I asked! Is bitcoin worth investing in? See what people say about it

First Comment:

Look at this bubble popping.

The lightest touch of an outside force and this once glorious little vision of rainbow water and soap — ceases to exist.

Where did the bubble go? It popped and now it’s gone. No trace remains. It’s vanished. Can’t find it, can’t bring it back, and certainly can’t re-inflate it.

Is this about to happen to Bitcoin?

Will the Bitcoin bubble pop and Bitcoin will cease to exist? Will it be no more?

I discuss this deeply in my book: Bitcoin vs the 2018 Recession. But for now let’s take a quick look at the answer:

If bubbles pop and cease to exist — why did we call the Dot-com era a ‘bubble’? When it popped did we stop using the internet? Was the internet gone forever? Or the 2008 mortgage crisis -- why did we call it the ‘housing bubble’? When it popped did we stop living in houses? Forever?

I take issue with the term ‘Bitcoin bubble.’ It causes panic. It implies Bitcoin may ‘pop’ and cease to exist -- forever. This fear paralyzes the mind. You see your hard earned money popping -- vanishing in an instant -- and all further thinking instantly stops. The visual is so simple, so powerful, we accept it as true. But what if it’s false? What if Bitcoin isn’t a bubble? What if Bitcoin is something else -- and our minds are too paralyzed to see it?

To illustrate imagine yourself as a hard working farmer in some dusty little village sleeping on the far flung outskirts of civilization. Each month you go to your village’s market. You trade bushels of wheat for shoes, for nails, for little sweets for your kids. Each trade is unique and the value of your wheat for your neighbors cows is always fluctuating based on crops, seasons and needs. That’s how you’ve always done it. That’s how your grandfather’s grandfather did it -- and as far as you’re concerned that’s how your grandchildren’s grandchildren will do it. Then one day a merchant arrives.

This merchant hails from a “city” -- a place you’ve never been to but know from tall tales and strange stories. The stories paint a picture of squalor, rampant violence, brothels, and drugs. Naturally you eye this merchant with a healthy dose of suspicion. Your suspicion doubles as he approaches you.

“I’d like to buy your entire harvest of wheat,” he says, a foreign twang to his tongue.

“I see,” you say, eyeing the merchant and his completely empty wagon. “And what do you offer in trade?”

“Trade?” he repeats apologetically. “No No, my good man. I will buy it from you -- with these.” At that he pulls a leather sack from his satchel. Onto his palm he pours shiny round bits of metal. Each bit is stamped with the profile of the monarch or king or whoever it is that claims to rule your lands -- though you’ve never seen this king in person, just the wars he’s caused.

“Excuse me?” you say, blinking in disbelief. “I’ve worked quite hard for this harvest, thank you very much. I won’t be trading my year’s work for shiny bits and baubles.”

“They’re called ‘coins’,” he replies patiently. “When you go to the city you trade them for food, drink, pleasurable company, anything your heart desires. Soon enough you and your neighbors will be using them to trade between yourselves!”

The words ‘soon enough’ sound like a threat to you, your neighbors, and the way you’ve all been conducting business for centuries. A stout group of yeomen promptly run the merchant out of town -- with a proper coating of tar and feathers for good measure.

And that’s how money started -- more or less. It had a rocky road. People feared money. They feared putting trust in it. What if they slaved all year long raising their cattle and chucking their wheat -- then traded it for round metal disks -- only to go to a city and find the metal wasn’t accepted for anything.

Bitcoin sits in a similar predicament. It comes from the internet, a place of both tremendous civilization and harmful vice. It’s associated with tall tales of drug lords and strange stories of hitmen-for-hire. The merchants peddling it are often ‘foreigners’ -- geeks and nerds who speak with strange words like ‘decentralization, hash power, nodes, DDoS, and HODL.’ And then they try to convince you to accept this ‘magic internet money’ created by a king -- Satoshi Nakamoto -- who you’ve never seen. No wonder you’re skeptical.

Bitcoin hasn’t gained trust yet. It’s still exotic, strange, and fairly difficult to wrap your head around. But dispelling these misconceptions is only a matter of time.

Bitcoin will gain trust.

Perhaps when we start thinking we’ll push past the paralysis of thinking Bitcoin is a bubble. Perhaps then we will see Bitcoin for what it truly is: not a bubble -- but a new Boom. Like the industrial boom. Like the tech boom. Bitcoin is the beginning of the financial boom.

That is not to say we have rosy cheeks and sunny skies ahead. Each revolution has its sensational successes with equally miserable depressions. The industrial revolution contributed to wars just as much as it contributed to global progress. The tech revolution caused trillions of dollars of economic loss just as much as it ushered in a fantastic digital world. Bitcoin likewise has many more hurdles to jump. Prices will skyrocket and sink and climb and fall. New financial innovations will allow anyone with a smartphone to be their own bank, lender, creditor -- while traditional banks may collapse. Trust will fluctuate with alarming volatility.

But make no mistake. Bitcoin is not a bubble. It will not pop and cease to exist. Instead it will be a new boom. A financial revolution.

Second Comment:

BITCOIN How it works?

A lot of monkeys lived near a village

One day a merchant came to the village to buy these monkeys!

He announced that he will buy the monkeys @ $100 each.

The villagers thought that this man is mad

They thought how can somebody buy stray monkeys at $100 each?

Still, some people caught some monkeys and gave it to this merchant and he gave $100 for each monkey.

This news spread like wildfire and people caught monkeys and sold it to the merchant

After a few days, the merchant announced that he will buy monkeys @ 200 each

The lazy villagers also ran around to catch the remaining monkeys!

They sold the remaining monkeys @ 200 each.

Then the merchant announced that he will buy monkeys @ 500 each!

The villagers start to lose sleep! ... They caught six or seven monkeys, which was all that was left and got 500 each.

The villagers were waiting anxiously for the next announcement

Then the merchant announced that he is going home for a week. And when he returns, he will buy monkeys @ 1000 each!

He asked his employee to take care of the monkeys he bought. He was alone taking care of all the monkeys in a cage.

The merchant went home.

The villagers were very sad as there were no more monkeys left for them to sell it at $1000 each

Then the employee told them that he will sell some monkeys @ 700 each secretly.

This news spread like fire. Since the merchant buys monkey @ 1000 each, there is a 300 profit for each monkey.

The next day, villagers made a queue near the monkey cage.

The employee sold all the monkeys at 700 each. The rich bought monkeys in big lots. The poor borrowed money from money lenders and also bought monkeys!

The villagers took care of their monkeys & waited for the merchant to return.

But nobody came! ... Then they ran to the employee...

But he has already left too!

The villagers then realised that they have bought the useless stray monkeys @ 700 each and unable to sell them!

The Bitcoin will be the next monkey business

It will make a lot of people bankrupt and a few people filthy rich in this monkey business.

That' how it will work

Third Comment:

Buying and holding the most common form of “investing” in Bitcoin is buying the currency in hopes it will appreciate in value (also knowns as “holding”, see the origins of the term here). If this is the case then you need to decide for yourself if you think this is a good time to buy. Meaning, do you think the price will continue to rise.

A few pointers for buying and holding Bitcoins:

• Never invest more than you are willing/able to lose – Bitcoin is a very risky investment and you should keep in that in mind at all times.

• After buying Bitcoins make sure to move them into your own personal wallet and never leave them at the exchange. My personal recommendation is to use a hardware wallet to store your Bitcoins. If you can’t afford a hardware wallet, try a paper wallet.

• Make sure to buy Bitcoins only from exchanges that have proven their reputation.

• Buy Bitcoins through Dollar cost averaging – This means that you don’t buy all of your Bitcoins in one trade but instead buy a fixed amount every month, week or even day throughout the year. [1]

Why Invest in Bitcoin?

It seems silly to some people that one bitcoin can be worth hundreds of dollars.

What makes bitcoins valuable?

Bitcoins are scarce and useful.

Let’s look to gold as an example currency. There is a limited amount of gold on earth.

As new gold is mined, there is always less and less gold left and it becomes harder and more expensive to find and mine.

The same is true with Bitcoin.

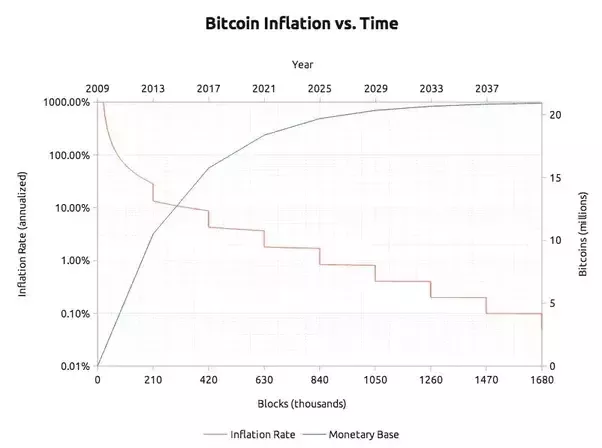

There are only 21 million Bitcoin, and as time goes on, they become harder and harder to mine. Take a look at Bitcoin’s inflation rate and supply rate:

Check out https://steemit.com/@a-0-0