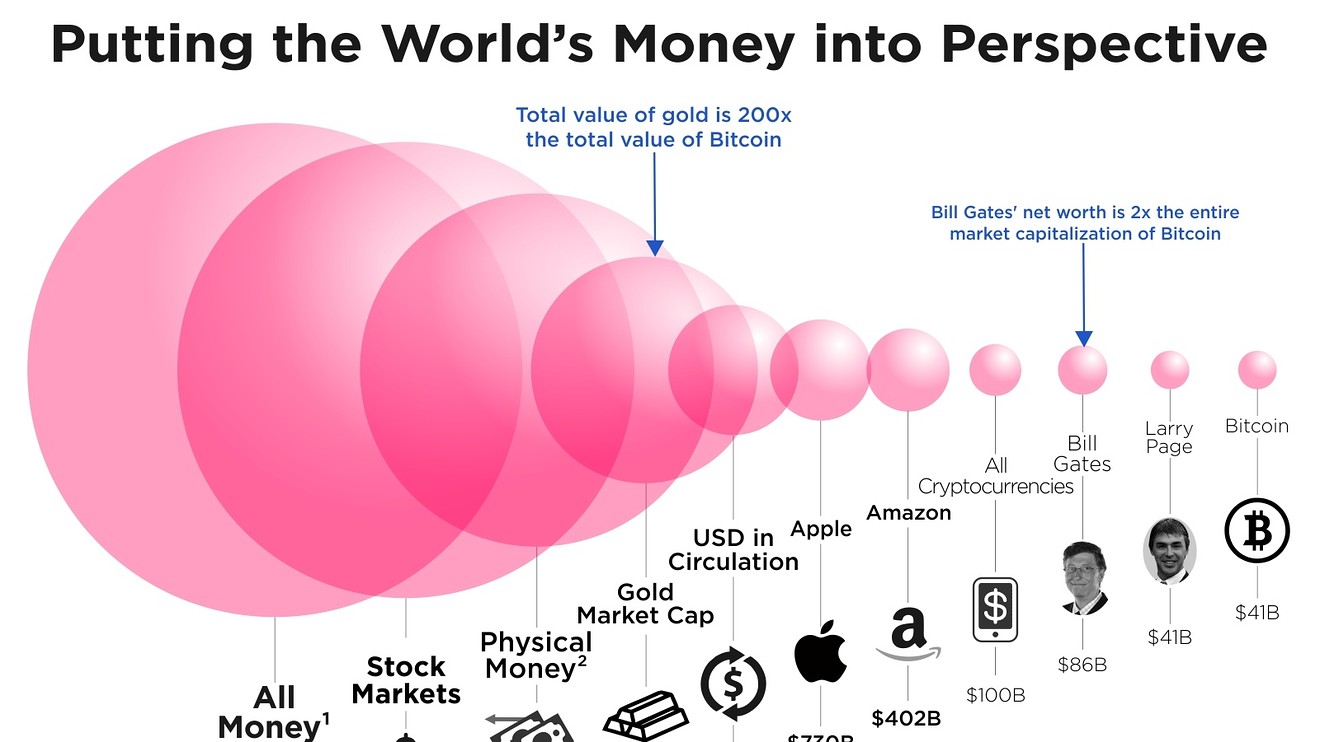

The long term fundamentals are in crypto still intact, and I do not believe in anyway shape or form that we are in a bubble. I believe crypto will become much more mainstream next year as the ICO boom of 2017 will see many innovative blockchain projects coming to completion in 2018. The disruption of every industry will accelerate as blockchain technology will undermine all the current systems. The total market cap of all crypto's still pales in comparison to all the other market caps in the global economy.

Interesting post - thanks @cryptounicorn .

Will we have free dinner?

October 25th.

Nice post. I will follow :) very detailed

Wow!educative post@cryptounicorn

For those who haven't sold their altcoins high for bitcoin, simply relax and sleep until the value come back.